|

市场调查报告书

商品编码

1773336

硫化固体橡胶市场机会、成长动力、产业趋势分析及2025-2034年预测Vulcanised Solid Rubber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

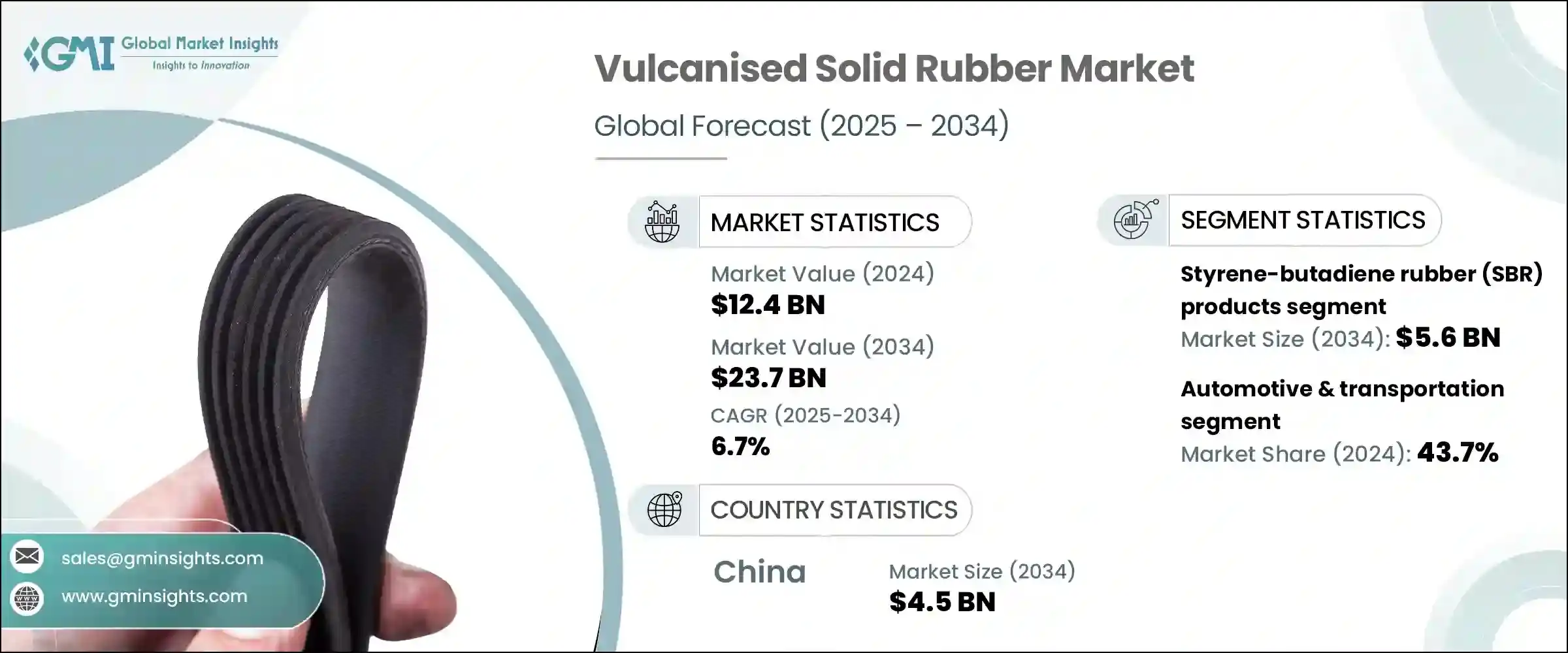

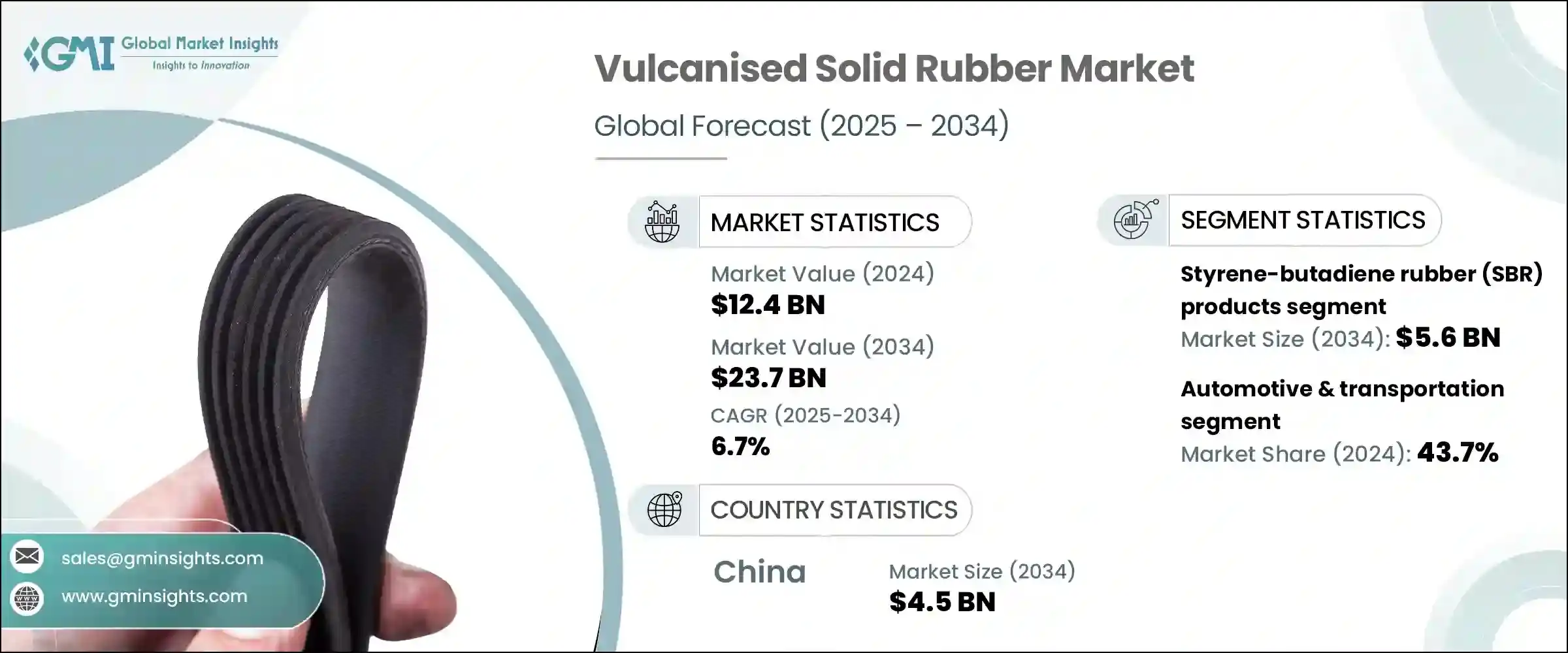

2024年,全球硫化固体橡胶市场规模达124亿美元,预计到2034年将以6.7%的复合年增长率成长,达到237亿美元。这一成长趋势主要得益于汽车和建筑业消费的成长,尤其是在欧洲等成熟地区和中国等快速发展的经济体。硫化固体橡胶以其卓越的耐候性、高耐用性和高弹性,持续受到市场关注,成为各种工业应用中必备的材料。全球各行各业越来越依赖其在密封、减震、防护垫和耐用地板系统方面的卓越性能。其在高机械应力和各种环境因素下的稳健性能,确保了成熟和新兴工业市场对其需求的持续成长。

该材料能够承受温度波动并提供可靠的隔热性能,使其成为注重长寿命和高韧性的製造环境中的首选材料。随着全球基础设施支出反弹,尤其是在东南亚和中东部分地区,越来越多的专案开始采用工业级橡胶解决方案,以实现长期效率。同时,汽车产业的持续转型——尤其是向电动车和混合动力车的转变——预计将进一步增强对隔音、减震和增强热管理材料的需求。因此,硫化固态橡胶越来越多地被应用于先进的汽车设计中,从而推动了产业创新和零件整合的蓬勃发展。这些不断变化的需求促使供应商透过提供更永续、性能导向和应用针对性的下一代橡胶配方来适应市场变化,从而进一步推动市场发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 124亿美元 |

| 预测值 | 237亿美元 |

| 复合年增长率 | 6.7% |

就产品类型而言,丁苯橡胶 (SBR) 继续占据全球市场主导地位。该细分市场在 2024 年创造了 29 亿美元的收入,预计到 2034 年将成长至 56 亿美元,复合年增长率为 6.9%。 SBR 的受欢迎程度源自于其成本效益和卓越的机械性能,尤其是在高摩擦和高磨损应用中。其耐磨性和老化稳定性使其非常适合用于垫圈、密封件、皮带和工业垫等零件。此外,该材料与天然橡胶完美融合,提高了其在汽车、鞋类和建筑等不同行业的适应性。这种相容性不仅增强了其物理性能,还拓宽了其用途范围,巩固了其在市场上的主导地位。

按应用细分,汽车和运输业在 2024 年占据全球硫化固体橡胶市场的最大份额,收入贡献率为 43.7%。该行业的领先地位得益于硫化橡胶零件在需要耐热性、耐油性和耐应力性的汽车部件中的广泛应用。这些特性使该材料非常适合用于引擎支架、车身底部护板、地板衬里和噪音控制系统。随着电动车的发展势头强劲,该行业对橡胶在非结构性但关键部件(例如噪音、振动和声振粗糙度 (NVH) 降低系统)中的依赖日益明显。电动车对更安静的座舱和隔热性能的需求正在推动橡胶配方的创新,并扩大其在新移动平台上的相关性。

从地区来看,中国已成为主要贡献者,2024年创造了23亿美元的收入,预计到2034年将达到45亿美元,复合年增长率为6.9%。中国强大的市场地位得益于其庞大的生产能力和持续向创新製造业转型。儘管原料成本不断上涨,但本土生产商仍在加紧研发高性能橡胶化合物,以满足全球市场的品质期望。中国强调自力更生和技术进步,促进了增值橡胶产品的广泛应用,增强了其在国际舞台上的竞争力。此外,国内消费持续稳定成长,支撑了内需并推动了长期成长机会。

全球硫化固体橡胶产业仍高度整合,前五大市场参与者占据了超过40%的市场。这些公司透过垂直整合、全面的产品供应和广泛的製造网路来保持竞争优势。领先的企业正在大力投资研发先进的生物基橡胶化合物,这些化合物挥发性有机化合物 (VOC) 含量低,能够在严苛条件下维持更长的使用寿命。策略性收购也在塑造市场方面发挥着重要作用,主要公司透过有针对性地收购利基复合生产商以及与区域生产商建立合资企业来扩大其业务范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计数据

(註:仅提供重点国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 天然橡胶(NR)产品

- 丁苯橡胶(SBR)产品

- 丁二烯橡胶(BR)产品

- 三元乙丙橡胶(EPDM)产品

- 丁腈橡胶(NBR)产品

- 氯丁橡胶(CR)产品

- 硅橡胶製品

- 其他特殊橡胶製品

第六章:市场估计与预测:依硬度等级,2021 - 2034 年

- 主要趋势

- 柔软(硬度 30-50)

- 中等(硬度 50-70)

- 硬(硬度 70-90)

- 超硬(硬度 90+)

第七章:市场估计与预测:按製造工艺,2021 - 2034 年

- 主要趋势

- 压缩成型

- 传递模塑

- 射出成型

- 挤压

- 压延

- 其他的

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 汽车与运输

- 轮胎和轮胎部件

- 密封件和垫圈

- 隔振器和支架

- 软管和皮带

- 其他汽车零件

- 工业机械和设备

- 工业密封件和垫圈

- 传送带及部件

- 滚轮和轮子

- 隔振系统

- 其他工业应用

- 建筑与基础设施

- 桥樑支座和伸缩缝

- 隔震系统

- 防水密封产品

- 地板和铺路材料

- 其他建筑应用

- 电气和电子产品

- 绝缘和电缆组件

- 连接器和密封件

- 其他电气应用

- 医疗保健和医疗器械

- 医用导管及组件

- 瓶塞和密封件

- 其他医疗应用

- 消费品

- 鞋类部件

- 体育用品

- 家居用品

- 其他消费应用

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Arlanxeo

- Bridgestone Corporation

- Continental AG

- Dow Inc.

- ExxonMobil Corporation

- Freudenberg Group

- Gates Corporation

- Goodyear Tire & Rubber Company

- JSR Corporation

- Kumho Petrochemical

- LANXESS AG

- Michelin

- Momentive Performance Materials Inc.

- NOK Corporation

- Parker Hannifin Corporation

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Trelleborg AB

- Wacker Chemie AG

- Zeon Corporation

The Global Vulcanised Solid Rubber Market was valued at USD 12.4 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 23.7 billion by 2034. This upward trend is largely fueled by rising consumption across the automotive and construction industries, particularly in well-established regions like Europe and rapidly advancing economies such as China. Vulcanised solid rubber continues to gain traction due to its impressive resistance to weathering, high durability, and elasticity, making it an essential material in a wide variety of industrial applications. Industries across the globe increasingly rely on it for its performance in sealing, vibration dampening, protective padding, and durable flooring systems. Its robust performance under high mechanical stress and exposure to various environmental factors ensures consistent demand across both mature and emerging industrial markets.

The material's ability to withstand temperature fluctuations and provide reliable insulation positions it as a preferred choice in manufacturing environments that require longevity and resilience. As infrastructure spending rebounds globally, especially across Southeast Asia and parts of the Middle East, more projects are turning to industrial-grade rubber solutions for long-term efficiency. Meanwhile, the ongoing transformation of the automotive sector-particularly the shift toward electric and hybrid mobility-is expected to further strengthen demand for materials that deliver noise insulation, vibration control, and enhanced thermal management. As a result, vulcanized solid rubber is increasingly being adopted in advanced vehicle designs, supporting a surge in innovation and component integration within the industry. These evolving requirements are prompting suppliers to adapt by offering next-generation rubber formulations that are more sustainable, performance-oriented, and application-specific, further driving the market's momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.4 Billion |

| Forecast Value | $23.7 Billion |

| CAGR | 6.7% |

In terms of product types, styrene-butadiene rubber (SBR) continues to dominate the global market landscape. This segment generated a revenue of USD 2.9 billion in 2024 and is forecasted to grow to USD 5.6 billion by 2034, registering a CAGR of 6.9% over the period. SBR's popularity is driven by its cost-efficiency and exceptional mechanical performance, especially in high-friction and wear-intensive applications. Its abrasion resistance and aging stability make it highly suitable for use in components such as gaskets, seals, belts, and industrial pads. Additionally, the material blends well with natural rubber, improving its adaptability across different industries like automotive, footwear, and construction. This compatibility not only enhances its physical properties but also broadens its range of use cases, reinforcing its dominance in the market.

When segmented by application, the automotive and transportation sector accounted for the largest share of the global vulcanized solid rubber market in 2024, with a revenue contribution of 43.7%. The sector's leadership is underpinned by the broad use of vulcanized rubber parts in vehicle components that demand heat resistance, oil tolerance, and stress durability. These characteristics make the material well-suited for use in engine mounts, underbody shields, floor liners, and noise-control systems. With electric vehicles gaining momentum, the industry's reliance on rubber for non-structural yet critical components such as noise, vibration, and harshness (NVH) reduction systems is becoming more pronounced. The need for quieter cabins and thermal insulation in EVs is fueling innovation in rubber formulations and expanding their relevance across new mobility platforms.

Regionally, China emerged as a leading contributor, generating USD 2.3 billion in revenue in 2024 and is expected to reach USD 4.5 billion by 2034, growing at a CAGR of 6.9%. The country's strong position is supported by its massive production capacity and ongoing shift towards innovation-led manufacturing. Despite rising raw material costs, local producers are ramping up efforts to develop high-performance rubber compounds that meet the quality expectations of global markets. China's emphasis on self-reliance and technological advancement is fostering greater adoption of value-added rubber products, enhancing its competitiveness on the international stage. Additionally, domestic consumption continues to rise steadily, supporting internal demand and driving long-term growth opportunities.

The global vulcanized solid rubber industry remains highly consolidated, with the top five market players accounting for over 40% of the total share. These companies maintain a competitive edge through vertical integration, comprehensive product offerings, and expansive manufacturing networks. Leading players are investing heavily in research and development to engineer advanced rubber compounds that are bio-based, low in volatile organic compounds (VOCs), and capable of withstanding longer life cycles under demanding conditions. Strategic acquisitions are also playing a significant role in shaping the market, with major companies expanding their footprint through targeted takeovers of niche compounders and joint ventures with regional producers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only )

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Natural rubber (NR) products

- 5.3 Styrene-butadiene rubber (SBR) products

- 5.4 Butadiene rubber (BR) products

- 5.5 Ethylene propylene diene monomer (EPDM) products

- 5.6 Nitrile rubber (NBR) products

- 5.7 Chloroprene rubber (CR) products

- 5.8 Silicone rubber products

- 5.9 Other specialty rubber products

Chapter 6 Market Estimates and Forecast, By Hardness Grade, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Soft (shore a 30-50)

- 6.3 Medium (shore a 50-70)

- 6.4 Hard (shore a 70-90)

- 6.5 Extra hard (shore a 90+)

Chapter 7 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Compression molding

- 7.3 Transfer molding

- 7.4 Injection molding

- 7.5 Extrusion

- 7.6 Calendering

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Automotive & transportation

- 8.2.1 Tires & tire components

- 8.2.2 Seals & gaskets

- 8.2.3 Vibration isolators & mounts

- 8.2.4 Hoses & belts

- 8.2.5 Other automotive components

- 8.3 Industrial machinery & equipment

- 8.3.1 Industrial seals & gaskets

- 8.3.2 Conveyor belts & components

- 8.3.3 Rollers & wheels

- 8.3.4 Vibration isolation systems

- 8.3.5 Other industrial applications

- 8.4 Construction & infrastructure

- 8.4.1 Bridge bearings & expansion joints

- 8.4.2 Seismic isolation systems

- 8.4.3 Waterproofing & sealing products

- 8.4.4 Flooring & paving materials

- 8.4.5 Other construction applications

- 8.5 Electrical & electronics

- 8.5.1 Insulation & cable components

- 8.5.2 Connectors & seals

- 8.5.3 Other electrical applications

- 8.6 Healthcare & medical devices

- 8.6.1 Medical tubing & components

- 8.6.2 Stoppers & seals

- 8.6.3 Other medical applications

- 8.7 Consumer goods

- 8.7.1 Footwear components

- 8.7.2 Sporting goods

- 8.7.3 Household products

- 8.7.4 Other consumer applications

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arlanxeo

- 10.2 Bridgestone Corporation

- 10.3 Continental AG

- 10.4 Dow Inc.

- 10.5 ExxonMobil Corporation

- 10.6 Freudenberg Group

- 10.7 Gates Corporation

- 10.8 Goodyear Tire & Rubber Company

- 10.9 JSR Corporation

- 10.10 Kumho Petrochemical

- 10.11 LANXESS AG

- 10.12 Michelin

- 10.13 Momentive Performance Materials Inc.

- 10.14 NOK Corporation

- 10.15 Parker Hannifin Corporation

- 10.16 Shin-Etsu Chemical Co., Ltd.

- 10.17 Sumitomo Rubber Industries, Ltd.

- 10.18 Trelleborg AB

- 10.19 Wacker Chemie AG

- 10.20 Zeon Corporation