|

市场调查报告书

商品编码

1773339

智慧电气面板市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Electric Panel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

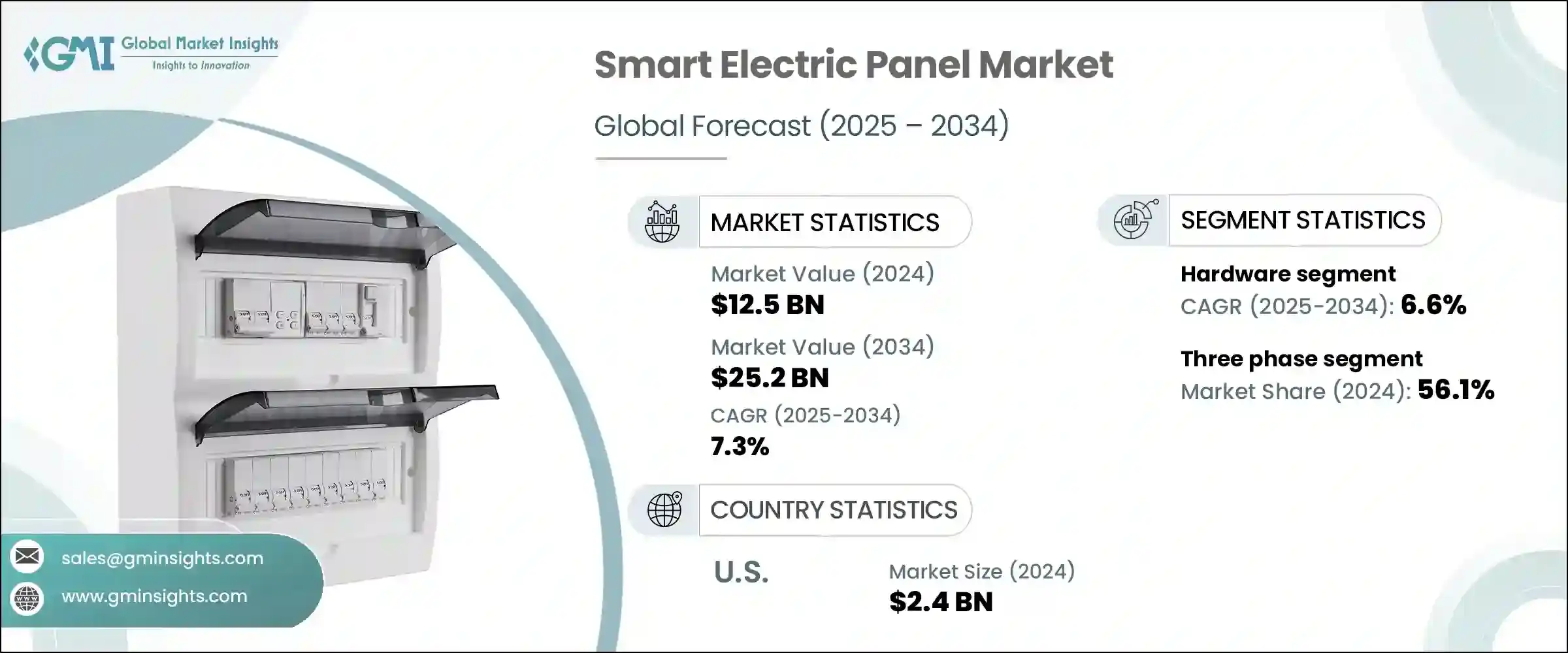

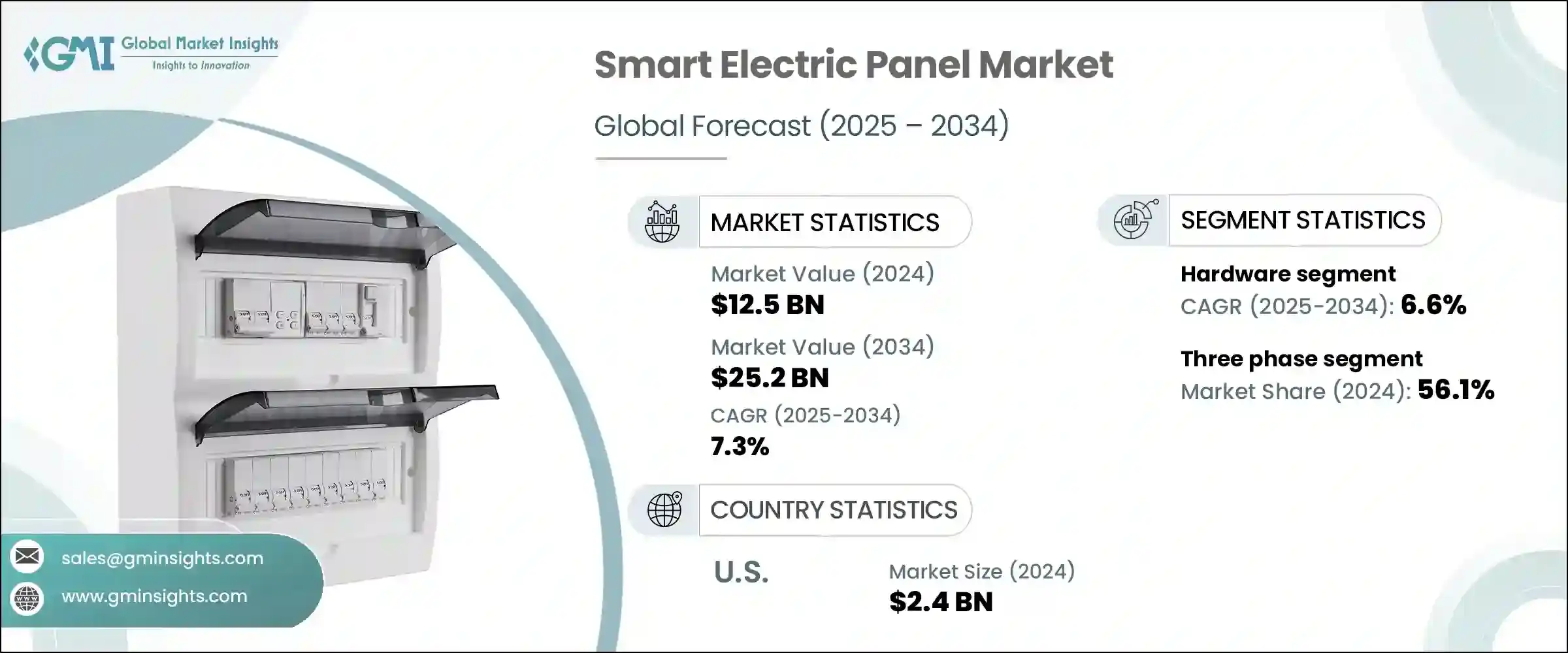

2024年,全球智慧配电板市场规模达125亿美元,预计到2034年将以7.3%的复合年增长率成长,达到252亿美元。随着建筑和能源系统的发展,对智慧互联电力基础设施的需求持续成长。智慧配电板正成为现代能源生态系统不可或缺的一部分,提供嵌入式人工智慧和机器学习功能,用于即时监控、预测性维护和需求面能源优化。随着能源成本的不断上涨以及对永续性的日益重视,企业和家庭都在寻求更智慧的用电管理方式。

与传统的云端系统相比,这些面板透过在本地处理资料、降低延迟并提高回应速度,支援更明智的决策。紧凑的模组化架构能够与智慧家居设备或可扩展的工业框架无缝集成,这种架构正日益受到青睐。 Zigbee、低功耗蓝牙 (BLE)、Z-Wave 和 Wi-Fi 等协定的日益普及提升了装置的互通性,使智慧面板成为互联环境的中心枢纽。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 125亿美元 |

| 预测值 | 252亿美元 |

| 复合年增长率 | 7.3% |

网路安全问题也影响产品开发,製造商纷纷采用安全韧体更新、用户身份验证和加密网关,以满足行业标准并保护电网基础设施。技术进步、用户需求和策略投资共同推动市场稳步扩张。

越来越多的消费者选择智慧面板来管理恆温器、照明系统和连网家电,以提高能源效率并降低电费。家庭优先考虑分时用电管理功能和即时用电分析,以控制用电模式。在住宅领域,智慧面板正在发展成为一体化能源解决方案,现已相容于 2 级电动车充电基础设施。

在商业环境中,与楼宇能源管理系统和暖通空调 (HVAC) 设备的整合正在进一步推动其应用。企业越来越依赖智慧面板进行电力监控和负载平衡,尤其是在高需求环境中。在分散营运的建筑公司和电信业者也开始采用这些智慧面板支援的远端监控功能。这有助于减少停机时间并增强分散式资产的可视性,最终有助于简化营运并降低成本。

智慧配电盘市场的软体组件部分在2024年价值41亿美元,这得益于用户体验的提升。云端连接允许从几乎任何地方进行远端存取、即时分析和客製化能源使用报告。人工智慧和机器学习软体的日益普及正在改变能源管理方式,使配电盘能够学习使用者行为并相应地调整电路功能。自主电路优化可提高整体效率,同时减少人工监督,帮助住宅和工业用户提高可靠性并降低营运成本。软体的进步使更聪明的能源预测和对波动的电网需求的自动响应成为可能。

三相智慧配电盘市场在2024年占据了56.1%的市场份额,这得益于其在工业厂房、医疗中心和IT资料中心等高负载设施中的应用。这些系统因其能够管理更高的电力需求并提供更高的运行稳定性而备受青睐。现代三相配电盘具有更大的电路灵活性和更高的额定电流,这对于管理复杂且高负载的电力负载至关重要。随着能源密集产业越来越多地采用自动化机械和互联基础设施,对稳健、可扩展的配电系统的需求持续成长。这些系统中嵌入的先进诊断功能和故障安全机制,为无法承受中断的设施增添了另一层价值。

2024年,美国智慧配电板市场规模达24亿美元。随着越来越多的美国家庭转向电气化,预计该市场将进一步扩张。电动车、热泵装置和电磁炉在家庭中的日益普及,直接推动了智慧配电板升级的需求。公用事业公司也正在透过激励计画推广智慧配电板的应用,旨在提高电网响应速度和能源效率。这些升级允许与电网进行双向通信,从而促进负载转移和尖峰需求管理,这对能源转型至关重要。

智慧电气面板市场的主要製造商包括西门子、施耐德电气、伊顿、罗克韦尔自动化、霍尼韦尔国际、ABB、艾默生电气、EcoFlow Technology、Accu Panels、通用电气、Leviton Manufacturing、Lumin、Hager Group、Qmerit Electrification、罗格朗、Havells India 和正泰集团。活跃于智慧电气面板产业的公司正在透过策略性研发投资和技术整合来加强其影响力。

许多公司正在将人工智慧、边缘运算和物联网相容性嵌入到其面板设计中,以支援即时监控和能源自动化。产品组合正在扩展,涵盖模组化、可扩展的单元,以符合智慧建筑趋势和绿色能源目标。各公司也专注于网路安全功能,例如加密通讯、安全韧体和进阶存取控制。为了加速市场渗透,主要参与者正在与住宅开发商、公用事业提供者和自动化系统整合商建立联盟。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依组件划分,2021 - 2034 年

- 主要趋势

- 硬体

- 软体

- 服务

第六章:市场规模及预测:依阶段,2021 - 2034

- 主要趋势

- 单相

- 三相

第七章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 有线

- 无线的

第 8 章:市场规模与预测:按应用,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

第九章:市场规模及预测:依销售管道,2021 - 2034 年

- 主要趋势

- 在线的

- 经销商

- 零售

第 10 章:市场规模与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 荷兰

- 奥地利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 马来西亚

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 南非

- 奈及利亚

- 科威特

- 阿曼

- 拉丁美洲

- 巴西

- 秘鲁

- 阿根廷

第 11 章:公司简介

- ABB

- Accu Panels

- Chint Group

- Eaton

- EcoFlow Technology

- Emerson Electric

- General Electric

- Hager Group

- Havells India

- Honeywell International

- Legrand

- Leviton Manufacturing

- Lumin

- Qmerit Electrification

- Rockwell Automation

- Schneider Electric

- Siemens

- SPAN

The Global Smart Electric Panel Market was valued at USD 12.5 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 25.2 billion by 2034. As buildings and energy systems evolve, the demand for intelligent, connected electrical infrastructure continues to rise. Smart electric panels are becoming integral to modern energy ecosystems, offering embedded artificial intelligence and machine learning capabilities for real-time monitoring, predictive maintenance, and demand-side energy optimization. With increasing energy costs and a growing emphasis on sustainability, businesses and homeowners alike are looking for smarter ways to manage power consumption.

These panels support better decision-making by processing data locally, reducing latency, and improving responsiveness compared to traditional cloud-dependent systems. Compact, modular architecture that allows seamless integration with smart home devices or scalable industrial frameworks is gaining momentum. The rising adoption of protocols like Zigbee, Bluetooth Low Energy (BLE), Z-Wave, and Wi-Fi boosts device interoperability, making smart panels a central hub for connected environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.5 Billion |

| Forecast Value | $25.2 Billion |

| CAGR | 7.3% |

Cybersecurity concerns are also influencing product development, with manufacturers incorporating secure firmware updates, user authentication, and encrypted gateways to meet industry standards and protect grid infrastructure. The market's steady expansion is being powered by a blend of technological advancements, user demand, and strategic investments.

A growing number of consumers are choosing smart panels to manage thermostats, lighting systems, and connected home appliances to improve energy efficiency and lower electricity bills. Households are prioritizing time-of-use management features and real-time consumption analytics to control usage patterns. In residential sectors, smart panels are evolving into all-in-one energy solutions, now offering compatibility with Level 2 electric vehicle charging infrastructure.

In commercial environments, integration with building energy management systems and HVAC setups is further propelling adoption. Businesses are increasingly reliant on smart panels for power monitoring and load balancing, particularly in high-demand settings. Construction firms and telecom operators operating across dispersed sites are also turning to remote monitoring capabilities enabled by these smart panels. This helps reduce downtime and enhance visibility across distributed assets, ultimately contributing to more streamlined operations and reduced costs.

The software component segment of the smart electric panel market was valued at USD 4.1 billion in 2024, driven by enhancing user experience. Cloud connectivity allows remote access, real-time analytics, and customized energy usage reports from virtually anywhere. The growing implementation of AI and machine learning software is transforming how energy is managed, enabling panels to learn user behavior and adjust circuit functions accordingly. Autonomous circuit optimization improves overall efficiency while reducing manual oversight, helping both residential and industrial users enhance reliability and reduce operational costs. Software advancements enable smarter energy forecasting and automated response to fluctuating grid demands.

The three-phase smart electric panels segment commanded a 56.1% share in 2024 due to their application in high-load facilities such as industrial plants, healthcare centers, and IT data hubs. These systems are favored for their ability to manage higher power requirements and deliver enhanced operational stability. Modern three-phase panels offer greater circuit flexibility and higher amperage ratings, which are essential in managing complex and heavy-duty electrical loads. As energy-intensive sectors increasingly adopt automated machinery and connected infrastructure, the need for robust, scalable electrical distribution systems continues to rise. Advanced diagnostic capabilities and fail-safe mechanisms embedded within these systems add another layer of value for facilities that cannot afford interruptions.

United States Smart Electric Panel Market was valued at USD 2.4 billion in 2024. The market is expected to expand further as more American households shift toward electrification. The increasing presence of electric vehicles, heat pump installations, and induction cooktops in homes is directly fueling the demand for intelligent panel upgrades. Utility companies are also promoting the adoption of smart panels through incentive programs aimed at achieving greater grid responsiveness and energy efficiency. These upgrades allow for two-way communication with the grid, facilitating load shifting and peak demand management, which are crucial to the energy transition.

Key manufacturers in the Smart Electric Panel Market include Siemens, Schneider Electric, Eaton, Rockwell Automation, Honeywell International, ABB, Emerson Electric, EcoFlow Technology, Accu Panels, General Electric, Leviton Manufacturing, Lumin, Hager Group, Qmerit Electrification, Legrand, Havells India, and Chint Group. Companies active in the smart electric panel industry are strengthening their presence through strategic R&D investments and technological integration.

Many are embedding AI, edge computing, and IoT compatibility into their panel designs to support real-time monitoring and energy automation. Product portfolios are expanding to include modular, scalable units that align with smart building trends and green energy goals. Firms are also focusing on cybersecurity features such as encrypted communications, secure firmware, and advanced access controls. To accelerate market penetration, key players are forming alliances with residential developers, utility providers, and automation system integrators.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Wired

- 7.3 Wireless

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 Online

- 9.3 Dealer

- 9.4 Retail

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 France

- 10.3.3 Germany

- 10.3.4 Italy

- 10.3.5 Russia

- 10.3.6 Spain

- 10.3.7 Netherlands

- 10.3.8 Austria

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 South Korea

- 10.4.4 India

- 10.4.5 Australia

- 10.4.6 New Zealand

- 10.4.7 Malaysia

- 10.4.8 Indonesia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 UAE

- 10.5.3 Qatar

- 10.5.4 Egypt

- 10.5.5 South Africa

- 10.5.6 Nigeria

- 10.5.7 Kuwait

- 10.5.8 Oman

- 10.6 Latin America

- 10.6.1 Brazil

- 10.6.2 Peru

- 10.6.3 Argentina

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Accu Panels

- 11.3 Chint Group

- 11.4 Eaton

- 11.5 EcoFlow Technology

- 11.6 Emerson Electric

- 11.7 General Electric

- 11.8 Hager Group

- 11.9 Havells India

- 11.10 Honeywell International

- 11.11 Legrand

- 11.12 Leviton Manufacturing

- 11.13 Lumin

- 11.14 Qmerit Electrification

- 11.15 Rockwell Automation

- 11.16 Schneider Electric

- 11.17 Siemens

- 11.18 SPAN