|

市场调查报告书

商品编码

1773340

龋齿检测仪市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dental Caries Detectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

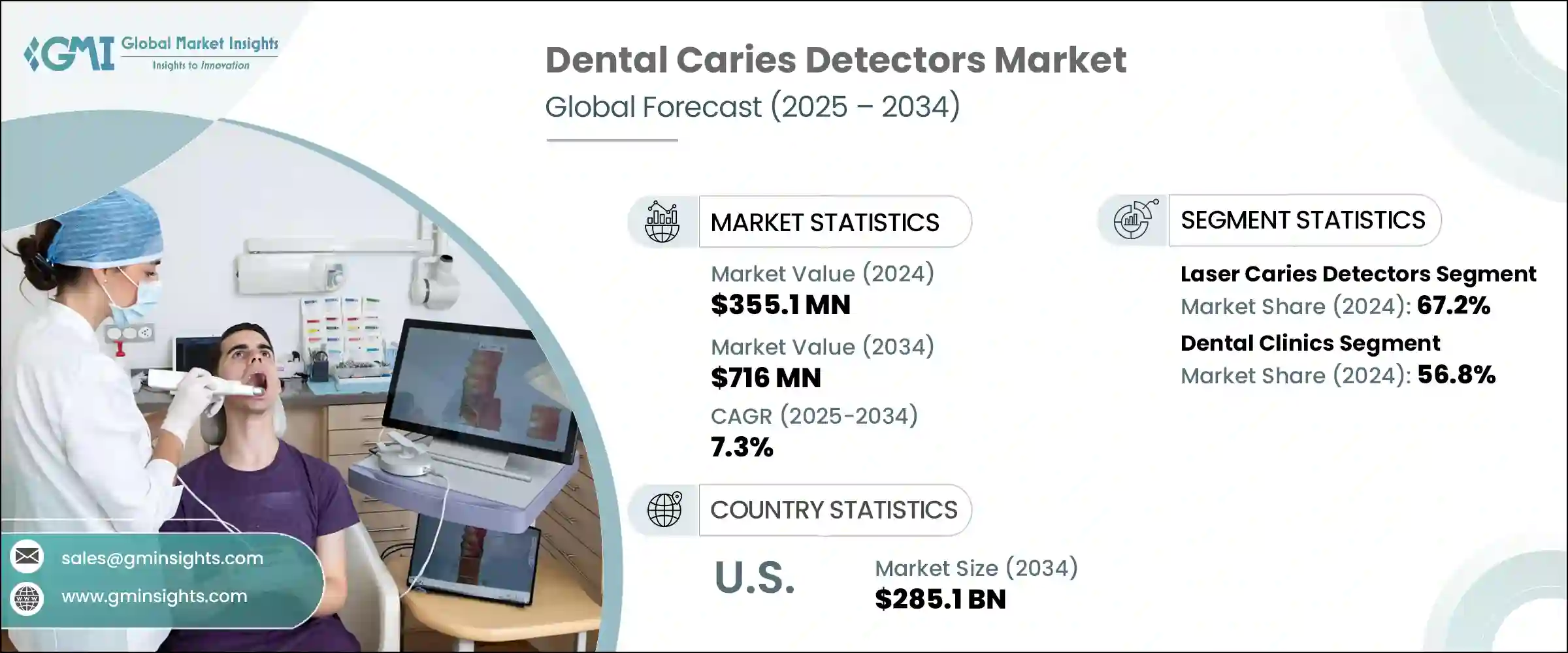

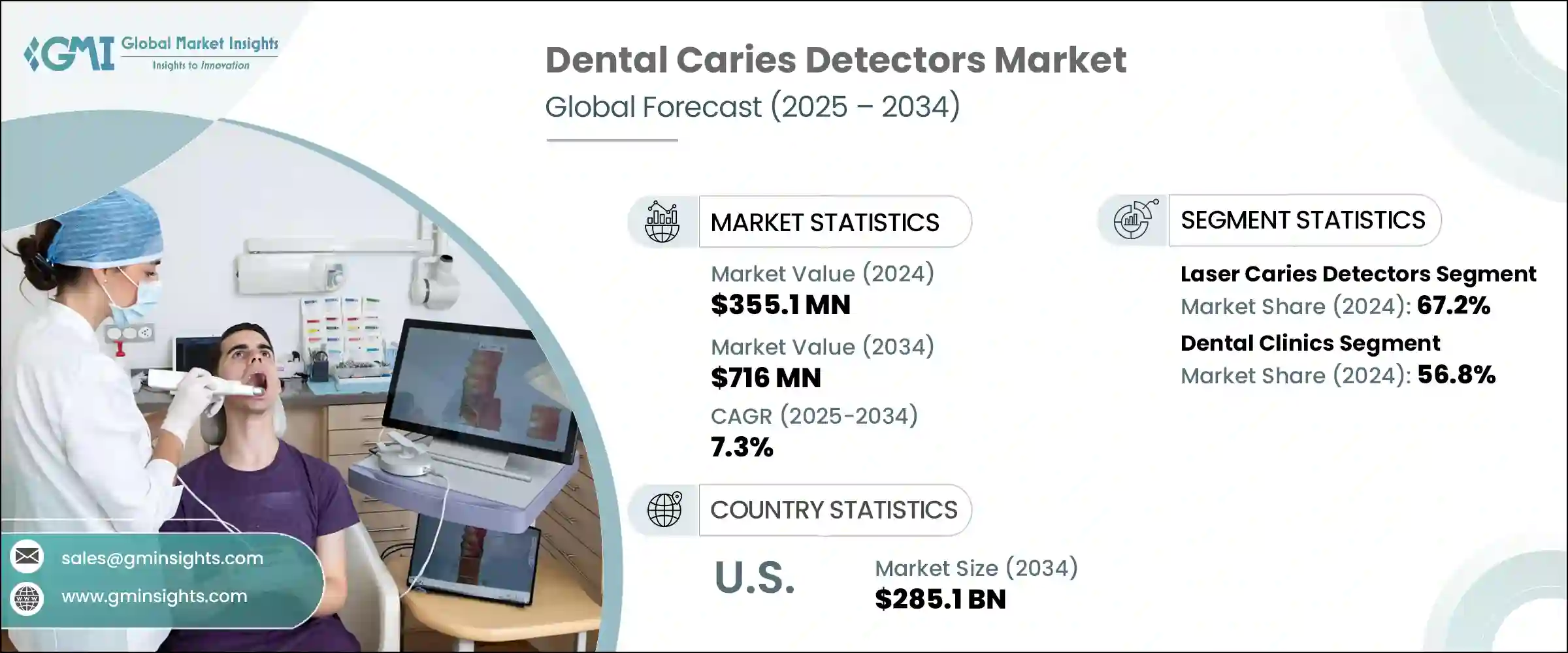

2024年,全球龋齿侦测仪市场规模达3.551亿美元,预计到2034年将以7.3%的复合年增长率成长,达到7.16亿美元。龋齿发生率的上升,尤其是在老化人口和年轻族群中,持续推动先进诊断工具的需求。由于未治疗的龋齿往往会导致复杂的口腔健康问题和更高的治疗费用,人们越来越关注早期非侵入性检测方法。越来越多的患者和医疗机构开始使用龋齿检测设备,以获得更快、更准确的评估。

口腔护理意识的提升以及预防措施被纳入个人和公共卫生系统,正在重塑口腔疾病的管理方式。随着现代科技的普及以及早期介入的趋势,牙科护理正变得更加主动而非被动。人们对整体健康的普遍关注也推动了这个市场的成长,促使牙医采用前瞻性工具,帮助有效地检测、监测和预防口腔健康问题。此外,数位平台和不断发展的患者护理模式正在改变牙医的诊断方式,从而为患者群体带来更好的临床疗效并降低长期成本。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 3.551亿美元 |

| 预测值 | 7.16亿美元 |

| 复合年增长率 | 7.3% |

技术驱动的创新是该市场的核心,各种设备透过数位X射线摄影、雷射萤光和近红外线成像等方法,提供更快的诊断速度和更精确的诊断精度。这些进步使执业医师能够在病变进展之前发现病变,从而能够采取以保留病灶和微创治疗为重点的干预措施。随着人们对补充护理和整体健康的兴趣日益增长,牙科诊所正在整合符合更广泛治疗目标的早期检测工具,包括舒适度、寿命和患者满意度。随着人们日益重视长期健康储蓄和口腔卫生教育,这些检测技术正成为常规检查的关键组成部分,改善了诊疗可及性,并优化了早期护理策略。

2024年,雷射龋齿侦测工具市场占有67.2%的市场份额,巩固了其在全球市场的领先地位。这些系统因其能够在可见的龋齿出现之前识别病变,正成为首选。微创手术的趋势推动了对能够保护天然珐琅质并进行早期预防干预的设备的需求。雷射技术通常依赖萤光,提供一种可靠、无痛的方法来区分健康和龋齿组织。随着人们对萤光在识别咬合面和邻面龋齿方面的临床可靠性的信心不断增强,基于雷射的系统在各个诊所中越来越被广泛接受。牙医投资这些工具不仅是为了提高诊断精确度,也是为了提升患者在常规检查中的舒适度和体验。

2024年,牙科诊所细分市场占据56.8%的市场。诊所面临越来越大的压力,需要透过实证实践来验证其诊断的准确性,尤其是在保险和医疗服务体係不断发展的情况下。整合先进的检测系统有助于服务提供者遵循现代护理方案,同时增强患者信任并降低过度治疗的风险。许多诊所正在转向数据驱动的治疗计划,其中精准的检测支持龋病的保守治疗和个人化护理方法。鑑于早期诊断是有效治疗的关键,诊所正在将自己定位为预防性牙科护理领域的领导者。

预计到2034年,美国龋齿侦测仪市场规模将达2.851亿美元。儘管美国是一个高收入国家,但其口腔健康负担依然沉重,尤其是在儿童、老年人和弱势群体中。预防性牙科就诊的障碍(例如费用高昂和就诊管道有限)使得早期检测对于控制普遍存在的龋齿至关重要。私人诊所和公共卫生机构越来越多地采用诊断工具,以控制长期医疗保健成本并支持更广泛的预防保健目标。诊断创新在缓解未治疗的牙科问题和改善全国范围内的口腔健康状况方面发挥关键作用。

龋齿检测仪市场的知名企业包括 Ivoclar Vivadent、Quantum Dental Technologies、Planmeca、AdDent、Biolase、Dentsply Sirona、Centrix、Kuraray、Acteon Group、Hu-Friedy、DentLight、KaVo Kerr、Vatech、Air Techniques 和Air Techniques 和。龋齿检测仪市场的领先公司致力于提高诊断精度和用户友好型设计,以优化临床工作流程。

许多公司正在整合人工智慧分析和即时成像技术,以改进龋齿识别并支援实证牙科。研发方面的策略性投资旨在提供适用于各种临床环境的紧凑、非侵入式且经济高效的设备。各公司也与牙医学校和医疗系统建立合作伙伴关係,以提高产品的采用率和教育推广。扩展产品组合以涵盖多功能诊断工具,进一步增强了其竞争地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球龋齿盛行率不断上升

- 提高人们对口腔健康和预防牙科的认识

- 成像和雷射检测技术的进步

- 牙科诊所和专业人员的数量不断增加

- 产业陷阱与挑战

- 先进龋齿检测设备成本高

- 缺乏报销政策

- 市场机会

- 用于早期龋齿检测的人工智慧诊断解决方案

- 便携式和远端牙科相容龋齿检测设备

- 成长动力

- 成长潜力分析

- 监管格局

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 报销场景

- 报销政策对市场成长的影响

- 未来市场趋势

- 消费者行为分析

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 雷射龋齿检测仪

- 光纤透照(FOTI)设备

第六章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 牙医诊所

- 医院

- 学术和研究机构

- 诊断中心

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Acteon Group

- AdDent

- Air Techniques

- Biolase

- Centrix

- DentLight

- Dentsply Sirona

- GreenMark Biomedical

- Hu-Friedy

- Ivoclar Vivadent

- KaVo Kerr

- Kuraray

- Planmeca

- Quantum Dental Technologies

- Vatech

The Global Dental Caries Detectors Market was valued at USD 355.1 million in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 716 million by 2034. Rising incidences of dental caries, particularly among aging populations and younger age groups, continue to drive the need for advanced diagnostic tools. As untreated cavities often lead to complex oral health issues and higher treatment costs, there is a growing focus on early-stage, non-invasive detection methods. Patients and providers alike are increasingly turning to caries detection devices for faster, more accurate assessments.

Advancements in oral care awareness and the integration of preventive measures into both individual and public health systems are reshaping how oral diseases are managed. With improved access to modern technologies and a shift toward early intervention, dental care is becoming more proactive than reactive. This market's growth is also supported by a wider interest in overall well-being, encouraging dentists to implement forward-thinking tools that help detect, monitor, and prevent oral health issues efficiently. Additionally, digital platforms and evolving patient care models are transforming the way dental practitioners approach diagnosis, enabling better clinical outcomes and long-term cost reduction across patient populations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $355.1 Million |

| Forecast Value | $716 Million |

| CAGR | 7.3% |

Technology-driven innovation is at the core of this market, with devices offering enhanced speed and diagnostic precision through methods like digital radiography, laser fluorescence, and near-infrared imaging. These advancements are empowering practitioners to identify lesions before they progress, enabling interventions that prioritize preservation and minimal invasion. As interest in complementary care and holistic health grows, dental offices are incorporating early detection tools that align with broader treatment goals, including comfort, longevity, and patient satisfaction. With a rising emphasis on long-term health savings and education around oral hygiene, these detection technologies are becoming key components in routine exams, improving access and optimizing early-stage care strategies.

The laser caries detection tools segment accounted for a 67.2% share in 2024, solidifying its lead within the global market. These systems are becoming the preferred choice due to their ability to identify lesions before visible decay develops. The trend toward minimally invasive procedures is fueling demand for devices that preserve natural enamel and allow early preventive intervention. Laser technologies often rely on fluorescence, providing a reliable, pain-free method to differentiate between healthy and decayed tissue. As confidence grows in the clinical reliability of fluorescence for identifying occlusal and interproximal caries, laser-based systems are gaining broader acceptance across practices. Dentists are investing in these tools not only to increase diagnostic precision but also to enhance patient comfort and experience during routine checkups.

The dental clinics segment held a 56.8% share in 2024. Clinics are under increasing pressure to validate their diagnostic accuracy with evidence-based practices, particularly as insurance and care delivery systems evolve. Integrating advanced detection systems helps providers align with modern care protocols while reinforcing patient trust and reducing the risk of overtreatment. Many clinics are shifting toward data-driven treatment planning, where accurate detection supports conservative management of carious lesions and personalized care approaches. With early diagnosis being key to effective treatment, clinics are positioning themselves as leaders in preventive dental care.

United States Dental Caries Detectors Market is projected to reach USD 285.1 million by 2034. Despite being a high-income nation, the U.S. faces a significant oral health burden, particularly among children, seniors, and underrepresented communities. Barriers to preventive dental visits-such as cost and limited access-make early detection critical in managing widespread decay. The adoption of diagnostic tools is increasing across both private clinics and public health settings to control long-term healthcare costs and support broader preventive care goals. The role of diagnostic innovation is pivotal in mitigating untreated dental issues and improving oral health outcomes nationwide.

Prominent players operating in the Dental Caries Detectors Market include Ivoclar Vivadent, Quantum Dental Technologies, Planmeca, AdDent, Biolase, Dentsply Sirona, Centrix, Kuraray, Acteon Group, Hu-Friedy, DentLight, KaVo Kerr, Vatech, Air Techniques, and GreenMark Biomedical. Leading companies in the dental caries detectors market are focusing on advancing diagnostic precision and user-friendly designs to enhance clinical workflows.

Many are integrating AI-powered analytics and real-time imaging to improve caries identification and support evidence-based dentistry. Strategic investments in R&D aim to deliver compact, non-invasive, and cost-effective devices suited for diverse clinical environments. Companies are also forming partnerships with dental schools and health systems to increase product adoption and educational outreach. Expanding product portfolios to include multifunctional diagnostic tools further strengthens their competitive position.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of dental caries globally

- 3.2.1.2 Rising awareness about oral health and preventive dentistry

- 3.2.1.3 Technological advancements in imaging and laser-based detection

- 3.2.1.4 Growing number of dental clinics and professionals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced caries detection devices

- 3.2.2.2 Lack of reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 AI-Powered Diagnostic Solutions for Early Caries Detection

- 3.2.3.2 Portable and Teledentistry-Compatible Caries Detection Devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Reimbursement scenario

- 3.7.1 Impact of reimbursement policies on market growth

- 3.8 Future market trends

- 3.9 Consumer behaviour analysis

- 3.10 Patent analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Laser caries detectors

- 5.3 Fiber optic transillumination (FOTI) devices

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dental clinics

- 6.3 Hospitals

- 6.4 Academic and research institutes

- 6.5 Diagnostic centers

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Mexico

- 7.5.2 Brazil

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Acteon Group

- 8.2 AdDent

- 8.3 Air Techniques

- 8.4 Biolase

- 8.5 Centrix

- 8.6 DentLight

- 8.7 Dentsply Sirona

- 8.8 GreenMark Biomedical

- 8.9 Hu-Friedy

- 8.10 Ivoclar Vivadent

- 8.11 KaVo Kerr

- 8.12 Kuraray

- 8.13 Planmeca

- 8.14 Quantum Dental Technologies

- 8.15 Vatech