|

市场调查报告书

商品编码

1773345

子宫肌瘤治疗设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Uterine Fibroid Treatment Device Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

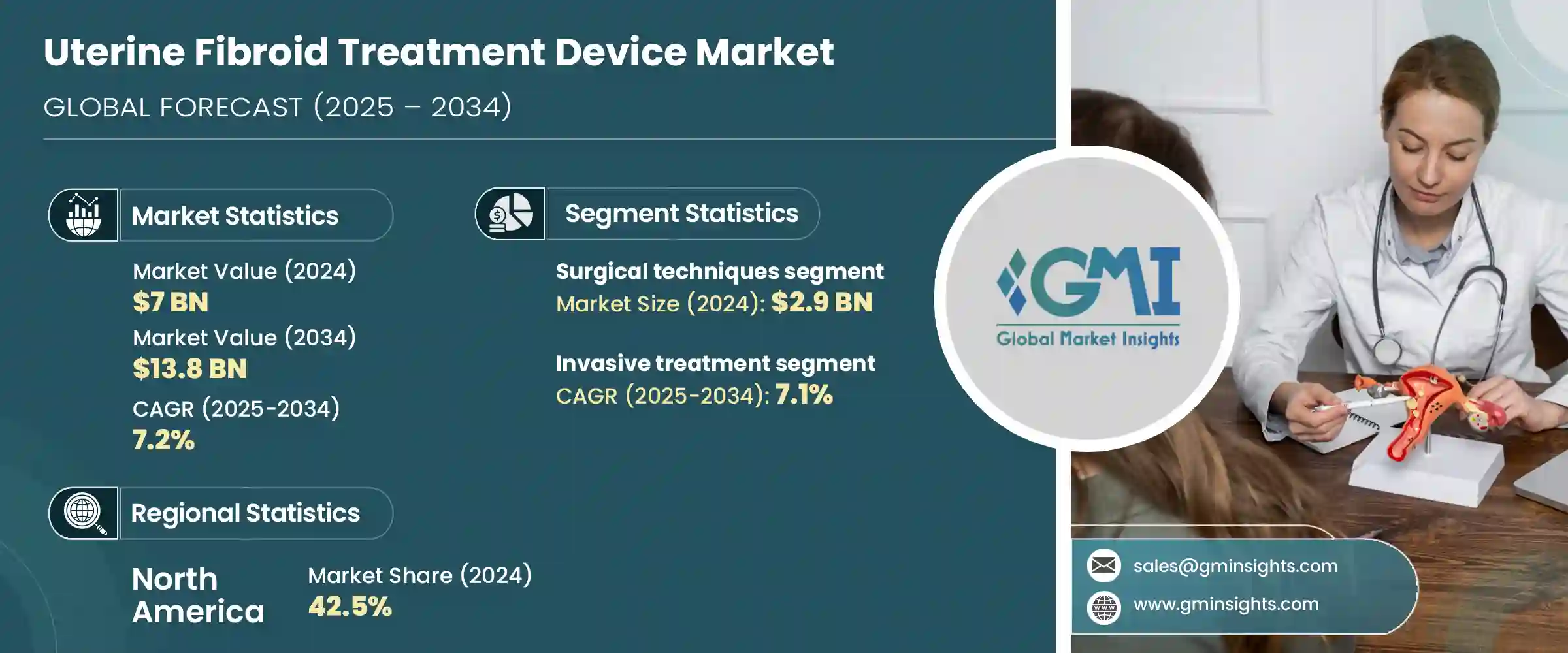

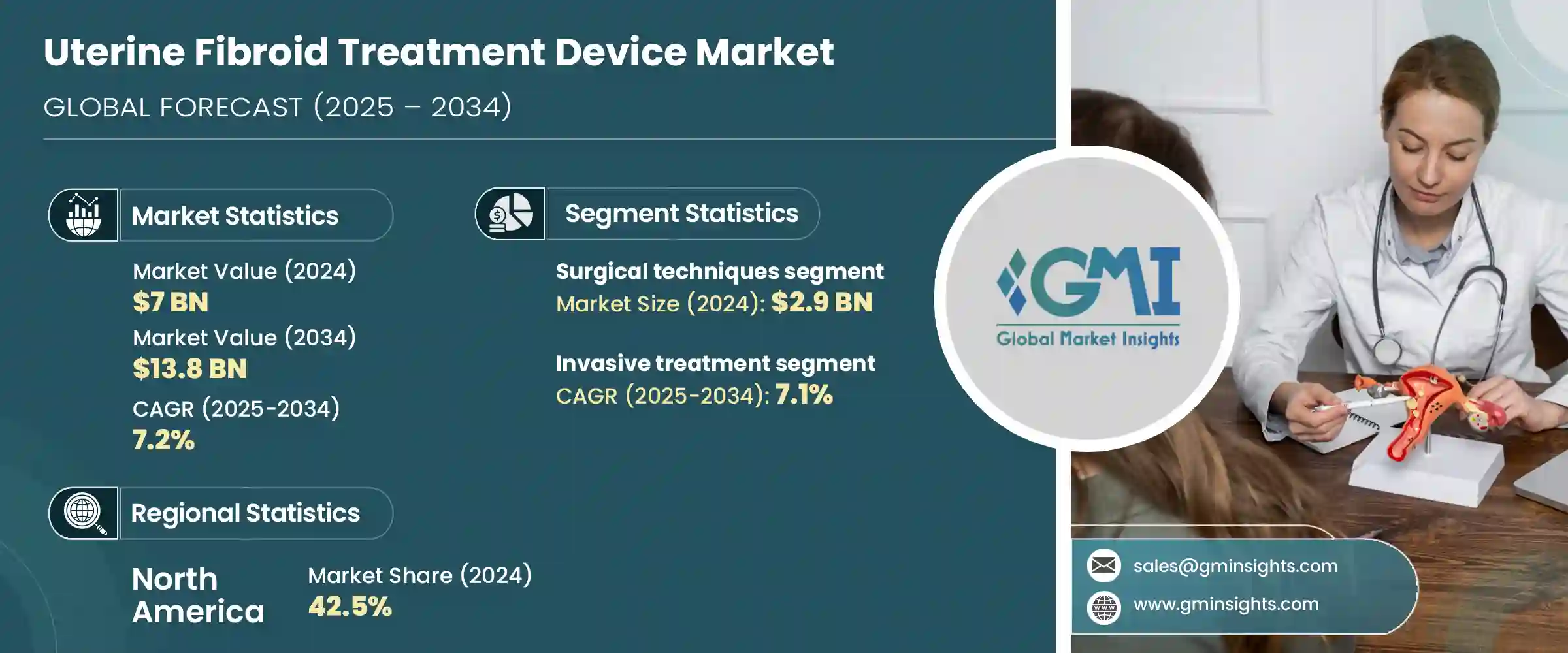

2024年,全球子宫肌瘤治疗设备市场规模达70亿美元,预计到2034年将以7.2%的复合年增长率成长,达到138亿美元。育龄女性子宫肌瘤病例的持续成长,大大推动了对可靠安全的先进治疗方案的需求。人们对微创和保留子宫手术的认识不断提高,以及向技术先进的解决方案的显着转变,正在推动医疗体系更广泛地采用这些技术。基于能量的技术因其能够有效治疗子宫肌瘤并保持子宫完整性而广受欢迎。

非侵入性及低创伤性治疗方法的持续创新正在改善患者的治疗效果,尤其对于那些寻求传统手术替代方案的患者而言。熟练执业医师的丰富,以及已开发和新兴医疗基础设施中治疗管道的扩大,也在支撑市场成长方面发挥关键作用。随着月经过多等妇科疾病的盛行率不断上升,子宫肌瘤治疗器械市场也持续扩张。 Canyon Medical、Minerva Surgical、美敦力、Terumo Corporation、强生(爱惜康)等公司正透过新型治疗器械推动子宫肌瘤治疗领域的发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 70亿美元 |

| 预测值 | 138亿美元 |

| 复合年增长率 | 7.2% |

2024年,外科手术领域收入达29亿美元。这些治疗着重于消除子宫肌瘤,或在某些情况下切除子宫本身,取决于病情的严重程度和复杂程度。当子宫肌瘤较大、数量众多或症状严重时,通常首选肌瘤切除术和子宫切除术等手术。这些手术因其高成功率和持久的症状缓解而受到医护人员和患者的青睐。医疗基础设施的不断扩展、保险方案的改善以及经验丰富的外科专业人员的更便捷性,支撑了该领域持续占据主导地位。月经过多及相关妇科疾病病例的增加也加剧了对外科手术的强劲需求。

2024年,侵入性手术领域引领市场,预计2034年将以7.1%的复合年增长率成长。这些治疗方法对复杂或严重的子宫肌瘤尤其有效,能够全面缓解症状。当药物或非侵入性疗法无法达到预期效果时,这些方法就成为首选。与非侵入性技术相比,开放式手术方法能够提供更明确的治疗结果,从而解决诸如骨盆腔不适、异常出血和生育相关併发症等长期存在的问题。此外,由于能够治疗深层或多发性子宫肌瘤,开放式手术领域也成为子宫肌瘤治疗器械市场的重要组成部分。

2024年,美国子宫肌瘤治疗设备市场规模达30亿美元。推动这一成长的关键因素之一是拥有大量专注于女性健康和妇科手术的医疗专家。每年,美国都会进行数千例能量疗法和栓塞手术,以有效治疗子宫肌瘤。随着治疗设备技术的不断进步以及人们对微创治疗方案的日益了解,美国将继续成为整体市场扩张的重要贡献者。此外,围绕新型治疗技术的教育以及医疗服务模式的改进也有助于提高患者对基于设备的子宫肌瘤治疗方案的接受度和信任度。

业界知名企业包括奥林巴斯、Insightec、深圳迈瑞生物医疗电子、Conmed、Merit Medical Systems、CooperSurgical、波士顿科学、Karl Storz、Hologic、Canyon Medical、美敦力、Minerva Surgical、Terumo Corporation、Nesa Medtech 和强生 (Ethicon)。这些公司透过持续的产品开发和创新,在塑造市场方向方面发挥着重要作用。为了巩固其在子宫肌瘤治疗设备市场的地位,领先公司正在积极投资研发,以推出安全性更高的微创技术。许多公司正专注于透过合併、策略合作和收购来扩展其产品组合,以获得创新的治疗平台。一些公司正在努力透过将即时成像和基于人工智慧的导航系统整合到他们的设备中来改善患者的治疗效果。此外,主要参与者正在透过进入尚未开发的市场和与区域医疗保健提供者结盟来扩大其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 子宫肌瘤盛行率不断上升

- 子宫和腹腔镜设备的技术进步

- 微创手术需求不断成长

- 产业陷阱与挑战

- 先进治疗设备成本高

- 农村和发展中地区的可用性有限

- 市场机会

- 一次性使用设备的采用率不断提高

- 保留生育能力的治疗方案的需求增加

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 定价分析

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 手术技术

- 子宫切除术

- 肌瘤切除术

- 腹腔镜技术

- 腹腔镜子宫肌瘤切除术

- 肌溶解症

- 消融技术

- 微波消融

- 水热烧蚀

- 冷冻消融

- 超音波消融

- 高强度聚焦超音波(HIFU)

- MRI导引聚焦超音波(MRGFUS)

- 栓塞技术

第六章:市场估计与预测:依治疗方式,2021 年至 2034 年

- 主要趋势

- 侵入性治疗

- 微创治疗

- 非侵入性治疗

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Boston Scientific

- Canyon Medical

- Conmed

- CooperSurgical

- Hologic

- Insightec

- Johnson & Johnson (Ethicon)

- Karl Storz

- Medtronic

- Merit Medical Systems

- Minerva Surgical

- Nesa Medtech

- Olympus

- Shenzhen Mindray Bio-Medical Electronics

- Terumo Corporation

The Global Uterine Fibroid Treatment Device Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 13.8 billion by 2034. The consistent rise in fibroid cases among women of childbearing age is significantly fueling the demand for advanced treatment options that are both reliable and safe. Greater awareness about minimally invasive and uterus-sparing procedures, along with a noticeable shift towards technologically sophisticated solutions, is driving broader adoption across healthcare systems. Energy-based technologies have gained popularity for their ability to manage fibroids efficiently while maintaining uterine integrity.

Continuous innovation in non-invasive and less aggressive treatment methods is enhancing patient outcomes, particularly for those seeking alternatives to traditional surgery. The availability of skilled practitioners and expanded access to treatment across developed and emerging healthcare infrastructures also play a critical role in supporting market growth. As the prevalence of conditions like menorrhagia and other gynecologic disorders increases, the market for uterine fibroid treatment devices continues to expand. Companies like Canyon Medical, Minerva Surgical, Medtronic, Terumo Corporation, Johnson & Johnson (Ethicon), and others are key players advancing the landscape of fibroid management with novel therapeutic devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $13.8 Billion |

| CAGR | 7.2% |

The surgical procedures segment generated USD 2.9 billion in 2024. These treatments focus on eliminating fibroids or, in certain situations, removing the uterus itself, depending on the extent and complexity of the condition. Procedures such as myomectomy and hysterectomy are often preferred when fibroids are large, numerous, or highly symptomatic. Their popularity among both healthcare providers and patients stems from high success rates and long-lasting relief from symptoms. The continued dominance of this segment is supported by an expanding healthcare infrastructure, improved insurance options, and better access to experienced surgical professionals. Factors like rising cases of excessive menstrual bleeding and related gynecological issues also contribute to the strong demand for surgical intervention.

In 2024, the invasive procedures segment led the market and is anticipated to grow at a CAGR of 7.1% through 2034. These treatments are especially effective for complicated or severe fibroid conditions, offering comprehensive symptom relief. When medications or non-invasive therapies fail to deliver the expected results, these methods become the preferred option. Open surgical approaches address persistent issues such as pelvic discomfort, abnormal bleeding, and fertility-related complications by providing more definitive outcomes compared to non-invasive techniques. The ability to treat deeply embedded or multiple fibroids also makes this segment a critical part of the uterine fibroid treatment device market.

U.S. Uterine Fibroid Treatment Device Market was valued at USD 3 billion in 2024. A key factor contributing to this growth is the availability of medical experts specializing in women's health and gynecologic procedures. Thousands of energy-based and embolization procedures are carried out annually to treat fibroids effectively. With continual technological advancements in treatment devices and broader awareness of less invasive alternatives, the U.S. continues to be a significant contributor to overall market expansion. Education around newer treatment techniques and improvements in healthcare delivery models are also helping to increase patient uptake and trust in device-based fibroid solutions.

Prominent industry players include Olympus, Insightec, Shenzhen Mindray Bio-Medical Electronics, Conmed, Merit Medical Systems, CooperSurgical, Boston Scientific, Karl Storz, Hologic, Canyon Medical, Medtronic, Minerva Surgical, Terumo Corporation, Nesa Medtech, and Johnson & Johnson (Ethicon). These companies are instrumental in shaping the market's direction through ongoing product development and innovation. To reinforce their position in the uterine fibroid treatment device market, leading companies are actively investing in research and development to introduce minimally invasive technologies with improved safety profiles. Many are focusing on expanding their product portfolios through mergers, strategic partnerships, and acquisitions to access innovative treatment platforms. Several firms are working to enhance patient outcomes by integrating real-time imaging and AI-based navigation systems into their devices. Additionally, key players are increasing their global footprint by entering untapped markets and aligning with regional healthcare providers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Treatment

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of uterine fibroids

- 3.2.1.2 Technological advancements in uterine & laparoscopic devices

- 3.2.1.3 Rising demand for minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced treatment devices

- 3.2.2.2 Limited availability in rural and developing areas

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing adoption of disposable and single-use devices

- 3.2.3.2 Increased demand for fertility-preserving treatment options

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Surgical techniques

- 5.2.1 Hysterectomy

- 5.2.2 Myomectomy

- 5.3 Laparoscopic techniques

- 5.3.1 Laparoscopic myomectomy

- 5.3.2 Myolysis

- 5.4 Ablation techniques

- 5.4.1 Microwave ablation

- 5.4.2 Hydrothermal ablation

- 5.4.3 Cryoablation

- 5.4.4 Ultrasound ablation

- 5.4.4.1 High intensity focused ultrasound (HIFU)

- 5.4.4.2 MRI-guided focused ultrasound (MRGFUS)

- 5.5 Embolization techniques

Chapter 6 Market Estimates and Forecast, By Treatment, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Invasive treatment

- 6.3 Minimally invasive treatment

- 6.4 Non-invasive treatment

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Boston Scientific

- 8.2 Canyon Medical

- 8.3 Conmed

- 8.4 CooperSurgical

- 8.5 Hologic

- 8.6 Insightec

- 8.7 Johnson & Johnson (Ethicon)

- 8.8 Karl Storz

- 8.9 Medtronic

- 8.10 Merit Medical Systems

- 8.11 Minerva Surgical

- 8.12 Nesa Medtech

- 8.13 Olympus

- 8.14 Shenzhen Mindray Bio-Medical Electronics

- 8.15 Terumo Corporation