|

市场调查报告书

商品编码

1773349

一次性注射器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Disposable Syringe Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

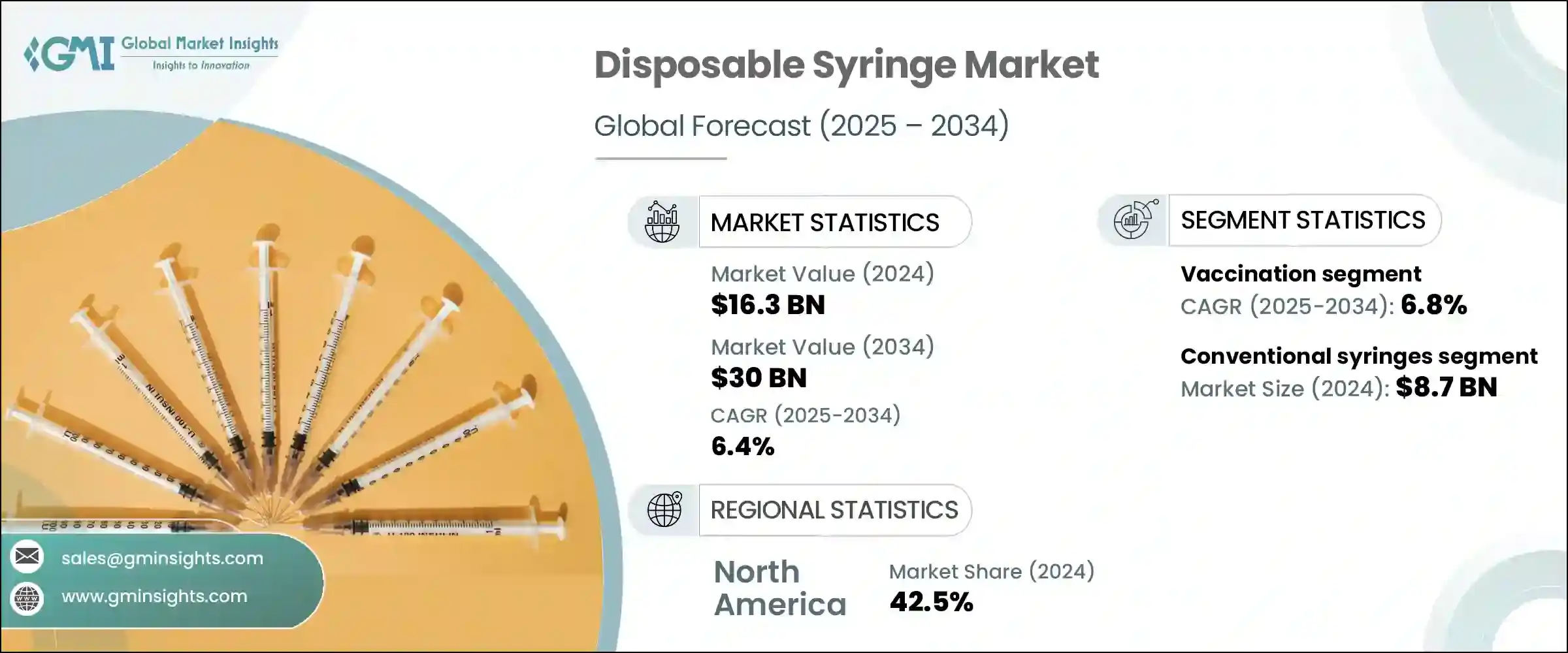

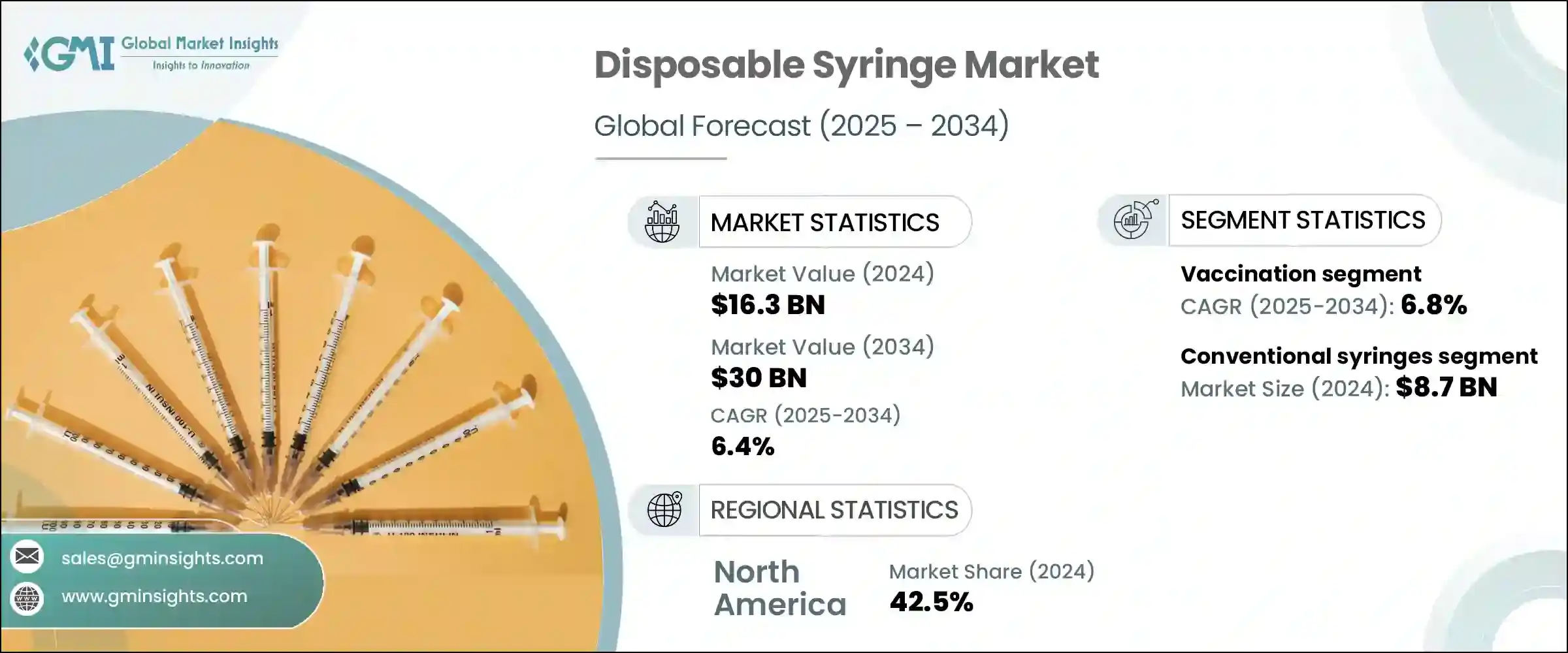

2024年,全球一次性注射器市场规模达163亿美元,预估年复合成长率为6.4%,2034年将达300亿美元。这一增长主要源于糖尿病、心血管疾病和自体免疫疾病等慢性疾病日益加重的负担,这些疾病都需要频繁注射治疗。此外,现代生活方式导致的健康併发症(例如肥胖和高血压)增多,也刺激了对安全、卫生和精准给药工具的需求。一次性注射器在降低交叉污染风险和确保精准给药方面发挥着至关重要的作用,尤其对于需要长期治疗的患者而言。

全球扩大免疫覆盖率的推动,以及传染病的频传,进一步加剧了一次性注射器在医疗基础设施中的使用。可伸缩针头和防针刺设计等增强安全性功能的出现,正在持续重塑诊所、医院和急救服务的采购模式。材料和注射器机制的快速改善与严格的医疗法规紧密结合,影响采购决策。这些因素共同为已开发经济体和发展中经济体一次性注射器的普及创造了良好的环境。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 163亿美元 |

| 预测值 | 300亿美元 |

| 复合年增长率 | 6.4% |

2024年,传统注射器市场规模达87亿美元。其结构简单、普及性强且经济高效,使其成为医疗和家庭护理领域中应用最广泛的产品。这些一次性注射器常用于接种疫苗、抽血和静脉注射药物。由于价格实惠且易于批量采购,不同地区的政府和私人医疗机构更青睐传统注射器。它们是持续进行的医疗保健活动、大规模疫苗接种计划和公共卫生推广计画的重要组成部分。其持续的相关性可以归因于其通用相容性、使用简单性以及在紧急护理和常规护理中的可靠性。

预计到2034年,疫苗接种应用领域的复合年增长率将达到6.8%。全球免疫接种工作的不断扩大推动了一次性注射器的需求成长,因为每剂疫苗通常都需要一支无菌的独立注射器。新型疫苗的推出,包括升级的加强剂和儿科联合疫苗,提高了疫苗接种的频率。预防性医疗保健的这种成长趋势极大地促进了一次性注射器使用量的增加。已开发经济体和新兴经济体的公共卫生计画正在透过扩大覆盖范围来提高注射器的使用率,从而推动供应链的持续活跃和製造业产量的提升。

2024年,美国一次性注射器市场规模达65亿美元。美国先进的医疗体系,加上人们对医疗相关损伤日益增长的认识,使得一次性注射器成为临床实践的首选。需求成长的主要动力源自于人们对医护人员安全的日益重视,尤其是在从紧急医疗服务到美容手术等各种环境中,避免意外针头相关的损伤。此类事件的高发性凸显了一次性注射器(尤其是配备安全机制的注射器)作为最大程度降低职业危害和遵守法规规范的重要手段。

一次性注射器市场的领导者包括 Braun Medical、Becton、Dickinson and Company、Baxter International、Terumo Corporation、Medtronic、Nipro Corporation、Agilent Technologies、Chris Merchant、Henke-Sass、Wolf、Ultimed、Vita Needle Company、Hindustan Syringes & Medical Devi、Kohfsun、Kohn 和benius Ksunnect。为了巩固其在竞争激烈的一次性注射器领域中的地位,主要製造商正专注于产品多样化和产品组合扩展,以满足日益增长的全球医疗保健需求。该公司正在透过采用可伸缩针头和自动禁用机制等技术来提高注射器的安全性,以遵守严格的医疗法规并降低针刺风险。与卫生部、国际卫生组织和采购机构的策略合作正在增强全球分销能力。许多公司正在增加对自动化生产线的投资,以提高效率、保持无菌并满足公共卫生紧急情况下的数量激增。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 慢性病盛行率不断上升

- 传染病疫情日益增多

- 注射器设计和材料的技术进步

- 外科手术和门诊量不断增加

- 产业陷阱与挑战

- 安全注射器成本高

- 塑胶医疗废弃物引发的环境问题

- 市场机会

- 转向可生物降解和环保的注射器材料

- 预充式註射器需求不断成长

- 成长动力

- 成长潜力分析

- 监管格局

- 波特的分析

- PESTLE 分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 传统注射器

- 安全注射器

- 可伸缩安全注射器

- 不可伸缩安全注射器

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 疫苗接种

- 血液收集

- 药物输送

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 诊断实验室

- 门诊手术中心(ASC)

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Agilent Technologies

- B Braun Melsungen

- Baxter International

- Becton, Dickinson and Company

- Braun Medical

- Chris Merchant

- Fresenius Kabi

- Henke-Sass, Wolf

- Hindustan Syringes & Medical Devices

- Kohope Medical

- Medtronic

- Nipro Corporation

- Terumo Corporation

- Ultimed

- Vita Needle Company

The Global Disposable Syringe Market was valued at USD 16.3 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 30 billion by 2034. This growth is largely driven by the increasing burden of chronic illnesses, including diabetes, cardiovascular conditions, and autoimmune diseases, all of which require frequent injectable therapies. Additionally, a rise in health complications associated with modern lifestyles-such as obesity and hypertension-is fueling demand for safe, hygienic, and precise drug delivery tools. Disposable syringes play a vital role in minimizing cross-contamination risks and ensuring accurate dosing, especially in patients requiring long-term treatments.

The global push for expanded immunization coverage, along with frequent outbreaks of infectious diseases, has further intensified the use of disposable syringes across healthcare infrastructures. The emergence of safety-enhanced features like retractable needles and anti-needlestick designs continues to reshape the procurement patterns in clinics, hospitals, and emergency services. Rapid improvements in materials and syringe mechanisms are aligning closely with stringent healthcare regulations, influencing purchasing decisions. These collective factors are creating a robust landscape for single-use syringe adoption across both developed and developing economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.3 Billion |

| Forecast Value | $30 Billion |

| CAGR | 6.4% |

In 2024, the conventional syringes segment generated USD 8.7 billion. Their straightforward construction, widespread availability, and cost-efficiency make them the most widely used across medical and home care settings. These single-use syringes are favored for administering vaccines, drawing blood, and delivering intravenous medications. Governments and private medical facilities across various regions prefer conventional syringes due to their affordability and ease of bulk procurement. They are a critical component in ongoing healthcare campaigns, large-scale vaccination initiatives, and public health outreach programs. Their continued relevance can be attributed to their universal compatibility, simplicity in use, and reliability in both emergency and routine care.

The vaccination application segment is expected to grow at a CAGR of 6.8% through 2034. Expanding global immunization efforts are driving increased demand for single-use syringes, as each administered vaccine dose typically requires a sterile, individual syringe. The rollout of newer vaccines, including updated booster shots and pediatric combination formulas, has led to a higher frequency of vaccination drives. This growing trend in preventive healthcare significantly contributes to the rising use of disposable syringes. Public health initiatives across both developed and emerging economies are amplifying syringe utilization through expanded outreach, thereby pushing continuous supply chain activity and heightened manufacturing output.

United States Disposable Syringe Market was valued at USD 6.5 billion in 2024. The country's advanced healthcare system, combined with rising awareness around healthcare-associated injuries, has positioned disposable syringes as a preferred option in clinical practice. A major driver of demand stems from the increasing focus on healthcare worker safety, especially to avoid accidental needle-related injuries in environments ranging from emergency medical services to aesthetic procedures. The high incidence of these events underlines the importance of single-use syringes, especially those designed with safety mechanisms, as a means of minimizing occupational hazards and adhering to regulatory protocols.

Leading players in the Disposable Syringe Market include Braun Medical, Becton, Dickinson and Company, Baxter International, Terumo Corporation, Medtronic, Nipro Corporation, Agilent Technologies, Chris Merchant, Henke-Sass, Wolf, Ultimed, Vita Needle Company, Hindustan Syringes & Medical Devices, Kohope Medical, Fresenius Kabi, and B Braun Melsungen. To reinforce their presence in the competitive disposable syringe landscape, key manufacturers are focusing on product diversification and portfolio expansion that addresses growing global healthcare demands. Companies are advancing syringe safety by incorporating technologies such as retractable needles and auto-disable mechanisms to comply with strict medical regulations and reduce needlestick risks. Strategic collaborations with health ministries, international health organizations, and procurement agencies are enhancing global distribution capabilities. Many firms are increasing investments in automated production lines to boost efficiency, maintain sterility, and meet volume surges during public health emergencies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Filament

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing number of infectious disease outbreak

- 3.2.1.3 Technological advancements in syringe design and material

- 3.2.1.4 Rising surgical procedures and outpatient care volume

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of safety syringes

- 3.2.2.2 Environmental concerns due to plastic medical waste

- 3.2.3 Market opportunities

- 3.2.3.1 Shift towards biodegradable and eco-friendly syringe materials

- 3.2.3.2 Rising demand for prefilled syringes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Porter's analysis

- 3.6 PESTLE analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Conventional syringes

- 5.3 Safety syringes

- 5.3.1 Retractable safety syringes

- 5.3.2 Non-retractable safety syringes

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Vaccination

- 6.3 Blood collection

- 6.4 Drug delivery

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Diagnostic laboratories

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profile

- 9.1 Agilent Technologies

- 9.2 B Braun Melsungen

- 9.3 Baxter International

- 9.4 Becton, Dickinson and Company

- 9.5 Braun Medical

- 9.6 Chris Merchant

- 9.7 Fresenius Kabi

- 9.8 Henke-Sass, Wolf

- 9.9 Hindustan Syringes & Medical Devices

- 9.10 Kohope Medical

- 9.11 Medtronic

- 9.12 Nipro Corporation

- 9.13 Terumo Corporation

- 9.14 Ultimed

- 9.15 Vita Needle Company