|

市场调查报告书

商品编码

1773350

医疗、法律和监管审查软体市场机会、成长动力、行业趋势分析和 2025 - 2034 年预测Medical, Legal, and Regulatory Review Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

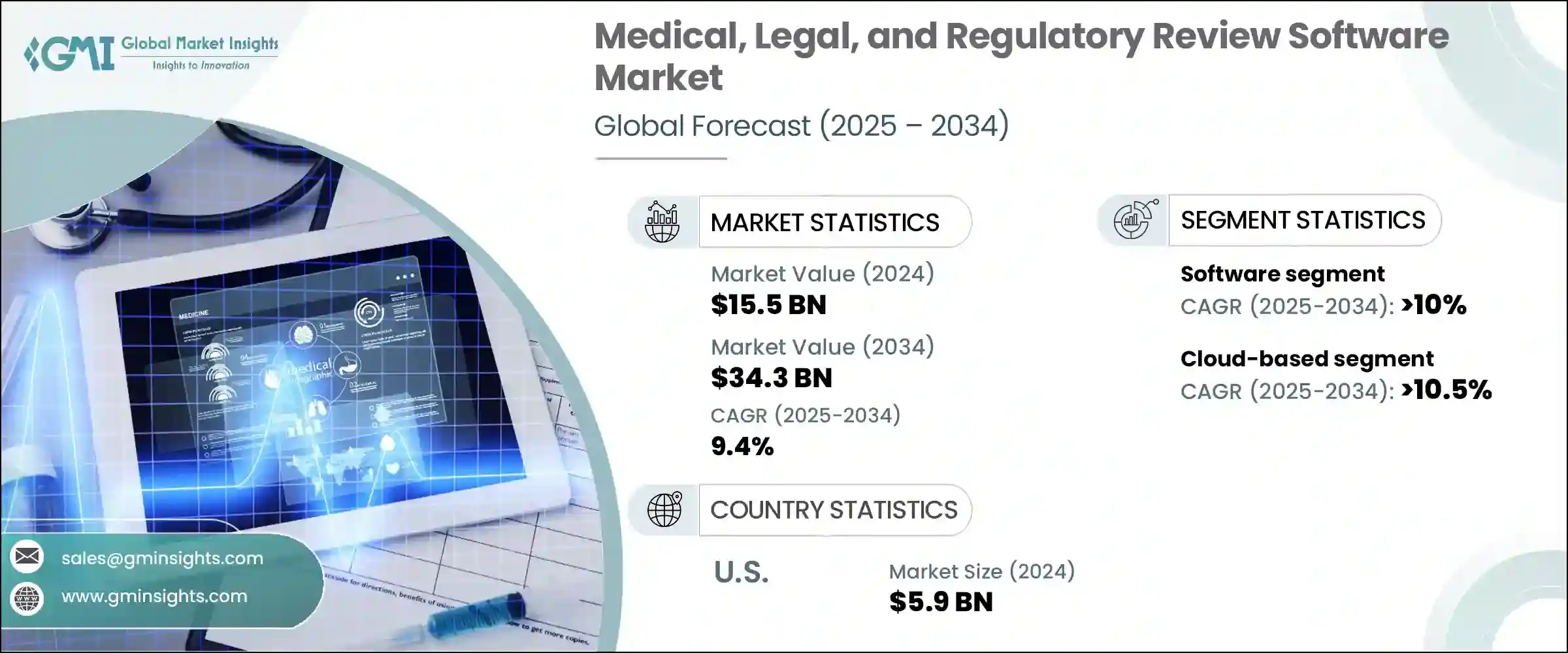

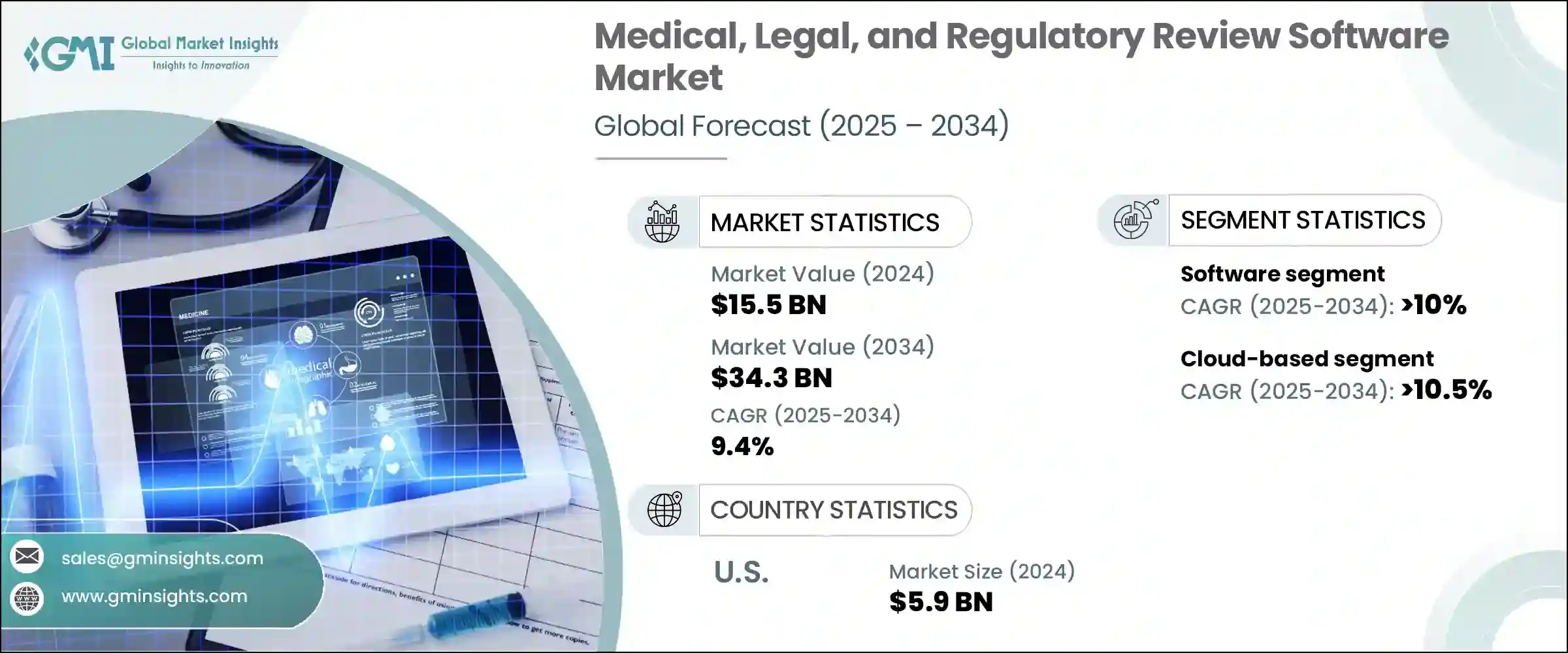

2024 年,全球医疗、法律和监管审查软体市场规模达 155 亿美元,预计到 2034 年将以 9.4% 的复合年增长率成长,达到 343 亿美元。製药和生命科学领域对合规、协作和情境感知内容审查流程日益增长的需求,推动了这一稳步成长轨迹。随着企业加速数位化策略并应对复杂的监管框架,对能够简化审查工作流程的整合 MLR 平台的需求显着增长。传统上,许多生命科学组织依赖手动、纸本或电子邮件驱动的 MLR 审查流程。然而,这些过时的系统正迅速被提供即时协作、基于人工智慧的合规性验证和自动审计追踪的智慧软体工具所取代。这些功能正在帮助 MLR 团队提高营运效率,降低法律风险,并更迅速、更自信地将产品推向市场。

随着数位化和多通路行销的日益普及,生命科学公司面临快速审查和批准各种内容格式的压力,同时还要确保符合区域监管要求。无论是网站、电子邮件或社群媒体平台的内容,人们越来越重视确保每项宣传或科研资产都经过全面的合规性审查。 MLR 软体系统作为一个集中式平台,可以管理这种复杂性,确保任何内容在公开发布之前均符合准确性、合法性和法规要求。向这些系统的转变不仅是为了实现自动化,而是为了满足快节奏、数位化互联、不容有任何差错的生态系统的期望。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 155亿美元 |

| 预测值 | 343亿美元 |

| 复合年增长率 | 9.4% |

从组件来看,软体领域在2024年引领了全球MLR审查软体市场,占总市场价值的近68%。预计到2034年,该领域的复合年增长率将超过10%。提供版本控制、整合审计功能和协作内容审查功能的端到端数位工具的广泛采用正在推动这一趋势。企业越来越多地投资于基于云端的平台,这些平台可以扩展到全球团队,减少人工审查错误,并实现即时回馈循环。数位转型的趋势进一步鼓励组织从分散的系统转向统一的软体生态系统,以支援跨多个利害关係人和团队的大量内容。

从部署角度来看,基于云端的解决方案在2024年占据了市场主导地位,约占总市场份额的64%。预计该细分市场在整个预测期内的复合年增长率将超过10.5%。向云端基础设施的广泛迁移使製药和生物技术公司能够集中内容管理,简化监管工作流程,并显着降低内部IT维护成本。云端平台提供跨部门和跨地区的一致、安全的访问,确保利害关係人始终符合最新的监管指南。随着公司拓展新市场,基于云端的MLR工具提供了在多样化且不断变化的合规环境中运作所需的适应性和回应能力。

从功能角度来看,监管审查在2024年成为领先的细分市场。与主要关注科学可信度或智慧财产权保护的法律或医学评估相比,监管审查的核心在于确保与特定地区的行销、推广和提交规则完全一致。为了满足这些监管要求,越来越多的组织开始采用具备自动化功能的软体解决方案,例如版本追踪、内容标记、审计文件和监管资讯系统整合。这些功能不仅提高了审查週期的准确性和速度,还能确保所有资料都得到完整记录且易于检索,从而帮助组织为可能面临的监管审计做好准备。

从地理分布来看,美国在2024年占据市场主导地位,贡献了约59亿美元的收入,占北美地区88.3%的份额。这种主导地位可以归因于联邦机构施加的严格监管要求,这些要求要求内容在公开传播之前必须经过严格验证。随着製药和医疗器材公司寻求管理大量行销和科研材料,同时最大限度地降低法律和合规风险,对先进的MLR软体工具的依赖日益增长。先进的云端系统和人工智慧整合平台的出现极大地支持了这一转变。

MLR 审查软体领域的领先供应商正在积极寻求策略合作伙伴关係、收购和产品创新,以扩展其能力和市场版图。随着监管复杂性的日益增加,各公司正在加倍投入研发,以建立更智慧的平台,从而支援更高的自动化程度、可追溯性和即时协作能力。关键投资领域包括基于人工智慧的合规性检查、模组化内容工作流程以及云端原生架构,这些架构使公司能够适应全球监管的细微差别。供应商正致力于创建可配置的平台,以适应特定司法管辖区的准则,同时保持全球一致性,从而帮助生命科学组织最大限度地降低风险、加快审批速度并随时准备跨地区审计。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 转向数位化和多通路行销

- 云端平台的采用率不断上升

- 审查流程中的人工智慧和自动化

- 中小企业合规意识不断增强

- 产业陷阱与挑战

- 复杂的监管格局

- 资料隐私和合规风险

- 市场机会

- 製药和生技研发线激增

- 远端和分散协作日益增多

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 成本細項分析

- 软体开发和授权成本

- 部署和整合成本

- 维护和支援成本

- 网路安全与合规成本

- 培训和变更管理成本

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 软体

- 服务

- 专业的

- 託管

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 基于云端

- 本地

第七章:市场估计与预测:依功能划分,2021 - 2034 年

- 主要趋势

- 医疗审查

- 法律审查

- 监管审查

第八章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製药公司

- 生技公司

- 医疗器材製造商

- 合约研究组织(CRO)

- 监理顾问公司

- 医疗保健行销机构

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 3M Health Information Systems

- Allscripts

- Change Healthcare

- Epic Systems

- Experian Health

- GE Healthcare

- Health Catalyst

- IBM Watson Health

- Inovalon Holdings

- LexisNexis Risk Solutions

- McKesson Corporation

- Medtronic

- Nuance Communications

- Optum

- Oracle Health

- Philips Healthcare

- Siemens Healthineers

- Thomson Reuters

- Verisk Analytics

- Wolters Kluwer

The Global Medical, Legal, and Regulatory Review Software Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 34.3 billion by 2034. This steady growth trajectory is fueled by the rising need for compliant, collaborative, and context-aware content review processes within the pharmaceutical and life sciences sectors. As companies accelerate their digital strategies and navigate complex regulatory frameworks, the demand for integrated MLR platforms that streamline review workflows has grown significantly. Traditionally, many life sciences organizations relied on manual, paper-based, or email-driven MLR review processes. However, those outdated systems are rapidly being replaced by intelligent software tools offering real-time collaboration, AI-based compliance verification, and automated audit trails. These capabilities are helping MLR teams boost operational efficiency, reduce legal exposure, and bring products to market more swiftly and confidently.

With the increasing push for digital and multichannel marketing, life sciences companies are under pressure to rapidly review and approve diverse content formats while staying aligned with regional regulatory requirements. Whether it's content for websites, emails, or social media platforms, there is a growing emphasis on ensuring every promotional or scientific asset undergoes a thorough compliance review. MLR software systems serve as a centralized platform to manage this complexity, ensuring accuracy, legality, and regulatory adherence before any content reaches the public domain. The shift toward these systems is not just about automation; it's about meeting the expectations of a fast-paced, digitally connected ecosystem that leaves no room for error.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $34.3 Billion |

| CAGR | 9.4% |

In terms of components, the software segment led the global MLR review software market in 2024, accounting for nearly 68% of the total market value. This segment is anticipated to grow at a CAGR of over 10% through 2034. The expanding adoption of end-to-end digital tools that offer version control, integrated audit functionality, and collaborative content review features is driving this trend. Enterprises are increasingly investing in cloud-based platforms that can scale across global teams, reduce manual review errors, and enable real-time feedback loops. The preference for digital transformation has further encouraged organizations to move away from fragmented systems toward unified software ecosystems that support higher volumes of content across multiple stakeholders and teams.

From a deployment perspective, cloud-based solutions dominated the market in 2024, capturing approximately 64% of the total share. This segment is projected to register a CAGR exceeding 10.5% throughout the forecast period. The widespread shift to cloud infrastructure is allowing pharmaceutical and biotech companies to centralize content management, streamline regulatory workflows, and significantly reduce internal IT maintenance costs. Cloud platforms provide consistent, secure access across departments and geographies, ensuring that stakeholders remain aligned with current regulatory guidance at all times. As companies expand into new markets, cloud-based MLR tools provide the adaptability and responsiveness needed to operate within diverse and evolving compliance landscapes.

Functionality-wise, regulatory review emerged as the leading segment in 2024. Compared to legal or medical assessments, which primarily focus on scientific credibility or intellectual property protection, regulatory review is centered on ensuring full alignment with region-specific marketing, promotion, and submission rules. To meet these regulatory expectations, more organizations are turning to software solutions equipped with automation capabilities such as version tracking, content tagging, audit documentation, and regulatory information system integration. These features not only improve the accuracy and speed of the review cycle but also prepare organizations for possible regulatory audits by ensuring that all materials are thoroughly documented and easily retrievable.

Geographically, the United States dominated the market in 2024, contributing around USD 5.9 billion in revenue, which translates to a commanding 88.3% share of the North American region. This dominance can be attributed to the stringent regulatory requirements imposed by federal agencies, which demand that content undergo rigorous validation before public dissemination. The reliance on advanced MLR software tools is growing as pharmaceutical and medical device companies seek to manage high volumes of marketing and scientific materials while minimizing legal and compliance risks. The availability of sophisticated cloud-based systems and AI-integrated platforms has significantly supported this transformation.

Leading vendors in the MLR review software landscape are actively pursuing strategic partnerships, acquisitions, and product innovation to expand their capabilities and market footprint. With increasing regulatory complexity, companies are doubling down on R&D to build smarter platforms that support greater automation, traceability, and real-time collaboration. Key areas of investment include AI-powered compliance checks, modular content workflows, and cloud-native architectures that allow companies to adapt to global regulatory nuances. Vendors are focusing on creating configurable platforms that accommodate jurisdiction-specific guidelines while maintaining global consistency, helping life sciences organizations minimize risk, speed up approvals, and stay audit-ready across regions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Functionality

- 2.2.5 Enterprise Size

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift towards digital and multichannel marketing

- 3.2.1.2 Rising adoption of cloud-based platforms

- 3.2.1.3 AI and automation in review processes

- 3.2.1.4 Growing compliance awareness among SMEs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex regulatory landscape

- 3.2.2.2 Data privacy and compliance risks

- 3.2.3 Market opportunities

- 3.2.3.1 Surging pharma and biotech pipelines

- 3.2.3.2 Growing remote and decentralized collaboration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

- 5.3.1 Professional

- 5.3.2 Managed

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Medical review

- 7.3 Legal review

- 7.4 Regulatory review

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Pharmaceutical companies

- 9.3 Biotechnology companies

- 9.4 Medical device manufacturers

- 9.5 Contract Research Organizations (CROs)

- 9.6 Regulatory consulting firms

- 9.7 Healthcare marketing agencies

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3M Health Information Systems

- 11.2 Allscripts

- 11.3 Change Healthcare

- 11.4 Epic Systems

- 11.5 Experian Health

- 11.6 GE Healthcare

- 11.7 Health Catalyst

- 11.8 IBM Watson Health

- 11.9 Inovalon Holdings

- 11.10 LexisNexis Risk Solutions

- 11.11 McKesson Corporation

- 11.12 Medtronic

- 11.13 Nuance Communications

- 11.14 Optum

- 11.15 Oracle Health

- 11.16 Philips Healthcare

- 11.17 Siemens Healthineers

- 11.18 Thomson Reuters

- 11.19 Verisk Analytics

- 11.20 Wolters Kluwer