|

市场调查报告书

商品编码

1773352

软体在地化市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Software Localization Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

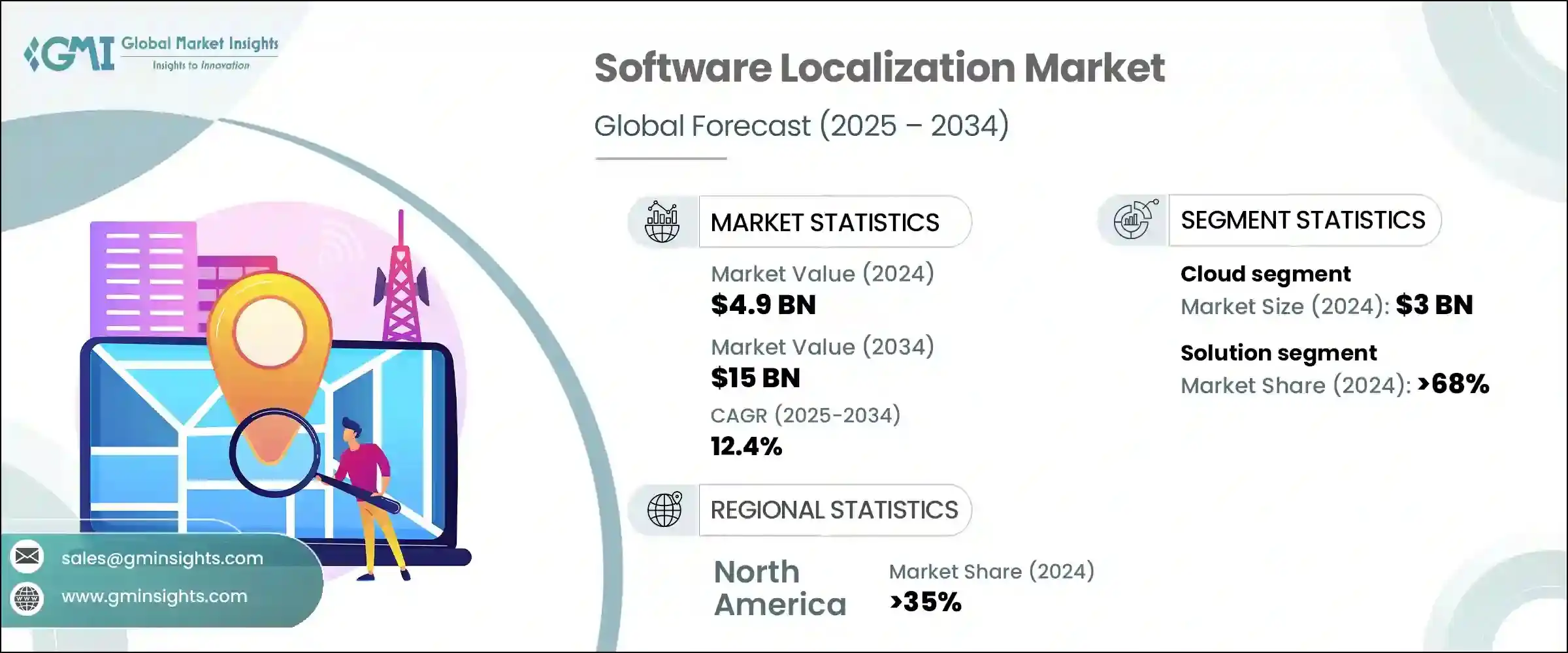

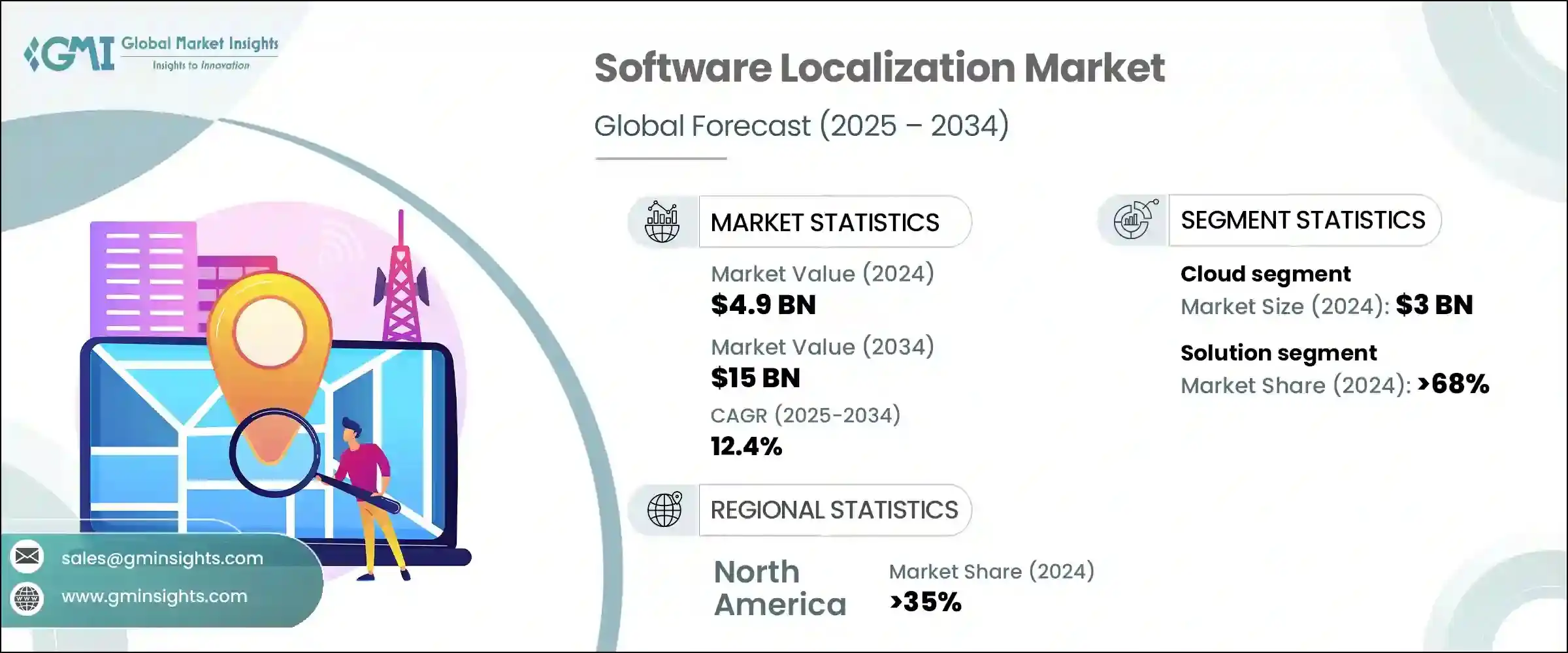

2024 年,全球软体在地化市场规模达 49 亿美元,预计到 2034 年将以 12.4% 的复合年增长率成长,达到 150 亿美元。这一成长主要得益于微服务架构的日益普及,尤其是在软体开发领域。现代应用程序,尤其是基于 SaaS 的服务,依赖于针对全球部署进行最佳化的鬆散耦合服务。这种模组化方法允许进行本地化更新,而无需重新设计整个系统,从而使软体本地化更加敏捷且可扩展。随着公司针对不同地区对在地化微功能进行 A/B 测试,它们会创建一个持续的回馈循环,从而增强在地化流程,支援更有效率的全球产品发布。

欧洲、亚洲和拉丁美洲各国政府正在推出更严格的数位无障碍和多语言合规法规,这进一步推动了软体在地化的需求。各地区的法律都要求网站和应用程式能够以使用者的母语访问,这些法规也延伸到了政府和银行等领域。这些法律要求迫使公司对其软体进行在地化,不仅是为了实现包容性,也是为了避免潜在的法律后果,并与当地民众建立信任。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 49亿美元 |

| 预测值 | 150亿美元 |

| 复合年增长率 | 12.4% |

2024年,基于云端的软体在地化市场规模达30亿美元。云端翻译管理系统 (TMS) 因其能够为企业提供可扩展性、协作和集中控制的能力,正日益被广泛采用。这些系统支援即时存取全球团队,并可与内容管理系统 (CMS)、程式码储存库和持续整合/持续交付 (CI/CD) 管道等其他系统无缝整合。云端 TMS 解决方案经济高效,可提高业务敏捷性,尤其适用于跨区域营运的公司。随着企业追求更高的灵活性和速度,对基于云端的在地化工具的需求持续增长,使公司无论团队位于何处都能存取必要的工具。

2024年,解决方案细分市场占据了68%的份额。越来越多的公司从使用单一用途的在地化工具转向采用多功能统一平台,将翻译记忆库、专案管理、机器翻译、品质保证和分析功能整合到一个解决方案中。这种转变有助于消除碎片化,提高一致性并缩短产品上市时间。对于管理跨多个部门(包括行销、软体开发和客户支援)的复杂多语言专案的大型公司来说,一体化解决方案尤其具有吸引力。

2024年,北美软体在地化市场占35%的市占率。美国人口的多元化是推动多语言内容需求的主要因素,尤其是在医疗保健、教育和政府等产业。为了增强可访问性并更好地服务非英语社区,各组织正在对软体进行在地化,使其更具包容性和可访问性。领先的美国科技公司正在敏捷的DevOps环境中利用基于人工智慧的在地化平台,从而能够提供即时更新、有效管理版本,并在快速发展的数位产品中提供一致的体验。

全球软体在地化市场的顶级公司包括 Smartling、Phrase、Transifex、Lokalise、Crowdin、Blend 和 TransPerfect。这些参与者透过提供一系列创新解决方案来满足寻求跨多种语言和地区在地化软体的企业不断变化的需求,从而成为塑造格局的关键。为了巩固其在软体在地化市场中的地位,该公司正在专注于几种策略。他们正在大力投资开发由人工智慧驱动的在地化平台,以增强自动化、准确性和即时更新。此外,公司正在转向整合的一体化解决方案,以便无缝管理在地化工作流程,从而提高效率。他们还透过包含满足特定需求的专用工具(例如机器翻译或品质保证)来扩展其服务范围。与全球企业的合作以及与其他软体开发商的伙伴关係也变得越来越普遍,以确保更广泛的覆盖范围和可扩展性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 企业应用程式的数位全球化程度不断提高

- 对母语使用者体验增强的需求

- 行动和 SaaS 平台在地化兴起

- 监理推动多语言软体无障碍

- 产业陷阱与挑战

- 不同语言对的翻译品质不一致

- 文化错位导致用户流失

- 市场机会

- 语言多元化的新兴市场的成长

- 整合人工智慧上下文翻译工具

- 与区域本地化服务提供者的合作

- 基于云端的平台可实现即时本地化

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 电脑辅助翻译软体

- 机器翻译软体

- 翻译管理软体

- 服务

- 专业的

- 託管

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 云

- 本地

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- IT和电信

- 媒体与娱乐

- 电子商务与零售

- 金融服务业

- 教育与电子学习

- 医疗保健与生命科学

- 旅游与饭店

第八章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- Web 应用程式

- 行动应用程式

- 桌面软体

- 游戏软体

- 企业软体

- 电子学习与培训

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Acclaro

- Alconost

- Appen

- Blend

- Crowdin

- Gengo

- Keywords Studios

- Lionbridge

- Lokalise

- Mars Translation

- Moravia

- Pactera EDGE

- Phras

- Semantix

- Smartling

- Tomedes

- Transifex

- TransPerfect

- Welocalize

The Global Software Localization Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 15 billion by 2034. This growth is largely driven by the increasing adoption of microservices architecture, particularly in software development. Modern applications, especially SaaS-based services, rely on loosely coupled services that are optimized for global deployment. This modular approach allows for localized updates without the need to redesign the entire system, making software localization more agile and scalable. As companies conduct A/B tests of localized micro-features for different regions, they create an ongoing feedback loop that enhances the localization process, supporting more effective product launches worldwide.

Governments across Europe, Asia, and Latin America are introducing stricter regulations on digital accessibility and multilingual compliance, which is further boosting the demand for software localization. Laws in various regions require websites and apps to be accessible in the native languages of their users, and these regulations extend to sectors like government and banking. These legal requirements force companies to localize their software not only for inclusivity but also to avoid potential legal consequences and to build trust with local populations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $15 Billion |

| CAGR | 12.4% |

In 2024, the cloud-based software localization segment accounted for USD 3 billion. Cloud-based Translation Management Systems (TMS) are increasingly being adopted due to their ability to offer scalability, collaboration, and centralized control for enterprises. These systems enable real-time access to global teams and seamlessly integrate with other systems like content management systems (CMS), code repositories, and CI/CD pipelines. Cloud TMS solutions are cost-effective and improve business agility, particularly for companies operating across multiple regions. As businesses seek more flexibility and speed, the demand for cloud-based localization tools continues to accelerate, allowing companies to access the necessary tools regardless of where their teams are located.

The solutions segment held a 68% share in 2024. Companies are increasingly shifting from using single-purpose localization tools to adopting multifunctional, unified platforms that combine translation memory, project management, machine translation, quality assurance, and analytics into a single solution. This transition helps eliminate fragmentation, improving consistency and reducing time-to-market. All-in-one solutions are particularly attractive to large companies that manage complex, multilingual projects across various departments, including marketing, software development, and customer support.

North America Software Localization Market held a 35% share in 2024. The diverse population of the United States is a major factor driving the demand for multilingual content, particularly in industries such as healthcare, education, and government. To enhance accessibility and better serve non-English-speaking communities, organizations are localizing software to make it more inclusive and accessible. Leading U.S. tech companies are leveraging AI-powered localization platforms within agile DevOps environments, enabling them to deliver real-time updates, manage versions effectively, and provide consistent experiences across fast-evolving digital products.

Top companies operating in the Global Software Localization Market include Smartling, Phrase, Transifex, Lokalise, Crowdin, Blend, and TransPerfect. These players are key to shaping the landscape by offering a range of innovative solutions that cater to the evolving needs of businesses seeking to localize their software across multiple languages and regions. To strengthen their position in the software localization market, companies are focusing on several strategies. They are investing heavily in the development of AI-driven localization platforms to enhance automation, accuracy, and real-time updates. Additionally, companies are shifting towards integrated, all-in-one solutions that allow for seamless management of localization workflows, providing greater efficiency. They are also expanding their service offerings by including specialized tools that address specific needs, such as machine translation or quality assurance. Collaborations with global enterprises and partnerships with other software developers are also becoming increasingly common to ensure broader reach and scalability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 End Use

- 2.2.5 Organization size

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing digital globalization across enterprise applications

- 3.2.1.2 Demand for native-language user experience enhancement

- 3.2.1.3 Rise in mobile and SaaS platform localization

- 3.2.1.4 Regulatory push for multilingual software accessibility

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Inconsistent translation quality across language pairs

- 3.2.2.2 Cultural misalignment leading to user disengagement

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in emerging markets with diverse languages

- 3.2.3.2 Integration of AI-powered contextual translation tools

- 3.2.3.3 Partnerships with regional localization service providers

- 3.2.3.4 Cloud-based platforms enabling real-time localization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and Environmental Aspects

- 3.10.1 Sustainable Practices

- 3.10.2 Waste Reduction Strategies

- 3.10.3 Energy Efficiency in Production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon Footprint Considerations

- 3.11 Use cases

- 3.11.1 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Computer-assisted Translation Software

- 5.2.2 Machine Translation Software

- 5.2.3 Translation Management Software

- 5.3 Services

- 5.3.1 Professional

- 5.3.2 Managed

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 IT & telecom

- 7.3 Media & entertainment

- 7.4 E-commerce & retail

- 7.5 BFSI

- 7.6 Education & e-learning

- 7.7 Healthcare & life sciences

- 7.8 Travel & hospitality

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 SME

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Web applications

- 9.3 Mobile applications

- 9.4 Desktop software

- 9.5 Gaming software

- 9.6 Enterprise software

- 9.7 E-learning & training

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Argentina

- 10.5.3 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Acclaro

- 11.2 Alconost

- 11.3 Appen

- 11.4 Blend

- 11.5 Crowdin

- 11.6 Gengo

- 11.7 Keywords Studios

- 11.8 Lionbridge

- 11.9 Lokalise

- 11.10 Mars Translation

- 11.11 Moravia

- 11.12 Pactera EDGE

- 11.13 Phras

- 11.14 Semantix

- 11.15 Smartling

- 11.16 Tomedes

- 11.17 Transifex

- 11.18 TransPerfect

- 11.19 Welocalize