|

市场调查报告书

商品编码

1773359

智慧电网分析市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Grid Analytics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

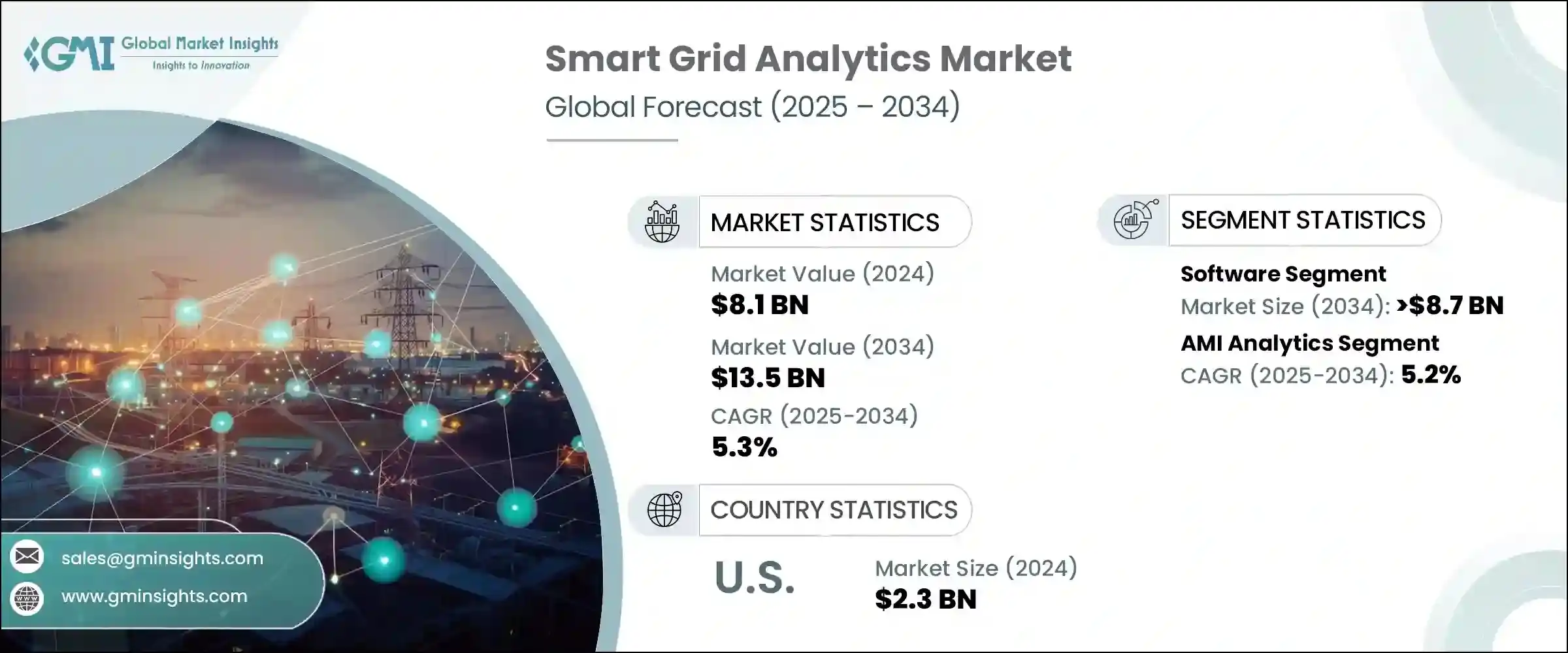

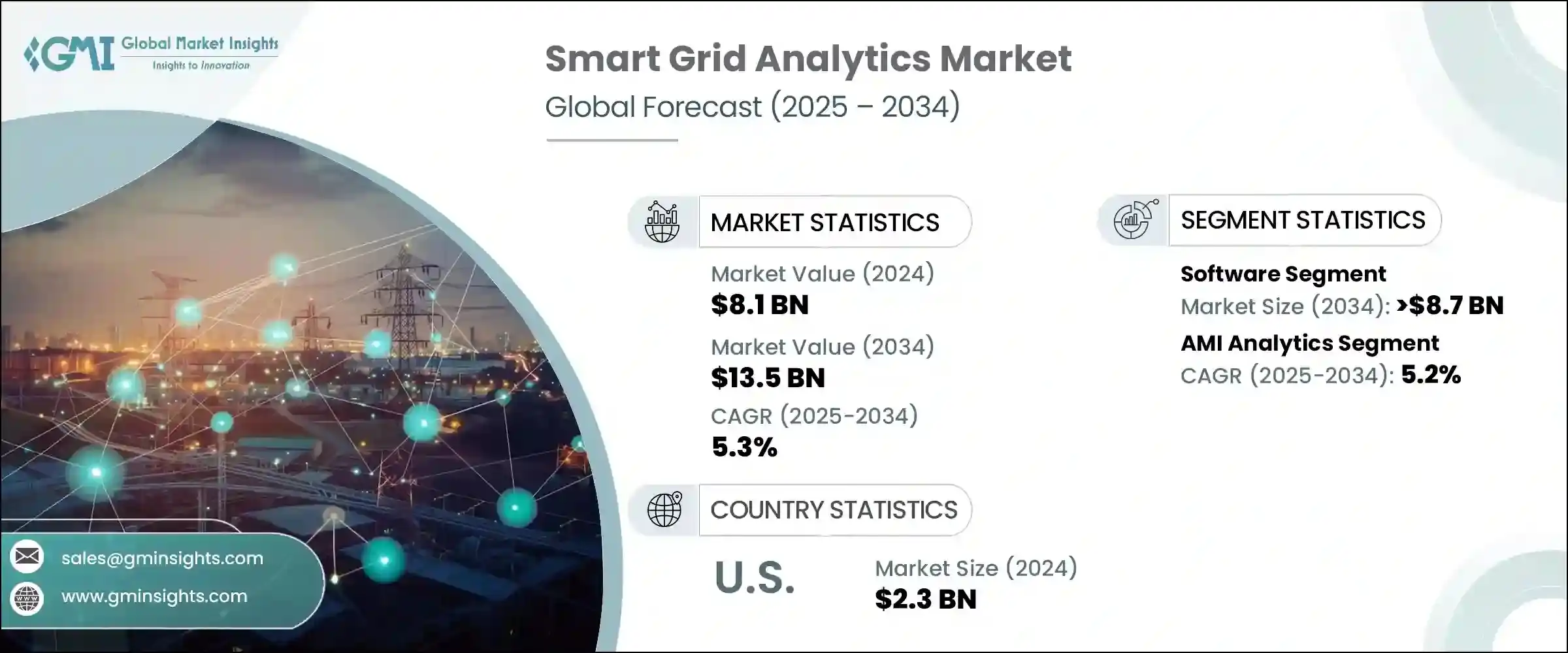

2024 年全球智慧电网分析市场价值为 81 亿美元,预计到 2034 年将以 5.3% 的复合年增长率成长,达到 135 亿美元。这一稳步增长得益于先进智慧电网技术的日益普及、全球脱碳的推动以及对可靠智慧能源基础设施日益增长的需求。公用事业公司更加重视分析,以管理现代电网日益复杂的问题并有效整合再生能源。随着能源消耗的成长和营运需求的动态化,公用事业公司正在采用智慧电网分析来增强电网稳定性、监控即时使用情况并优化资产性能。物联网和云端技术的快速发展使得各种规模的公用事业公司都能更轻鬆地获得和扩展分析解决方案。市场参与者正在积极建立合作伙伴关係、进行收购和开展合作,以增强其数位化能力并拓宽其影响力。

转向以数据为中心的能源管理系统还能加快故障检测速度、实现预测性维护并提高客户满意度——这些因素对于电网现代化至关重要。透过利用即时资料分析,公用事业公司可以在电网行为异常升级为严重故障之前识别它们,从而最大限度地减少停机和服务中断。这些先进的系统使能源供应商能够主动维护设备、延长资产使用寿命并优化整个网路的负载平衡。反过来,这又提高了配电的整体可靠性和效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 81亿美元 |

| 预测值 | 135亿美元 |

| 复合年增长率 | 5.3% |

预计到2034年,服务业规模将达45亿美元。这一增长主要源于对系统实施、咨询和持续支援方面专家指导需求的不断增长。随着能源产业数位转型的加速,越来越多的企业选择託管服务来应对人工智慧、云端运算和物联网等新技术。这些服务确保无缝整合和持续优化,尤其是在确保营运安全和满足不断变化的监管标准方面。

预计到2034年,AMI分析领域的复合年增长率将达到5.2%,这主要得益于其在提高营运效率、管理分散式能源资源和支援即时决策方面的优势。透过利用智慧电錶的详细资料,公用事业公司可以优化能源分配、减少停机时间并提高电网可靠性。清洁能源的普及和对永续性的日益重视,持续增强了对AMI分析的需求,尤其是在监管机构推动更智慧的能源管理和客户互动工具不断扩展的背景下。

2024年,美国智慧电网分析市场规模达23亿美元。这一成长势头源于基础设施升级投资的不断增长、智慧电网解决方案的广泛部署以及可再生能源整合的推动。进阶分析对于监控复杂的电网活动、提高系统效率和即时维护电网安全至关重要。政府支持的现代化计划以及数位工具的日益普及,进一步加速了美国市场的成长。

西门子、施耐德电机、霍尼韦尔和Itron等产业领导企业均在塑造电网分析的未来发展中发挥重要作用。智慧电网分析市场的顶尖公司正在透过定向收购、技术投资和策略联盟来巩固其市场地位。许多公司正在投资人工智慧驱动的分析平台和可扩展的云端系统,以帮助公用事业公司实现即时视觉性、预测洞察和营运自动化。与公用事业供应商的合作能够提供符合当地监管要求和基础设施挑战的客製化解决方案。各公司也正在增强网路安全功能,并推广可互操作系统,以保护整个电网网路的资料安全。全球扩张计画正在进行中,并在新兴市场进行在地化部署,以满足日益增长的智慧基础设施需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依组件划分,2021 - 2034 年

- 主要趋势

- 软体

- 服务

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- AMI 分析

- 负载预测和需求响应

- 电网监控

- 预测性维护

- 其他的

第七章:市场规模及预测:依类型,2021 - 2034

- 主要趋势

- 描述性分析

- 诊断分析

- 预测分析

- 规范分析

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 澳洲

- 日本

- 韩国

- 印度

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 智利

第九章:公司简介

- Accenture

- Anritsu

- Capgemini

- Ericsson

- GE Vernova

- Hive Power

- Honeywell

- IBM

- Itron

- Kamstrup

- Landis + GYR

- Oracle

- SAP

- Schneider Electric

- Sentient Energy

- Siemens

The Global Smart Grid Analytics Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 13.5 billion by 2034. This steady growth is driven by the rising adoption of advanced smart grid technologies, the global push toward decarbonization, and the increasing demand for reliable and intelligent energy infrastructure. Utilities are placing greater emphasis on analytics to manage the rising complexities of modern power networks and to integrate renewable energy efficiently. As energy consumption grows and operational demands become more dynamic, utilities are adopting smart grid analytics to enhance grid stability, monitor real-time usage, and optimize asset performance. The rapid expansion of IoT and cloud technologies has made analytics solutions more accessible and scalable for utilities of all sizes. Players in the market are actively forming partnerships, executing acquisitions, and entering collaborations to boost their digital capabilities and broaden their reach.

The shift toward data-centric energy management systems also enables faster fault detection, predictive maintenance, and better customer satisfaction-factors crucial for grid modernization. By leveraging real-time data analytics, utilities can identify anomalies in grid behavior before they escalate into critical failures, minimizing downtime and service disruptions. These advanced systems empower energy providers to proactively maintain equipment, extend asset lifespans, and optimize load balancing across the network. In turn, this enhances the overall reliability and efficiency of power distribution.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $13.5 Billion |

| CAGR | 5.3% |

The services segment is projected to reach USD 4.5 billion by 2034. This growth is being fueled by increasing demand for expert guidance in system implementation, consulting, and ongoing support. As digital transformation accelerates across the energy sector, organizations are increasingly turning to managed services to handle new technologies including artificial intelligence, cloud, and IoT. These services ensure seamless integration and sustained optimization, particularly in securing operations and meeting evolving regulatory standards.

AMI analytics segment is expected to grow at a CAGR of 5.2% through 2034, largely due to its benefits in improving operational efficiency, managing distributed energy resources, and supporting real-time decision-making. By leveraging detailed data from smart meters, utilities can fine-tune energy distribution, reduce downtime, and boost grid reliability. The rise in clean energy adoption and a stronger focus on sustainability continues to strengthen demand for AMI analytics, especially as regulatory bodies push for smarter energy management and customer engagement tools expand.

United States Smart Grid Analytics Market was valued at USD 2.3 billion in 2024. This momentum stems from rising investment in infrastructure upgrades, widespread deployment of smart grid solutions, and the drive to integrate renewables. Advanced analytics are becoming essential to monitor complex grid activity, enhance system efficiency, and maintain grid security in real time. Government-backed modernization initiatives and the growing use of digital tools are further accelerating the US market's growth.

Key industry leaders include Siemens, Schneider Electric, Honeywell, and Itron, all playing a significant role in shaping the future of grid analytics. Top companies in the smart grid analytics market are reinforcing their presence through targeted acquisitions, technology investments, and strategic alliances. Many are investing in AI-powered analytics platforms and scalable cloud-based systems to help utilities achieve real-time visibility, predictive insights, and operational automation. Collaborations with utility providers enable tailored solutions that align with local regulatory demands and infrastructure challenges. Firms are also enhancing cybersecurity features and promoting interoperable systems to secure data across grid networks. Global expansion efforts are underway, with localized deployments in emerging markets to meet the growing demand for smart infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 AMI analytics

- 6.3 Load forecasting and demand response

- 6.4 Grid monitoring

- 6.5 Predictive maintenance

- 6.6 Others

Chapter 7 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Descriptive analytics

- 7.3 Diagnostic analytics

- 7.4 Predictive analytics

- 7.5 Prescriptive analytics

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 India

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

Chapter 9 Company Profiles

- 9.1 Accenture

- 9.2 Anritsu

- 9.3 Capgemini

- 9.4 Ericsson

- 9.5 GE Vernova

- 9.6 Hive Power

- 9.7 Honeywell

- 9.8 IBM

- 9.9 Itron

- 9.10 Kamstrup

- 9.11 Landis + GYR

- 9.12 Oracle

- 9.13 SAP

- 9.14 Schneider Electric

- 9.15 Sentient Energy

- 9.16 Siemens