|

市场调查报告书

商品编码

1773361

米淀粉市场机会、成长动力、产业趋势分析及2025-2034年预测Rice Starch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

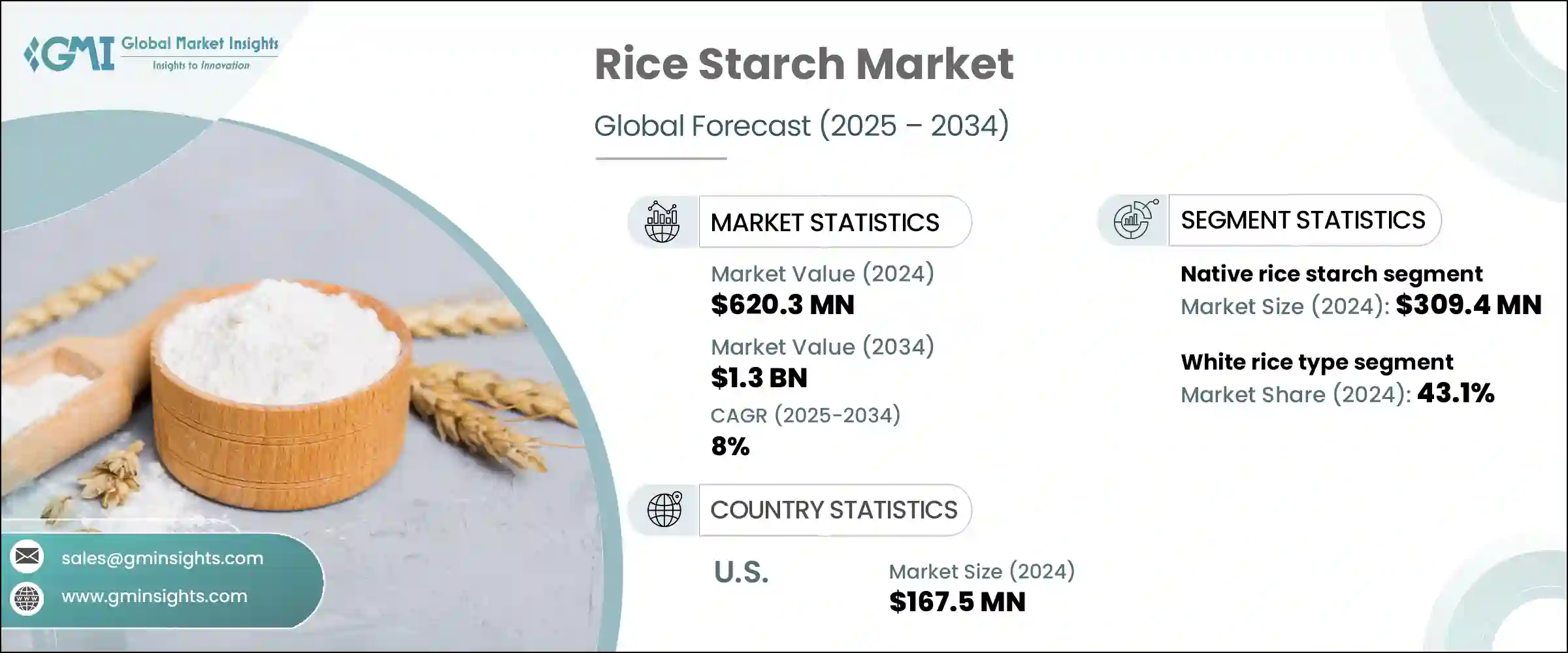

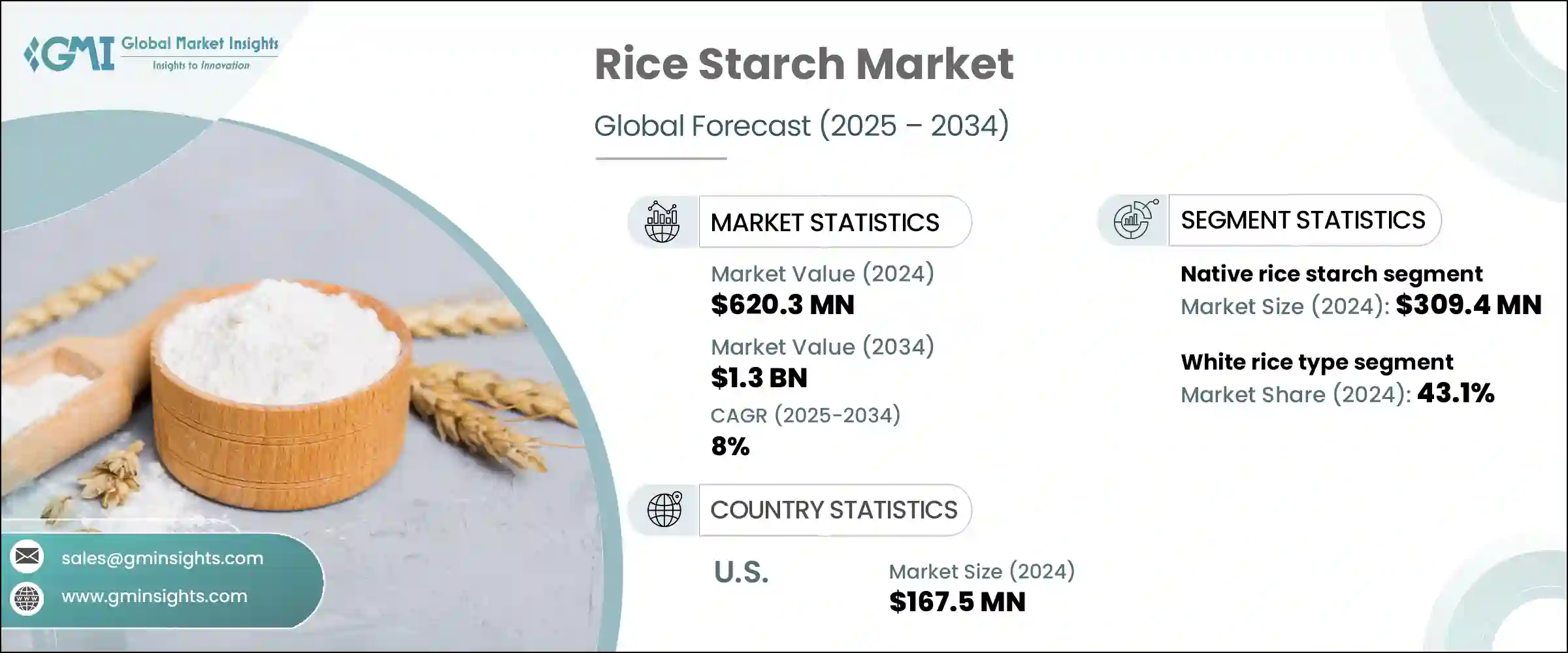

2024 年全球米淀粉市场价值为 6.203 亿美元,预计到 2034 年将以 8% 的复合年增长率增长至 13 亿美元。这一市场扩张是由多个行业越来越多地采用大米淀粉所驱动的。该分析提供了过去表现和未来预测的平衡视图,为市场的整体发展趋势提供了宝贵的见解。对市场价值和数量进行分析以吸引潜在投资者。对清洁标籤成分的需求不断增长以及消费者更广泛地转向天然食品成分,推动了持续成长。食品和饮料行业仍然是主要驱动力,大米淀粉具有增稠、质构和稳定等多功能特性,因此被广泛用于产品配方中。对无麸质和无过敏原产品的需求激增进一步推动了这一趋势。

此外,传统成长较慢的领域中涌现的全新创新用途,可望为大米淀粉市场的整体扩张做出重大贡献。这些新兴应用创造了新的需求流,补充并增强了快速成长产业的动能。透过丰富终端用途,例如专业药物配方、高级化妆品和利基食品应用,这些新兴领域有助于稳定成长,并为跨行业整合创造机会。这种更广泛的应用不仅推动了产量的成长,还鼓励了研发投资,推动了产品创新,并使製造商能够开拓先前尚未开发的市场。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.203亿美元 |

| 预测值 | 13亿美元 |

| 复合年增长率 | 8% |

2024年,天然米淀粉市场估值达3.094亿美元,预计2034年将以7.9%的复合年增长率成长。由于广泛应用于各行各业,天然米淀粉将继续占据市场主导地位。它尤其受到青睐,因为它采用研磨工艺製成,用途广泛,并且符合清洁标籤的要求。食品和饮料产业是天然米淀粉最大的消费群体,利用其在乳製品、酱料和婴儿营养品等产品中的增稠、胶凝和稳定功能。其天然来源和功能性优势使其成为许多配方中必不可少的成分。

2024年,白米市场规模达2.674亿美元,预计到2034年将以8.1%的复合年增长率成长,占据43.1%的市场份额。由于易于加工、供应充足且风味中性,白米仍然是大米淀粉的主要来源。消费者和製造商都青睐白米淀粉,因为其产量稳定且品质优良,非常适合用于需要高品质淀粉的食品、药品和化妆品。大型生产商也青睐白米,因为它具有标准化的特性和高效的提取方法。此外,人们对有机食品和低加工食品的兴趣日益浓厚,也推动了对白米淀粉的需求,白米淀粉正日益被视为一种优质原料。

2024年,美国米淀粉市场规模达1.675亿美元,预计2025年至2034年期间的复合年增长率将达到7.8%。美国市场的成长归因于人们对清洁标籤、无麸质和植物性成分日益增长的偏好。食品和饮料产业仍然是主要的消费领域,尤其是在烘焙、乳製品和方便食品领域。由于大米淀粉具有低致敏性和可生物降解的特性,製药和化妆品行业的需求也在增长。加工技术的进步提高了产品质量,扩大了应用范围,进一步增强了市场成长。美国是北美最活跃的市场参与者,推动着整个地区的成长。

在全球范围内,大米淀粉市场呈现中等规模整合,罗盖特公司 (Roquette Freres)、嘉吉公司 (Cargill Incorporation)、贝诺公司 (BENEO GmbH)、阿格那公司 (AGRANA Beteiligungs-AG) 和 Ingredient Incorporated 等主要参与者占据主导地位。这些公司占有相当大的市场份额,并在塑造行业趋势方面发挥重要作用。米淀粉市场的领先公司采取各种策略措施来巩固其市场地位。他们高度重视创新,开发新的配方和加工技术,以增强产品功能并满足清洁标籤的要求。与食品和饮料製造商建立策略合作伙伴关係有助于扩大其分销网络和最终用途应用。对永续采购和生产实践的投资强化了他们对环境责任的承诺,从而吸引了具有环保意识的消费者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 对清洁标籤成分的需求不断增长

- 麸质不耐症盛行率上升

- 食品饮料产业应用日益增多

- 扩大在医药和化妆品的应用

- 产业陷阱与挑战

- 来自替代淀粉的竞争

- 原物料价格波动

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- Pestel 分析

- 价格趋势

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 天然米淀粉

- 改性米淀粉

- 实体改造

- 预糊化米淀粉

- 热湿处理米淀粉

- 其他物理改性米淀粉

- 化学改性

- 交联米淀粉

- 氧化米淀粉

- 乙酰化米淀粉

- 其他化学改性米淀粉

- 酵素改性

- 实体改造

- 抗性米淀粉

第六章:市场估计与预测:依来源,2021-2034

- 主要趋势

- 白米

- 糙米

- 碎米及副产品

- 其他的

第七章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 粉末

- 液体和凝胶

- 其他的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 烘焙和糖果

- 乳製品

- 汤、酱汁和调味品

- 肉类和家禽产品

- 零食和方便食品

- 饮料

- 婴儿食品和婴儿产品类型

- 无麸质产品

- 其他食品应用

- 製药

- 药片黏合崩解

- 胶囊产品解决方案

- 药物输送系统

- 其他药物应用

- 化妆品和个人护理

- 保养产品

- 护髮产品

- 彩妆

- 其他化妆品应用

- 纸张和纺织品

- 纸张施胶和涂层

- 纺织品上浆和整理

- 其他纸张和纺织品应用

- 其他应用

- 黏合剂和胶水

- 可生物降解包装

- 其他工业应用

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- A&B Ingredients

- AGRANA Beteiligungs-AG

- Agrana Group

- Anhui Lianhe

- Archer Daniels Midland Company

- Bangkok Starch Industrial Co., Ltd.

- Beneo (Sudzucker Group)

- Cargill, Incorporated

- Golden Agriculture Co., Ltd.

- Herba Ingredients

- Hunan ER-KANG

- Ingredion Incorporated

- Jiangxi Golden Agriculture Co., Ltd.

- Roquette Freres

- Shaanxi Tianyu Pharmaceutical Co., Ltd.

- Sonish Starch Technology Co., Ltd.

- Tate & Lyle PLC

- THAI WAH PUBLIC COMPANY LIMITED

- Thai Flour Industry Co., Ltd.

- Wuxi Chuangda Food Co., Ltd.

The Global Rice Starch Market was valued at USD 620.3 million in 2024 and is estimated to grow at a CAGR of 8% to reach USD 1.3 billion by 2034. This market expansion is driven by the increasing adoption of rice starch across multiple industries. The analysis provides a balanced view of past performance alongside future projections, offering valuable insights into the market's overall trajectory. Both market value and volume are analyzed to attract potential investors. Consistent growth has been supported by rising demand for clean-label ingredients and a broader consumer shift towards natural food components. The food and beverage sector remains the primary driver, with rice starch's multifunctional properties, like thickening, texturizing, and stabilizing, leading to its widespread inclusion in product formulations. The surge in demand for gluten-free and allergen-free products has further fueled this trend.

Additionally, new and innovative uses emerging within traditionally slower-growing segments are poised to contribute significantly to the rice starch market's overall expansion. These developing applications create fresh demand streams that complement and strengthen the momentum seen in faster-growing industries. By diversifying the range of end-use cases, such as specialized pharmaceutical formulations, advanced cosmetic products, and niche food applications, these emerging sectors help stabilize growth and open opportunities for cross-industry integration. This broader adoption not only drives incremental volume but also encourages investment in research and development, fueling product innovation and enabling manufacturers to tap into previously untapped markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $620.3 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 8% |

In 2024, the native rice starch segment held a valuation of USD 309.4 million and is anticipated to grow at a CAGR of 7.9% through 2034. Native rice starch continues to dominate the market due to its extensive use across various industries. It is especially favored because of its milled-derived form, versatility, and alignment with clean-label requirements. The food and beverage industry represents the largest consumer base for native rice starch, leveraging its thickening, gelling, and stabilizing functions in products such as dairy, sauces, and infant nutrition. Its natural origin and functional benefits make it an essential ingredient in many formulations.

The white rice type segment accounted for USD 267.4 million in 2024 and is expected to grow at an 8.1% CAGR through 2034, holding a 43.1% share. White rice remains the leading source of rice starch, thanks to its ease of processing, abundant availability, and neutral flavor profile. Both consumers and manufacturers prefer rice starch derived from white rice due to its consistent, high-quality yield, making it ideal for use in food, pharmaceutical, and cosmetic products that demand superior starch quality. Large-scale producers also favor white rice because of its standardized properties and efficient extraction methods. Additionally, rising interest in organic and minimally processed foods is boosting the demand for rice starch from white rice, which is increasingly perceived as a premium ingredient.

U.S. Rice Starch Market was valued at USD 167.5 million in 2024 and is expected to grow at a 7.8% CAGR from 2025 to 2034. Growth in the U.S. is attributed to the rising preference for clean-label, gluten-free, and plant-based ingredients. The food and beverage industry continues to be the dominant consumer, particularly within bakery, dairy, and convenience food applications. Demand is also increasing in the pharmaceutical and cosmetics sectors due to rice starch's hypoallergenic and biodegradable properties. Advances in processing technologies have enhanced product quality and expanded the range of applications, further strengthening market growth. The U.S. stands as the most active market player in North America, driving growth across the region.

On a global scale, the Rice Starch Market is moderately consolidated, with major players such as Roquette Freres, Cargill Incorporation, BENEO GmbH, AGRANA Beteiligungs-AG, and Ingredient Incorporated leading the competition. These companies hold significant market shares and are instrumental in shaping industry trends. Leading companies in the rice starch market adopt various strategic initiatives to strengthen their market position. They focus heavily on innovation, developing new formulations and processing techniques that enhance product functionality and meet clean-label demands. Strategic partnerships and collaborations with food and beverage manufacturers help expand their distribution networks and end-use applications. Investment in sustainable sourcing and production practices reinforces their commitment to environmental responsibility, which appeals to eco-conscious consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360 synopsis

- 2.2 Key market trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical success factors

- 2.7 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for clean label ingredients

- 3.2.1.2 Rising prevalence of gluten intolerance

- 3.2.1.3 Increasing applications in food & beverage industry

- 3.2.1.4 Expanding use in pharmaceutical & cosmetic products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from alternative starches

- 3.2.2.2 Price volatility of raw materials

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle east & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Native rice starch

- 5.3 Modified rice starch

- 5.3.1 Physically modified

- 5.3.1.1 Pre-gelatinized rice starch

- 5.3.1.2 Heat-moisture treated rice starch

- 5.3.1.3 Other physically modified rice starch

- 5.3.2 Chemically modified

- 5.3.2.1 Cross-linked rice starch

- 5.3.2.2 Oxidized rice starch

- 5.3.2.3 Acetylated rice starch

- 5.3.2.4 Other chemically modified rice starch

- 5.3.3 Enzymatically modified

- 5.3.1 Physically modified

- 5.4 Resistant Rice Starch

Chapter 6 Market Estimates & Forecast, By Source, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 White rice

- 6.3 Brown rice

- 6.4 Broken rice & by-products

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Liquid & gel

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.2.1 Bakery & confectionery

- 8.2.2 Dairy products

- 8.2.3 Soups, sauces & dressings

- 8.2.4 Meat & Poultry Products

- 8.2.5 Snacks & convenience foods

- 8.2.6 Beverages

- 8.2.7 Baby food & infant product type

- 8.2.8 Gluten-free products

- 8.2.9 Other food applications

- 8.3 Pharmaceuticals

- 8.3.1 Tablet binding & disintegration

- 8.3.2 Capsule product solutions

- 8.3.3 Drug delivery systems

- 8.3.4 Other pharmaceutical applications

- 8.3.5 Cosmetics & personal care

- 8.3.6 Skin care products

- 8.3.7 Hair care products

- 8.3.8 Color cosmetics

- 8.3.9 Other cosmetic applications

- 8.4 Paper & textile

- 8.4.1 Paper sizing & coating

- 8.4.2 Textile sizing & finishing

- 8.4.3 Other paper & textile applications

- 8.5 Other applications

- 8.5.1 Adhesives & glues

- 8.5.2 Biodegradable packaging

- 8.5.3 Other industrial applications

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 A&B Ingredients

- 10.2 AGRANA Beteiligungs-AG

- 10.3 Agrana Group

- 10.4 Anhui Lianhe

- 10.5 Archer Daniels Midland Company

- 10.6 Bangkok Starch Industrial Co., Ltd.

- 10.7 Beneo (Sudzucker Group)

- 10.8 Cargill, Incorporated

- 10.9 Golden Agriculture Co., Ltd.

- 10.10 Herba Ingredients

- 10.11 Hunan ER-KANG

- 10.12 Ingredion Incorporated

- 10.13 Jiangxi Golden Agriculture Co., Ltd.

- 10.14 Roquette Freres

- 10.15 Shaanxi Tianyu Pharmaceutical Co., Ltd.

- 10.16 Sonish Starch Technology Co., Ltd.

- 10.17 Tate & Lyle PLC

- 10.18 THAI WAH PUBLIC COMPANY LIMITED

- 10.19 Thai Flour Industry Co., Ltd.

- 10.20 Wuxi Chuangda Food Co., Ltd.