|

市场调查报告书

商品编码

1773362

传统码垛机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Conventional Palletizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

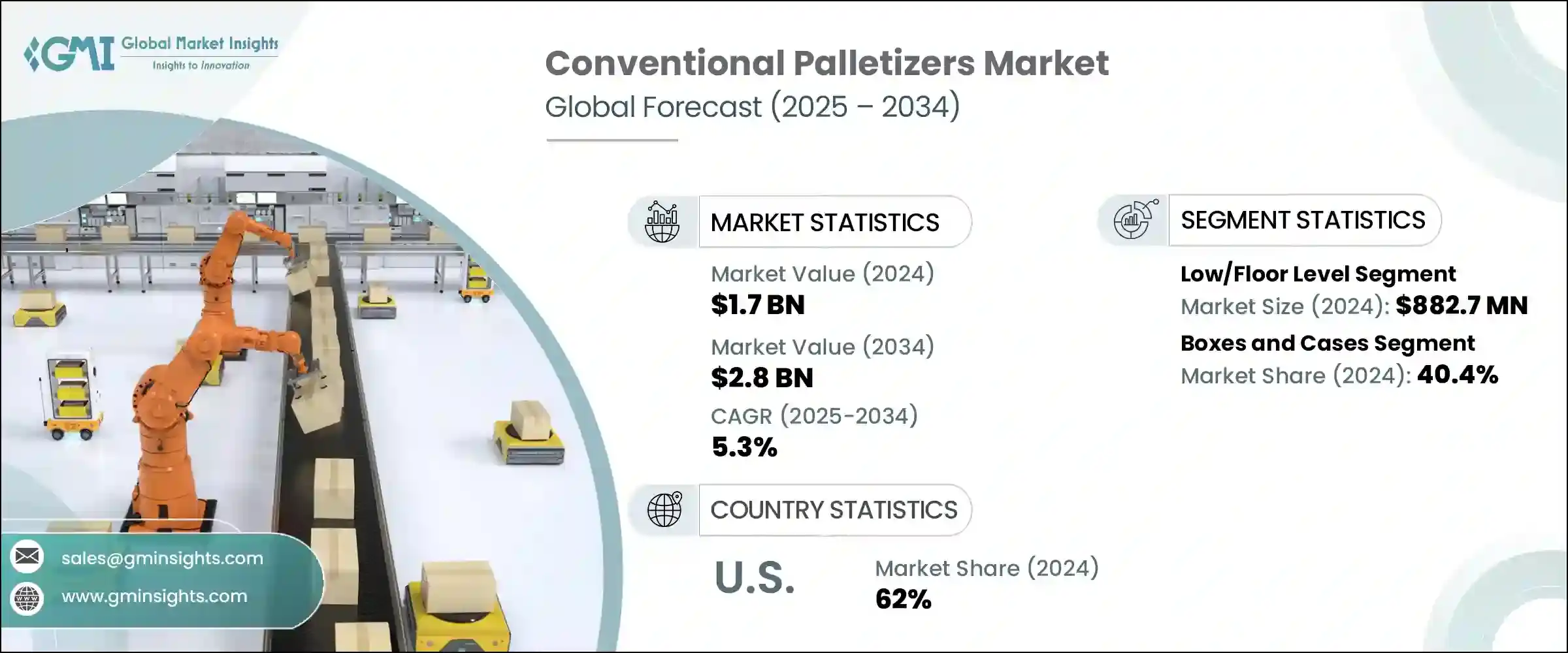

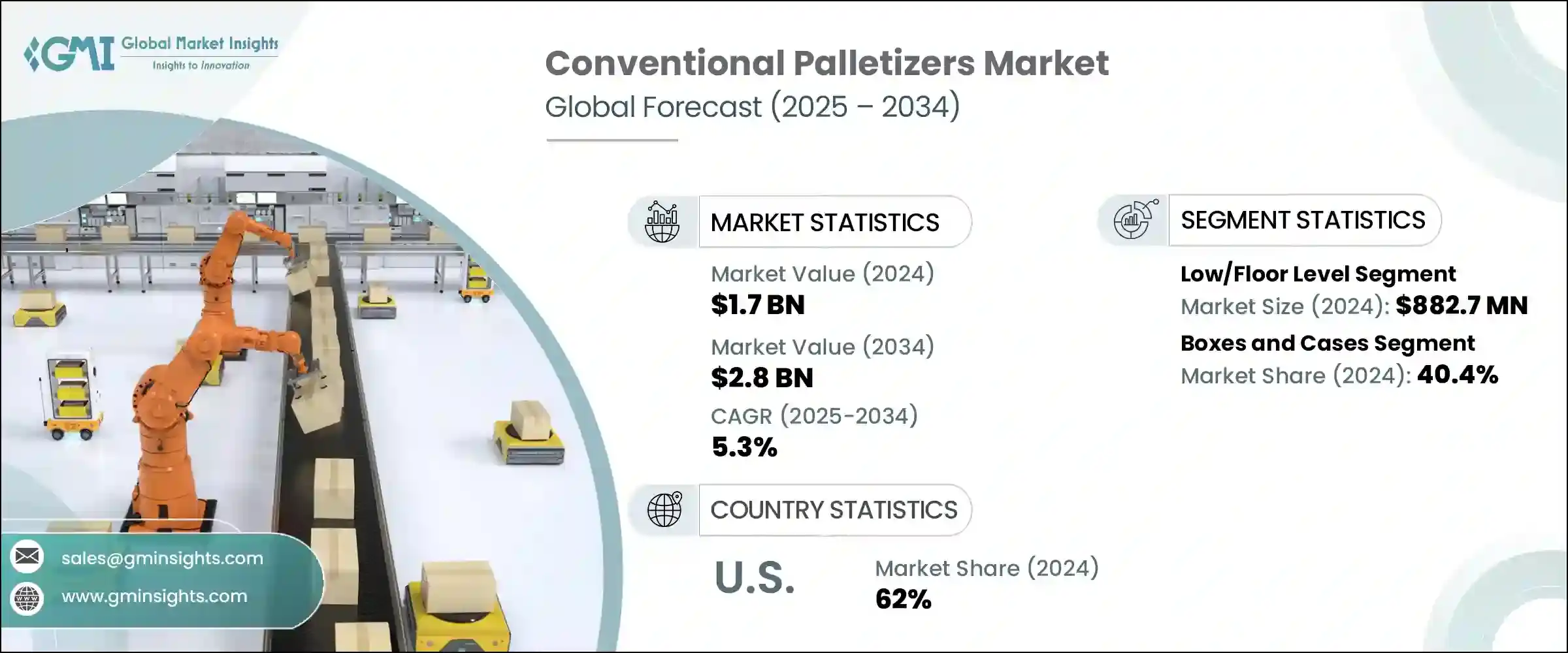

2024 年全球传统码垛机市场规模达 17 亿美元,预计到 2034 年将以 5.3% 的复合年增长率成长至 28 亿美元。各行各业对精简包装和物流流程的需求激增是该市场的主要驱动力之一。随着电子商务的持续成长和全球供应链的日益复杂,製造环境中对自动堆迭系统的需求也越来越明显。在将箱子或袋子运送到配送中心之前,需要对其进行一致性处理时,这些系统尤其重要。虽然在配送中心,机器人替代品通常更适合处理各种产品,但传统码垛机在工业环境中仍然能够有效地高速均匀地堆迭产品。

传统堆迭系统可在满托盘和空托盘之间无缝切换,无需中断生产,从而提高包装线效率。此功能可保持工作流程稳定,并最大限度地减少停机时间。与其他解决方案相比,这些机器采用紧凑封闭的码垛机构,占用空间更小。占地面积的减少也消除了安装大型安全护栏的需要,使其成为优先考虑空间优化的设施的理想选择。以大量连续生产而闻名的食品饮料产业,高度依赖这些机器来处理乳製品、零食和罐头食品等产品。由于易腐烂货物需要快速处理和交付,传统码垛机能够保持与快节奏生产需求相符的输出速度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 5.3% |

低位/地面码垛机市场在2024年创造了8.827亿美元的市场规模。这些机器采用地面输送系统,将货物排列整齐并旋转成排,然后将其推入托盘层。与从上方装载的高层码垛机不同,地面码垛机无需垂直移动。这项特点缩短了装载时间,提高了操作简便性,使其更有效率,并适用于各种规模的生产车间。

2024年,纸盒和纸箱细分市场占据了40.4%的市场。这些系统尤其适用于处理纸箱和矩形包装等统一的容器。其坚固的结构使其适合精确堆垛,从而实现高速操作并最大程度地减少误差。无论是食品、电子产品、药品或个人护理用品,纸盒和纸箱凭藉其保护性、易于标识和堆迭效率,仍然是各行各业的主流包装形式。从事大规模生产的製造商倾向于使用速度快、精度高的码垛系统,尤其是在统一性和包装量要求高的情况下。

2024年,美国传统码垛机市场占有62%的份额。为了抵消不断上涨的劳动力成本和劳动力短缺,美国製造商加大了对传统码垛系统的投资。这些系统可以自动化高强度和重复性的工作,从而提高安全性和生产力,同时降低员工流失率。自动化的推动也与更广泛的经济趋势息息相关,包括製造业的成长和线上零售通路的扩张,这些都刺激了对高效能生产线终端设备的需求。

引领全球传统码垛机市场的关键公司包括 Columbia Machine Inc.、Okura Yusoki、ROBOPAC、MSK Covertech、Premier Tech、KUKA AG、SIPA SpA、Signode Industrial Group LLC、OCME Srl、Brenton Engineering、PAYPER SA、Concetti SpA、BWBWal Group LLC、OCME Srl、Brenton Engineering、PAYPER SA、Concetti SpA、BWBWible Systems Systems、Baelx 和无锡包装有限公司。传统码垛机市场的公司正在透过多样化其设备供应来巩固其市场地位,以满足食品、製药和物流等不同行业的需求。他们还整合了可程式逻辑控制器 (PLC)、人机介面 (HMI) 和模组化设计等更智慧的技术,以提高操作灵活性。透过扩展售后服务和提供维护支持,这些参与者正在提高客户保留率和系统寿命。与系统整合商和包装自动化公司的策略合作使製造商能够提供完整的交钥匙解决方案,从而为客户增加价值。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 电子商务和物流的成长

- 食品和饮料行业的需求不断增长

- 劳动成本增加以及各行业采用自动化

- 产业陷阱与挑战

- 初期投资及维护成本高

- 产品变化的灵活性有限

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 进阶

- 低/地板水平

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 盒子和箱子

- 袋子和麻袋

- 托盘和板条箱

- 其他的

第七章:市场估计与预测:依最终用途产业,2021 年至 2034 年

- 主要趋势

- 食品和饮料

- 製药

- 消费品

- 电子商务与物流

- 其他的

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Baust & Co GmbH

- Brenton Engineering

- BW Flexible Systems

- Columbia Machine Inc

- Concetti SpA

- KUKA AG

- MSK Covertech

- OCME Srl

- Okura Yusoki

- PAYPER SA

- Premier Tech

- ROBOPAC

- Signode Industrial Group LLC

- SIPA SpA

- Wuxi Taiyang Packaging Technology Co Ltd

The Global Conventional Palletizers Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 2.8 billion by 2034. The surge in demand for streamlined packaging and logistics operations across various industries is one of the primary drivers for this market. As e-commerce continues to grow and global supply chains become increasingly complex, the need for automated palletizing systems in manufacturing environments has become more pronounced. These systems are particularly important where consistent handling of cases or bags is essential before they are transported to distribution hubs. While robotic alternatives are commonly favored for varied product assortments in fulfillment centers, conventional palletizers remain highly effective for uniform product stacking at high speeds in industrial settings.

Conventional palletizing systems improve packaging line efficiency by enabling seamless transitions between filled and empty pallets without disrupting production. This capability keeps the workflow steady and minimizes idle time. Compared to alternative solutions, these machines require less floor space thanks to their compact and enclosed stacking mechanisms. The reduced footprint also eliminates the need for expansive safety barriers, making them ideal for facilities where space optimization is a priority. The food and beverage sector, known for its high-volume continuous production, relies heavily on these machines to handle products like dairy, snacks, and canned goods. With perishable goods requiring quick processing and delivery, conventional palletizers are trusted to maintain output speeds that align with fast-paced production demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 5.3% |

The low/floor-level palletizer segment generated USD 882.7 million in 2024. These machines operate on a floor-level conveyor system that aligns and rotates items into rows before pushing them into pallet layers. Unlike their high-level counterparts, which load from above, floor-level units eliminate the need for vertical movement during stacking. This feature reduces load time and increases operational simplicity, making them more efficient and accessible across production floors of varying sizes.

In 2024, the boxes and cases segment held a 40.4% share. These systems are particularly effective at handling uniform containers such as cartons and rectangular packages. Their rigid form makes them suitable for precise stacking, allowing for high-speed operations with minimal error. Whether it's food, electronics, pharmaceuticals, or personal care items, boxes, and cases remain a dominant packaging format across industries due to their protective nature, ease of branding, and stacking efficiency. Manufacturers dealing in mass production turn to palletizing systems that offer speed and accuracy, especially where uniformity and packaging volume are high.

United States Conventional Palletizers Market held a 62% share in 2024. The need to offset rising labor costs and workforce shortages has prompted manufacturers in the country to increase investments in conventional palletizing systems. These systems automate physically intense and repetitive tasks, thereby improving safety and productivity while reducing employee turnover. The push for automation is also tied to broader economic trends, including manufacturing growth and the expansion of online retail channels, which are all fueling demand for high-efficiency end-of-line equipment.

Key companies leading the Global Conventional Palletizers Market include Columbia Machine Inc., Okura Yusoki, ROBOPAC, MSK Covertech, Premier Tech, KUKA AG, SIPA SpA, Signode Industrial Group LLC, OCME Srl, Brenton Engineering, PAYPER SA, Concetti SpA, BW Flexible Systems, Baust & Co. GmbH, and Wuxi Taiyang Packaging Technology Co. Ltd. Companies in the conventional palletizers market are strengthening their market position by diversifying their equipment offerings to cater to various industry requirements, including food, pharmaceuticals, and logistics. They are also integrating smarter technologies such as programmable logic controllers (PLCs), human-machine interfaces (HMIs), and modular designs to enhance operational flexibility. By expanding after-sales services and providing maintenance support, these players are improving customer retention and system longevity. Strategic collaborations with system integrators and packaging automation firms allow manufacturers to offer complete turnkey solutions, increasing value to clients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End Use Industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of e-commerce and logistics

- 3.2.1.2 Rising demand from the food and beverages industry

- 3.2.1.3 Increased labor costs and adoption of automation in various industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Limited flexibility for product variation

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 High level

- 5.3 Low/floor level

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Boxes and cases

- 6.3 Bags and sacks

- 6.4 Trays and crates

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.3 Pharmaceuticals

- 7.4 Consumer goods

- 7.5 E-commerce and logistics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Distribution channel, 2021 – 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Baust & Co GmbH

- 10.2 Brenton Engineering

- 10.3 BW Flexible Systems

- 10.4 Columbia Machine Inc

- 10.5 Concetti SpA

- 10.6 KUKA AG

- 10.7 MSK Covertech

- 10.8 OCME Srl

- 10.9 Okura Yusoki

- 10.10 PAYPER SA

- 10.11 Premier Tech

- 10.12 ROBOPAC

- 10.13 Signode Industrial Group LLC

- 10.14 SIPA SpA

- 10.15 Wuxi Taiyang Packaging Technology Co Ltd