|

市场调查报告书

商品编码

1773363

压疮治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Pressure Ulcers Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

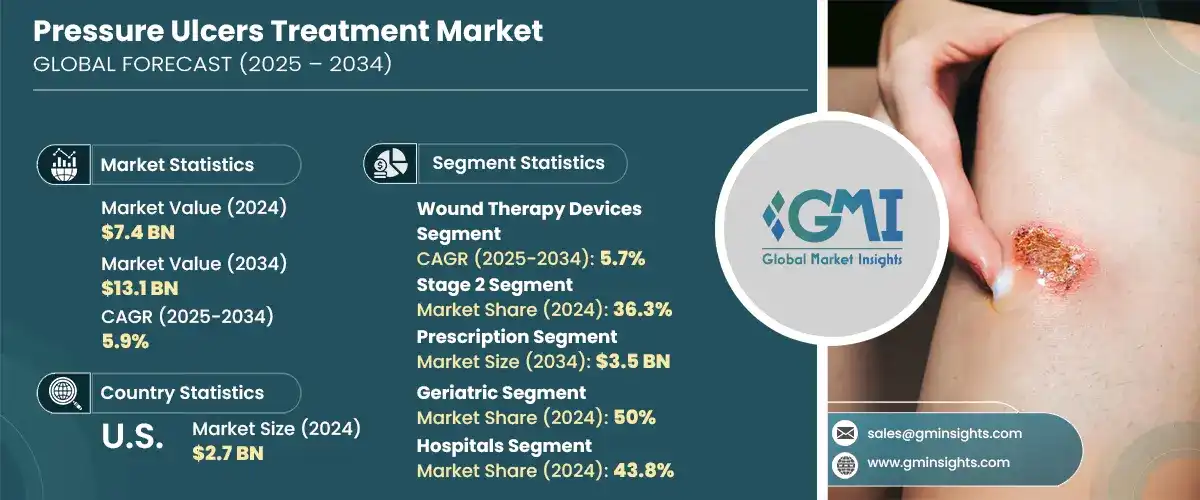

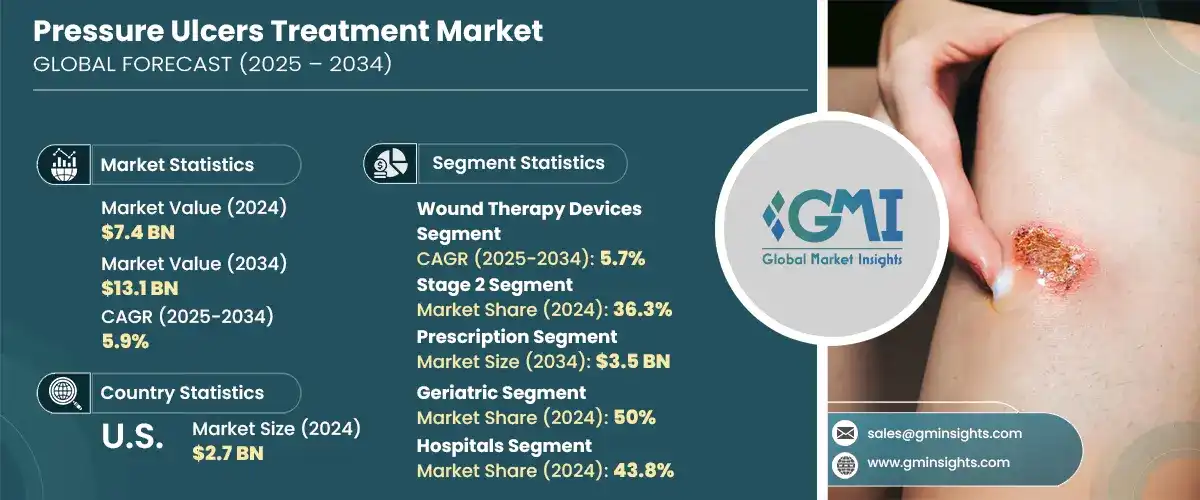

2024年,全球压疮治疗市场规模达74亿美元,预计2034年将以5.9%的复合年增长率成长,达到131亿美元。人口老化是推动这一成长的主要因素,尤其是在已开发国家。在这些国家,行动不便和长期不活动会增加压疮的风险。随着年龄的增长,人们更容易出现阻碍活动的情况,进而引发压疮。此外,肥胖和糖尿病等生活方式相关疾病的盛行率不断上升,这两种疾病都会减缓伤口癒合,进一步推动了对有效伤口护理疗法的需求。慢性病发病率的上升导致临床上难癒合伤口的病例增多,这刺激了对能够改善患者预后的先进治疗方法的需求。

伤口护理解决方案的持续技术发展也推动了市场发展。智慧伤口敷料、生物活性产品和现代治疗系统等创新技术正在透过缩短癒合时间并提高患者舒适度,彻底改变压疮管理。由于这些解决方案在处理复杂伤口方面效果显着,在医院和家庭护理环境中的应用日益广泛。人们对早期介入和预防策略益处的认识不断提高,正在鼓励更多患者和医疗保健提供者选择先进的产品。来自政府医疗保健计画(尤其是在北美和欧洲)的支持也推动了这些产品的采用。报销计画和临床指引也强化了人们对实证伤口照护方法的偏好。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 74亿美元 |

| 预测值 | 131亿美元 |

| 复合年增长率 | 5.9% |

压疮治疗涵盖一系列旨在预防和治癒压力性皮肤损伤的医疗解决方案。这些溃疡,也称为褥疮或褥疮,通常发生在行动不便的患者身上。治疗的目标是缓解压力、促进组织修復、预防感染并改善患者整体健康。治疗方案包括专用敷料、生物製剂、治疗设备和专为伤口护理设计的药剂。随着临床关注点转向改善癒合效果,结合多种疗法的综合治疗方法在市场上日益普及。

在关键产品类别中,伤口治疗设备在2024年成为表现最佳的细分市场,估值达33亿美元,预计2034年将成长至57亿美元,复合年增长率为5.7%。这些设备包含有助于加速伤口癒合、降低感染风险和最大程度减轻患者不适的技术。这些设备在医院和门诊环境中的使用日益增多,凸显了人们日益依赖先进技术来更有效地管理复杂伤口。压力管理系统和自动化伤口监测的最新进展进一步增强了该细分市场的功能,使其在临床上得到更广泛的应用。

就产品类型而言,处方药领域在2024年占据领先地位,预计到2034年将达到35亿美元。这种主导地位可以归因于处方疗法的更高疗效,以及在治疗重症病例时需要规范干预的医疗需求。此类产品包括先进的外用製剂和用于治疗更复杂或慢性伤口的全身疗法。随着医疗保健提供者越来越青睐基于患者需求的个人化治疗方案,预计处方药领域将在未来几年保持领先。

按最终用途划分,医院在2024年占据了最大的市场份额,达到43.8%,预计到2034年将创造55亿美元的收入。医院凭藉其完善的基础设施、经验丰富的医务人员以及专业的伤口护理科室,仍然是治疗压疮(尤其晚期压疮)的主要中心。行动不便或有潜在健康问题的患者更有可能寻求医院的治疗,因为医院可以有效地运用多学科方法。此外,医院通常是需要外科手术或重症监护的患者的第一接诊点。

从区域来看,北美地区以2024年29亿美元的收入引领全球市场,预计2034年将达到50亿美元,复合年增长率为5.5%。这一领先地位得益于其完善的医疗保健体系、对尖端伤口护理技术的早期采用以及对临床研发的大量投入。该地区老年人口的不断增长以及肥胖和糖尿病等併发症的高发病率,使得先进的治疗方案成为必要。此外,优惠的报销方案和强而有力的监管也使得创新疗法得以有序推广。

领先企业透过广泛的产品组合、策略性研发投入和全球布局不断巩固其地位。主要参与者正在积极开发先进的伤口管理解决方案,并扩大其在新兴经济体的影响力。合併、授权协议和产品发布等竞争策略在塑造产业格局方面发挥着至关重要的作用。新创公司和小型企业也透过专注于专业生物製剂和客製化护理方案来开拓利基市场,从而加快了行业创新的步伐。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 慢性病盛行率上升

- 伤口护理技术日益进步

- 提高认识和预防保健措施

- 老年人口不断增加

- 产业陷阱与挑战

- 治疗费用高

- 市场机会

- 扩大居家伤口管理

- 不断成长的研发投入与活动

- 成长动力

- 成长潜力分析

- 技术格局

- 监管格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 扩张计划

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 伤口护理敷料

- 藻酸盐敷料

- 泡棉敷料

- 水胶体敷料

- 水凝胶敷料

- 薄膜敷料

- 其他伤口护理敷料

- 生物製剂

- 皮肤替代品

- 生长因子

- 其他生物製剂

- 伤口治疗设备

- 负压伤口治疗

- 高压氧治疗

- 其他伤口治疗设备

- 药物

- 其他产品

第六章:市场估计与预测:按溃疡分期,2021 年至 2034 年

- 主要趋势

- 第一阶段

- 第 2 阶段

- 第 3 阶段

- 第四阶段

第七章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 场外交易(OTC)

- 处方

第八章:市场估计与预测:按年龄组,2021 年至 2034 年

- 主要趋势

- 儿科

- 成人

- 老年

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心(ASC)

- 专科诊所

- 其他最终用途

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- 3M Healthcare

- AHA Hyperbarics

- Integra LifeSciences

- Ascend Laboratories

- B. Braun

- Baxter

- BioTissue

- Cardinal Health

- Coloplast

- Convatec

- Ethicon (Johnson and Johnson)

- GlaxoSmithKline (GSK)

- Ipca Laboratories

- LifeNet Health

- Medline

- MIMEDX

- Molnlycke Health Care

- Organogenesis

- Pfizer

- Smith & Nephew

- StimLabs

- Zimmer Biomet

The Global Pressure Ulcers Treatment Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 13.1 billion by 2034. A major contributor to this growth is the aging population, particularly in developed nations, where limited mobility and prolonged immobility increase the risk of pressure ulcers. As individuals age, they are more likely to develop conditions that hinder movement, leading to the development of pressure sores. Additionally, the rising prevalence of lifestyle-related diseases such as obesity and diabetes-both of which are known to slow wound healing-further drives demand for effective wound care therapies. The growing incidence of chronic illnesses is translating into increased clinical cases of non-healing wounds, spurring the demand for sophisticated treatment approaches that improve patient outcomes.

The market is also benefiting from ongoing technological developments in wound care solutions. Innovations such as smart wound dressings, biologically active products, and modern therapy systems are revolutionizing pressure ulcer management by reducing healing time and improving comfort for patients. These solutions are increasingly adopted across both hospital settings and homecare environments due to their effectiveness in managing complex wounds. Greater awareness about early intervention and the benefits of preventive strategies is encouraging more patients and healthcare providers to opt for advanced products. Support from government healthcare programs, particularly in North America and Europe, is also bolstering adoption. Reimbursement schemes and clinical guidelines are reinforcing the preference for evidence-based wound care methods.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $13.1 Billion |

| CAGR | 5.9% |

Pressure ulcer treatment encompasses a range of medical solutions aimed at preventing and healing pressure-induced skin injuries. These ulcers, also referred to as bedsores or decubitus ulcers, generally occur in patients with limited mobility. The goal of treatment is to relieve pressure, promote tissue recovery, prevent infection, and enhance overall patient health. Therapeutic options include specialized dressings, biologics, therapy devices, and pharmaceutical agents designed for wound care. As clinical attention shifts toward improving healing outcomes, integrated treatment approaches that combine multiple therapies are gaining ground in the market.

Among the key product categories, wound therapy devices emerged as the top-performing segment in 2024 with a valuation of USD 3.3 billion and are projected to grow to USD 5.7 billion by 2034, registering a CAGR of 5.7%. These devices include technologies that support faster healing, reduce infection risk, and minimize patient discomfort. Their increasing use in hospitals and outpatient settings highlights the growing reliance on advanced technology to manage complex wounds more efficiently. Recent improvements in pressure management systems and automated wound monitoring are further enhancing the capabilities of this segment, leading to broader clinical adoption.

In terms of type, the prescription segment led in 2024 and is estimated to reach USD 3.5 billion by 2034. This dominance can be attributed to the higher efficacy of prescription therapies and the medical necessity for regulated interventions in treating severe cases. Products in this category include advanced topical formulations and systemic therapies that are prescribed for more complex or chronic wounds. As healthcare providers increasingly favor personalized treatment plans based on patient needs, the prescription category is expected to maintain its lead over the coming years.

By end use, hospitals represented the largest share of the market in 2024, accounting for 43.8%, and are projected to generate USD 5.5 billion in revenue by 2034. Hospitals remain the primary centers for treating pressure ulcers, particularly in advanced stages, owing to their comprehensive infrastructure, availability of skilled medical staff, and specialized departments for wound care. Patients with limited mobility or underlying health issues are more likely to seek hospital-based care where multidisciplinary approaches can be deployed effectively. Additionally, hospitals are often the first point of contact for patients requiring surgical intervention or intensive care.

Regionally, North America led the global market with a revenue of USD 2.9 billion in 2024 and is expected to reach USD 5 billion by 2034, growing at a CAGR of 5.5%. This leadership is supported by a well-established healthcare framework, early adoption of cutting-edge wound care technologies, and substantial investment in clinical research and development. The rising number of elderly individuals and the high prevalence of comorbid conditions such as obesity and diabetes in the region make advanced treatment solutions a necessity. Furthermore, favorable reimbursement scenarios and strong regulatory oversight have enabled a structured rollout of innovative therapies.

Leading companies continue to strengthen their positions through extensive product portfolios, strategic R&D investment, and global reach. Major participants are actively developing advanced wound management solutions and expanding their presence in emerging economies. Competitive strategies such as mergers, licensing agreements, and product launches are playing a vital role in shaping the landscape. Startups and smaller firms are also carving out a niche by focusing on specialized biologics and customizable care options, intensifying the pace of innovation within the industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Ulcer stage

- 2.2.4 Type

- 2.2.5 Age group

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic disease

- 3.2.1.2 Growing advancement in wound care technologies

- 3.2.1.3 Increasing awareness and preventive care measures

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding homecare-based wound management

- 3.2.3.2 Growing R&D investment and activities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Regulatory landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wound care dressings

- 5.2.1 Alginate dressings

- 5.2.2 Foam dressings

- 5.2.3 Hydrocolloid dressings

- 5.2.4 Hydrogel dressings

- 5.2.5 Film dressings

- 5.2.6 Other wound care dressings

- 5.3 Biologics

- 5.3.1 Skin substitutes

- 5.3.2 Growth factors

- 5.3.3 Other biologics

- 5.4 Wound therapy devices

- 5.4.1 Negative pressure wound therapy

- 5.4.2 Hyperbaric oxygen therapy

- 5.4.3 Other wound therapy devices

- 5.5 Medications

- 5.6 Other products

Chapter 6 Market Estimates and Forecast, By Ulcer Stage, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Stage 1

- 6.3 Stage 2

- 6.4 Stage 3

- 6.5 Stage 4

Chapter 7 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Over-the-counter (OTC)

- 7.3 Prescription

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pediatric

- 8.3 Adult

- 8.4 Geriatric

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers (ASCs)

- 9.4 Specialty clinics

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3M Healthcare

- 11.2 AHA Hyperbarics

- 11.3 Integra LifeSciences

- 11.4 Ascend Laboratories

- 11.5 B. Braun

- 11.6 Baxter

- 11.7 BioTissue

- 11.8 Cardinal Health

- 11.9 Coloplast

- 11.10 Convatec

- 11.11 Ethicon (Johnson and Johnson)

- 11.12 GlaxoSmithKline (GSK)

- 11.13 Ipca Laboratories

- 11.14 LifeNet Health

- 11.15 Medline

- 11.16 MIMEDX

- 11.17 Molnlycke Health Care

- 11.18 Organogenesis

- 11.19 Pfizer

- 11.20 Smith & Nephew

- 11.21 StimLabs

- 11.22 Zimmer Biomet