|

市场调查报告书

商品编码

1773365

海藻萃取物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Seaweed Extracts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

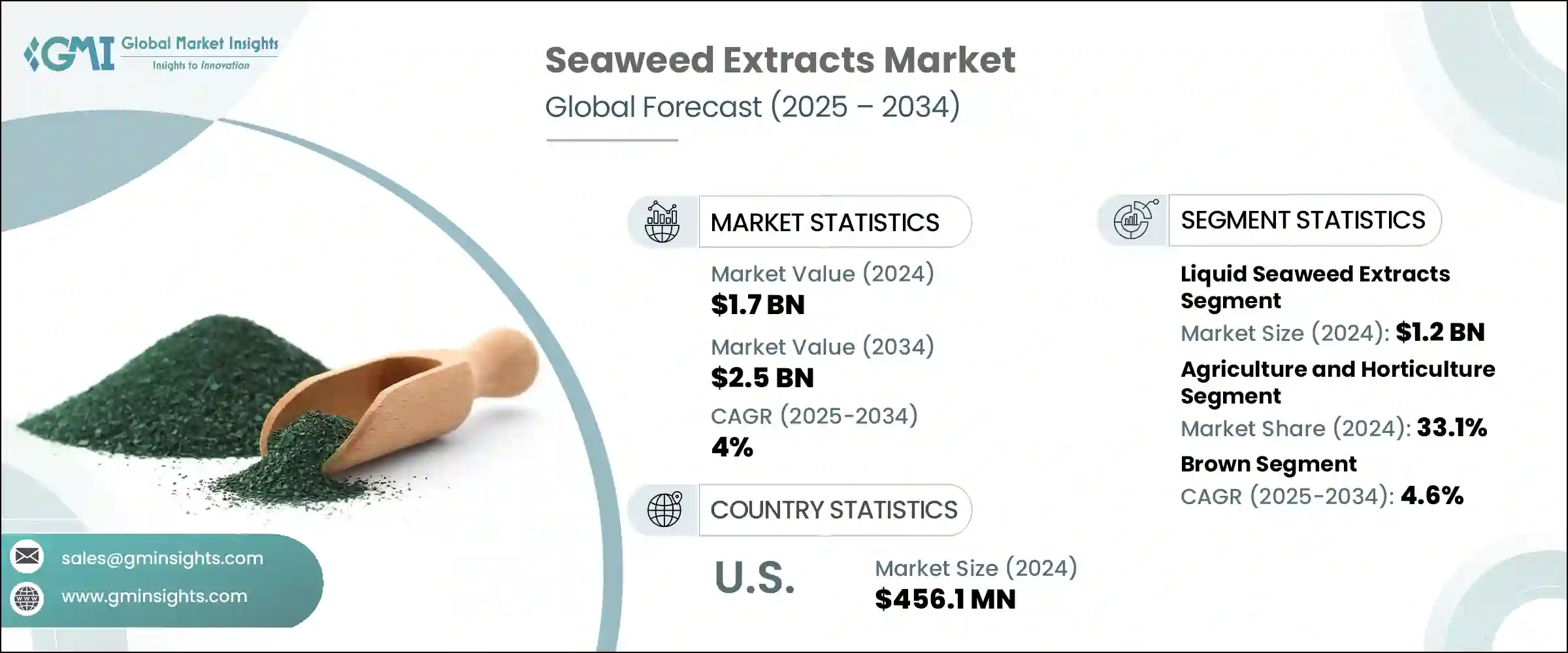

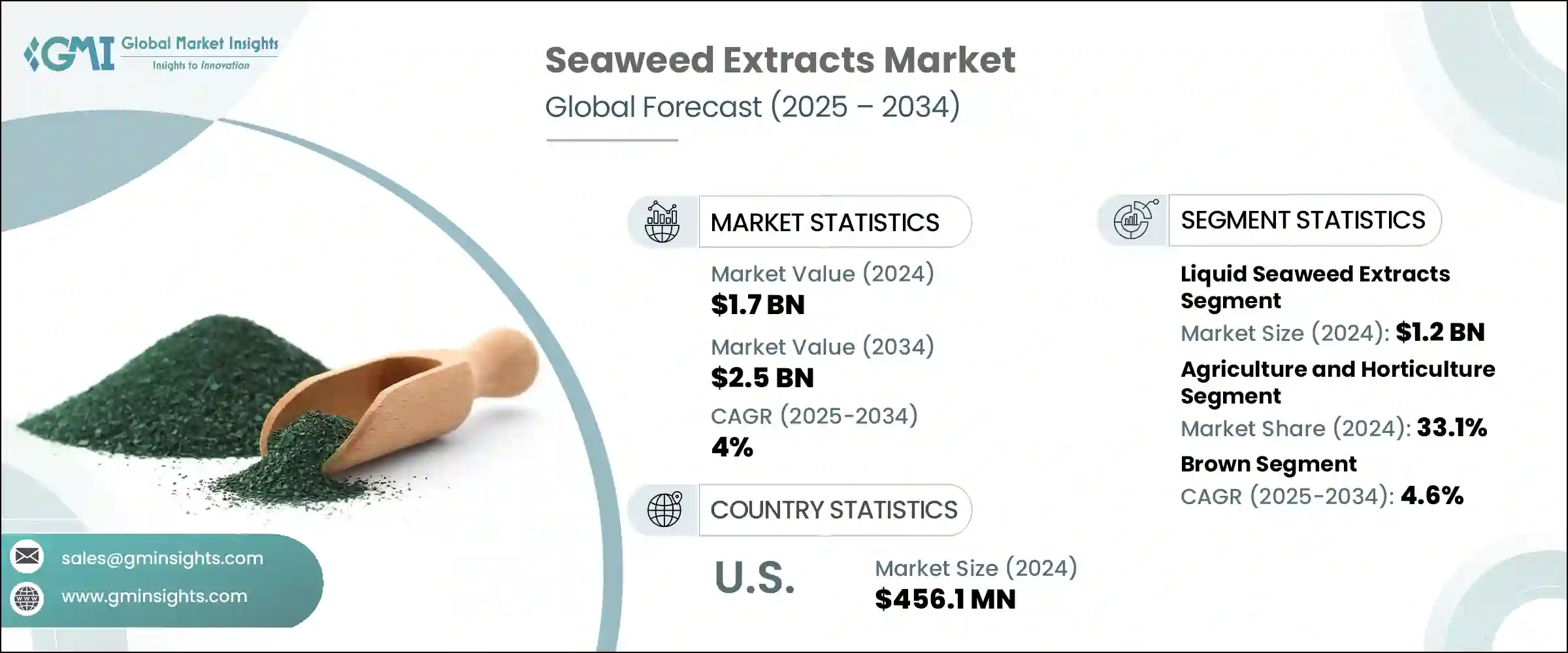

2024年,全球海藻萃取物市场规模达17亿美元,预计2034年将以4%的复合年增长率成长,达到25亿美元。这一增长主要源于个人护理、食品、製药和农业等领域对有机、永续和生物基产品的需求激增。这些源自海洋的浓缩物富含微量元素和天然生长激素,因其多种功效而备受认可——从增强植物抗逆力到在加工食品中用作天然增稠剂,再到在化妆品中提供抗氧化特性。随着消费者日益追求清洁标籤和环保产品,海藻萃取物因其多功能性和积极的可持续性特征而备受关注,使其成为天然配方和农业投入品中的宝贵成分。

海藻萃取物可作为植物生物刺激素和天然土壤改良剂,改善养分吸收和土壤通气。海藻萃取物提供可溶性粉末和薄片等易于使用的形态,可提供多功能有机解决方案,与传统和有机农业实践无缝衔接。这些形态易于处理、储存和混合,是大规模农业和小型园艺作业的理想选择。除了作为有效的土壤改良剂外,它们还能提供钾、镁和铁等必需的微量元素,这些元素对植物生长和抗逆性至关重要。其天然的螯合特性可提高土壤中养分的生物可利用性,提高吸收效率并改善植物的整体健康。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 25亿美元 |

| 复合年增长率 | 4% |

2024年,海藻萃取物市场的液体製剂板块产值达12亿美元。其易于施用和快速吸收的特性使其成为各种农业实践的首选,特别适用于叶面喷施和土壤改良。由于其一致性高、製备时间短且与标准灌溉系统相容,这些製剂深受农民青睐。液体海藻在提高作物抗逆性、养分吸收和产量方面的有效性,进一步推动了其广泛应用,尤其是在精准农业和有机种植方法中。

2024年,农业和园艺领域占比33.1%,预计2034年将以4.3%的复合年增长率成长。随着种植者越来越多地转向永续投入,海藻萃取物作为天然生物刺激素和土壤改良剂越来越受到青睐。同时,在食品和饮料领域,卡拉胶和琼脂等海藻衍生化合物作为合成添加剂的清洁标籤替代品,需求旺盛。它们能够改善酱汁、乳製品替代品和即食产品的质地、黏度和保质期,这进一步巩固了它们在配方改良和植物性产品中的关键作用。

2024年,美国海藻萃取物市场产值达4.561亿美元。该地区的成长主要源于农业、食品、化妆品和医药领域的需求。人们对有机农业和作物抗逆性的认识不断提高,推动了生物刺激素市场的采用。同时,食品中清洁标籤成分的兴起以及天然化妆品的兴起,也促进了海藻增稠剂、稳定剂以及抗氧化剂和抗炎剂等护肤成分的使用。

海藻萃取物市场的主要参与者包括Algaia SA、杜邦公司、Roullier Group、Gelymar SA和嘉吉公司。领先的公司正在加大研发投入,以开发针对特定终端市场的高纯度标准化萃取物。他们正在与农业合作社、食品製造商和护肤品牌建立合作伙伴关係,将海藻萃取物整合到新的生物和生态产品中。企业还透过实施永续采购计划和获得符合清洁标籤和有机标准的认证来增强可追溯性。此外,扩大生产能力并在主要海藻养殖区附近建立设施,可确保供应的可靠性和成本效益。企业利用策略性收购和合资企业来实现产品组合的多元化,将藻类生物刺激素与互补性投入结合。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- Pestel 分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计资料(HS 编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 液态海藻萃取物

- 粉状海藻萃取物

- 薄片和颗粒

- 其他形式

第六章:市场估计与预测:按应用 2021 - 2034

- 主要趋势

- 农业和园艺

- 食品和饮料

- 动物饲料

- 化妆品和个人护理

- 药品和营养保健品

- 其他工业用途

第七章:市场估计与预测:按海藻来源,2021 - 2034 年

- 主要趋势

- 褐藻

- 红海藻

- 绿色海藻

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- MEA 其余地区

第九章:公司简介

- Acadian Seaplants Limited

- Algaia SA

- Cargill, Inc.

- CP Kelco (JM Huber Corporation)

- DuPont de Nemours, Inc.

- Gelymar SA

- Qingdao Gather Great Ocean Algae Industry Group

- Roullier Group

- Seasol International

The Global Seaweed Extracts Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 2.5 billion by 2034. This growth is driven by a surge in demand for organic, sustainable, and bio-based products across sectors such as personal care, food, pharmaceuticals, and agriculture. These marine-derived concentrates, rich in trace elements and natural growth hormones, have gained recognition for their multifunctional benefits-from enhancing plant resilience to serving as natural thickeners in processed foods and offering antioxidant properties in cosmetics. As consumers increasingly seek clean-label and eco-conscious products, seaweed extracts have attracted attention for their versatility and positive sustainability profile, positioning them as a valuable ingredient in natural formulations and farming inputs.

Seaweed extracts serve as plant biostimulants and natural soil enhancers, improving nutrient uptake and soil aeration. Available in user-friendly forms such as soluble powders and flakes, seaweed extracts provide versatile organic solutions that integrate seamlessly with traditional and organic farming practices. These formats are easy to handle, store, and mix, making them ideal for large-scale agricultural use as well as smaller horticultural operations. In addition to acting as effective soil conditioners, they supply essential trace minerals like potassium, magnesium, and iron, which play a vital role in plant development and stress tolerance. Their natural chelating properties enhance the bioavailability of nutrients in the soil, improving uptake efficiency and overall plant health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 4% |

Liquid formulations segment in the seaweed extracts market generated USD 1.2 billion in 2024. Their ease of application and rapid absorption have made them a preferred option across a range of agricultural practices, particularly for foliar spraying and soil enhancement. Farmers favor these formulations due to their uniform consistency, reduced preparation time, and compatibility with standard irrigation systems. The effectiveness of liquid seaweed in improving crop resilience, nutrient uptake, and yield further drives its widespread use, especially in precision farming and organic cultivation methods.

The agriculture and horticulture segment accounted for a 33.1% share in 2024 and is projected to grow at a CAGR of 4.3% through 2034. As growers increasingly shift toward sustainable inputs, seaweed extracts have gained traction as natural biostimulants and soil conditioners. Meanwhile, in the food and beverage sector, seaweed-derived compounds such as carrageenan and agar are experiencing strong demand as clean-label alternatives to synthetic additives. Their ability to deliver texture, viscosity, and shelf-life improvements in sauces, dairy substitutes, and ready-to-eat products reinforces their critical role in reformulated and plant-based offerings.

United States Seaweed Extracts Market generated USD 456.1 million in 2024. Growth in the region is driven by demand across agriculture, food, cosmetics, and pharmaceuticals. Increasing awareness around organic farming and stress resilience in crops has fueled adoption in biostimulant markets. Meanwhile, the shift toward clean-label ingredients in food and the rise in natural cosmetics have boosted the use of seaweed-based thickeners, stabilizers, and skincare beneficials like antioxidants and anti-inflammatories.

Major players operating in the Seaweed Extracts Market include Algaia S.A., DuPont de Nemours, Inc., Roullier Group, Gelymar S.A., and Cargill, Inc. Leading firms are boosting their R&D investments to develop high-purity, standardized extracts tailored for specific end-markets. They're forming partnerships with agricultural cooperatives, food manufacturers, and skincare brands to integrate seaweed extracts into new bio- and eco-based products. Companies are also enhancing traceability by implementing sustainable sourcing programs and obtaining certifications to meet clean-label and organic standards. In addition, expanding production capacity and establishing facilities near major seaweed farming regions ensures supply reliability and cost efficiency. Firms leverage strategic acquisitions and joint ventures to diversify product portfolios-combining algal biostimulants with complementary inputs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Seaweed source

- 2.3 TAM analysis, 2025-2034

- 2.4 Cxo perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Liquid seaweed extracts

- 5.3 Powdered seaweed extracts

- 5.4 Flakes and granules

- 5.5 Other forms

Chapter 6 Market Estimates and Forecast, By Application 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Agriculture and horticulture

- 6.3 Food & beverages

- 6.4 Animal feed

- 6.5 Cosmetics & personal care

- 6.6 Pharmaceuticals & nutraceuticals

- 6.7 Other industrial uses

Chapter 7 Market Estimates and Forecast, By Seaweed Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Brown seaweed

- 7.3 Red seaweed

- 7.4 Green seaweed

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 Acadian Seaplants Limited

- 9.2 Algaia S.A.

- 9.3 Cargill, Inc.

- 9.4 CP Kelco (J.M. Huber Corporation)

- 9.5 DuPont de Nemours, Inc.

- 9.6 Gelymar S.A.

- 9.7 Qingdao Gather Great Ocean Algae Industry Group

- 9.8 Roullier Group

- 9.9 Seasol International