|

市场调查报告书

商品编码

1773366

绵羊及山羊设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sheep and Goat Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

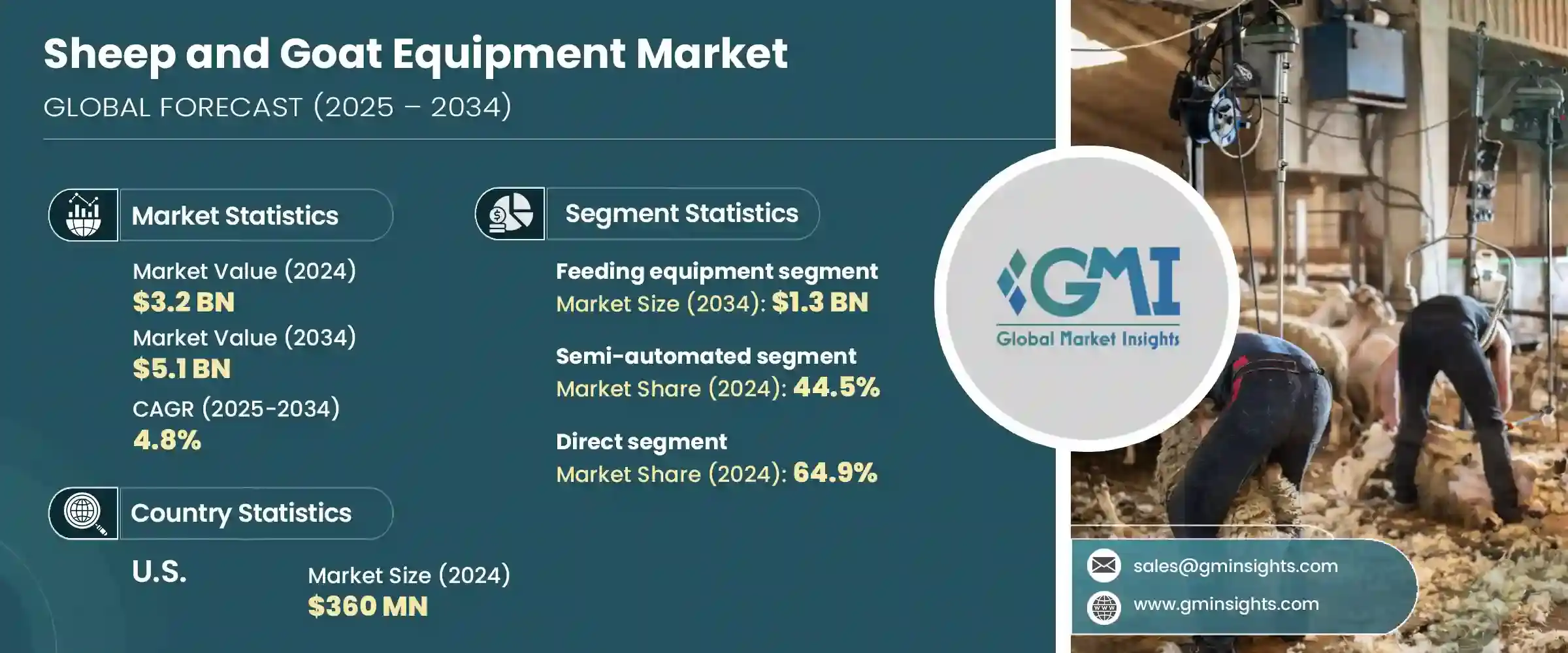

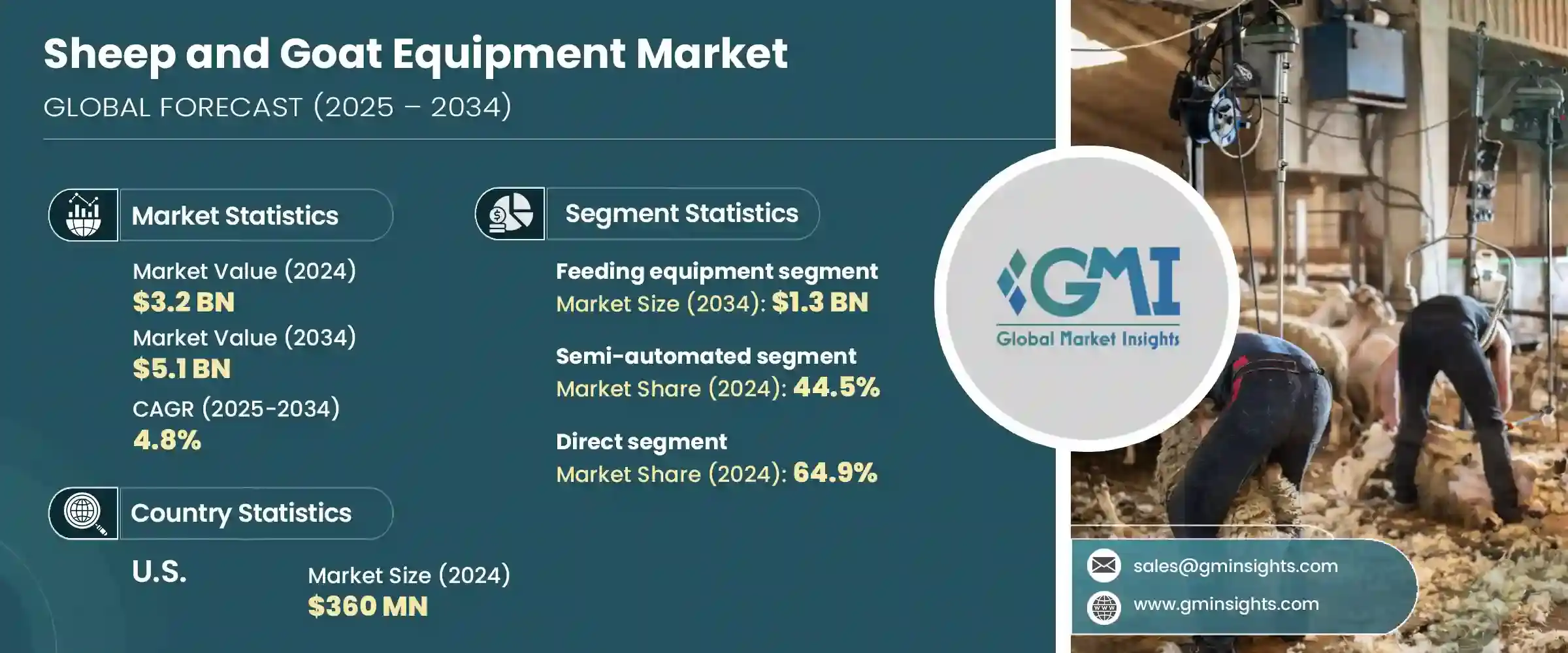

2024年,全球绵羊和山羊设备市场价值32亿美元,预计2034年将以4.8%的复合年增长率成长,达到51亿美元。随着农业实践的不断现代化和更有效率的牲畜管理方法的采用,该行业正在经历重大转型。越来越多的农民开始寻求创新的设备解决方案,以提高生产力并减少对体力劳动的依赖。随着简化日常营运的需求日益增长,机械化餵食工具、先进的剪毛系统和精密监测设备等设备正成为畜牧场的重要组成部分。

随着生产者认识到自动化系统在饲餵流程一致性、节省劳力密集工作时间以及提升动物福利方面的优势,其应用也日益广泛。农场主们正致力于优化资源配置,尤其是在牲畜饲料占据营运成本很大一部分的情况下。设备中的技术整合不仅有助于减少饲料浪费和人工成本,还能透过早期疾病检测和行为追踪,更好地管理动物的健康。这些创新正在重塑畜牧业的管理方式,推动市场在未来十年持续成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 32亿美元 |

| 预测值 | 51亿美元 |

| 复合年增长率 | 4.8% |

就设备类型而言,饲餵设备占据主导地位,2024年该细分市场价值达8亿美元。预计该类别将稳定成长,到2034年将达到13亿美元。饲料管理设备需求持续强劲,因为它有助于生产商减少饲料损失并提高配送效率。自动分配器、精准餵食器和其他饲餵工具因其能够促进动物更健康的生长并最大限度地减少饲料浪费而备受青睐,而饲料浪费仍然是畜牧业运营成本中最高的环节之一。

基于操作模式的市场数据显示,半自动化设备在2024年约占全球营收份额的44.5%。预计该细分市场在预测期内的复合年增长率将达到4.4%。这些系统对寻求在自动化和手动控制之间取得平衡的中型和大型农场主越来越有吸引力。它们能够提高运行速度、提供稳定的性能并减少对人工的依赖,使其成为一种高效的替代方案,尤其是在农业劳动力短缺的地区。

分销管道在决定产品可及性和服务品质方面发挥关键作用。 2024年,直销通路占据市场主导地位,份额约64.9%。这种模式使製造商能够直接与最终用户互动,从而实现更好的设备定制,并有机会满足特定的农业需求。它还支援即时回馈收集,使製造商能够根据不断变化的市场动态调整其产品。直销通路也有利于物流,确保更快的交付和更顺畅的库存流动,尤其是在季节性需求高峰期间。

从区域来看,美国在全球市场中占有强劲地位,2024 年市场规模达 3.6 亿美元。预计 2025 年至 2034 年期间,美国畜牧业的复合年增长率将达到 5.1%。受现代化农业基础设施以及肉类、牛奶和羊毛需求不断增长的推动,美国畜牧业持续扩张。根据美国农业实践定制的高性能设备的供应,极大地促进了该行业的上升趋势。

在鼓励永续农业和畜牧业管理创新的政策支持下,北美整体也正在稳步发展。对负责任的资源利用和农业设备数位化整合的重视,正在巩固该地区在全球市场的地位。

在这个不断发展的市场中,製造商专注于提供节能係统、增强耐用性和客製化功能,以满足绵羊和山羊养殖户的多样化需求。此外,他们也越来越重视售后服务和区域支援基础设施。在新兴市场,对高性价比且可靠的设备的需求日益增长,例如餵料器、围栏装置、电子识别 (EID) 秤和移动处理系统。这些优先事项将继续影响主要产业参与者的策略方向,帮助他们扩展产品组合,满足全球畜牧业的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依设备类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依设备类型,2021-2034

- 主要趋势

- 餵料设备

- 饲料搅拌机

- 饲料分配器

- 干草餵料器

- 矿物质饲料

- 搬运设备

- 门和麵板

- 滑槽

- 分类系统

- 装卸坡道

- 剪切设备

- 电动剪

- 手动剪板机

- 剪切平台

- 其他的

- 称重设备

- 数位牲畜秤

- 平台秤

- 移动称重系统

- 便携式重量箱

- 步行称重系统

- 其他的

- 修剪设备

- 蹄修整器

- 羊毛剪

- 电动剪

- 其他的

- 浇水设备

- 自动饮水器

- 水槽

- 水过滤系统

- 其他的

- 养殖设备

- 人工授精工具

- 超音波机器

- 羊羔围栏

- 发热量检测装置

- 其他的

- 健康管理设备

- 疫苗枪

- 淋水设备

- 医疗用品储存

- 其他的

第六章:市场估计与预测:依营运模式,2021-2034 年

- 主要趋势

- 手动设备

- 半自动化设备

- 全自动设备

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 个体农户

- 合作社

- 商业化农业经营

- 屠宰场

- 研究设施

- 其他的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 阿联酋

- 沙乌地阿拉伯

第十章:公司简介

- Allflex Livestock Intelligence

- Arrowquip

- Gallagher

- Heiniger

- IAE

- Kerbl

- Lister Shearing

- Premier 1 Supplies

- Priefert

- Ritchie Agricultural

- Stockpro

- Sydell Inc.

- Te Pari Products

- Tru-Test (Datamars)

- WOPA

The Global Sheep and Goat Equipment Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 5.1 billion by 2034. The industry is undergoing a major transformation as farming practices continue to modernize and adopt more efficient methods for managing livestock. Farmers are increasingly turning to innovative equipment solutions that improve productivity and reduce the reliance on manual labor. With the growing need to streamline daily operations, equipment like mechanized feeding tools, advanced shearing systems, and precision monitoring devices is becoming an essential component of livestock farms.

The adoption of automated systems is rising as producers recognize the benefits of consistency in feeding routines, time savings in labor-intensive tasks, and enhanced animal welfare. Farmers are focusing on optimizing their resources, especially as livestock feed accounts for a large portion of operational expenses. Technological integration in equipment is not only helping reduce feed waste and labor costs but also supports better health management of animals through early disease detection and behavioral tracking. These innovations are reshaping how livestock operations are managed, pushing the market toward consistent growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 4.8% |

In terms of equipment type, feeding equipment held a dominant position, with the segment valued at USD 800 million in 2024. This category is projected to grow steadily and reach USD 1.3 billion by 2034. Equipment designed for feed management continues to see strong demand as it helps producers reduce feed loss and improve distribution efficiency. Automatic dispensers, precision feeders, and other feeding tools are being preferred due to their ability to support healthier animal growth and minimize feed waste, which remains one of the highest operational costs in livestock farming.

The market based on operation mode shows that semi-automated equipment accounted for approximately 44.5% of the global revenue share in 2024. This segment is expected to expand at a CAGR of 4.4% during the forecast period. These systems are becoming increasingly attractive to mid-scale and large-scale farmers who seek to strike a balance between automation and manual control. Their ability to offer improved operational speed, consistent performance, and reduced dependence on manual labor makes them an efficient alternative, especially in regions facing agricultural workforce shortages.

Distribution channels play a key role in determining product accessibility and service quality. In 2024, the direct distribution segment dominated the market with a share of around 64.9%. This model allows manufacturers to engage directly with end users, enabling better customization of equipment and providing the opportunity to address specific farming needs. It also supports real-time feedback collection, allowing manufacturers to adapt their offerings based on changing market dynamics. The direct channel also benefits logistics, ensuring quicker deliveries and smoother inventory flow, particularly during seasonal demand spikes.

Regionally, the United States held a strong presence in the global landscape, with the market valued at USD 360 million in 2024. The country is expected to see growth at a CAGR of 5.1% between 2025 and 2034. The U.S. livestock sector continues to expand, bolstered by modern farming infrastructure and rising demand for meat, milk, and wool. The availability of high-performance equipment tailored to U.S. farming practices contributes significantly to the industry's upward trajectory.

North America as a whole is also witnessing steady progress, supported by policies that encourage sustainable agriculture and innovations in livestock management. The emphasis on responsible resource use and digital integration in farm equipment is strengthening the region's position in the global market.

In this evolving market, manufacturers are concentrating on offering energy-efficient systems, enhanced durability, and tailored features that cater to the diverse requirements of sheep and goat farmers. There is also an increasing emphasis on after-sales services and regional support infrastructure. In emerging markets, demand is growing for cost-effective yet reliable equipment such as feeders, fencing units, electronic identification (EID) scales, and mobile handling systems. These priorities continue to shape the strategic direction of key industry participants as they expand their portfolios and cater to the needs of the global livestock community.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Operation mode

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistic

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Feeding equipment

- 5.2.1 Feed mixers

- 5.2.2 Feed dispensers

- 5.2.3 Hay feeders

- 5.2.4 Mineral feeders

- 5.3 Handling equipment

- 5.3.1 Gates and panels

- 5.3.2 Chutes

- 5.3.3 Sorting systems

- 5.3.4 Loading ramps

- 5.4 Shearing equipment

- 5.4.1 Electric shears

- 5.4.2 Manual shears

- 5.4.3 Shearing platforms

- 5.4.4 Others

- 5.5 Weighing equipment

- 5.5.1 Digital livestock scales

- 5.5.2 Platform scales

- 5.5.3 Mobile weighing systems

- 5.5.4 Portable weight crates

- 5.5.5 Walk-through weighing systems

- 5.5.6 Others

- 5.6 Trimming equipment

- 5.6.1 Hoof trimmers

- 5.6.2 Wool shears

- 5.6.3 Electric clippers

- 5.6.4 Others

- 5.7 Watering equipment

- 5.7.1 Automatic waterers

- 5.7.2 Water troughs

- 5.7.3 Water filtration systems

- 5.7.4 Others

- 5.8 Breeding equipment

- 5.8.1 Artificial insemination tools

- 5.8.2 Ultrasound machines

- 5.8.3 Lambing pens

- 5.8.4 Heat detection devices

- 5.8.5 Others

- 5.9 Health management equipment

- 5.9.1 Vaccination guns

- 5.9.2 Drenching equipment

- 5.9.3 Medical supplies storage

- 5.9.4 Others

Chapter 6 Market Estimates & Forecast, By Operation Mode, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual equipment

- 6.3 Semi-automated equipment

- 6.4 Fully automated equipment

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Individual farmers

- 7.3 Cooperatives

- 7.4 Commercial farming operations

- 7.5 Slaughterhouses

- 7.6 Research facilities

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trend

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 UAE

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Allflex Livestock Intelligence

- 10.2 Arrowquip

- 10.3 Gallagher

- 10.4 Heiniger

- 10.5 IAE

- 10.6 Kerbl

- 10.7 Lister Shearing

- 10.8 Premier 1 Supplies

- 10.9 Priefert

- 10.10 Ritchie Agricultural

- 10.11 Stockpro

- 10.12 Sydell Inc.

- 10.13 Te Pari Products

- 10.14 Tru-Test (Datamars)

- 10.15 WOPA