|

市场调查报告书

商品编码

1773367

乘用车柴油引擎排气门市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Passenger Vehicle Diesel Engine Exhaust Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

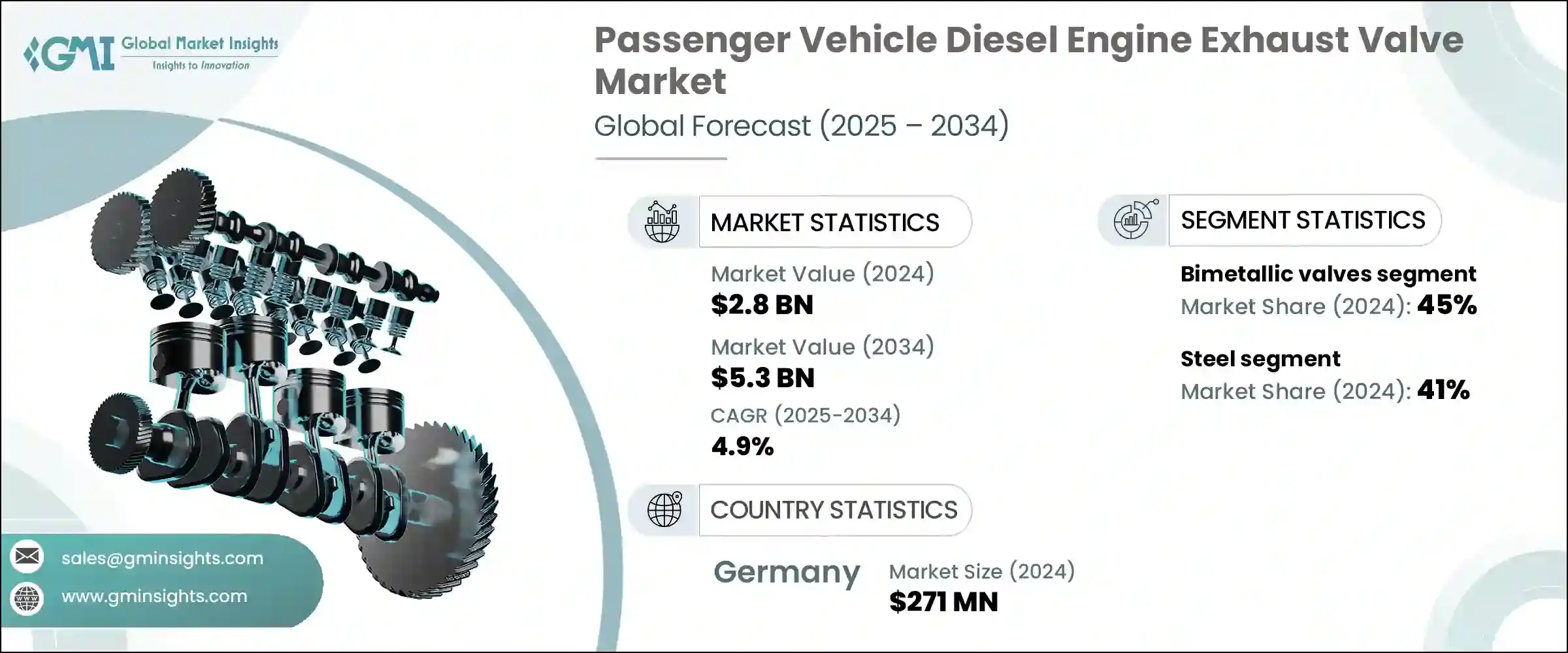

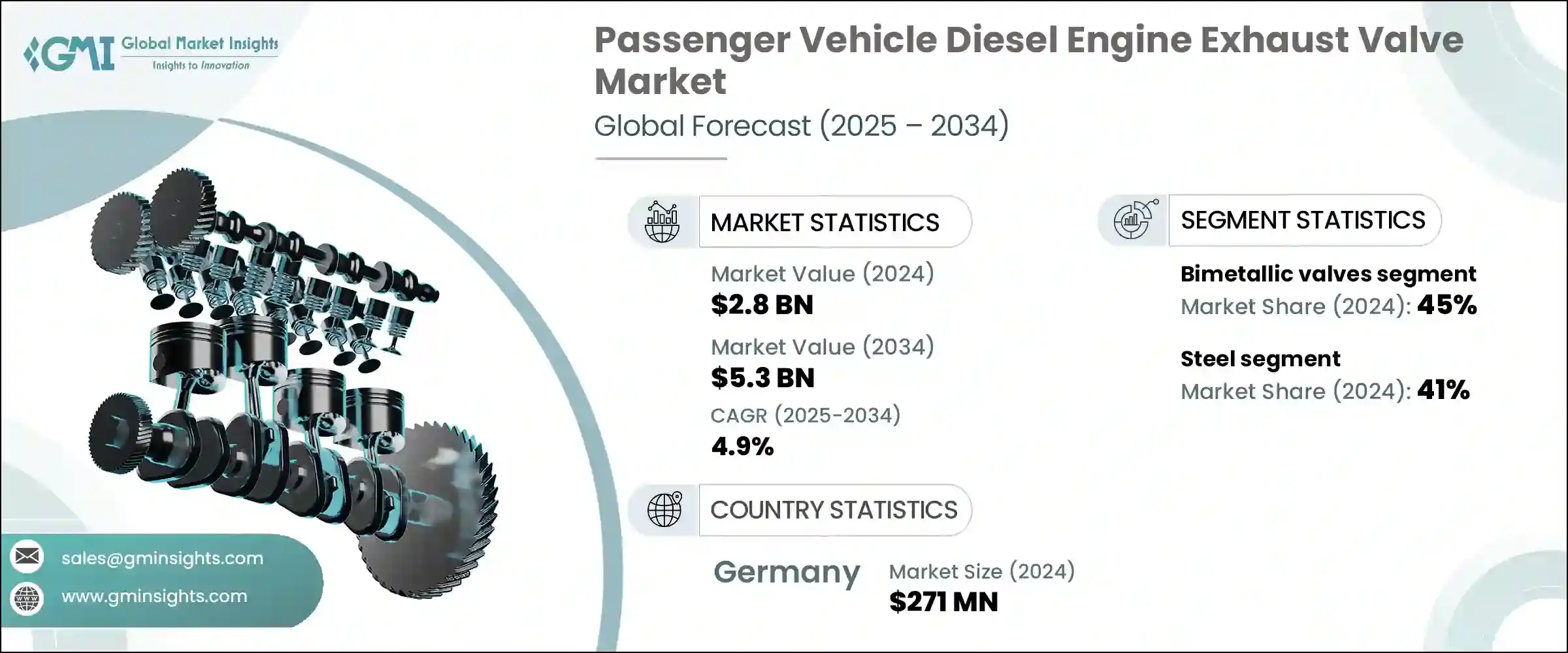

2024 年全球乘用车柴油引擎排气门市场价值为 28 亿美元,预计到 2034 年将以 4.9% 的复合年增长率增长,达到 53 亿美元。这种稳定成长很大程度上得益于汽车售后市场的扩张,尤其是在柴油乘用车已使用多年的地区。与购买新车相比,车主越来越倾向于维护和更换排气门等关键零件,从而确保了售后市场持续的需求。线上分销管道的兴起和当地修理厂的普及进一步增强了获取替换零件的管道,为阀门製造商创造了独立于原始设备製造商 (OEM) 合约的可靠收入来源。这种趋势在新车销售停滞但售后市场维护活动不断增加的市场中尤其明显。

研发进步在提升排气门性能方面发挥着至关重要的作用。诸如特殊表面涂层、双金属气门设计以及耐热钢合金的使用等创新技术,延长了气门的耐用性,提高了排放合规性,并优化了引擎的整体效率。数控加工和数位检测技术带来的高精度使製造商能够对气门几何形状进行微调,以满足现代柴油引擎在更高的燃烧压力和更严格的排放标准下运行的严苛工况。这些技术改进使原始设备製造商能够继续将柴油引擎整合到高功率密度乘用车中,同时满足监管要求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 53亿美元 |

| 复合年增长率 | 4.9% |

2024年,双金属阀门占据了45%的市场份额,预计到2034年将以5%的复合年增长率成长。双金属阀门因其卓越的强度和耐热性而广受欢迎,使其成为在极端高温高压条件下运行的柴油引擎的理想选择。这些阀门通常采用耐热奥氏体钢阀头,搭配马氏体或铬钢阀桿,在严苛的引擎环境中提供卓越的性能和持久的使用寿命。

钢製阀门市场在2024年占据41%的市场份额,预计在2025年至2034年期间的复合年增长率为4%。由于现有的製造基础设施更倾向于采用传统的锻造和机械加工工艺,而非钛合金或镍合金等成本更高的替代材料,钢製阀门仍然是最具成本效益的选择。高级钢製阀门在恶劣工况、腐蚀和磨损方面表现出色。铬、钼和钒合金的加入增强了阀门的耐用性、抗蠕变性和疲劳寿命,尤其有利于稀薄燃烧和涡轮增压柴油发动机,而无需使用昂贵的材料。

德国乘用车柴油引擎排气门市场占25%的市场份额,2024年市场规模达2.71亿美元。德国汽车产业受益于其完善的生产生态系统,其对柴油技术的持续投入支撑了排气门的稳定需求。德国製造商准备增加高端柴油SUV、多用途车和轿车的产量,这些车型将销往东欧、拉丁美洲和非洲等出口市场。儘管欧洲大部分地区正在转向电动车,但德国仍高度重视清洁柴油合规性,符合欧盟6d标准,并巩固了在柴油引擎领域的地位。

全球乘用车柴油引擎排气门市场的主要竞争者包括 Mahle、Aisan、Fuji Oozx、Eaton、Rane、Nittan、登云汽配、SSV、扬州光辉和 Tenneco。这些公司透过持续的产品创新和策略合作共同塑造市场动态。为了巩固在乘用车柴油引擎排气门市场的地位,各公司优先考虑材料和製造流程的创新,以提高阀门的耐用性和排放合规性。他们在研发方面投入巨资,开发出符合日益严格的监管标准的先进表面涂层和双金属设计。该公司还专注于透过与本地服务供应商合作和增强电子商务平台来扩大售后市场分销网络,确保在全球范围内更容易获得替换零件。与 OEM 建立策略联盟使这些製造商能够获得长期供应合同,同时瞄准柴油车辆老化地区的售后市场成长。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 柴油动力SUV和轿车的需求不断增长

- 高扭矩和燃油效率要求

- 更加重视引擎的耐用性

- 高端和多功能细分市场的崛起

- 产业陷阱与挑战

- 全球柴油乘用车需求下降

- 严格的排放法规增加了合规成本

- 市场机会

- 重型柴油SUV和MPV的需求不断成长

- 更严格的排放标准推动阀门创新

- 阀门更换带来的售后市场成长

- 阀门材料和设计的进步

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 案例研究

- 用例

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依阀门类型,2021 - 2034 年

- 主要趋势

- 单金属阀门

- 双金属阀门

- 空心阀

- 充钠阀门

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 掀背车

- 轿车

- SUV

- MPV(多用途汽车)

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 钢

- 钛

- 镍基合金

- 其他的

第八章:市场估计与预测:按引擎类型,2021 - 2034 年

- 主要趋势

- 涡轮增压柴油发动机

- 自然吸气柴油发动机

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM(原始设备製造商)

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳新银行

- 东南亚

- 马来西亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Aisan

- AnFu

- Burg

- Dengyun Auto-parts

- Eaton

- Ferrea

- Fuji Oozx

- JinQingLong

- Mahle

- Nittan

- Rane

- ShengChi

- SSV

- Tenneco (including Federal-Mogul)

- Tongcheng

- Tyen Machinery

- Wode Valve

- Worldwide Auto

- Xin Yue

- Yangzhou Guanghui

The Global Passenger Vehicle Diesel Engine Exhaust Valve Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 5.3 billion by 2034. This steady growth is largely fueled by the expansion of automotive aftermarket services, especially in regions where diesel passenger vehicles have been in use for many years. Instead of purchasing new cars, vehicle owners increasingly prefer maintaining and replacing key components like exhaust valves, ensuring ongoing demand in the aftermarket sector. The rise of online distribution channels and the widespread availability of local repair shops has further enhanced access to replacement parts, creating reliable revenue streams for valve manufacturers independent of original equipment manufacturer (OEM) contracts. This trend is particularly significant in markets with stagnant new vehicle sales but rising aftermarket maintenance activities.

Advancements in research and development are playing a critical role in enhancing exhaust valve performance. Innovations such as specialized surface coatings, bimetallic valve designs, and the use of heat-resistant steel alloys have extended valve durability, improved emissions compliance, and optimized overall engine efficiency. The precision afforded by CNC machining and digital inspection technologies has allowed manufacturers to fine-tune valve geometries to meet the demanding conditions of modern diesel engines, which operate under increased combustion pressures and tighter emissions standards. These technological improvements enable OEMs to continue integrating diesel engines into power-dense passenger vehicles while meeting regulatory requirements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 4.9% |

In 2024, bimetallic valves dominated the market by 45% share and are forecasted to grow at a CAGR of 5% through 2034. Their popularity stems from their exceptional blend of strength and thermal resistance, making them ideal for diesel engines operating under extreme heat and pressure. These valves typically feature a heat-resistant austenitic steel head combined with a martensitic or chrome steel stem, offering superior performance and longevity in demanding engine environments.

The steel valve segment accounted for 41% share in 2024 and is projected to grow at a CAGR of 4% between 2025 and 2034. Steel valves remain the most cost-effective option due to existing manufacturing infrastructure that favors traditional forging and machining processes over more expensive alternatives like titanium or nickel alloys. High-grade steel valves demonstrate remarkable resistance to harsh operating conditions, corrosion, and wear. The inclusion of chromium, molybdenum, and vanadium alloys enhances their durability, creep resistance, and fatigue life, particularly benefiting lean burn and turbocharged diesel engines without the need for costly materials.

Germany Passenger Vehicle Diesel Engine Exhaust Valve Market held a 25% share and generated USD 271 million in 2024. Germany's automotive sector benefits from a well-established production ecosystem and its continued commitment to diesel technology supports steady demand for exhaust valves. German manufacturers are poised to increase the output of premium diesel SUVs, multi-purpose vehicles, and sedans destined for export markets including Eastern Europe, Latin America, and Africa. While much of Europe shifts toward electric mobility, Germany maintains a strong focus on clean diesel compliance, aligning with Euro 6d standards and reinforcing its position in the diesel engine segment.

Key players competing in the Global Passenger Vehicle Diesel Engine Exhaust Valve Market include Mahle, Aisan, Fuji Oozx, Eaton, Rane, Nittan, Dengyun Auto Parts, SSV, Yangzhou Guanghui, and Tenneco. These companies collectively shape market dynamics through continuous product innovation and strategic collaborations. To strengthen their foothold in the passenger vehicle diesel engine exhaust valve market, companies prioritize innovation in materials and manufacturing processes to improve valve durability and emissions compliance. They invest heavily in R&D to develop advanced surface coatings and bimetallic designs that meet increasingly strict regulatory standards. Firms also focus on expanding aftermarket distribution networks by partnering with local service providers and enhancing e-commerce platforms, ensuring easier access to replacement parts worldwide. Strategic alliances with OEMs enable these manufacturers to secure long-term supply contracts while simultaneously targeting aftermarket growth in regions with aging diesel vehicle fleets.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Valve type

- 2.2.3 Vehicle

- 2.2.4 Material

- 2.2.5 Engine type

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for diesel-powered SUVs & sedans

- 3.2.1.2 High torque & fuel efficiency requirements

- 3.2.1.3 Increasing focus on engine durability

- 3.2.1.4 Rise in premium & multipurpose segments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Declining global demand for diesel passenger vehicles

- 3.2.2.2 Stringent emission regulations increasing compliance costs

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for heavy-duty diesel SUVs and MPVs

- 3.2.3.2 Stricter emission norms driving valve innovation

- 3.2.3.3 Aftermarket growth from valve replacements

- 3.2.3.4 Advancements in valve material and design

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Case studies

- 3.9 Use cases

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Valve Type, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Monometallic valves

- 5.3 Bimetallic valves

- 5.4 Hollow valves

- 5.5 Sodium-filled valves

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Hatchback

- 6.3 Sedan

- 6.4 SUVs

- 6.5 MPV (multi-purpose vehicle)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Titanium

- 7.4 Nickel-based alloys

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Engine type, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Turbocharged diesel engine

- 8.3 Naturally aspirated diesel engine

Chapter 9 Market Estimates & Forecast, By Sales channel, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 OEMs (Original equipment manufacturers)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aisan

- 11.2 AnFu

- 11.3 Burg

- 11.4 Dengyun Auto-parts

- 11.5 Eaton

- 11.6 Ferrea

- 11.7 Fuji Oozx

- 11.8 JinQingLong

- 11.9 Mahle

- 11.10 Nittan

- 11.11 Rane

- 11.12 ShengChi

- 11.13 SSV

- 11.14 Tenneco (including Federal-Mogul)

- 11.15 Tongcheng

- 11.16 Tyen Machinery

- 11.17 Wode Valve

- 11.18 Worldwide Auto

- 11.19 Xin Yue

- 11.20 Yangzhou Guanghui