|

市场调查报告书

商品编码

1773369

航太紧固件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aerospace Fasteners Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

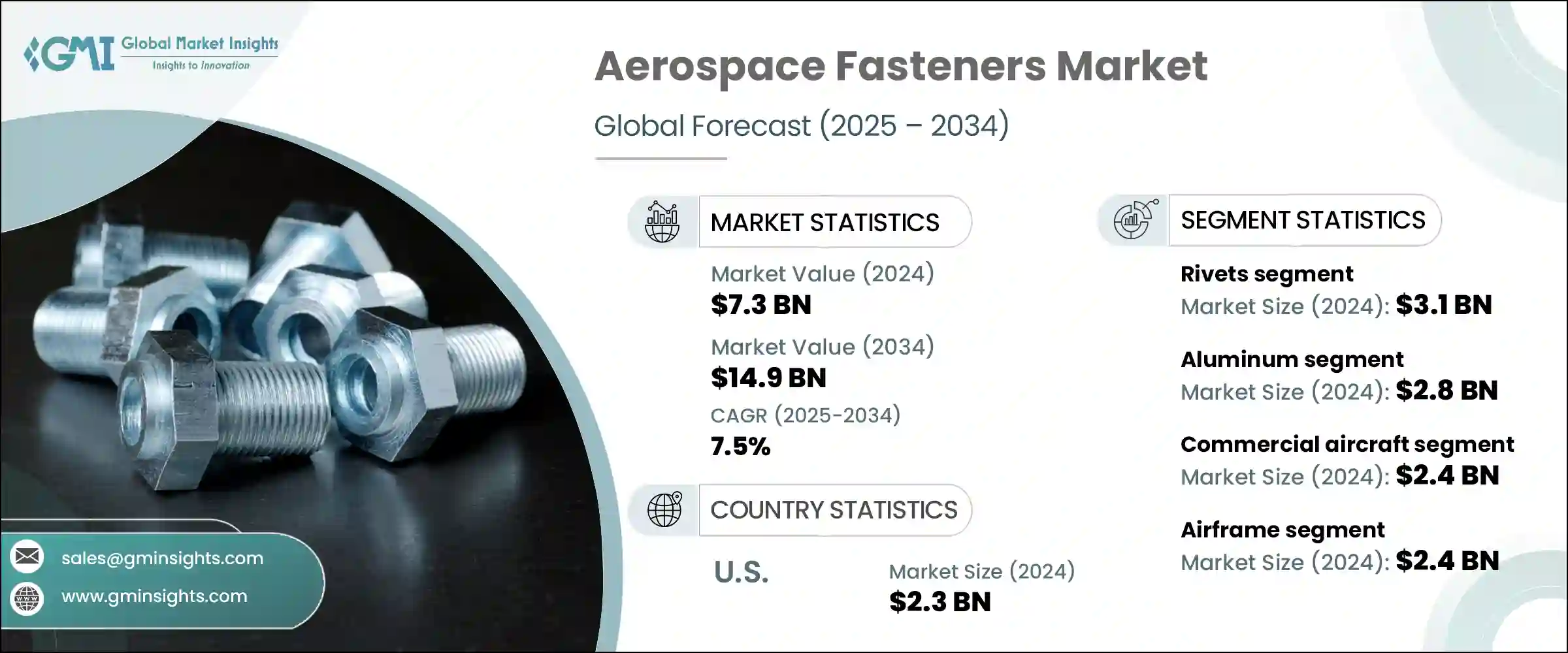

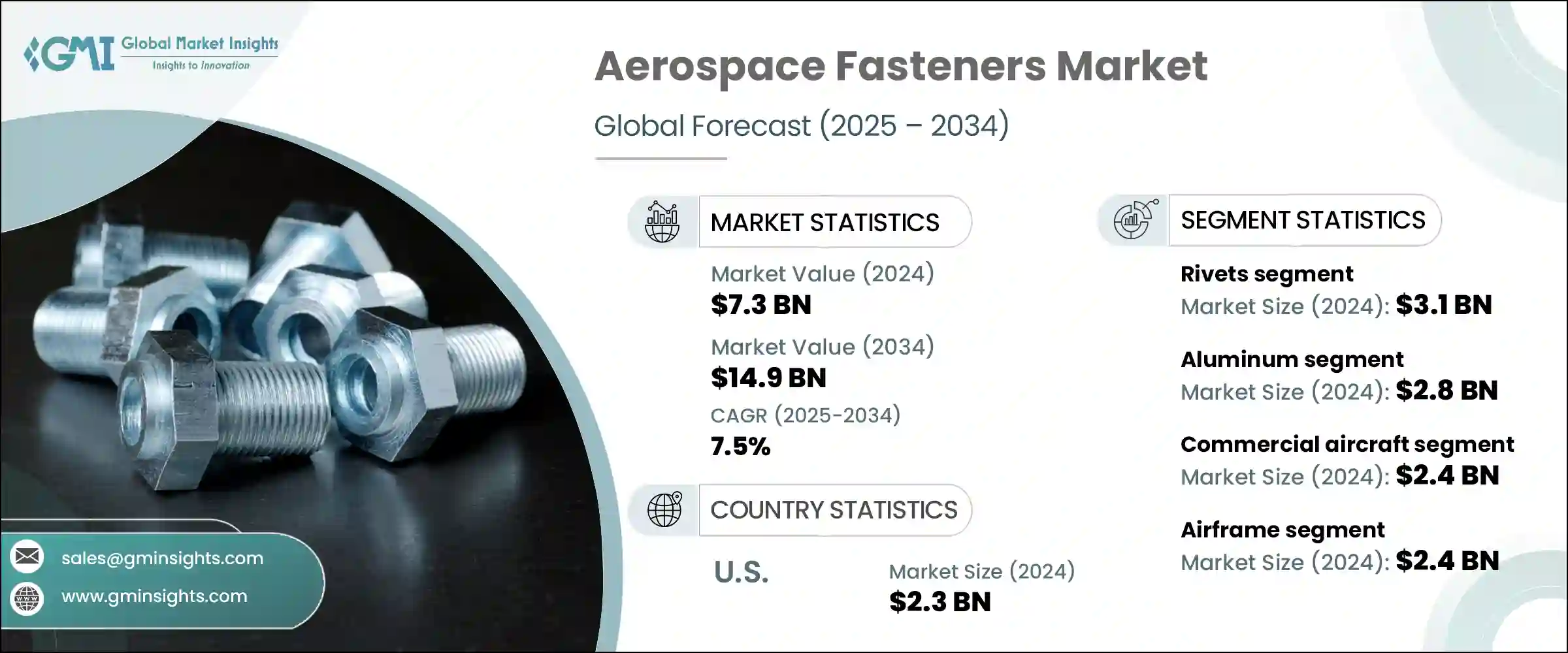

2024年,全球航太紧固件市场规模达73亿美元,预计到2034年将以7.5%的复合年增长率成长,达到149亿美元。这一强劲的成长轨迹与商用航空机队的快速扩张以及军用航空基础设施的持续升级密切相关。新兴经济体日益增长的航空旅行需求,加上国防投资的不断增加,正推动着过时的飞机零件被更新、更轻巧、更高性能的替代方案所取代。燃油效率和耐用性的重要性日益提升,使航太紧固件成为结构部件製造创新的核心,使其成为原始设备製造商(OEM)组装和售后服务中不可或缺的一部分。

全球贸易格局对该市场产生了重大影响。先前针对进口航空级铝和钢(尤其是来自中国的铝和钢)征收的关税导致原材料成本上升,并限制了关键零件的取得。这些干扰迫使美国製造商重新考虑采购策略,许多製造商转向国内供应商或多元化供应商组合,以最大程度地降低风险。这些措施旨在抵消成本压力,同时在紧凑的製造生态系统中保持交付时间。随着轻量化设计和增强结构可靠性的持续发展,製造商正专注于能够与复合材料无缝配合的紧固件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 73亿美元 |

| 预测值 | 149亿美元 |

| 复合年增长率 | 7.5% |

2024年,铆钉市场产值达31亿美元。铆钉因其在提供轻质耐用的接头方面发挥重要作用,而这些接头对于维护机身完整性至关重要,因此保持了市场主导地位。这些紧固件广泛应用于商用飞机生产,特别适用于机翼和机身等高振动、高承重区域。铆钉安装技术的进步,尤其是盲铆钉技术,进一步提高了效率和可靠性,使其成为原始设备製造OEM)製造和日常维护作业中不可或缺的一部分。

2024年,航太紧固件市场中的铝材市场价值将达28亿美元。铝材因其优异的强度重量比、耐腐蚀性和成本效益而广受欢迎,使其成为减轻飞机重量和提高燃油经济性的首选材料。随着飞机设计越来越注重减重,对铝材紧固件的需求持续攀升,尤其是在非关键结构应用和内装零件方面。增强的铝合金配方也提高了材料与现代复合材料结构的兼容性,推动了製造和服务部门对铝材的采用。

2024年,美国航太紧固件市场产值达23亿美元。美国占据主导地位,得益于其全球航太枢纽的地位,汇集了许多领先的商用和国防航空製造商。该领域的主要参与者持续透过持续的机队维护和下一代系统的整合来刺激国内需求。美国还拥有全球最全面的MRO网路之一,为大型民用和军用机队的定期维护週期和系统升级提供支援。国防开支的不断增长,主要集中在下一代轰炸机和高超音速飞机等战略空中能力,加剧了对钛合金、高温因科镍合金和碳基复合材料製成的专用紧固件的需求。

积极影响航太航太紧固件市场的关键参与者包括 TriMas Corporation、波音、LISI 航太 、Wurth Group、B& 航太 Specialties Inc.、Cherry 航太、Precision Castparts Corp.、National 航太 Fasteners Corporation、Preci-Manufacturing、Stanley Black & Decker Inc.、MS 航太 Inc.为了增强竞争优势,航太紧固件产业的公司正在采取几项关键策略。他们正在大力投资研发更轻、耐腐蚀且在极端条件下也能可靠运作的紧固件。与飞机原始设备製造商的策略合作有助于确保儘早整合到新的平台设计中。此外,该公司还专注于透过在地化製造和数位采购系统优化供应链,以最大限度地减少中断。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 全球空中交通量增加和机队扩张

- 军用飞机现代化浪潮

- MRO(维修、维修和大修)服务的成长

- 采用先进的製造技术

- 太空探索和卫星发射的兴起

- 产业陷阱与挑战

- 先进紧固件材料成本高

- 严格的监管和认证要求

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 未来市场趋势

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 重点国防现代化项目

- 预算预测(2025-2034)

- 对产业成长的影响

- 各国国防预算

- 供应链弹性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 合併、收购和策略伙伴关係格局

- 风险评估与管理

- 主要合约授予(2021-2024)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 铆钉

- 螺丝

- 螺帽和螺栓

- 其他的

第六章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 铝

- 钢

- 高温合金

- 钛

第七章:市场估计与预测:按平台,2021 年至 2034 年

- 主要趋势

- 商用飞机

- 窄体飞机

- 宽体飞机

- 支线喷射机

- 军用机

- 公务机

- 直升机

- 无人驾驶飞行器(UAV)

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 机体

- 内饰

- 引擎

- 控制面

- 起落架

- 其他

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- OEM (原始设备製造商)

- MRO(维修、修理和大修)

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- B&B Specialties Inc.

- Boeing

- Bollhoff Group

- Cherry Aerospace

- Howmet Aerospace Inc.

- LISI Aerospace

- MS Aerospace

- National Aerospace Fasteners Corporation

- Preci-Manufacturing

- Precision Castparts Corp.

- Stanley Black & Decker, Inc.

- TriMas Corporation

- Wurth Group

The Global Aerospace Fasteners Market was valued at USD 7.3 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 14.9 billion by 2034. This robust growth trajectory is closely tied to the rapid expansion of commercial airline fleets and the continuous upgrades in military aviation infrastructure. Rising air travel demand across emerging economies, coupled with increasing investments in national defense, is fueling the replacement of outdated aircraft components with newer, lightweight, and high-performance alternatives. The growing importance of fuel efficiency and durability has placed aerospace fasteners at the center of innovation in structural component manufacturing, making them essential in both OEM assembly and aftermarket servicing.

The global trade landscape has had a significant influence on this market. Previous tariffs targeting imported aerospace-grade aluminum and steel-especially those from China-led to elevated raw material costs and constrained access to essential components. These disruptions forced US-based manufacturers to rethink sourcing strategies, with many turning to domestic suppliers or diversifying vendor portfolios to minimize risk. These actions aimed to offset cost pressures while maintaining delivery timelines in a tightly scheduled manufacturing ecosystem. With an ongoing shift toward lightweight design and enhanced structural reliability, manufacturers are focusing on fasteners that can work seamlessly with composite materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.3 Billion |

| Forecast Value | $14.9 Billion |

| CAGR | 7.5% |

The rivets segment generated USD 3.1 billion in 2024. Rivets maintain dominance due to their essential role in delivering lightweight yet durable joints that are critical in maintaining airframe integrity. These fasteners are widely used in commercial aircraft production, particularly for high-vibration, load-bearing areas such as wings and fuselages. Advances in rivet installation-particularly blind rivet technology-have further increased efficiency and reliability, making them indispensable across both OEM manufacturing and ongoing maintenance operations.

Aluminum segment in the aerospace fasteners segment in 2024, valued at USD 2.8 billion. Its popularity stems from a superior strength-to-weight ratio, corrosion resistance, and cost-effectiveness, making it the material of choice for reducing aircraft mass and improving fuel economy. As aircraft designs increasingly focus on weight reduction, demand for aluminum fasteners continues to climb, particularly in non-critical structural applications and interior components. Enhanced aluminum alloy formulations are also boosting material compatibility with modern composite structures, driving adoption across both manufacturing and servicing divisions.

United States Aerospace Fasteners Market generated USD 2.3 billion in 2024. The country's dominance can be traced to its position as a global aerospace hub, home to leading manufacturers across commercial and defense aviation. Major players in this space continue to fuel domestic demand with both ongoing fleet maintenance and the integration of next-generation systems. The U.S. also hosts one of the world's most comprehensive MRO networks, supporting regular service cycles and system upgrades for large civilian and military fleets. Rising defense expenditures, focused on strategic air capabilities such as next-gen bombers and hypersonic aircraft, have intensified demand for specialized fasteners made from titanium alloys, high-temperature Inconel, and carbon-based composites.

Key players actively shaping the Aerospace Fasteners Market include TriMas Corporation, Boeing, LISI Aerospace, Wurth Group, B&B Specialties Inc., Cherry Aerospace, Precision Castparts Corp., National Aerospace Fasteners Corporation, Preci-Manufacturing, Stanley Black & Decker Inc., M.S Aerospace, Bollhoff Group, and Howmet Aerospace Inc. To enhance their competitive edge, companies in the aerospace fasteners industry are adopting several key strategies. They're investing heavily in R&D to develop lighter, corrosion-resistant fasteners that perform reliably under extreme conditions. Strategic collaborations with aircraft OEMs help ensure early integration into new platform designs. Additionally, firms are focusing on supply chain optimization through localized manufacturing and digital procurement systems to minimize disruptions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Material trends

- 2.2.3 Platform trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO Perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global air traffic & fleet expansion

- 3.2.1.2 Surge in military aircraft modernization

- 3.2.1.3 Growth in MRO (maintenance, repair, and overhaul) services

- 3.2.1.4 Adoption of advanced manufacturing technologies

- 3.2.1.5 Rising space exploration & satellite launches

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced fastener materials

- 3.2.2.2 Stringent regulatory and certification requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Defense budget analysis

- 3.14 Global defense spending trends

- 3.15 Regional defense budget allocation

- 3.15.1 North America

- 3.15.2 Europe

- 3.15.3 Asia Pacific

- 3.15.4 Middle East and Africa

- 3.15.5 Latin America

- 3.16 Key defense modernization programs

- 3.17 Budget forecast (2025-2034)

- 3.17.1 Impact on industry growth

- 3.17.2 Defense budgets by country

- 3.18 Supply chain resilience

- 3.19 Geopolitical analysis

- 3.20 Workforce analysis

- 3.21 Digital transformation

- 3.22 Mergers, acquisitions, and strategic partnerships landscape

- 3.23 Risk assessment and management

- 3.24 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Rivets

- 5.3 Screws

- 5.4 Nuts & bolts

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Aluminum

- 6.3 Steel

- 6.4 Superalloys

- 6.5 Titanium

Chapter 7 Market Estimates and Forecast, By Platform, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Commercial aircraft

- 7.2.1 Narrow-body

- 7.2.2 Wide-body

- 7.2.3 Regional jets

- 7.3 Military aircraft

- 7.4 Business jets

- 7.5 Helicopters

- 7.6 Unmanned aerial vehicles (UAVs)

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Airframe

- 8.3 Interiors

- 8.4 Engine

- 8.5 Control surfaces

- 8.6 Landing gear

- 8.7 Other

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 OEM (Original Equipment Manufacturers)

- 9.3 MRO (Maintenance, Repair, and Overhaul)

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 B&B Specialties Inc.

- 11.2 Boeing

- 11.3 Bollhoff Group

- 11.4 Cherry Aerospace

- 11.5 Howmet Aerospace Inc.

- 11.6 LISI Aerospace

- 11.7 M.S Aerospace

- 11.8 National Aerospace Fasteners Corporation

- 11.9 Preci-Manufacturing

- 11.10 Precision Castparts Corp.

- 11.11 Stanley Black & Decker, Inc.

- 11.12 TriMas Corporation

- 11.13 Wurth Group