|

市场调查报告书

商品编码

1773372

储存架市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Storage Rack Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

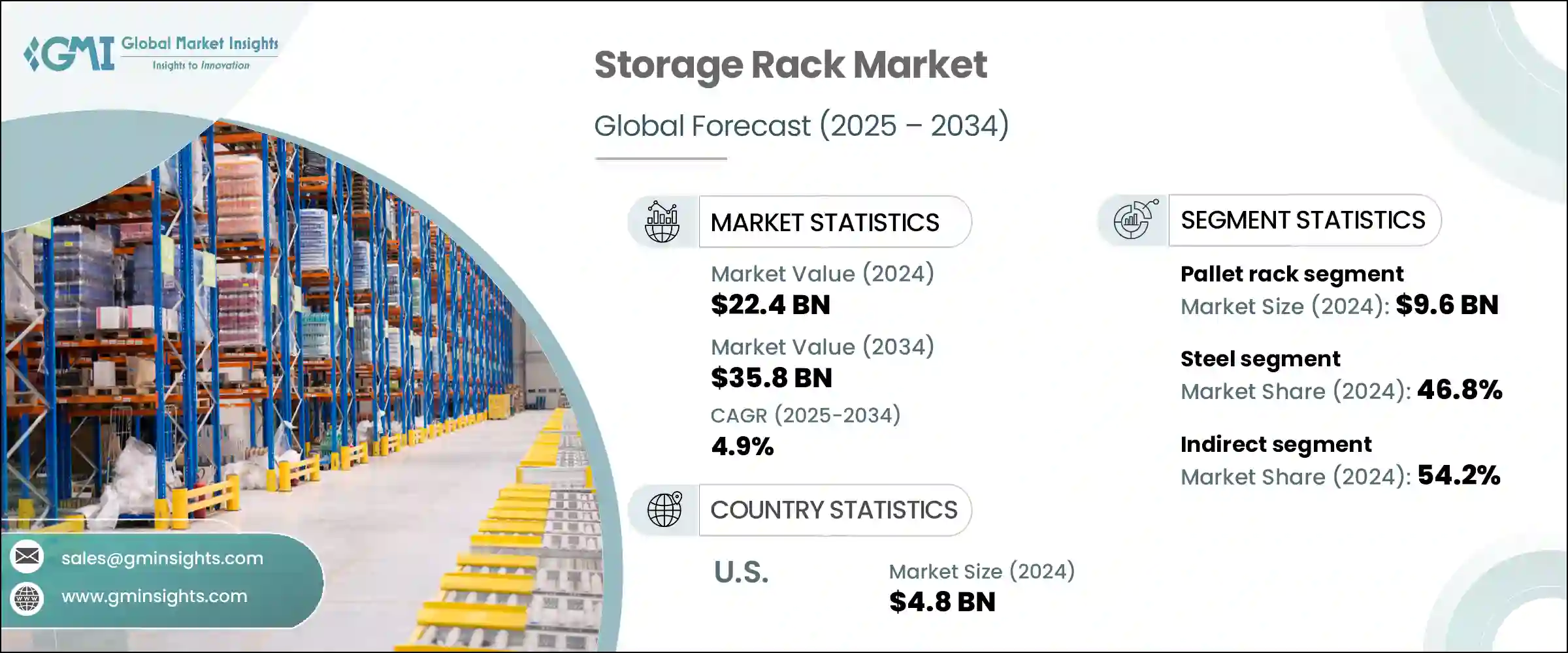

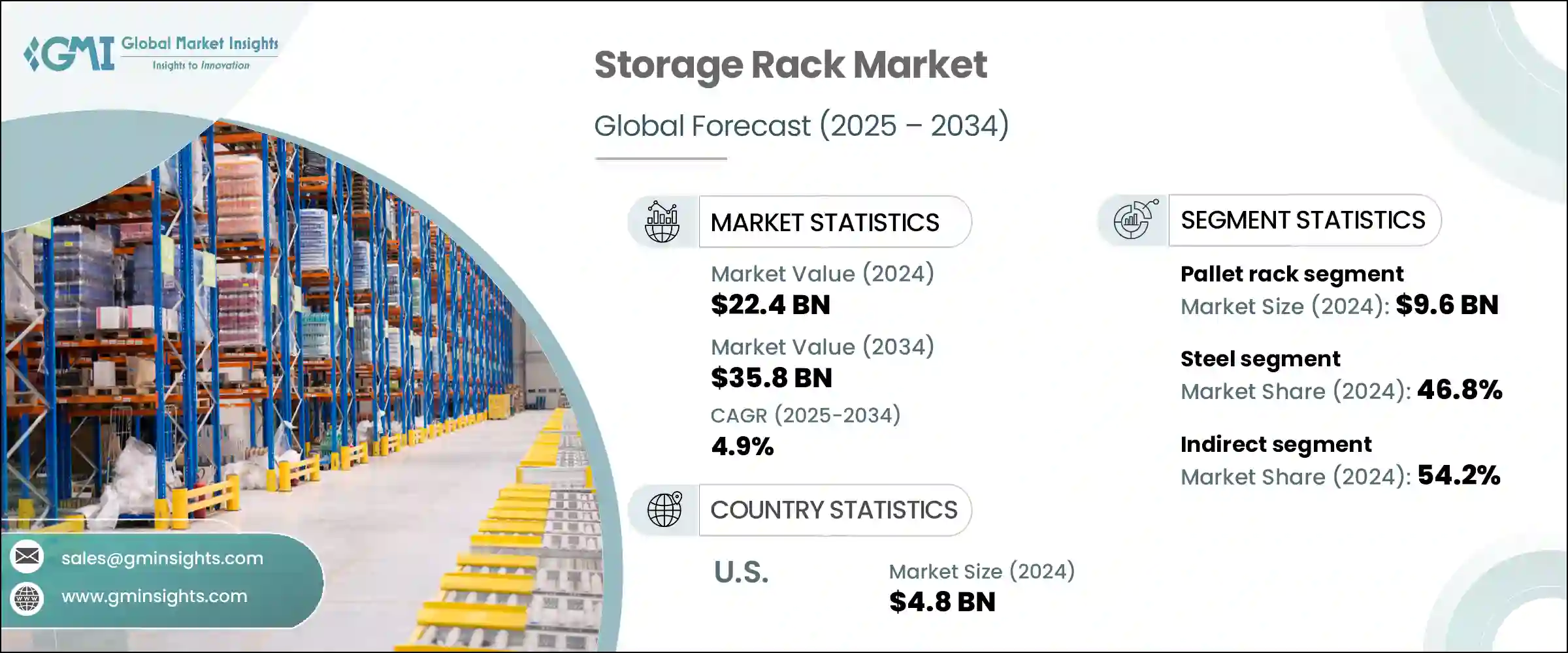

2024年,全球仓储货架市场规模达224亿美元,预计到2034年将以4.9%的复合年增长率成长,达到358亿美元。城市配送中心对高效、节省空间解决方案的需求不断增长,推动了这一成长。由于城市中心面临营运成本上升和空间受限的问题,企业纷纷转向高密度货架、模组化货架和夹层结构来优化储存。电子商务的扩张,尤其是在快速商务领域的扩张,加速了快速订单拣选和库存週转的需求。为了满足这一需求,仓库正在采用能够与机器人拣选和自动储存与检索系统等自动化系统无缝协作的货架。

随着物流工作流程和配送时间的变化,仓储基础设施也在快速发展,企业优先考虑能够提高营运速度和灵活性的货架系统。城市配送中心正在采用窄巷道货架、移动式货架和垂直布局。模组化趋势也十分强劲,企业青睐可调节、可扩展的储存解决方案,这些解决方案能够随着库存需求的变化而发展。自动化、智慧仓储趋势以及适合快节奏配送环境的经济高效的设计解决方案的采用,共同推动市场的转型。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 224亿美元 |

| 预测值 | 358亿美元 |

| 复合年增长率 | 4.9% |

2024年,托盘货架市场贡献了96亿美元的市场规模,预计到2034年将以5.3%的复合年增长率成长。由于其适应性强、经济价值高且相容于多个行业,托盘货架仍是市场上应用最广泛的货架。托盘货架设计用于水平存放托盘库存,并采用多层垂直结构,可提高仓库效率,并适应不同的库存重量和容量。托盘货架的应用范围涵盖物流、食品饮料、零售、製药和汽车等关键行业,使其成为传统和现代仓库模式的必备设备。

2024年,钢材市场占比达46.8%,继续保持其作为仓储货架主要材料的领先地位,预计2025年至2034年的复合年增长率将达到5.4%。其高强度重量比、长寿命和高成本效益使其成为大型仓储和工业应用的理想选择。钢製货架广泛应用于重型仓储环境,可承载大量密集的库存。製造业、零售业和电子商务等行业依赖钢製货架,因为它们能够处理散装物料、简化操作流程,并承受重型设备的使用而不会对结构造成损害。

2024年,美国仓储货架市场规模达48亿美元,预计2034年将以5.5%的复合年增长率成长。这一成长源自于美国电子商务的快速扩张、仓库机器人的普及以及自动化系统的广泛应用。工业部门、物流供应商和大型零售商推动了需求成长。此外,製药和食品供应链中冷链基础设施的建设也促进了市场扩张。该地区高昂的劳动力成本进一步刺激了对高密度仓储的投资,以提高生产力并减少人工操作。美国仍然是该地区的主导市场,其次是墨西哥和加拿大。

仓储货架产业的领导企业包括 Interlake Mecalux、Dematic、卡迪斯集团、丰田自动织布机、Constructor Group、Gonvarri Material Handling、AK Material Handling Systems、SSI Schaefer、Ridg-U-Rak、Mecalux、Daifuku、Arpac、North American Steel Equipment、AR Racking 和 Junghn。仓储货架市场的顶尖企业正专注于数位整合、产品创新和营运效率,以增强竞争优势。

许多公司正在投资开发相容自动化的货架系统,以支援机器人技术、自动化仓库系统 (AS/RS) 和先进的仓库软体平台。客製化也是关键,製造商提供模组化设计,以满足不同的空间限制和储存需求。与物流公司和供应链营运商建立策略合作伙伴关係有助于扩大客户网络并简化配送流程。此外,企业正在建立更强大的本地供应链和区域製造中心,以缩短交货时间并快速适应不断变化的市场需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 城市仓储和微型配送中心

- 扩大物流与供应链网络

- 自动化仓储的兴起

- 冷藏和食品物流的成长

- 产业陷阱与挑战

- 现有设施的空间和结构限制

- 市场缺乏标准化

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计(HS编码73269099)

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 托盘架

- 驶入式/驶过式货架

- 悬臂式货架

- 其他的

第六章:市场估计与预测:依承载力,2021 - 2034 年

- 主要趋势

- 轻型

- 中型

- 重负

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 钢

- 铝

- 塑胶

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 零售与电子商务

- 汽车与製造业

- 食品和饮料

- 仓储与物流

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- AK Material Handling Systems

- AR Racking

- Arpac

- Constructor Group

- Daifuku

- Dematic

- Gonvarri Material Handling

- Interlake Mecalux

- Jungheinrich

- Kardex Group

- Mecalux

- North American Steel Equipment

- Ridg-U-Rak

- SSI Schaefer

- Toyota Industries

The Global Storage Rack Market was valued at USD 22.4 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 35.8 billion by 2034. Increasing demand for efficient, space-saving solutions in urban fulfillment hubs is fueling this growth. As urban centers face rising operational costs and space limitations, businesses are turning to high-density racking, modular shelving, and mezzanine-based structures to optimize storage. The expansion of e-commerce, especially in the quick commerce segment, has accelerated the need for rapid order picking and inventory turnover. To support this, warehouses are adopting racks that work seamlessly with automation systems like robotic picking and automated storage and retrieval systems.

Storage infrastructure is evolving rapidly alongside changes in logistics workflows and delivery timelines, with businesses prioritizing racking systems that boost operational speed and flexibility. Urban distribution centers are adopting narrow aisle racks, mobile shelving, and vertical layouts. The trend toward modularity is also strong, with businesses favoring adjustable and expandable storage solutions that can evolve with changing inventory demands. The market's transformation is being powered by a mix of adoption of automation, smart warehousing trends, and cost-efficient design solutions suited for fast-paced distribution environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.4 Billion |

| Forecast Value | $35.8 Billion |

| CAGR | 4.9% |

In 2024, the pallet racks segment contributed USD 9.6 billion and is projected to grow at a CAGR of 5.3% through 2034. These racks remain the most widely used in the market due to their adaptability, economic value, and compatibility across a range of sectors. Designed to store palletized inventory horizontally with multiple vertical tiers, pallet racks enhance warehouse efficiency and accommodate variable inventory weights and volumes. Their relevance spans key industries, including logistics, food and beverage, retail, pharma, and automotive, making them a staple in both traditional and modern warehouse formats.

The steel segment accounted for 46.8% share in 2024, maintaining its lead as the primary material of choice for storage racks, and is expected to grow at a CAGR of 5.4% from 2025 to 2034. Its high strength-to-weight ratio, longevity, and cost-efficiency make it ideal for large-scale warehousing and industrial applications. Steel racks are widely implemented in heavy-duty storage environments where they support large and dense inventory loads. Sectors like manufacturing, retail, and e-commerce rely on steel-based racks for their ability to handle bulk materials, streamline operations, and endure heavy equipment use without structural compromise.

U.S. Storage Rack Market was valued at USD 4.8 billion in 2024 and is anticipated to grow at a CAGR of 5.5% through 2034. This growth stems from the country's rapid e-commerce expansion, rising adoption of warehouse robotics, and widespread implementation of automation systems. Demand is driven by industrial sectors, logistics providers, and large-scale retailers. In addition, the development of cold chain infrastructure in pharma and food supply chains is contributing to market expansion. High labor costs in the region further incentivize investment in high-density storage to enhance productivity and reduce manual handling. The U.S. remains the dominant market in the region, followed by Mexico and Canada.

Leading players in the Storage Rack Industry include Interlake Mecalux, Dematic, Kardex Group, Toyota Industries, Constructor Group, Gonvarri Material Handling, AK Material Handling Systems, SSI Schaefer, Ridg-U-Rak, Mecalux, Daifuku, Arpac, North American Steel Equipment, AR Racking, and Jungheinrich. Top companies in the storage rack market are focusing on digital integration, product innovation, and operational efficiency to strengthen their competitive edge.

Many are investing in the development of automation-compatible racking systems to support robotics, AS/RS, and advanced warehouse software platforms. Customization is also key, with manufacturers offering modular designs tailored to different space constraints and storage requirements. Strategic partnerships with logistics firms and supply chain operators help expand client networks and streamline distribution. In addition, companies are building stronger local supply chains and regional manufacturing hubs to reduce delivery times and adapt quickly to shifting market demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Carrying capacity

- 2.2.4 Material

- 2.2.5 End use

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urban warehousing & micro fulfillment centers

- 3.2.1.2 Expansion of logistics & supply chain networks

- 3.2.1.3 Rise in automated warehousing

- 3.2.1.4 Growth of cold storage & food logistics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Space & structural constraints in existing facilities

- 3.2.2.2 Lack of standardization across markets

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 73269099)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Pallet rack

- 5.3 Drive-in / drive-thru rack

- 5.4 Cantilever rack

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Carrying Capacity, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Light duty

- 6.3 Medium duty

- 6.4 Heavy duty

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Plastic

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Retail & e-commerce

- 8.3 Automotive & manufacturing

- 8.4 Food & beverage

- 8.5 Warehouse & logistics

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AK Material Handling Systems

- 11.2 AR Racking

- 11.3 Arpac

- 11.4 Constructor Group

- 11.5 Daifuku

- 11.6 Dematic

- 11.7 Gonvarri Material Handling

- 11.8 Interlake Mecalux

- 11.9 Jungheinrich

- 11.10 Kardex Group

- 11.11 Mecalux

- 11.12 North American Steel Equipment

- 11.13 Ridg-U-Rak

- 11.14 SSI Schaefer

- 11.15 Toyota Industries