|

市场调查报告书

商品编码

1773377

製程工厂燃气涡轮机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Process Plants Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

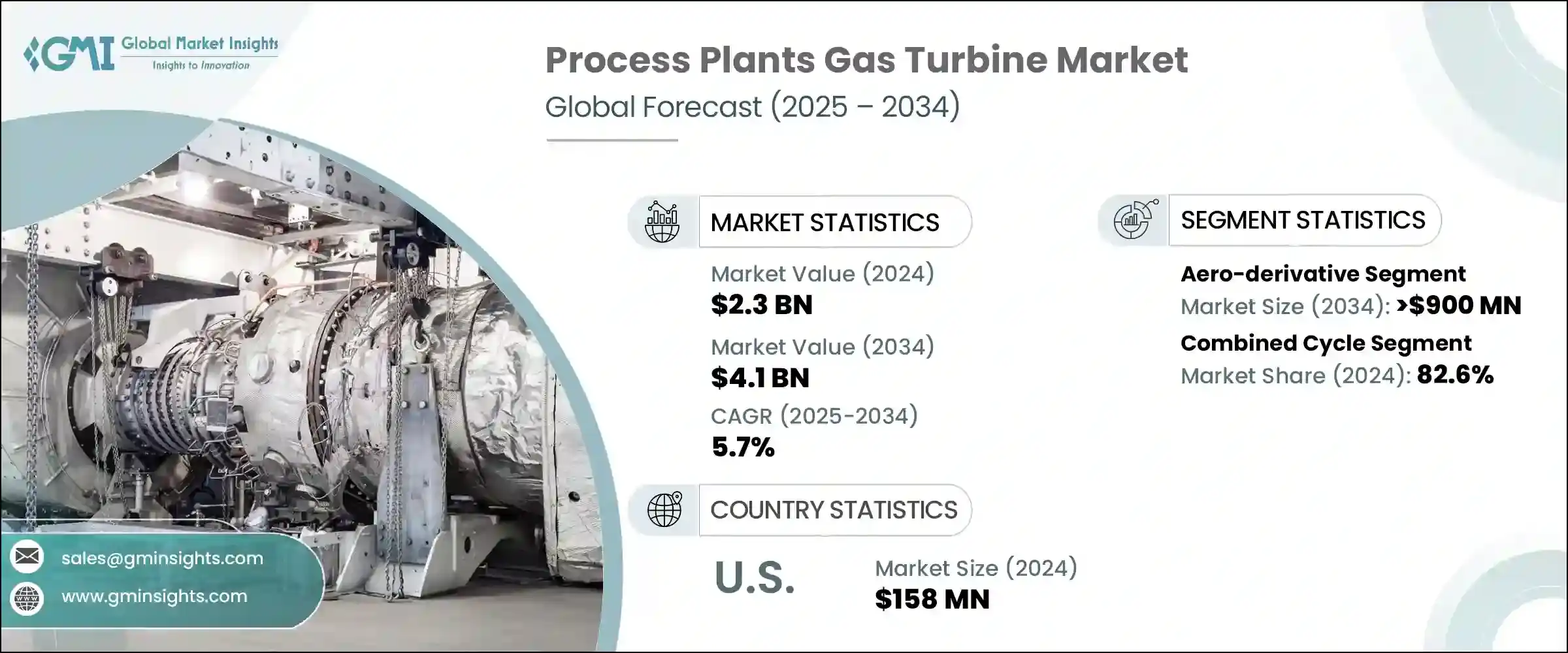

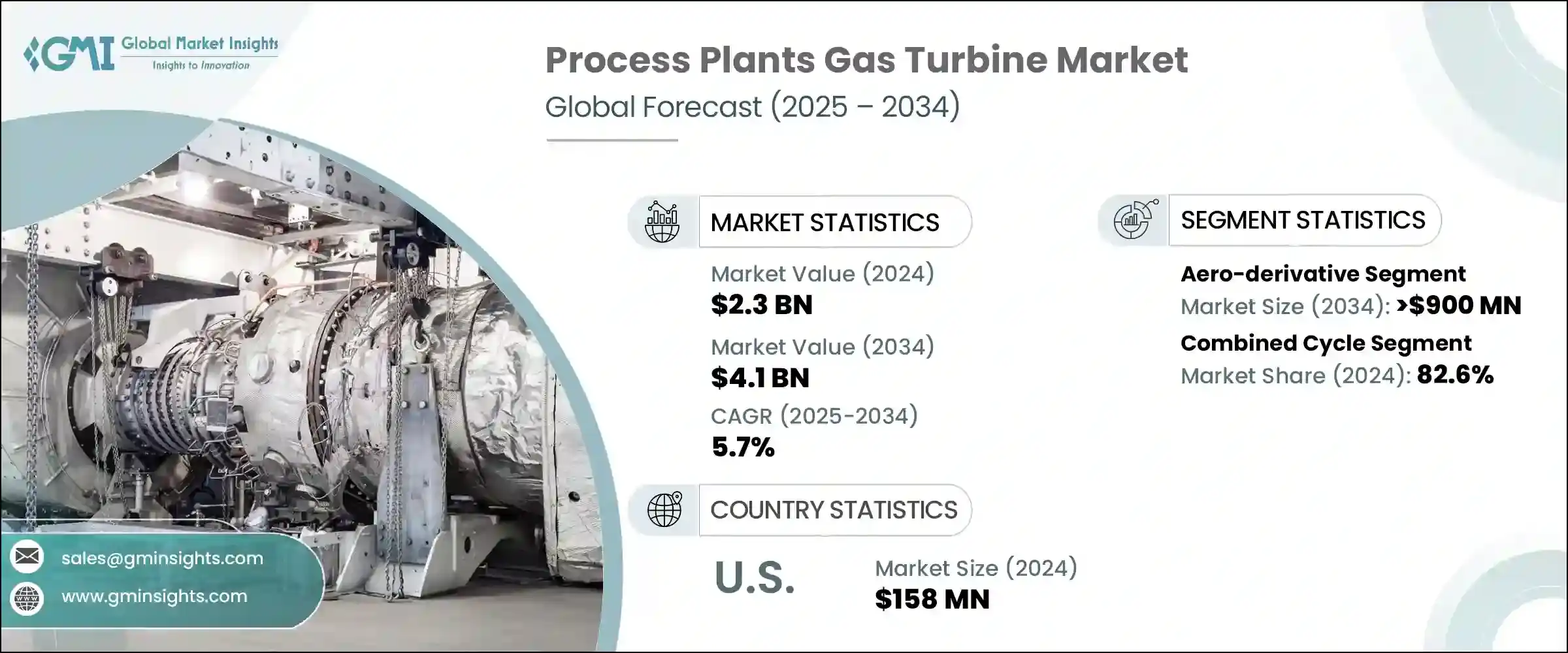

2024年,全球製程工厂燃气涡轮机市场规模达23亿美元,预计到2034年将以5.7%的复合年增长率成长,达到41亿美元。製程工业越来越多地选择燃气涡轮机进行现场发电,以减少对不可靠电网基础设施的依赖,尤其是在电力频繁中断的地区。这些燃气涡轮机在自备电厂的应用日益广泛,它们支援不间断运作并防止生产损失,直接促进了市场扩张。这些系统通常用于热电联产 (CHP) 装置,可同时发电和产生蒸汽,从而提高工厂整体效率。这种双重功能是推动燃气涡轮机在工业设施中广泛应用的关键因素。

中小型製程设施正在推动对紧凑型模组化透平机组的需求,这些机组可快速部署,并减少大规模土木工程的需求。透平机组也被部署在临时或偏远的场所,包括移动化学品或管道作业,这些场所无法使用传统的基础设施。这些透平机组直接整合到製造过程中,为机械系统提供动力,或为水泥、玻璃和石化等行业的专用功能提供热能。废气产生的热量越来越多地被用于干燥、煅烧或蒸汽裂解,为製程工业带来额外的效率效益。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 5.7% |

预计到2034年,重型燃气涡轮机市场的复合年增长率将达到5.5%。这些燃气涡轮机广泛安装在重工业环境中,例如钢铁厂、水泥厂和石化厂,这些地方的基载电力需求持续成长。燃气涡轮机与热电联产解决方案的整合支援同时输送电力和热能,为大型工业中心提供高效的能源循环,并巩固该市场的长期成长。

预计到2034年,开式循环燃气涡轮机市场的复合年增长率将达到5.5%。这类配置因其快速启动能力而备受青睐,适合尖峰负载和备用应用。电力供应不稳定的产业正在转向开式循环燃气涡轮机,以确保营运安全并防止电力中断,这将继续增强市场活力。

2024年,美国製程工厂燃气涡轮机市场规模达1.58亿美元。美国对工业电气化的重视以及对老化联合循环资产进行现代化改造的需求,正推动燃气涡轮机与再生能源的整合。环保机构的监管措施正在进一步加速化肥和化学製造等领域老旧燃气涡轮系统的更换,从而推动美国燃气涡轮机的普及。

全球製程工厂燃气涡轮机市场的主要参与者包括 MAN Energy Solutions、三菱重工、西门子能源、贝克休斯、劳斯莱斯、GE Vernova 等。製程工厂燃气涡轮机市场的领先公司专注于产品优化、扩大在地化製造和深化特定应用客製化。研发投资旨在开发排放更低、燃料灵活性更高、模组化程度更高的涡轮机。许多参与者正积极与 EPC 承包商和製程工厂营运商建立合作伙伴关係,以提供交钥匙涡轮机套件和长期服务协议。为了满足不断变化的工业需求,製造商正在将数位诊断和预测性维护功能整合到涡轮机平台中。扩大在亚太和中东等地区的生产足迹仍然是一项战略重点。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- ≤ 50 千瓦

- > 50 千瓦至 500 千瓦

- > 500 千瓦至 1 兆瓦

- > 1 兆瓦至 30 兆瓦

- > 30 兆瓦至 70 兆瓦

- > 70 兆瓦至 200 兆瓦

- > 200 兆瓦

第六章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 航改型

- 重负

第七章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 开放式循环

- 复合循环

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 俄罗斯

- 义大利

- 荷兰

- 芬兰

- 希腊

- 丹麦

- 罗马尼亚

- 波兰

- 瑞典

- 亚太地区

- 中国

- 澳洲

- 日本

- 韩国

- 印尼

- 泰国

- 马来西亚

- 孟加拉

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 科威特

- 阿曼

- 埃及

- 土耳其

- 巴林

- 伊拉克

- 约旦

- 黎巴嫩

- 南非

- 奈及利亚

- 阿尔及利亚

- 肯亚

- 迦纳

- 拉丁美洲

- 巴西

- 阿根廷

- 秘鲁

- 智利

第九章:公司简介

- Ansaldo Energia

- Baker Hughes

- Bharat Heavy Electricals

- Capstone Green Energy

- Destinus Energy

- Doosan

- Flex Energy Solutions

- GE Vernova

- Harbin Electric

- IHI Corporation

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Nanjing Turbine & Electric Machinery

- Rolls Royce

- Shanghai Electric Gas Turbine

- Siemens Energy

- Solar Turbines

- Vericor

- Wartsilä

The Global Process Plants Gas Turbine Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 4.1 billion by 2034. Process industries are increasingly choosing gas turbines for on-site power generation to reduce dependence on unreliable grid infrastructure, particularly in areas with frequent power disturbances. The growing use of these turbines in captive power applications supports uninterrupted operations and safeguards against production losses, contributing directly to market expansion. These systems are commonly used in combined heat and power (CHP) setups, where they simultaneously generate electricity and steam, enhancing overall plant efficiency. This dual functionality is a critical factor driving gas turbine installations across industrial facilities.

Small and mid-sized process facilities are fueling demand for compact and modular turbine packages that offer rapid deployment and limit the need for extensive civil works. Turbines are also being deployed in temporary or remote sites, including mobile chemical or pipeline operations, where conventional infrastructure is not viable. These turbines are directly integrated into manufacturing processes to power mechanical systems or deliver heat energy for specialized functions in sectors such as cement, glass, and petrochemicals. The heat from exhaust gases is increasingly being utilized for drying, calcining, or steam cracking, offering added efficiency benefits to process industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.7% |

Heavy-duty gas turbines segment is forecasted to grow at a CAGR of 5.5% through 2034. These turbines are widely installed in heavy industrial environments such as steelworks, cement facilities, and petrochemical complexes, where base-load power demand is continuous. Their integration with cogeneration solutions supports the simultaneous delivery of electricity and thermal energy, providing an efficient energy loop at large industrial hubs and reinforcing long-term growth in this segment.

The open cycle segment is expected to grow at a CAGR of 5.5% through 2034. These configurations are favored for their ability to start rapidly, making them suitable for peak load and backup applications. Industries facing unstable power supply are turning to open-cycle gas turbines to secure operations and prevent power interruptions, which continues to strengthen market dynamics.

U.S. Process Plants Gas Turbine Market was valued at USD 158 million in 2024. The nation's focus on industrial electrification and the need to modernize aging combined cycle assets are encouraging the integration of gas turbines with renewable sources. Regulatory measures from environmental agencies are further accelerating the replacement of outdated turbine systems in segments such as fertilizers and chemical manufacturing, pushing U.S. adoption forward.

Key players in the Global Process Plants Gas Turbine Market include MAN Energy Solutions, Mitsubishi Heavy Industries, Siemens Energy, Baker Hughes, Rolls Royce, GE Vernova, and several others. Leading companies in the process plants gas turbine market are focused on product optimization, expanding localized manufacturing, and deepening application-specific customization. Investments in R&D are aimed at developing turbines with lower emissions, enhanced fuel flexibility, and greater modularity. Many players are actively forming partnerships with EPC contractors and process plant operators to offer turnkey turbine packages and long-term service agreements. To cater to evolving industrial demands, manufacturers are integrating digital diagnostics and predictive maintenance capabilities into turbine platforms. Expanding production footprints in regions such as Asia-Pacific and the Middle East also remains a strategic priority.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 50 kW

- 5.3 > 50 kW to 500 kW

- 5.4 > 500 kW to 1 MW

- 5.5 > 1 MW to 30 MW

- 5.6 > 30 MW to 70 MW

- 5.7 > 70 MW to 200 MW

- 5.8 > 200 MW

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Denmark

- 8.3.10 Romania

- 8.3.11 Poland

- 8.3.12 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.4.8 Bangladesh

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 Lebanon

- 8.5.12 South Africa

- 8.5.13 Nigeria

- 8.5.14 Algeria

- 8.5.15 Kenya

- 8.5.16 Ghana

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Baker Hughes

- 9.3 Bharat Heavy Electricals

- 9.4 Capstone Green Energy

- 9.5 Destinus Energy

- 9.6 Doosan

- 9.7 Flex Energy Solutions

- 9.8 GE Vernova

- 9.9 Harbin Electric

- 9.10 IHI Corporation

- 9.11 Kawasaki Heavy Industries

- 9.12 MAN Energy Solutions

- 9.13 Mitsubishi Heavy Industries

- 9.14 Nanjing Turbine & Electric Machinery

- 9.15 Rolls Royce

- 9.16 Shanghai Electric Gas Turbine

- 9.17 Siemens Energy

- 9.18 Solar Turbines

- 9.19 Vericor

- 9.20 Wartsilä