|

市场调查报告书

商品编码

1773381

液晶电视核心晶片市场机会、成长动力、产业趋势分析及2025-2034年预测LCD TV Core Chip Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球液晶电视核心晶片市场规模达64亿美元,预计2034年将以9.3%的复合年增长率成长,达到157亿美元。随着用户寻求与串流媒体平台、人工智慧语音助理、网路连接和响应式多工处理的无缝集成,智慧连网电视的快速普及将继续推动这一成长。为此,製造商正在设计高性能处理晶片,以支援包括超高清视讯解码、高级内容渲染和基于应用程式的使用者介面在内的复杂功能。

物联网和智慧家庭生态系统的发展进一步扩大了对晶片的需求,这些晶片不仅性能更强大,而且节能高效。随着消费者逐渐转向 4K 和 8K 分辨率,核心晶片必须提供显着增强的运算能力,以应对这些格式带来的高频宽、压缩和影像处理需求。这一发展趋势将下一代晶片定位为电视体验的核心,彻底改变用户与内容、应用程式和智慧功能的互动方式。随着对速度更快、更智慧、更节能的电视的需求日益增长,先进的核心处理单位正成为效能和创新的核心。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 64亿美元 |

| 预测值 | 157亿美元 |

| 复合年增长率 | 9.3% |

系统单晶片 (SoC) 解决方案是推动这项转变的主要力量,2022 年市值将达到 12 亿美元。这些整合晶片组将中央处理、图形渲染、记忆体管理和连接等关键功能整合到一个平台中,大幅简化了内部架构。这种整合可以实现更快的资料传输、更低的延迟和更流畅的多工处理,所有这些都有助于带来卓越的观看体验。 SoC 让智慧电视能够有效率地运行串流平台、AI 功能和互动服务,使其成为当今互联客厅中不可或缺的一部分。

2024年,单晶片解决方案市场占65.6%的市场份额,进一步巩固了其在提升电视效能方面的作用。这些紧凑型晶片减少了对多个组件的需求,从而最大限度地减少了功耗和电路板空间。其高效率和设计灵活性使其在中高阶液晶电视领域备受青睐,这些电视製造商致力于在不牺牲智慧功能的情况下,提供时尚的外观、极速的运行速度和极具竞争力的生产成本。

2024年,美国液晶电视核心晶片市场规模达14亿美元,这得益于消费者对配备高清显示器和嵌入式串流媒体技术的先进智慧电视的强烈偏好。凭藉持续的创新和强劲的消费水平,美国市场已成为晶片需求和开发的领先中心。研发投入以及全球主要供应商的布局进一步巩固了美国在该领域的地位。

液晶电视核心晶片市场的顶级公司包括联咏科技、联发科技和瑞昱半导体。液晶电视核心晶片市场公司采用的关键策略包括整合 AI 驱动的增强功能以及对 8K 和 UHD 等超高解析度内容格式的支援。主要参与者正在开发客製化晶片,以最大限度地降低能耗,同时最大限度地提高处理能力,并针对智慧电视生态系统进行客製化。许多公司专注于与领先的电视製造商合作,共同开发功能丰富的平台。此外,公司优先考虑系统级整合和更快的上市时间,提供将记忆体、显示控制和连接等多种功能集于一身的 SoC。对研发和下一代压缩演算法的持续投资也增强了它们在快速发展的数位娱乐环境中的竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 智慧和连网电视的普及

- 过渡到更高的显示分辨率

- 人工智慧能力的整合

- OTT平台的出现

- 中产阶级消费者的全球扩张

- 产业陷阱与挑战

- 价格压力和利润

- 半导体供应链波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依晶片组类型,2021-2034

- 主要趋势

- 视讯处理晶片组

- 音讯处理晶片组

- 调谐器和解调器晶片组

- 电源管理IC

- 时序控制器 (TCON) IC

- 系统单晶片 (SoC)

- 其他的

第六章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 单晶片解决方案(SoC)

- 多晶片解决方案

第七章:市场估计与预测:依决议,2021-2034

- 主要趋势

- 高清(720p)

- 全高清 (1080p)

- 4K 超高清

- 8K 超高清

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 智慧电视

- 非智慧型(传统)液晶电视

第九章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 住宅

- 商业的

- 其他的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Analog Devices Inc.

- Broadcom Inc.

- Hisilicon (Huawei Technologies)

- Innosilicon

- MediaTek Inc.

- Novatek Microelectronics Corp.

- NXP Semiconductors

- Parade Technologies

- Realtek Semiconductor Corp.

- ROHM Semiconductor

- Samsung Electronics (System LSI)

- Skyworks Solutions

- Socionext Inc.

- Sony Semiconductor Solutions

- STMicroelectronics

- Synaptics Inc.

- Texas Instruments

- Toshiba Electronic Devices & Storage Corporation

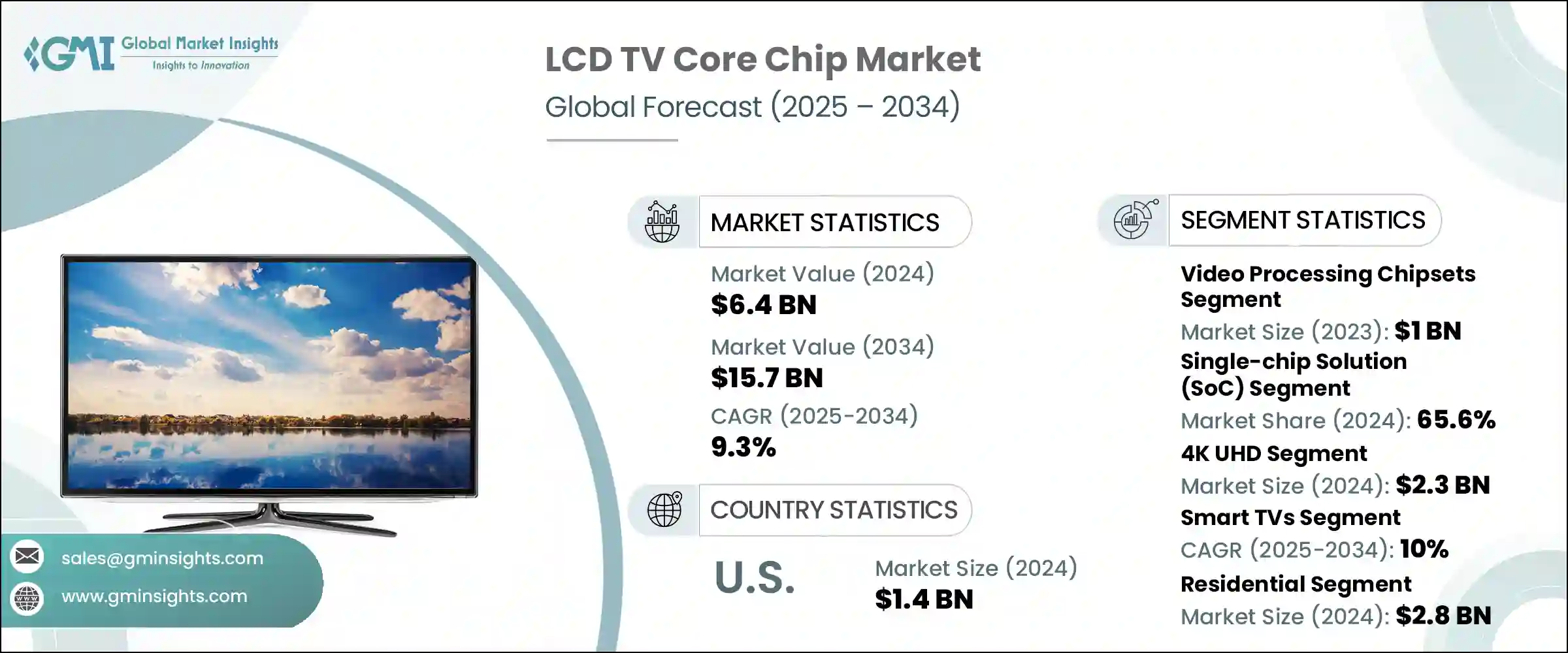

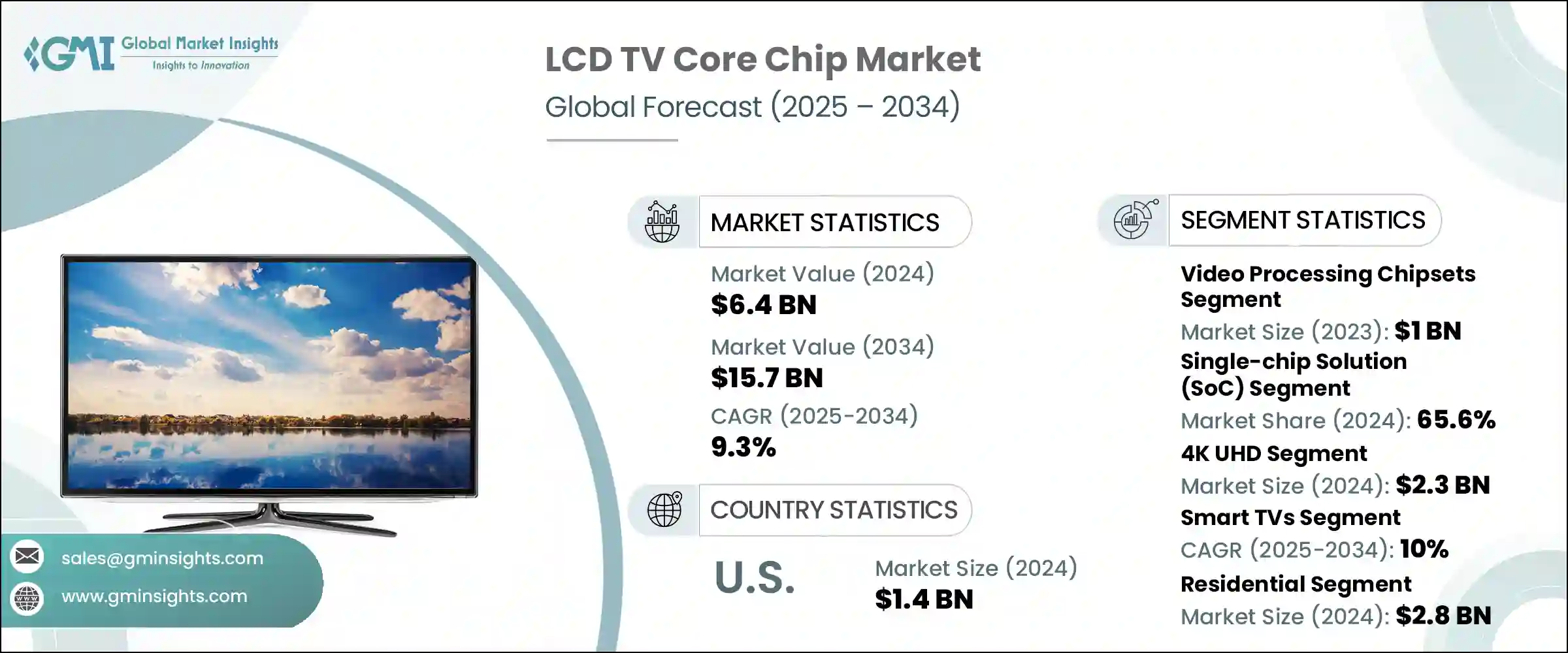

The Global LCD TV Core Chip Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 15.7 billion by 2034. Rapid adoption of smart and connected TVs continues to fuel this growth, as users seek seamless integration with streaming platforms, AI-powered voice assistants, internet connectivity, and responsive multitasking. In response, manufacturers are designing high-performance processing chips to support complex functions, including ultra-high-definition video decoding, advanced content rendering, and app-based user interfaces.

The growth of IoT and smart home ecosystems has further amplified the demand for chips that are not only more powerful but also energy efficient. As consumers gravitate toward 4K and 8K resolutions, core chips must deliver significantly enhanced computing capabilities to manage the high bandwidth, compression, and image processing needs associated with these formats. This evolution is positioning next-generation chips at the heart of the television experience, transforming how users interact with content, apps, and smart features. As the demand for faster, smarter, and more energy-efficient TVs grows, advanced core processing units are becoming central to performance and innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $15.7 Billion |

| CAGR | 9.3% |

System-on-chip (SoC) solutions are driving much of this shift, valued at USD 1.2 billion in 2022. These integrated chipsets combine critical functions-such as central processing, graphics rendering, memory management, and connectivity-into a single platform, drastically simplifying internal architecture. This integration allows for quicker data transmission, reduced latency, and smoother multitasking, all of which contribute to a superior viewing experience. SoCs enable smart TVs to operate streaming platforms, AI features, and interactive services efficiently, making them essential in today's connected living rooms.

In 2024, the single-chip solutions segment held a 65.6% share, reinforcing its role in advancing TV performance. These compact chips reduce the need for multiple components, minimizing power consumption and space on circuit boards. Their efficiency and design flexibility make them highly favored in mid-range to premium LCD TVs, where manufacturers strive to deliver sleek aesthetics, lightning-fast operation, and competitive production costs without compromising on smart capabilities.

U.S. LCD TV Core Chip Market was valued at USD 1.4 billion in 2024, driven by strong consumer preference for advanced smart TVs featuring high-definition displays and embedded streaming technologies. With continuous innovation and robust consumption levels, the U.S. market is a leading hub for chip demand and development. Investments in R&D and the presence of major global suppliers have further solidified the country's position in this space.

Top companies in the LCD TV Core Chip Market include Novatek Microelectronics Corp., MediaTek Inc., and Realtek Semiconductor Corp. Key strategies adopted by companies in the LCD TV core chip market include the integration of AI-driven enhancements and support for ultra-high-resolution content formats, such as 8K and UHD. Major players are developing customized chips that minimize energy use while maximizing processing power, tailored to smart TV ecosystems. Many focus on partnerships with leading TV manufacturers to co-develop feature-rich platforms. Additionally, companies are prioritizing system-level integration and faster time-to-market, offering SoCs that combine multiple functionalities like memory, display control, and connectivity in one unit. Ongoing investment in R&D and next-gen compression algorithms also strengthens their competitive edge in a rapidly evolving digital entertainment environment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.6.1 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Proliferation of smart and connected TVs

- 3.4.1.2 Transition to higher display resolutions

- 3.4.1.3 Integration of AI capabilities

- 3.4.1.4 Emergence of OTT platforms

- 3.4.1.5 Global expansion of middle-class consumers

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Price pressure and margins

- 3.4.2.2 Semiconductor supply chain volatility

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging business models

- 3.10 Compliance requirements

- 3.11 Sustainability measures

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type of Chipset, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Video processing chipsets

- 5.3 Audio processing chipsets

- 5.4 Tuner & demodulator chipsets

- 5.5 Power management ICs

- 5.6 Timing Controller (TCON) ICs

- 5.7 System-on-Chip (SoC)

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Single-chip Solution (SoC)

- 6.3 Multi-chip solution

Chapter 7 Market Estimates & Forecast, By Resolution, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 HD (720p)

- 7.3 Full HD (1080p)

- 7.4 4K UHD

- 7.5 8K UHD

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Smart TVs

- 8.3 Non-smart (Conventional) LCD TVs

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices Inc.

- 11.2 Broadcom Inc.

- 11.3 Hisilicon (Huawei Technologies)

- 11.4 Innosilicon

- 11.5 MediaTek Inc.

- 11.6 Novatek Microelectronics Corp.

- 11.7 NXP Semiconductors

- 11.8 Parade Technologies

- 11.9 Realtek Semiconductor Corp.

- 11.10 ROHM Semiconductor

- 11.11 Samsung Electronics (System LSI)

- 11.12 Skyworks Solutions

- 11.13 Socionext Inc.

- 11.14 Sony Semiconductor Solutions

- 11.15 STMicroelectronics

- 11.16 Synaptics Inc.

- 11.17 Texas Instruments

- 11.18 Toshiba Electronic Devices & Storage Corporation