|

市场调查报告书

商品编码

1773382

分配枪市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dispensing Guns Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

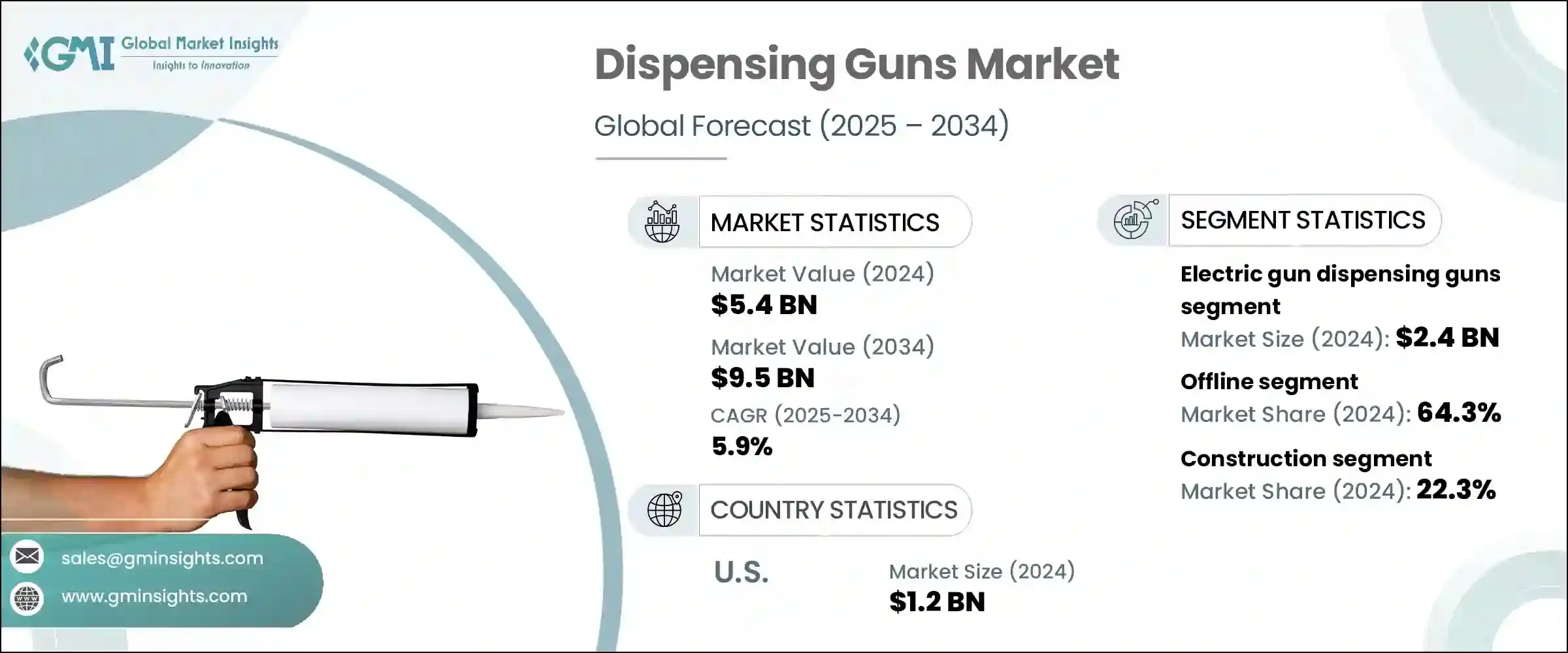

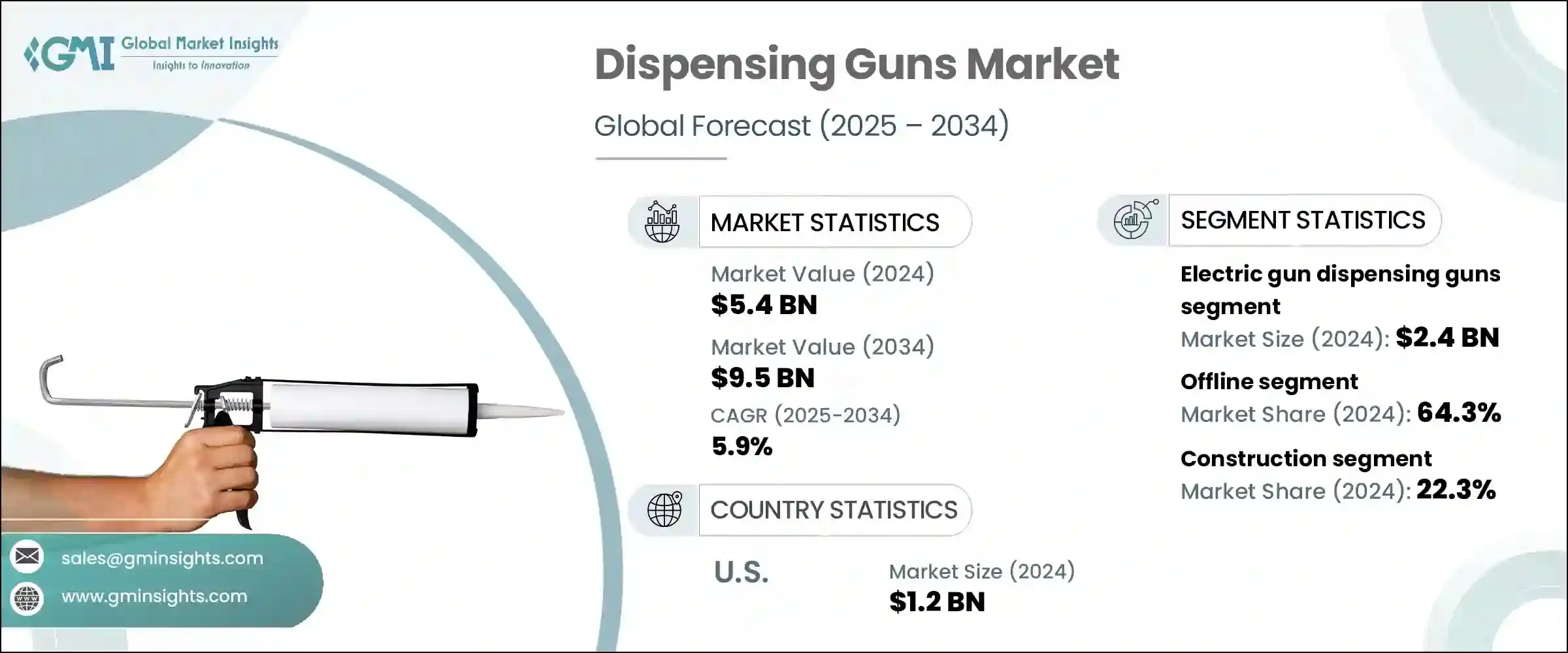

2024年,全球点胶枪市场规模达54亿美元,预计2034年将以5.9%的复合年增长率成长,达到95亿美元。这一成长主要得益于建筑和汽车行业的强劲需求,因为速度和精度在这些行业中至关重要。监管激励措施,尤其是在北美和欧洲,对这一成长做出了重大贡献。例如,美国环保署 (EPA) 提倡使用低挥发性有机化合物 (VOC) 黏合剂,而欧洲的绿色协议则鼓励在建筑中使用环保材料。这些法规有助于缩短专案工期并最大限度地减少浪费,从而使压力供料设备製造商受益。

工业自动化仍然是点胶枪市场的关键驱动力,因为自动化点胶机比传统的手动工具具有更高的可靠性。汽车组装和建筑行业对精度的日益增长的需求确保了该市场将持续扩张。此外,这些先进的点胶枪在材料利用率方面更加高效,这与日益增长的环保解决方案需求相契合,从而支持企业的永续发展计画。随着对速度和精度的需求从可选功能逐渐成为标准配置,该技术在市场上的持久生命力将得到保证。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 54亿美元 |

| 预测值 | 95亿美元 |

| 复合年增长率 | 5.9% |

2024年,电动点胶枪市场规模达24亿美元。数位控制、无线连接和即时资料监控等功能如今已成为许多电动机型的标准配备。这些改进有助于工厂团队加强品质检查并优化生产流程。电池供电设计与轻量化结构相结合,为操作员在长时间轮班期间提供更高的舒适度,从而推动了从气动型号向电动型号的过渡。汽车和电子产品製造商越来越多地采用电动点胶枪来实现精确的黏合剂喷涂,从而减少浪费和固化时间,最终缩短生产週期。

2024年,线下市场占了64.3%的份额。为了满足日益增长的本地需求,分销商正在巴西、印度和东南亚等新兴市场扩大仓库。这种扩张对实体店市场的发展扮演了至关重要的角色。与航太或家电製造等行业合作开发的客製化设备通常会在展会上首次亮相,并一直展出到最终规格确认,这不仅促进了新订单的产生,也促进了回头客的增加。服务技术人员强调了直接实践培训的优势,事实证明,这种培训比线上教学更有效。

2024年,美国点胶枪市场产值将达12亿美元。推动这一市场成长的因素主要有三:汽车工厂的现代化改造、生物医药研究的扩展以及绿色建筑项目的蓬勃发展。美国环保署(EPA)的新法规促使建筑商使用低VOC(挥发性有机化合物)黏合剂,而美国绿色建筑委员会预计环保建筑计画每年将成长10%。

点胶枪市场的领导者包括牧田 (Makita)、TigeR、史丹利百得 (Stanley Black & Decker)、罗伯特·博世 (Robert Bosch)、密尔瓦基工具 (Milwaukee Tool)、3M、GreatStar、诺信公司 (Nordson Corporation)、Siroflex、田岛 (TaJima)、Irim、Tk; Engineering。各公司为巩固其在点胶枪市场的地位而采取的关键策略包括专注于产品创新,特别是透过整合无线连接、即时资料追踪和增强的人体工学等先进技术来提高用户舒适度和生产力。

企业也正在拓展其全球分销网络,以满足东南亚、印度和巴西等新兴市场日益增长的需求。与航太、汽车和生物医药等产业的策略合作,对于获得长期合约至关重要。此外,製造商正在透过开发符合监管标准的环保解决方案来强调永续性。这些策略不仅有助于企业巩固市场地位,也能使其产品在竞争激烈的产业中脱颖而出。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 手动枪

- 气动枪

- 电动枪

- 其他的

第五章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 建造

- 汽车

- 工业製造

- 食品和饮料

- 卫生保健

- 其他的

第六章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 无线

- 有线

第七章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 金属

- 塑胶

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 离线

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- 3M

- Albion Engineering

- GreatStar

- Henkel

- Irion

- Makita

- METABO

- Milwaukee Tool

- Nordson Corporation

- PC Cox

- Robert Bosch

- Siroflex

- Stanley Black & Decker

- TaJima

- Tiger

The Global Dispensing Guns Market was valued at USD 5.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 9.5 billion by 2034. This growth is largely driven by the strong demand from the construction and automotive sectors, where speed and precision are essential. Regulatory incentives, particularly in North America and Europe, have contributed significantly to this growth. For instance, the U.S. Environmental Protection Agency (EPA) promotes the use of low-VOC adhesives, while Europe's Green Deal encourages the use of environmentally friendly materials in construction. These regulations help reduce project timelines and minimize waste, benefiting manufacturers of pressure-fed equipment.

Industrial automation continues to be a key driver in the dispensing-gun market, as automated applicators provide higher reliability than traditional hand-operated tools. The rising need for precision in the automotive assembly and building industries ensures that this market will continue to expand. Additionally, these advanced dispensing guns are more efficient in material usage, aligning well with the growing demand for eco-friendly solutions, which supports companies' sustainability initiatives. As demand for speed and accuracy becomes standard rather than an optional feature, technology's longevity in the market is assured.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $9.5 Billion |

| CAGR | 5.9% |

In 2024, the electric dispensing guns segment generated USD 2.4 billion. Features such as digital controls, wireless connectivity, and real-time data monitoring are now commonplace in many electric models. These improvements help factory teams enhance quality checks and optimize production processes. Battery-powered designs, combined with lightweight builds, provide operators with greater comfort during extended shifts, encouraging the transition from pneumatic models to electric units. Automotive and electronics manufacturers are increasingly adopting these guns to achieve precise adhesive applications that reduce waste and cure time, which ultimately leads to faster production cycles.

The offline segment held a 64.3% share in 2024. Distributors are expanding their warehouses across emerging markets such as Brazil, India, and Southeast Asia to meet the rising local demand. This expansion has been pivotal in supporting the brick-and-mortar segment. Custom rigs developed in collaboration with industries like aerospace or appliance manufacturing often debut at trade shows and remain on display until final specifications are confirmed, fueling both new orders and repeat business. Service technicians have emphasized the benefits of direct, hands-on training, which proves far more effective than online tutorials.

United States Dispensing Guns Market generated USD 1.2 billion in 2024. Three factors are driving this market growth: the modernization of automotive factories, expansion in biomedicine research, and the boom in green construction projects. The EPA's new regulations push builders toward using low-VOC adhesives, while the U.S. Green Building Council anticipates a 10% annual increase in eco-friendly construction projects.

Leading players in the Dispensing Guns Market include Makita, TigeR, Stanley Black & Decker, Robert Bosch, Milwaukee Tool, 3M, GreatStar, Nordson Corporation, Siroflex, TaJima, Irion, METABO, PC Cox, Henkel, Albion Engineering. Key strategies adopted by companies to solidify their position in the dispensing guns market include focusing on product innovation, particularly through the integration of advanced technologies like wireless connectivity, real-time data tracking, and enhanced ergonomics to improve user comfort and productivity.

Companies are also expanding their global distribution networks to meet rising demand in emerging markets such as Southeast Asia, India, and Brazil. Strategic collaborations with industries like aerospace, automotive, and biomedicine have been instrumental in securing long-term contracts. Additionally, manufacturers are emphasizing sustainability by developing eco-friendly solutions in line with regulatory standards. These strategies help companies not only strengthen their market foothold but also differentiate their offerings in a highly competitive industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Material

- 2.2.5 Technology

- 2.2.6 Distribution channel

- 2.3 CXO Perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 4.1 Key trends

- 4.2 Manual gun

- 4.3 Pneumatic gun

- 4.4 Electric gun

- 4.5 Others

Chapter 5 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Construction

- 5.3 Automotive

- 5.4 Industrial manufacturing

- 5.5 Food and beverage

- 5.6 Healthcare

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Cordless

- 6.3 Corded

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Metal

- 7.3 Plastic

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Malaysia

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 Albion Engineering

- 10.3 GreatStar

- 10.4 Henkel

- 10.5 Irion

- 10.6 Makita

- 10.7 METABO

- 10.8 Milwaukee Tool

- 10.9 Nordson Corporation

- 10.10 PC Cox

- 10.11 Robert Bosch

- 10.12 Siroflex

- 10.13 Stanley Black & Decker

- 10.14 TaJima

- 10.15 Tiger