|

市场调查报告书

商品编码

1773383

食物过敏治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Food Allergy Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

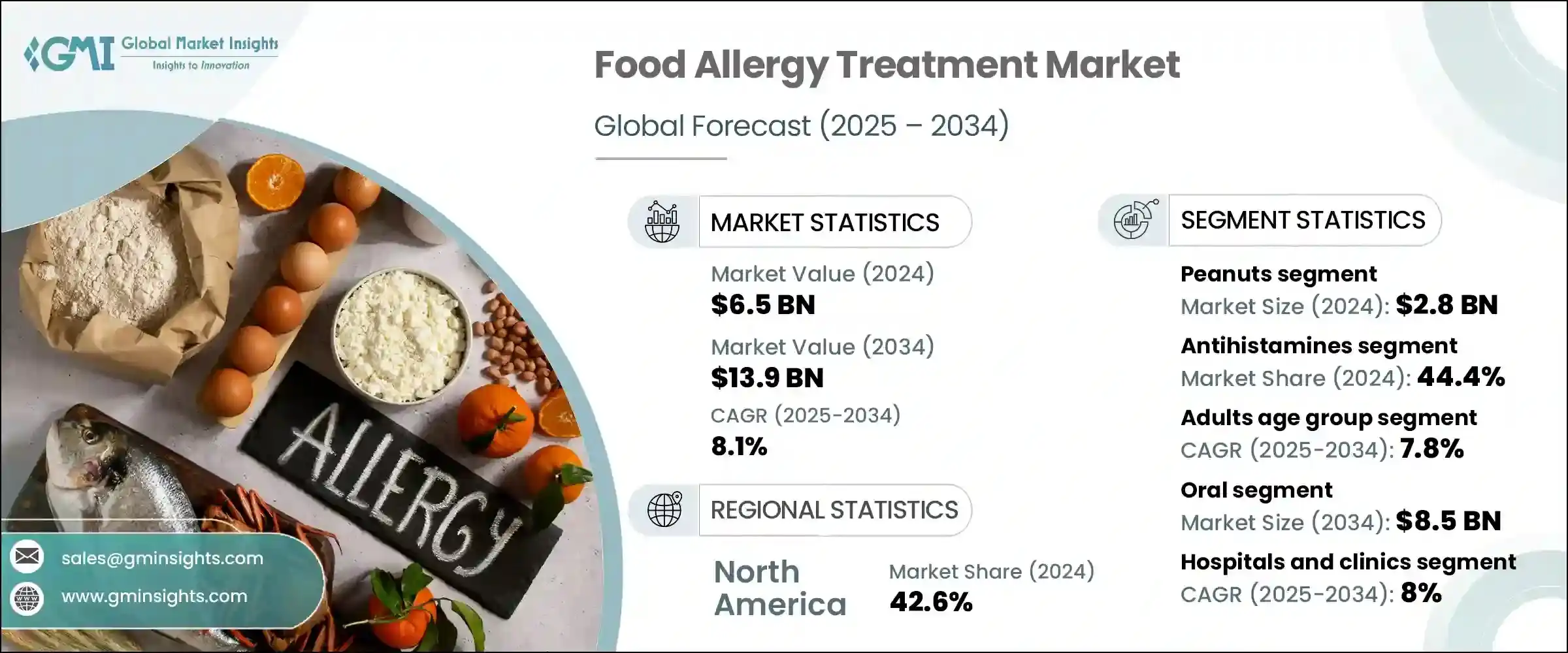

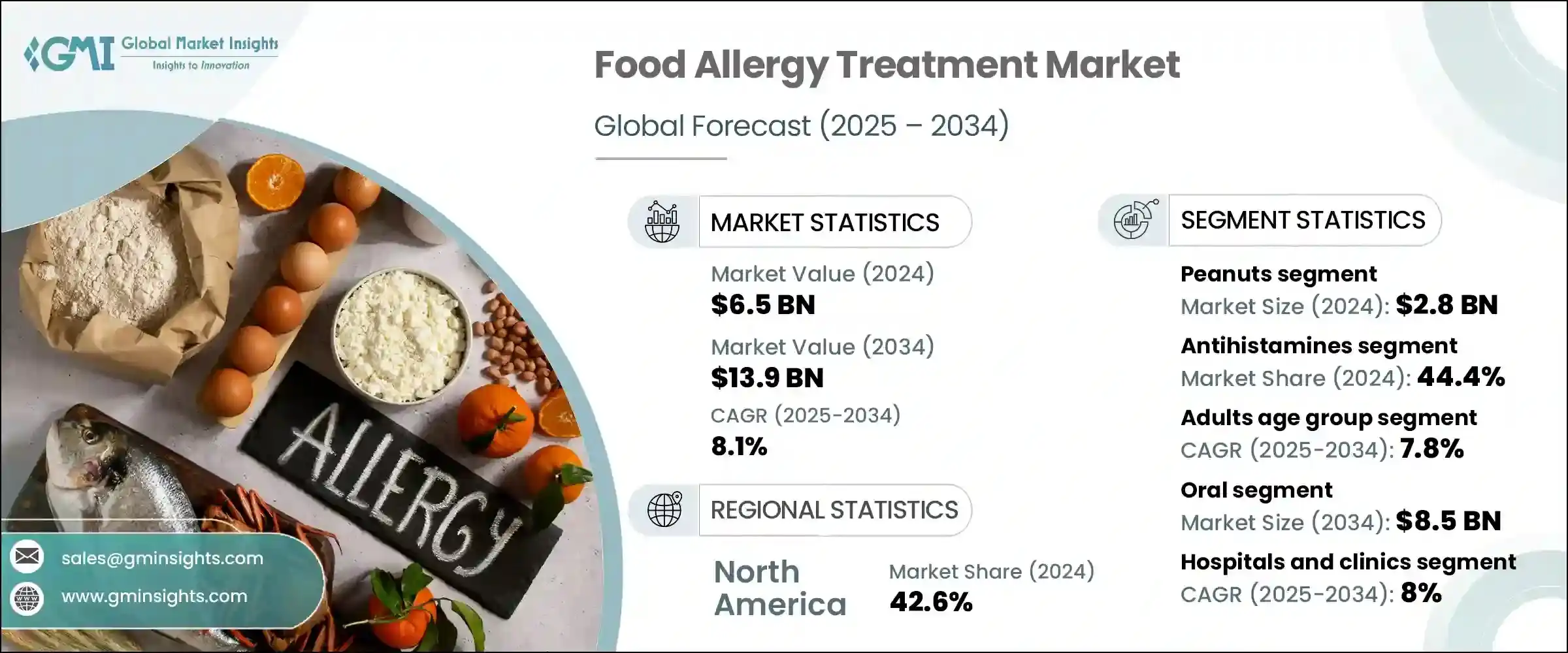

2024年,全球食物过敏治疗市场规模达65亿美元,预计2034年将以8.1%的复合年增长率成长,达到139亿美元。这一强劲增长主要归因于儿童和成人食物过敏发病率的上升。不断变化的饮食模式和过敏原接触的增加,尤其是在发展中地区,推动了对及时诊断和有效治疗方案的需求。环境因素和城市生活方式也是加剧过敏反应的关键因素,促使人们寻求早期介入。

预防性医疗保健和个人化治疗方案的日益普及进一步拓宽了治疗领域。随着人们意识的提高,人们更倾向于早期管理,这不仅可以减少併发症,还能提高患者的长期生活品质。随着检测工具的普及以及对门诊治疗的日益重视,医疗保健生态系统正在快速发展。随着食物过敏持续影响人们的身心健康和社会福祉,越来越多的学校、工作场所和旅游机构正在采取支持性政策,加强对过敏相关风险的整体应对。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 65亿美元 |

| 预测值 | 139亿美元 |

| 复合年增长率 | 8.1% |

治疗方法的创新是该市场的另一个驱动力,对免疫疗法贴片、口腔黏膜治疗和以微生物组为重点的疗法等新型製剂的需求激增。该行业正在经历一场范式转变,转向包容性和性别中立的医疗保健方案,这凸显了扩大儿童以外人群的治疗覆盖范围的必要性。随着人们越来越担心食物过敏带来的心理负担,患者和照护者越来越多地接受安全性更高、疗效更好的标靶疗法。

依过敏原类型,市场细分为乳製品、花生、树坚果和其他过敏原。其中,花生类过敏原贡献最大,2024年创造了28亿美元的收入。人们对花生的敏感度日益增加,尤其是在城市人群中,这导致对先进疗法的需求不断增加。过敏反应的严重性和干预的紧迫性使花生过敏成为药物研发的重点。这一趋势促使生技公司加强投资力度,并获得监管机构的大力支持,为安全性和有效性更高的尖端疗法铺平了道路。

根据治疗类型,市场分为抗组织胺、肾上腺素、免疫疗法和其他。抗组织胺在2024年占据主导地位,市占率为44.4%。这些药物是治疗轻度至中度症状(如搔痒、肿胀或充血)的首选药物。它们使用方便、供应广泛且为非处方药,是许多患者的首选。抗组织胺通常是急救和预防护理的第一道防线,这巩固了它们在治疗领域的强势地位。

就年龄层而言,市场分为儿童和成人。 2024年,成人占据主导地位,预计在预测期内将以7.8%的显着复合年增长率成长。随着成人食物过敏病例的增加以及人们对延迟诊断的认识不断提高,这个细分市场正在迅速扩张。加工食品消费增加扰乱了肠道菌群,过敏反应加剧等因素也促进了这个细分市场的成长。此外,像过敏性休克这样的严重过敏反应在成人中更为常见,这加剧了对综合治疗方案的需求。

依给药途径划分,口服药物在2024年占据市场主导地位,预计2034年将达到85亿美元。口服药物因其便利性和价格实惠而备受青睐。与注射剂相比,口服药物所需的临床监督更少,从而提高了患者的依从性并降低了治疗成本。这些优势使其在家庭护理和临床环境中广泛应用。

按最终用途细分,市场包括医院和诊所、家庭护理机构和其他机构。医院和诊所在2024年的收入份额最高,预计在预测期内的复合年增长率为8%。这些机构提供专业的诊断工具和紧急应变能力,对于管理严重的过敏反应至关重要。此外,医院提供的临床计画和后续治疗支援持续护理,确保更好地管理长期过敏状况。医疗基础设施投资的增加,尤其是在新兴经济体,也推动了医院过敏治疗服务的成长。

从区域来看,北美占据全球市场主导地位,2024 年的市占率高达 42.6%。该地区受益于早期诊断、强大的医疗基础设施以及过敏管理医疗支出的不断增长。光是美国市场就从 2023 年的 23 亿美元成长到 2024 年的 25 亿美元,反映出市场对个人化治疗的需求不断增长,以及公共卫生措施的有力推进。

欧洲紧随其后,2024 年市场价值达 17 亿美元,预计将呈现强劲成长。政府支持的计画、治疗技术的进步以及生物製剂和精准疗法可及性的提高,正在提升欧洲的市场格局。製药公司与公共机构之间的策略合作也在推动创新和确保更广泛地获得新型疗法方面发挥关键作用。

竞争格局仍然高度活跃,主要参与者包括赛诺菲、梯瓦製药、Kenvue、基因泰克和 Hal Allergy,它们在 2024 年占据了近 60% 的市场份额。这些公司专注于透过收购、产品发布和研发计划来扩大其产品组合。同时,区域性和本地公司继续透过提供符合本地需求且经济高效的解决方案来创造竞争压力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 全球食物过敏盛行率不断上升,尤其是在儿童中

- 增加对创新和有针对性的治疗方案的投资

- 公众意识不断增强,过敏管理更加积极主动

- 产业陷阱与挑战

- 缺乏标准化的诊断工具

- 新兴疗法的不良反应风险

- 市场机会

- 口服免疫疗法和生物製剂的扩展

- 製药公司与研究机构的合作

- 成长动力

- 成长潜力分析

- 管道分析

- 未来市场趋势

- 技术和创新格局

- 监管格局

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

第五章:市场估计与预测:按过敏原类型,2021 - 2034 年

- 主要趋势

- 乳製品

- 花生

- 树坚果

- 其他过敏原类型

第六章:市场估计与预测:按治疗类型,2021 - 2034 年

- 主要趋势

- 抗组织胺药

- 肾上腺素

- 免疫疗法

- 其他治疗类型

第七章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 孩子们

- 成年人

第八章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 肠外

- 鼻内

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 居家照护环境

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- AdvaCare

- Aimmune Therapeutics

- Alerje

- ARS Pharma

- Camallergy

- Celltrion

- DBV Technologies

- Genentech

- Hal Allergy

- Kenvue

- Sanofi

- Stallergenes Greer

- Teva Pharmaceutical

The Global Food Allergy Treatment Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 13.9 billion by 2034. This robust growth is largely attributed to the rising incidence of food allergies across both pediatric and adult populations. Evolving dietary patterns and increased exposure to allergens, especially in developing regions, are driving the demand for timely diagnosis and efficient treatment solutions. Environmental factors and urban lifestyles also play a crucial role in aggravating allergic reactions, prompting individuals to seek early intervention.

Preventive healthcare and the growing popularity of personalized treatment plans are further broadening the treatment landscape. With improved awareness, people are opting for early-stage management, which not only reduces complications but also enhances the long-term quality of life for patients. The healthcare ecosystem is rapidly evolving with the availability of detection tools and a growing emphasis on outpatient care. As food allergies continue to impact mental, physical, and social well-being, more schools, workplaces, and travel organizations are adopting supportive policies, strengthening the overall response to allergy-related risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $13.9 Billion |

| CAGR | 8.1% |

Innovation in treatment approaches is another driver of this market, with demand surging for newer formulations such as immunotherapy patches, oral mucosal treatments, and microbiome-focused therapeutics. The industry is experiencing a paradigm shift toward inclusive and gender-neutral healthcare protocols, highlighting the need for broader treatment access beyond children. With rising concerns over the psychological toll of living with food allergies, patients and caregivers are increasingly embracing targeted therapies that offer better safety profiles and improved outcomes.

By allergen type, the market is segmented into dairy products, peanuts, tree nuts, and other allergens. Among these, the peanuts segment emerged as the largest contributor, generating USD 2.8 billion in revenue in 2024. Increasing sensitivity to peanuts, particularly in urban populations, has led to heightened demand for advanced therapies. The severity of reactions and the immediate need for intervention have made peanut allergies a focal point for pharmaceutical R&D. This trend has resulted in increased investments from biotech firms and strong support from regulatory bodies, paving the way for cutting-edge therapies with improved safety and efficacy.

Based on treatment type, the market is categorized into antihistamines, epinephrine, immunotherapy, and others. Antihistamines maintained dominance in 2024 with a market share of 44.4%. These are the go-to medications for managing mild to moderate symptoms like itching, swelling, or congestion. Their ease of use, wide availability, and over-the-counter status make them an accessible choice for many patients. Antihistamines are often the first line of defense in both emergency and preventive care, supporting their strong position in the treatment landscape.

In terms of age group, the market is divided between children and adults. Adults held the leading share in 2024 and are projected to grow at a notable CAGR of 7.8% over the forecast period. With growing adult-onset food allergies and rising awareness about late diagnoses, this segment is rapidly expanding. Factors such as increased consumption of processed foods disrupted gut microbiota, and stronger allergic reactions are contributing to the segment's growth. Additionally, severe allergic reactions like anaphylaxis are more common among adults, intensifying the demand for comprehensive treatment options.

On the basis of the route of administration, the oral segment led the market in 2024 and is expected to reach USD 8.5 billion by 2034. Oral medications are favored for their convenience and affordability. Compared to injectables, they require less clinical oversight, resulting in higher patient compliance and lower treatment costs. These advantages have contributed to their wide adoption across both home care and clinical settings.

When segmented by end use, the market includes hospitals and clinics, home care settings, and others. Hospitals and clinics accounted for the highest revenue share in 2024 and are estimated to grow at a CAGR of 8% during the forecast timeline. These facilities offer specialized diagnostic tools and emergency response capabilities, making them essential for managing severe allergic reactions. Moreover, clinical programs and follow-up treatments available in hospitals support continuity of care, ensuring better management of long-term allergic conditions. Increased investment in healthcare infrastructure, particularly in emerging economies, is also fueling the growth of hospital-based allergy treatment services.

Regionally, North America dominated the global market with a commanding share of 42.6% in 2024. The region benefits from early diagnosis, strong healthcare infrastructure, and rising healthcare expenditure on allergy management. The market in the United States alone rose from USD 2.3 billion in 2023 to USD 2.5 billion in 2024, reflecting the heightened demand for personalized therapies and robust public health initiatives.

Europe followed with a market value of USD 1.7 billion in 2024 and is expected to show strong growth. Government-backed programs, advancements in treatment technology, and improved accessibility to biologics and precision therapies are enhancing the regional landscape. Strategic collaborations between pharmaceutical companies and public institutions are also playing a key role in driving innovation and ensuring better access to novel treatments.

The competitive landscape remains highly dynamic, led by major players such as Sanofi, Teva Pharmaceutical, Kenvue, Genentech, and Hal Allergy, who together accounted for nearly 60% of the market in 2024. These companies are focused on expanding their portfolios through acquisitions, product launches, and R&D initiatives. Meanwhile, regional and local firms continue to create competitive pressure by offering cost-effective solutions tailored to local demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Allergen type

- 2.2.3 Treatment type

- 2.2.4 Age group

- 2.2.5 Route of administration

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global prevalence of food allergies, especially among children

- 3.2.1.2 Increasing investment in innovative and targeted treatment options

- 3.2.1.3 Growing public awareness and proactive allergy management

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardized diagnostic tools

- 3.2.2.2 Risk of adverse reactions to emerging therapies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of oral immunotherapy and biologics

- 3.2.3.2 Collaborations between pharmaceutical firms and research institutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Future market trends

- 3.6 Technology and innovation landscape

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East and Africa

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Allergen Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dairy products

- 5.3 Peanuts

- 5.4 Tree nuts

- 5.5 Other allergen types

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antihistamines

- 6.3 Epinephrine

- 6.4 Immunotherapy

- 6.5 Other treatment types

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Children

- 7.3 Adults

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Parenteral

- 8.4 Intranasal

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital and clinics

- 9.3 Homecare settings

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AdvaCare

- 11.2 Aimmune Therapeutics

- 11.3 Alerje

- 11.4 ARS Pharma

- 11.5 Camallergy

- 11.6 Celltrion

- 11.7 DBV Technologies

- 11.8 Genentech

- 11.9 Hal Allergy

- 11.10 Kenvue

- 11.11 Sanofi

- 11.12 Stallergenes Greer

- 11.13 Teva Pharmaceutical