|

市场调查报告书

商品编码

1773384

室内生物塑胶市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Bioplastic for Interior Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

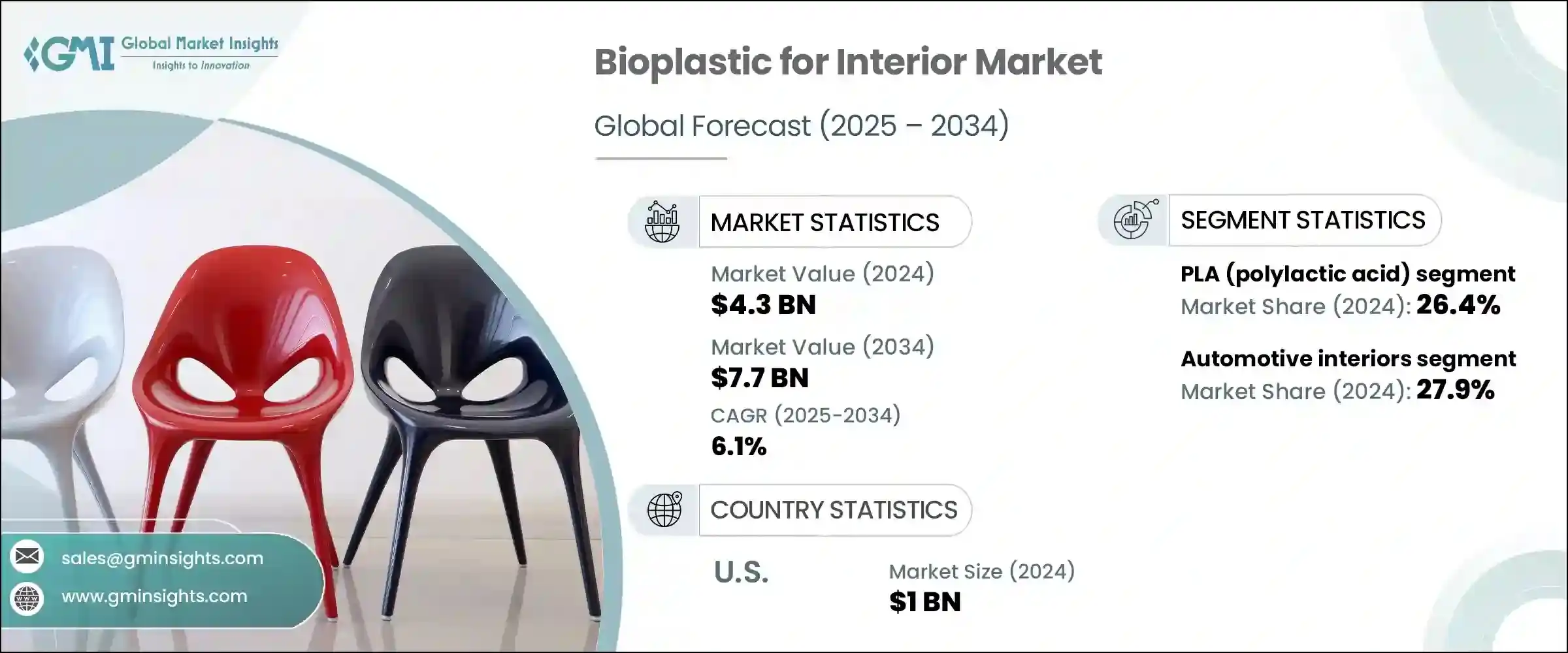

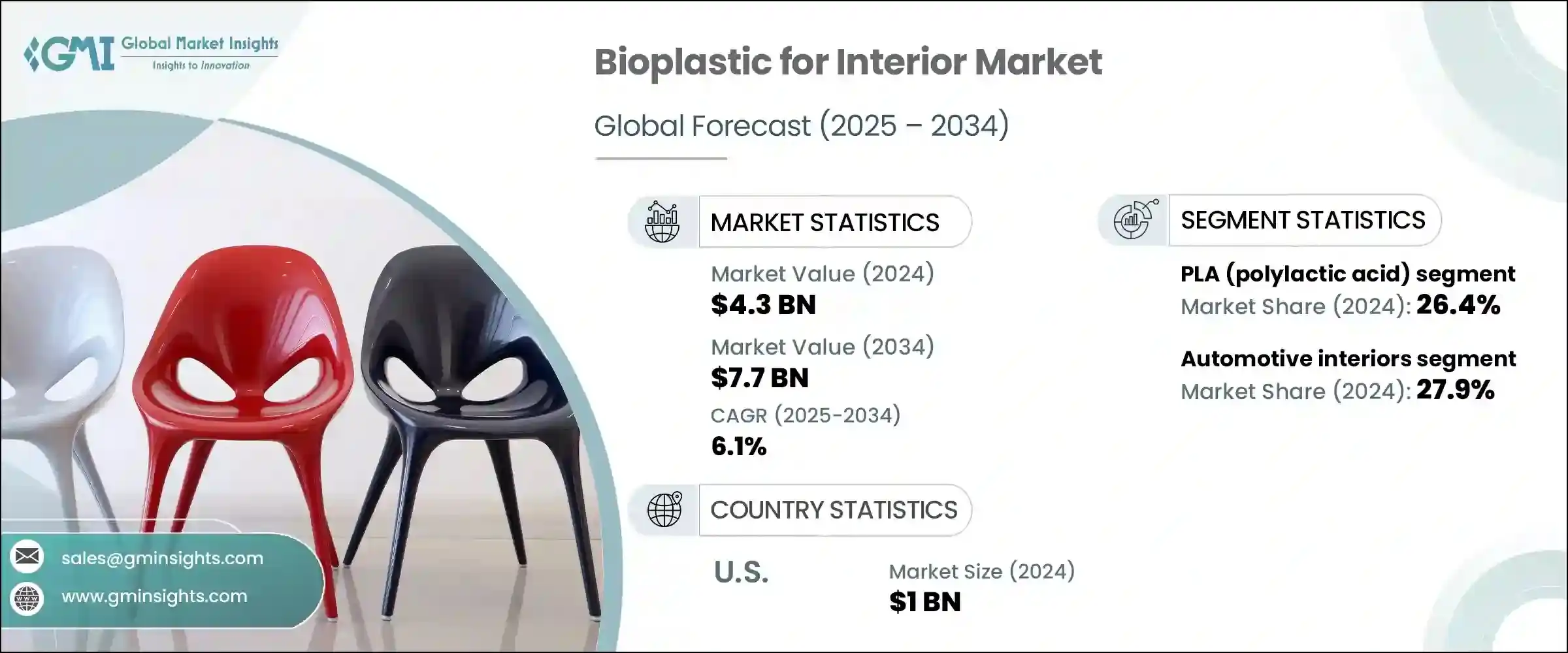

2024年,全球室内装潢用生物塑胶市场规模达43亿美元,预计2034年将以6.1%的复合年增长率成长,达到77亿美元。消费者和企业日益增强的环保意识正在重塑室内装潢材料格局,推动人们向再生、低影响的替代方案转变。传统塑胶正日益被生物塑胶所取代,生物塑胶源自于甘蔗、玉米和纤维素等天然资源。这些材料不仅支持环保目标,还具有生物降解性和减少碳排放等实际优势,与永续生活和生产实践的广泛倡导相契合。

随着人们追求更环保的设计元素,对绿色室内设计的需求日益增长,这也进一步强化了生物塑胶在这项转型中所扮演的角色。摆脱石油基塑胶的趋势已不再局限于利基应用领域;它在家具、墙面处理、室内装饰元素、地板等众多领域都越来越受到青睐。全球废弃物管理法规的日益严格以及人们对塑胶污染日益增长的担忧,迫使製造商采用可持续的替代品,这进一步推动了生物塑胶在室内装饰中的成长。企业也意识到迎合环保偏好的商业价值,从而广泛采用兼具高性能和永续性的生物塑胶材料。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 43亿美元 |

| 预测值 | 77亿美元 |

| 复合年增长率 | 6.1% |

2024年,聚乳酸 (PLA) 占据按聚合物类型分類的市场份额的26.4%。 PLA凭藉其良好的环保特性、可再生性和广泛的应用前景,继续引领该领域。 PLA源自植物糖,是传统塑胶零件的永续替代品。其卓越的视觉清晰度和强大的机械性能使其成为各种内装应用的首选,尤其是在註重透明度或抛光效果的领域。随着对环保解决方案的需求日益增长,PLA已成为製造商兼顾功能性和生态效益的首选聚合物。

从应用角度来看,汽车内装在2024年占据最大份额,占整体市场的27.9%。汽车製造商正积极用生物塑胶取代传统塑胶零件,以满足环保法规和消费者期望。生物塑胶的减重能力在提高燃油效率方面发挥着重要作用,同时也支持车辆的可回收性。这些材料用于各种内装部件,包括座椅底座、仪表板结构、装饰件和麵板。它们具有精密成型能力,并与更清洁的生产技术相容,使其成为性能和设计灵活性同等重要的汽车应用的理想选择。

从终端用户来看,建筑业在2024年引领市场,占据主导地位。然而,汽车原始设备製造商(OEM)已成为内装领域最积极采用生物塑胶的产业。作为更广泛的环境策略的一部分,这些公司积极参与将生物基材料融入汽车内装。在结构和外观部件中使用生物塑胶不仅可以减轻车辆重量,还可以降低生命週期排放。许多公司正在与材料供应商建立长期合作关係,以增强其生物塑胶采购能力并确保稳定的供应链。

家具製造商在生物塑胶使用量方面排名第二。他们正在将生物基材料融入模组化系统和永续家居装饰,以满足环保意识强的买家不断变化的需求。室内设计工作室正在使用生物塑胶定制项目,尤其是在遵守绿色认证计划的高端住宅和商业环境中。这些材料在零售和展厅设施的使用也日益增多,在这些领域,永续的美学设计有助于提升品牌定位。此外,建筑商和商业室内承包商也开始使用生物塑胶来製造符合现代绿建筑规范的覆层、面板和隔间等产品。

2024年,美国内装用生物塑胶市场规模达10亿美元。美国市场的成长主要得益于消费者意识的提升以及旨在减少环境影响的监管力度,尤其是在汽车和建筑行业。为了满足消费者对清洁技术和永续产品的需求,领先的製造商正在优先考虑生物基材料。生物聚合物的创新推动了材料性能的提升,使得生物塑胶能够更顺畅地融入大规模生产线。因此,美国生产商不仅在拓展产能,还在为永续製造树立新的标竿。

在全球范围内,内装生物塑胶市场受到竞争环境的影响,企业专注于专有材料、先进的加工技术和永续的生产模式。领先的企业正在不断巩固上游原材料来源,以稳定成本并确保供应。同时,企业也努力提高产品耐用性、获得绿色认证和提供设计弹性,从而脱颖而出。这些策略使关键利益相关者能够在快速发展的市场中保持领先地位,以满足监管要求和消费者对环保内饰的期望。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按聚合物类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)

(註:仅提供重点国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按聚合物类型,2021 - 2034 年

- 主要趋势

- PLA(聚乳酸)

- 淀粉基生物塑料

- 聚羟基脂肪酸酯(PHA)

- 纤维素基生物塑料

- Bio-PE(生物聚乙烯)

- 生物PET(生物聚对苯二甲酸乙二酯)

- 其他的

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 汽车内装

- 家具和家居内饰

- 商业和办公室室内设计

- 零售和酒店室内设计

- 其他的

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 汽车OEM

- 家具製造商

- 室内设计公司

- 零售商和展厅

- 承包商和建筑商

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Arkema SA

- BASF SE

- Biome Bioplastics

- Braskem SA

- Cardia Bioplastics

- Celanese Corporation

- Covestro AG

- DuPont de Nemours, Inc

- Evonik Industries AG

- FKuR Kunststoff GmbH

- Mitsubishi Chemical Group

- NatureWorks LLC

- Novamont

- TotalEnergies Corbion

The Global Bioplastic for Interior Market was valued at USD 4.3 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 7.7 billion by 2034. Growing environmental consciousness among consumers and organizations is reshaping the interior materials landscape, encouraging the shift toward renewable, low-impact alternatives. Traditional plastics are increasingly being replaced by bioplastics, which are derived from natural sources such as sugarcane, corn, and cellulose. These materials not only support environmental goals but also deliver practical advantages like biodegradability and reduced carbon emissions, aligning with the broader push for sustainable living and production practices.

As people seek more eco-conscious design elements, the demand for green interiors is accelerating, reinforcing the role of bioplastics in this transition. The move away from petroleum-based plastics is no longer limited to niche applications; it is gaining traction across furniture, wall treatments, interior decorative elements, and flooring, among other uses. Stricter global waste management regulations and mounting concerns over plastic pollution are pressuring manufacturers to adopt sustainable alternatives, further fueling the growth of bioplastics in interior applications. Businesses are also realizing the commercial value of catering to environmentally driven preferences, leading to widespread adoption of bioplastic materials that offer performance without compromising sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.3 Billion |

| Forecast Value | $7.7 Billion |

| CAGR | 6.1% |

In 2024, polylactic acid (PLA) accounted for 26.4% of the total market share by polymer type. PLA continues to lead the segment due to its favorable environmental profile, renewability, and wide usability. Sourced from plant-based sugars, PLA offers a sustainable substitute for conventional plastic components. Its visual clarity and strong mechanical performance make it a preferred choice for a variety of interior applications, especially where transparency or a polished finish is important. As demand for environmentally responsible solutions grows, PLA stands out as a go-to polymer for manufacturers aiming to blend functionality with ecological benefits.

From an application standpoint, automotive interiors held the largest share in 2024, contributing 27.9% to the overall market. Automakers are actively replacing traditional plastic parts with bioplastics to meet both environmental regulations and consumer expectations. The ability of bioplastics to deliver weight savings plays a significant role in enhancing fuel efficiency while also supporting vehicle recyclability. These materials are used in numerous interior parts, including seat bases, dashboard structures, trim pieces, and panels. Their capacity for precise molding and compatibility with cleaner production techniques make them ideal for automotive applications, where performance and design flexibility are equally important.

On the basis of end users, the building construction segment led the market in 2024, capturing a dominant position. However, automotive OEMs emerged as the most active adopters of bioplastics in the interiors domain. These companies are heavily involved in integrating bio-based materials into vehicle interiors as part of broader environmental strategies. Incorporating bioplastics in structural and aesthetic parts not only reduces vehicle mass but also lowers lifecycle emissions. Many companies are forming long-term collaborations with material suppliers to enhance their bioplastic sourcing capabilities and ensure stable supply chains.

Furniture manufacturers ranked second in terms of bioplastic usage. They are incorporating bio-based materials into modular systems and sustainable home decor, meeting the evolving needs of environmentally conscious buyers. Interior design studios are customizing projects with bioplastics, particularly in high-end residential and commercial settings that adhere to green certification programs. The use of these materials is also rising in retail and showroom installations, where sustainable aesthetics contribute to brand positioning. Additionally, builders and commercial interior contractors are turning to bioplastics for items like cladding, panels, and partitions that comply with modern green building codes.

In 2024, the bioplastic for interior market in the United States was valued at USD 1 billion. Growth in the U.S. is being driven by a combination of consumer awareness and regulatory efforts to reduce environmental impact, especially in the automotive and construction sectors. Leading manufacturers are prioritizing bio-based materials in response to consumer demands for cleaner technologies and sustainable products. Enhanced material performance, driven by innovation in bio-polymers, is allowing smoother integration of bioplastics into large-scale production lines. As a result, U.S.-based producers are not only expanding their capabilities but also setting new benchmarks for sustainable manufacturing.

Globally, the bioplastic for interior market are shaped by a competitive environment where companies are focusing on proprietary materials, advanced processing technologies, and sustainable production models. Leading players are increasingly securing upstream raw material sources to stabilize costs and ensure availability. At the same time, efforts to improve product durability, achieve green certifications, and offer design flexibility are helping companies differentiate themselves. These strategies are enabling key stakeholders to stay ahead in a market that is quickly evolving to meet both regulatory demands and consumer expectations for environmentally friendly interiors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Polymer type

- 2.2.2 Application

- 2.2.3 End use

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By polymer type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Polymer Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 PLA (polylactic acid)

- 5.3 Starch-based bioplastics

- 5.4 Polyhydroxyalkanoates (PHA)

- 5.5 Cellulose-based bioplastics

- 5.6 Bio-PE (bio-polyethylene)

- 5.7 Bio-PET (bio-polyethylene terephthalate)

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive interiors

- 6.3 Furniture & home interiors

- 6.4 Commercial & office interiors

- 6.5 Retail & hospitality interiors

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive OEM

- 7.3 Furniture manufacturers

- 7.4 Interior design firms

- 7.5 Retailers & showrooms

- 7.6 Contractors & Builders

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arkema S.A.

- 9.2 BASF SE

- 9.3 Biome Bioplastics

- 9.4 Braskem S.A.

- 9.5 Cardia Bioplastics

- 9.6 Celanese Corporation

- 9.7 Covestro AG

- 9.8 DuPont de Nemours, Inc

- 9.9 Evonik Industries AG

- 9.10 FKuR Kunststoff GmbH

- 9.11 Mitsubishi Chemical Group

- 9.12 NatureWorks LLC

- 9.13 Novamont

- 9.14 TotalEnergies Corbion