|

市场调查报告书

商品编码

1773387

等离子照明市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Plasma Lighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

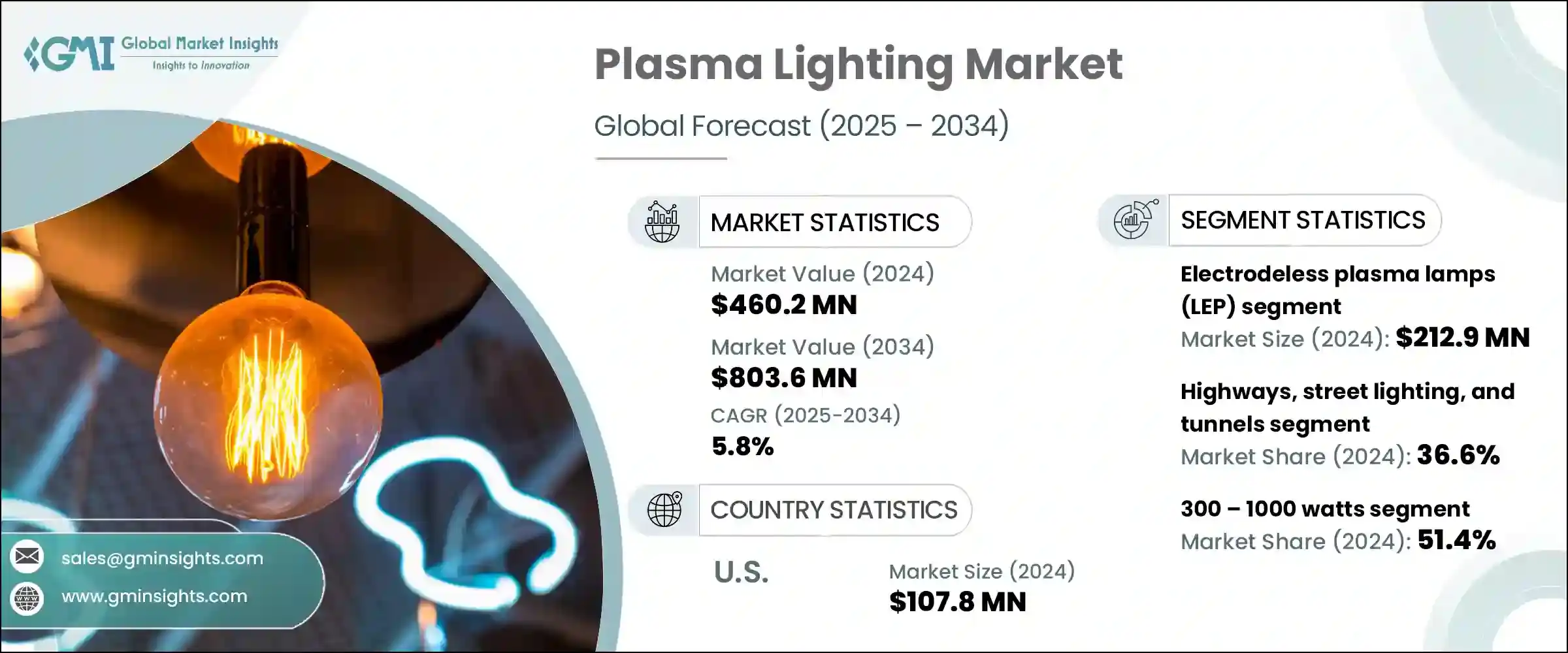

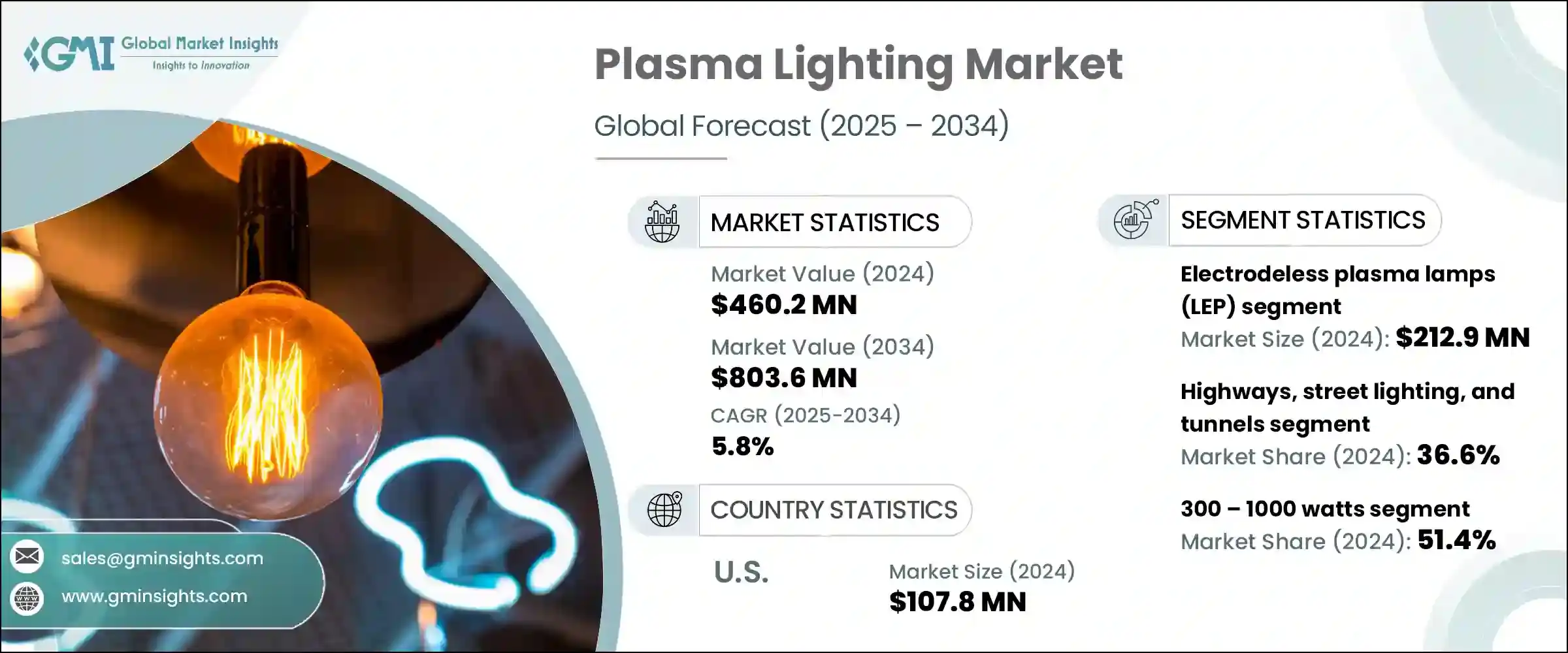

2024年,全球等离子照明市场规模达4.602亿美元,预计2034年将以5.8%的复合年增长率成长,达到8.036亿美元。园艺照明、工业及户外照明领域的需求不断增长,推动了这一成长。受控环境农业 (CEA)、垂直农业和温室农业系统的扩张是推动园艺领域等离子照明需求的重要因素。

等离子灯产生的光谱与自然光非常相似,有助于植物健康生长并提高产量。其使用寿命长、节能高效且经久耐用,非常适合需要持续稳定照明的环境。同时,工业和户外应用需要能够在恶劣条件下提供高流明输出和长使用寿命的照明解决方案。等离子灯凭藉其高显色指数 (CRI)、抗衝击性和耐受温度波动的能力,完美地满足了这些要求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.602亿美元 |

| 预测值 | 8.036亿美元 |

| 复合年增长率 | 5.8% |

政府主导的基础设施现代化和节能减排倡议,正在显着加速各行各业从传统金属卤化物和HID照明系统向先进等离子照明技术的转型。这些政策驱动的措施致力于降低能耗、减少碳足迹,同时提升照明品质和耐用性。因此,等离子照明凭藉其卓越的节能性、更长的使用寿命和更佳的光质,正成为公共基础设施项目的首选。

无电极等离子灯 (LEP) 细分市场在 2024 年的市值为 2.129 亿美元,凭藉其可靠的技术以及在市政和工业照明领域的广泛应用,占据了等离子照明市场的主导地位。 LEP 灯具有稳定的光输出和较长的使用寿命,非常适合需要稳定高强度照明的场所。然而,LEP 灯的成长面临着营运成本上升和新兴照明技术日益激烈的竞争的挑战。

2024年,高速公路、街道照明和隧道照明领域占据市场主导地位,占据36.6%的显着份额,这主要得益于基础设施开发项目激增,这些项目对可靠、高强度、低维护的照明解决方案的需求。公共机构和市政当局青睐等离子照明,是因为其在隧道、桥樑和繁忙道路等恶劣的户外条件下拥有卓越的使用寿命和强大的性能,而这些条件下安全和运营成本的节省至关重要。等离子照明能够以极低的维护成本提供一致的照明,从而减少关键基础设施环境中的停机时间和更换成本,这进一步增强了公共机构和市政当局的青睐。

2024年,美国等离子照明市场规模达1.078亿美元,这得益于政府积极投资基础设施现代化,以及其在工业和园艺领域的广泛应用。美国率先采用尖端照明技术,加速了等离子照明融入智慧城市计画和环境可控农业系统。这些措施强调能源效率、精确的光谱控制和持久的解决方案,进一步增加了等离子照明在各种应用中的需求。强劲的基础设施支出、技术创新以及特定行业的需求,将在未来几年维持美国等离子照明市场的强劲成长动能。

等离子照明产业的领导者包括LG电子、Gavita International BV和Ushio Inc.,它们透过持续创新和策略性市场拓展占据了重要的市场地位。为了巩固市场地位并建立竞争优势,等离子照明产业的企业专注于多项策略措施。创新发挥核心作用,企业大力投资开发更节能、更持久的等离子照明解决方案,以满足园艺和工业应用不断变化的需求。与农业技术提供者、基础设施开发商和市政当局的合作,使企业能够扩大业务范围,并根据特定客户需求客製化产品。扩展产品组合以涵盖智慧可控照明系统,有助于抓住精准农业和智慧城市基础设施等新兴趋势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 园艺照明需求不断成长

- 卓越的能源效率和使用寿命

- 环保合规压力

- 工业和户外应用的需求不断增长

- 永续照明投资不断增加

- 产业陷阱与挑战

- LED技术的竞争

- 有限的供应商生态系统

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 无极等离子灯(LEP)

- 微波等离子照明

- 射频(RF)等离子照明

第六章:市场估计与预测:按功率,2021-2034

- 主要趋势

- 小于300瓦

- 300 – 1000 瓦

- 1000瓦以上

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 高速公路、街道照明和隧道

- 工业的

- 体育和娱乐

- 园艺

- 其他的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Alphalite Inc.

- Gavita International BV

- Green De Corp

- Hive Lighting

- LG Electronics

- Lumartix SA.

- pinkRF

- Plasma International GmbH

- PlasmaBright

- Ushio Inc.

- WAVEPIA CO., LTD.

- Solaronix SA

The Global Plasma Lighting Market was valued at USD 460.2 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 803.6 million by 2034. This growth is fueled by rising demand from both horticultural lighting and industrial and outdoor sectors. The expansion of controlled environment agriculture (CEA), vertical farming, and greenhouse farming systems is a significant factor driving the need for plasma lighting in horticulture.

Plasma lights produce a broad spectrum of light closely resembling natural sunlight, which promotes healthier plant growth and higher yields. Their long lifespan, energy efficiency, and robust durability make them highly suitable for environments that require consistent, continuous lighting. Meanwhile, industrial and outdoor applications demand lighting solutions that deliver high-lumen output and long operational life under tough conditions. Plasma lighting fits these requirements perfectly due to its high color rendering index (CRI), resistance to shocks, and ability to withstand temperature fluctuations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $460.2 Million |

| Forecast Value | $803.6 Million |

| CAGR | 5.8% |

Infrastructure modernization and energy-efficient initiatives led by governments are significantly accelerating the transition from traditional metal halide and HID lighting systems to advanced plasma lighting technologies across various sectors. These policy-driven efforts focus on reducing energy consumption and lowering carbon footprints while enhancing lighting quality and durability. As a result, plasma lighting, with its superior energy efficiency, longer lifespan, and better light quality, is becoming the preferred choice for public infrastructure projects.

The electrodeless plasma lamps (LEP) segment held a market value of USD 212.9 million in 2024, dominating the plasma lighting market because of its dependable technology and widespread adoption in municipal and industrial lighting applications. LEP lamps offer a consistent light output and long service life, making them ideal for locations demanding steady, high-intensity illumination. However, their growth faces challenges from increasing operational costs and rising competition from emerging lighting technologies.

The highways, street lighting, and tunnels segment dominated the market in 2024, holding a significant 36.6% share, driven primarily by the surge in infrastructure development projects demanding dependable, high-intensity, and low-maintenance lighting solutions. Public authorities and municipalities favor plasma lighting because of its exceptional longevity and robust performance under tough outdoor conditions, such as in tunnels, bridges, and busy roadways, where both safety and operational cost savings are paramount. This preference is reinforced by plasma lighting's ability to deliver consistent illumination with minimal maintenance, reducing downtime and replacement costs in critical infrastructure settings.

United States Plasma Lighting Market was valued at USD 107.8 million in 2024, fueled by proactive government investments in modernizing infrastructure alongside widespread applications in industrial and horticultural sectors. The country's early embrace of cutting-edge lighting technologies has accelerated the integration of plasma lighting into smart city projects and controlled environment agriculture systems. These initiatives emphasize energy efficiency, precise light spectrum control, and long-lasting solutions, further increasing the demand for plasma lighting across diverse applications. The combination of robust infrastructure spending, technological innovation, and sector-specific demand is set to sustain strong growth momentum in the U.S. plasma lighting market over the coming years.

Leading companies in the Plasma Lighting Industry include LG Electronics, Gavita International B.V., and Ushio Inc., which hold significant market positions through continuous innovation and strategic market outreach. To strengthen their market presence and build a competitive edge, companies in the plasma lighting sector focus on multiple strategic initiatives. Innovation plays a central role, with firms investing heavily in developing more energy-efficient, longer-lasting plasma lighting solutions that meet the evolving needs of horticultural and industrial applications. Partnerships and collaborations with agricultural technology providers, infrastructure developers, and municipal authorities allow companies to expand their reach and tailor products to specific client demands. Expanding product portfolios to include smart, controllable lighting systems helps tap into emerging trends like precision agriculture and smart city infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Power trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for horticultural lighting

- 3.2.1.2 Superior energy efficiency and lifespan

- 3.2.1.3 Environmental compliance pressure

- 3.2.1.4 Increasing demand from industrial & outdoor applications

- 3.2.1.5 Growing investments in sustainable lighting

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from LED technology

- 3.2.2.2 Limited vendor ecosystem

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and ip analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Electrodeless plasma lamps (LEP)

- 5.3 Microwave plasma lighting

- 5.4 Radio frequency (RF) plasma lighting

Chapter 6 Market Estimates & Forecast, By Power, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Less than 300 watts

- 6.3 300 – 1000 watts

- 6.4 Above 1000 watts

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Highways, street lighting, and tunnels

- 7.3 Industrial

- 7.4 Sports & entertainment

- 7.5 Horticulture

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alphalite Inc.

- 9.2 Gavita International B.V.

- 9.3 Green De Corp

- 9.4 Hive Lighting

- 9.5 LG Electronics

- 9.6 Lumartix SA.

- 9.7 pinkRF

- 9.8 Plasma International GmbH

- 9.9 PlasmaBright

- 9.10 Ushio Inc.

- 9.11 WAVEPIA CO., LTD.

- 9.12 Solaronix SA