|

市场调查报告书

商品编码

1773388

口腔内感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Intra-Oral Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

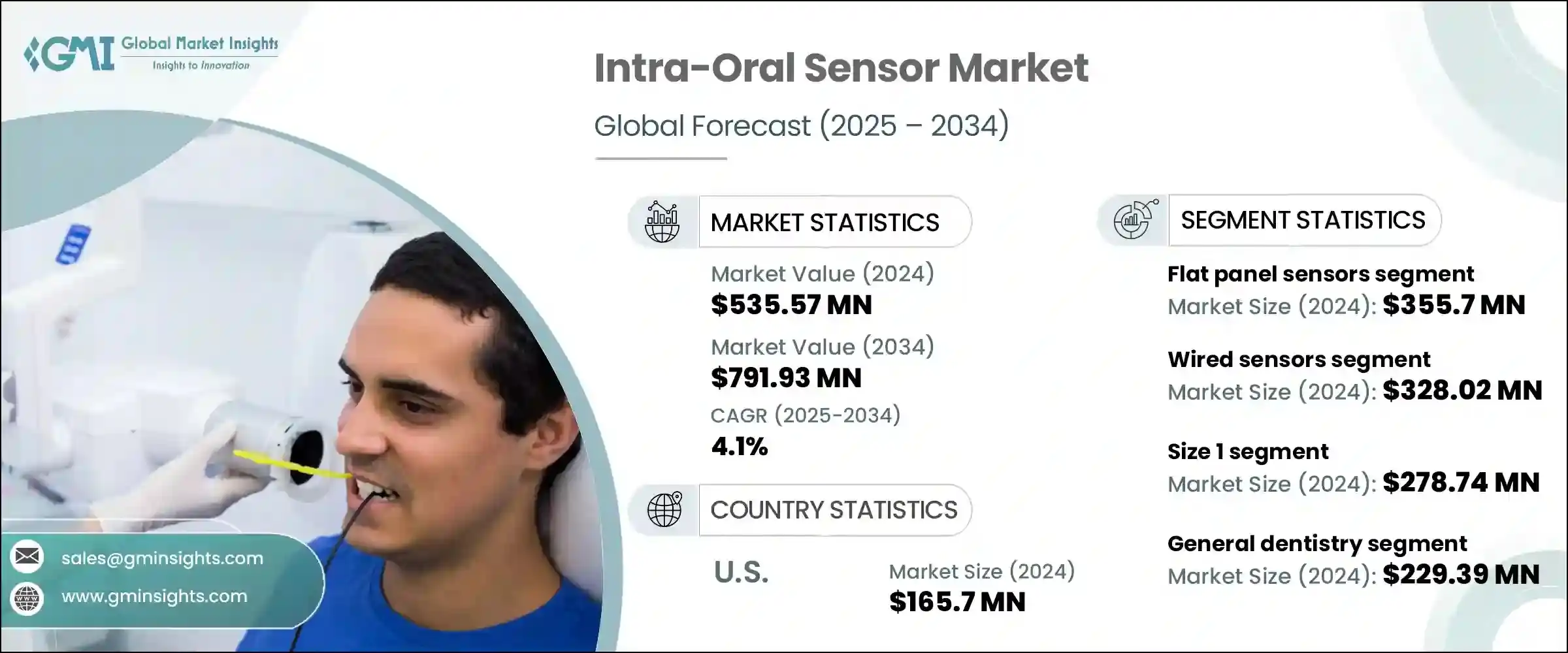

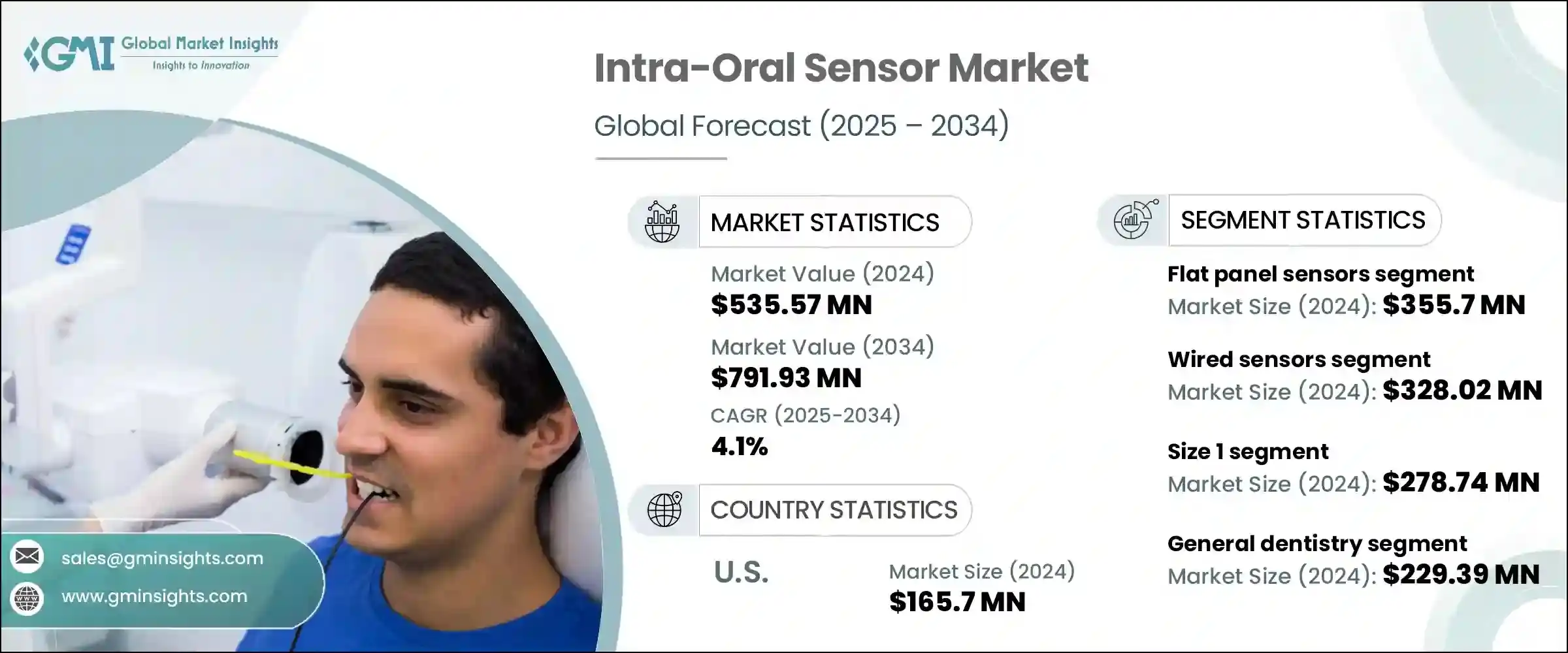

2024 年全球口内感测器市场价值为 5.3557 亿美元,预计到 2034 年将以 4.1% 的复合年增长率成长,达到 7.9193 亿美元。这一增长是由牙科疾病发病率的上升以及对早期准确诊断的需求不断增长所驱动的。口内感测器在捕捉牙齿和周围结构的高解析度数位影像方面发挥着至关重要的作用,可以提高诊断准确性、制定更精确的治疗计划并改善患者预后。随着牙科专业人员寻求更好的诊断工具,尤其是在检测与年龄相关的疾病方面,先进的影像系统正变得不可或缺。人工智慧整合 3D 成像和锥状束电脑断层扫描 (CBCT) 等技术提高了影像保真度和诊断速度,减少了患者的不适并简化了牙科工作流程。

人工智慧口内感测器的快速普及正在改变全球牙科诊所,提升诊断精准度,改善患者整体照护。这些先进的系统利用人工智慧自动侦测异常,简化影像分析,并减少人为错误,使医生能够更快、更准确地做出诊断。随着人工智慧的不断发展,配备机器学习演算法的感测器如今只需极少的人工输入,即可识别蛀牙、牙龈疾病和骨质疏鬆的早期迹象。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.3557亿美元 |

| 预测值 | 7.9193亿美元 |

| 复合年增长率 | 4.1% |

2024年,口内感测器市场中的平板感测器细分市场产值达到3.557亿美元。其受欢迎程度的提升主要得益于其高清影像输出,从而增强了精细牙体结构的可视化。这些感测器能够无缝整合到数位化工作流程中,在精度、速度以及与诊所管理系统的互通性至关重要的现代牙科环境中,它们不可或缺。由于这些感测器能够提高诊断准确性和患者沟通,尤其是在治疗计划和咨询期间,因此越来越受到牙科专业人士的青睐。此外,其符合人体工学的设计和即时影像传输使其对患者和操作者都十分友善。

有线感测器市场在2024年的估值为3.2802亿美元,并持续保持强劲的市场地位。有线感测器以其耐用性、可靠的影像一致性以及易于整合到现有牙科软体生态系统而闻名,对于那些优先考虑可靠性而非无线灵活性的从业者来说,它仍然是首选。这些系统采用持续供电和即时资料传输,最大限度地减少了手术过程中的中断。其成本效益、极低的维护需求以及良好的业绩记录进一步巩固了它们的受欢迎程度,尤其是在需要经济实惠且可扩展的成像解决方案的诊所中。

2024年,德国口内感测器市场规模达3,027万美元,这得益于该国先进的医疗体系和强大的牙科设备生产基地。在强大的保险框架和国家数位化策略的支持下,尖端牙科技术的采用率持续上升。政府鼓励数位医疗解决方案的政策,使得数位感测器取代传统影像工具的现象稳步增加。此外,严格的牙科临床指南和严格的培训标准也促使诊所不断升级其影像能力,以确保诊断的卓越性并符合不断发展的卫生法规。

市场上的知名企业包括 FONA srl、Carestream Dental LLC.、Acteon Group、Dexis LLC.、Genoray Co., Ltd. 和 Dentsply Sirona Inc .。製造商正专注于整合 AI 和 CBCT 技术,以提供更高的诊断准确性和更快的成像速度。与牙科软体供应商和影像 OEM 的合作正在创建全面、易于整合的影像解决方案。为了满足日益增长的需求,各公司正在扩展其产品组合,包括紧凑型无线口内感测器,这些感测器优先考虑患者舒适度和诊所效率。他们还投资研发,以提高感测器解析度并减少辐射暴露。针对牙科专业人员的教育计划和培训课程有助于提高采用率并确保有效利用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 牙齿疾病发生率上升

- 数位化牙科的普及率不断提高

- 成像感测器的技术进步

- 老年人口不断增加

- 扩大新兴市场的牙科保健基础设施

- 产业陷阱与挑战

- 先进的口内感测器成本高昂

- 由于缺乏数位基础设施,发展中地区的采用率有限

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 平板感应器

- CCD(电荷耦合元件)感测器

- CMOS(互补金属氧化物半导体)感测器

- 萤光粉储存板(PSP)

- 其他的

第六章:市场估计与预测:依连结性,2021 - 2034 年

- 主要趋势

- 有线感应器

- 无线感测器

第七章:市场估计与预测:按感测器尺寸,2021 - 2034 年

- 主要趋势

- 0号尺寸

- 尺寸 1

- 2号尺寸

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 一般牙科

- 牙髓科

- 正畸

- 牙周病学

- 种植学

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销(OEM到买家)

- 经销商

- 线上零售平台

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Acteon Group

- Carestream Dental LLC.

- Dentsply Sirona Inc.

- Dexis LLC.

- FONA srl

- Genoray Co., Ltd.

- Hamamatsu Photonics KK

- ImageWorks Corporation

- Midmark Corporation

- MyRay

- Owandy Radiology

- Planmeca Oy

- Trident Srl

- Vatech Co., Ltd.

- XDR Radiology

The Global Intra-Oral Sensor Market was valued at USD 535.57 million in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 791.93 million by 2034. This expansion is driven by a rising incidence of dental disorders and a growing demand for early and accurate diagnosis. Intra-oral sensors play an essential role in capturing high-resolution digital images of teeth and surrounding structures, enabling improved diagnostic accuracy, more precise treatment planning, and enhanced patient outcomes. As dental professionals seek better diagnostic tools-especially in detecting age-related conditions-advanced imaging systems are becoming indispensable. Technologies such as AI-integrated 3D imaging and Cone Beam Computed Tomography (CBCT) have improved image fidelity and diagnostic speed, reducing patient discomfort and streamlining dental workflows.

The rapid adoption of AI-powered intra-oral sensors is transforming dental clinics worldwide by elevating diagnostic precision and improving overall patient care. These advanced systems leverage artificial intelligence to automatically detect anomalies, streamline image analysis, and reduce human error, allowing practitioners to deliver faster and more accurate diagnoses. As AI continues to evolve, sensors equipped with machine learning algorithms can now identify early signs of cavities, gum disease, and bone loss with minimal manual input.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $535.57 million |

| Forecast Value | $791.93 million |

| CAGR | 4.1% |

The flat panel sensors segment in the intra-oral sensor market generated USD 355.7 million in 2024. Their rise in popularity is largely driven by high-definition image output, which allows for enhanced visualization of fine dental structures. These sensors integrate seamlessly into digital workflows, making them indispensable in modern dental environments where precision, speed, and interoperability with practice management systems are essential. Dental professionals increasingly favor these sensors due to their ability to improve diagnostic accuracy and patient communication, especially during treatment planning and consultations. Additionally, their ergonomic design and real-time image delivery make them both patient- and operator-friendly.

The wired sensors segment secured a valuation of USD 328.02 million in 2024 and continues to hold a strong market position. Known for their durability, dependable image consistency, and ease of integration into existing dental software ecosystems, wired sensors remain a top choice among practitioners who prioritize reliability over wireless flexibility. These systems operate with continuous power and real-time data transfer, minimizing disruptions during procedures. Their cost-effectiveness, minimal maintenance needs, and proven track record further reinforce their preference, especially in clinics that require budget-friendly, scalable imaging solutions.

Germany Intra-Oral Sensor Market was valued at USD 30.27 million in 2024, propelled by the nation's advanced healthcare system and robust dental equipment production base. Backed by strong insurance frameworks and national digitization strategies, the adoption of cutting-edge dental technologies continues to rise. Government policies encouraging digital health solutions have led to a steady increase in the replacement of traditional imaging tools with digital sensors. Additionally, stringent clinical guidelines and rigorous training standards in dentistry push clinics to frequently upgrade their imaging capabilities, ensuring both diagnostic excellence and compliance with evolving health regulations.

Prominent players in the market include FONA srl, Carestream Dental LLC., Acteon Group, Dexis LLC., Genoray Co., Ltd., Dentsply Sirona Inc. Manufacturers are focusing on integrating AI and CBCT technologies to offer enhanced diagnostic accuracy and faster imaging. Partnerships with dental software providers and imaging OEMs are creating comprehensive, easy-to-integrate imaging solutions. To meet growing demand, companies are expanding their product portfolios to include compact, wireless intra-oral sensors that prioritize patient comfort and clinic efficiency. They are also investing in R&D to improve sensor resolution and reduce radiation exposure. Educational initiatives and training programs for dental professionals help improve adoption rates and ensure effective utilization.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of dental disorders

- 3.2.1.2 Increasing adoption of digital dentistry

- 3.2.1.3 Technological advancements in imaging sensors

- 3.2.1.4 Growing geriatric population

- 3.2.1.5 Expanding dental care infrastructure in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced intraoral sensors

- 3.2.2.2 Limited adoption in developing regions due to lack of digital infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Flat panel sensors

- 5.2.1 CCD (charge-coupled device) sensors

- 5.2.2 CMOS (complementary metal-oxide semiconductor) sensors

- 5.3 Phosphor storage plate (PSP)

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Connectivity, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Wired sensors

- 6.3 Wireless sensors

Chapter 7 Market Estimates and Forecast, By Sensor Size, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Size 0

- 7.3 Size 1

- 7.4 Size 2

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 General dentistry

- 8.3 Endodontics

- 8.4 Orthodontics

- 8.5 Periodontics

- 8.6 Implantology

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales (OEM to Buyer)

- 9.3 Distributors

- 9.4 Online retail platforms

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Acteon Group

- 11.2 Carestream Dental LLC.

- 11.3 Dentsply Sirona Inc.

- 11.4 Dexis LLC.

- 11.5 FONA srl

- 11.6 Genoray Co., Ltd.

- 11.7 Hamamatsu Photonics K.K.

- 11.8 ImageWorks Corporation

- 11.9 Midmark Corporation

- 11.10 MyRay

- 11.11 Owandy Radiology

- 11.12 Planmeca Oy

- 11.13 Trident S.r.l.

- 11.14 Vatech Co., Ltd.

- 11.15 XDR Radiology