|

市场调查报告书

商品编码

1773389

汽车挡泥板轮圈面板零件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Fender Wheel House Panel Parts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

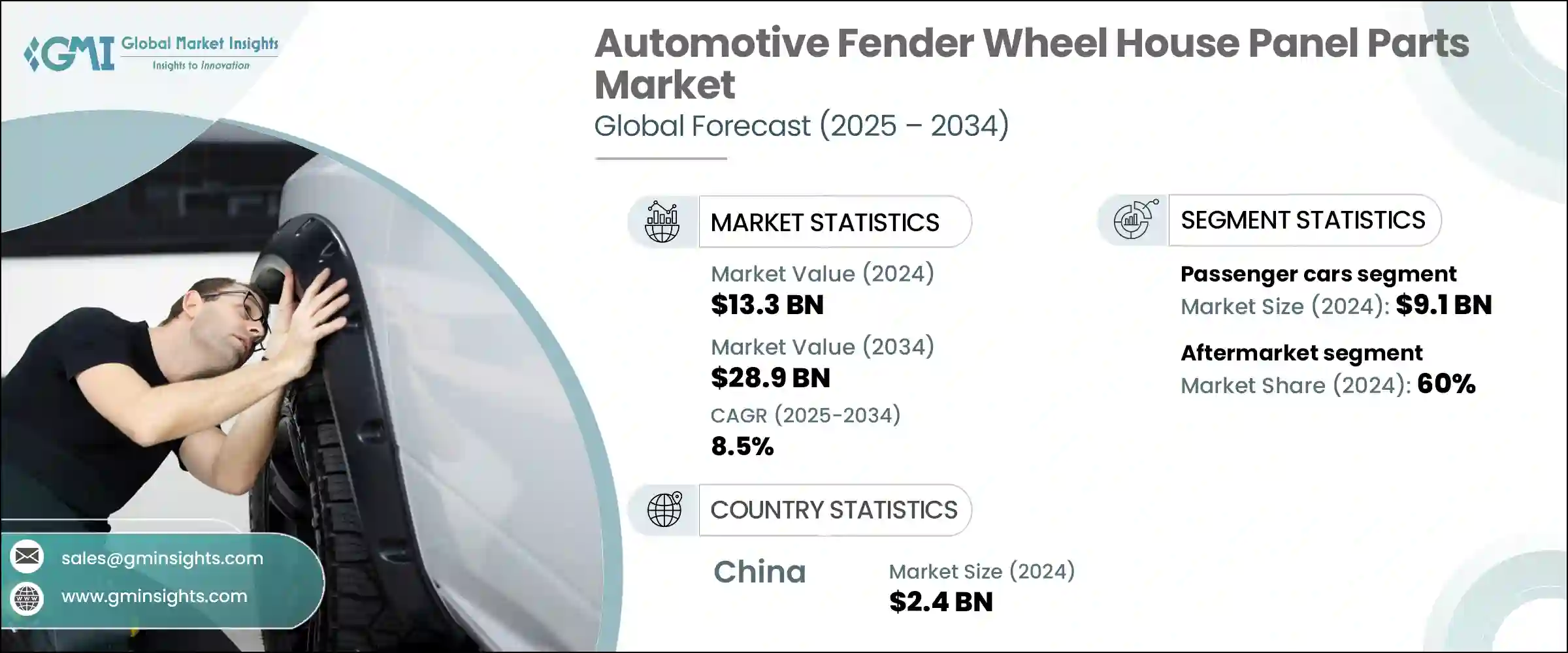

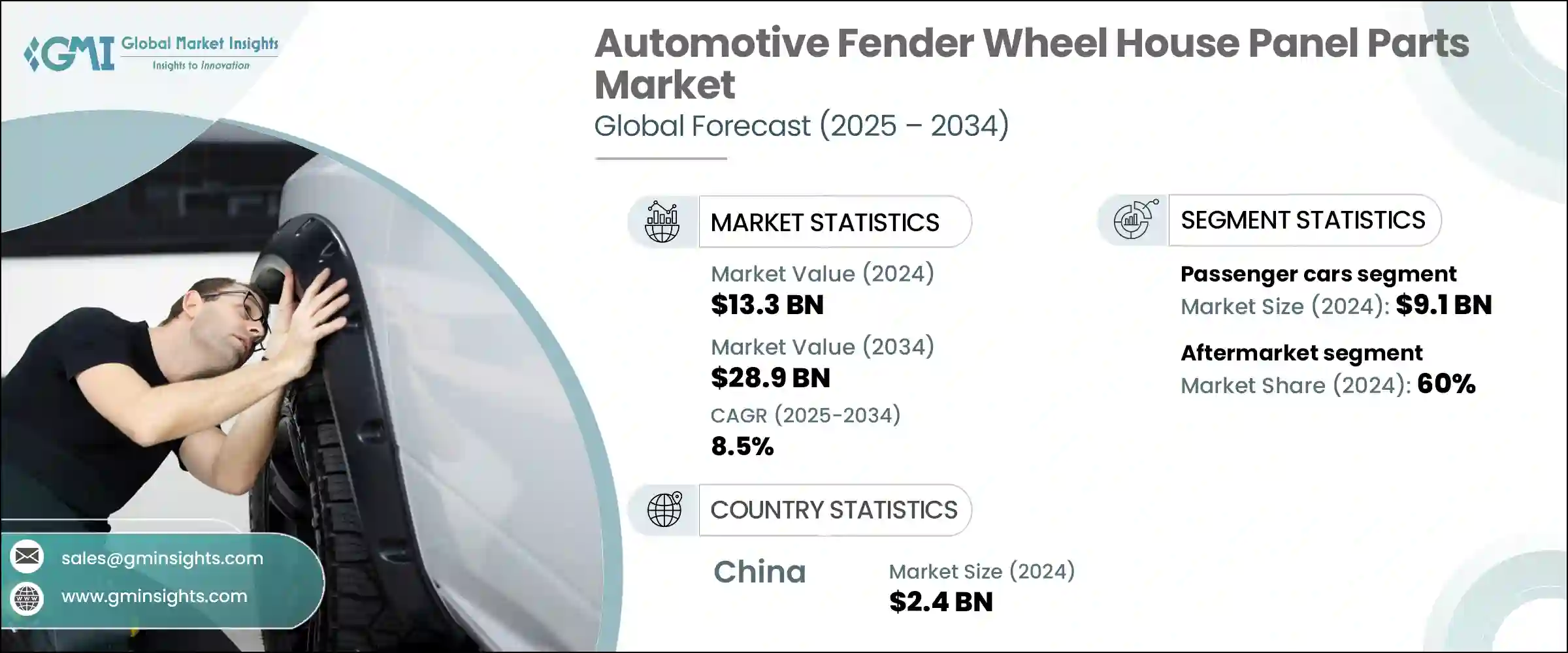

2024年,全球汽车翼子板和轮毂罩零件市场价值133亿美元,预计到2034年将以8.5%的复合年增长率成长,达到289亿美元。随着汽车製造商越来越注重车辆效率、安全性能和设计创新,该市场正在稳步扩张。翼子板部件,包括衬里、前后翼子板和轮圈罩面板,对于视觉吸引力和功能性能都至关重要。这些零件不仅有助于减少风阻、提高空气动力学性能,还能保护车辆底部免受路面因素和碎屑的伤害。更严格的碰撞安全法规和设计要求使得它们在新车平台中变得更加重要,尤其是在汽车製造商追求更坚固、更符合空气动力学的车辆结构的情况下。

汽车製造商正在从钢材转向复合材料、热塑性塑胶和铝等更轻的替代品,以减轻车辆总重。这种转变对提高燃油效率至关重要,尤其是在电动车领域,更轻的结构可以延长续航里程。空气动力学面板的趋势也影响产品开发,因为光滑的挡泥板轮廓和一体式轮拱可以改善气流并降低能耗。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 133亿美元 |

| 预测值 | 289亿美元 |

| 复合年增长率 | 8.5% |

这些改进对于电动和高性能车型尤其有益,因为降噪和效率是这些车型的卖点。随着製造商不断适应国际能源标准,模组化组装技术也日益普及,允许将多个组件整合到单一单元中,从而加快製造速度并简化安装。

2024年,乘用车市场产值达91亿美元。该市场持续蓬勃发展,尤其是在拉丁美洲和亚太等个人出行日益普及的地区。轿车、SUV和掀背车等乘用车类型越来越依赖流线型设计、空气动力学造型和更轻的材料,这推动了对增强型挡泥板系统的需求。电动和混合动力乘用车的兴起也重塑了挡泥板的设计要求,因为新型车辆需要更轻、结构更独特的面板配置。此外,为了满足严格的噪音标准并提供更好的道路碎屑防护,製造商正在开发兼具功能性和安全性的多层挡泥板。

2024年,售后市场占了60%的市占率。由于轻微事故、车辆老化或磨损后对替换零件的需求持续增长,该领域持续增长。轮罩板和挡泥板等车身外部零件是更换频率最高的零件之一,尤其是在容易出现恶劣天气或交通拥挤的地区。消费者被线上通路、独立门市和本地供应商提供的种类繁多、经济实惠的售后配件所吸引。售后市场也能让消费者以实惠的价格定製或维修车辆,尤其是在汽车保有量高但保固期有限的地区。

2024年,中国汽车翼子板轮毂罩零件市场规模达24亿美元。受不断增长的消费需求和持续的汽车生产投资推动,中国仍然是汽车製造业的强国,尤其是在乘用车和电动车领域。在政府的大力支持和国家能源目标的支持下,中国大力推动电动车发展,鼓励在汽车零件中使用先进材料和空气动力学设计。中国强大的供应链和经济高效的生产能力是其关键优势,使其成为金属和复合材料翼板零件的主要出口国。

全球汽车翼板轮圈罩零件市场的知名市场参与者包括科世达集团、法雷奥公司、矢崎株式会社、Flex-N-Gate 公司、李尔公司、麦格纳国际公司、爱信精机株式会社等。汽车翼子板轮毂罩零件市场的领先公司正专注于创新材料开发和先进製造技术,以保持竞争力。许多公司正在投资轻质复合材料技术和模组化面板系统,以缩短组装时间并提高车辆空气动力学性能。与电动车製造商的合作使供应商能够根据电动传动系统和结构布局来客製化零件。企业也在扩大新兴市场的生产,以满足不断增长的区域需求并降低成本。为了迎合售后市场的需求,企业正在透过推出可客製化、耐用且价格合理的零件来实现产品多样化。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 对部队的影响

- 成长动力

- 车辆复杂性和电子控制单元整合度不断提高

- ADAS 和基于感测器的安全系统的进步

- 连网汽车技术的发展使远端诊断成为可能

- 需要专业维护的电动和混合动力汽车日益普及

- 产业陷阱与挑战

- 先进诊断工具和设备的高初始投资

- 缺乏接受过电动车和 ADAS 技术培训的熟练技术人员

- 市场机会

- 基于人工智慧的预测性维护系统的开发

- 透过智慧诊断扩展行动平台

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 前挡泥板

- 挡泥板衬里

- 后挡泥板

- 轮罩板

- 内挡泥板

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 钢

- 塑胶

- 铝

- 合成的

- 碳纤维

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- 越野车

- 商用车

- 轻型商用车

- 中型商用车

- 重型商用车

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 汽车零件分销商和批发商

- 车队营运商

- 政府和市政机构

- 专用车辆製造商

- DIY 爱好者和业余爱好者

- 其他的

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 售后市场

- OEM

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Aisin Seiki

- Dongfeng Liuzhou

- Dongfeng Motor

- Ficosa International

- Flex-N-Gate

- Gestamp Automocion

- Hyundai Mobis

- Inteva Products

- Kostal

- Lear Corporation

- Magna International

- Martinrea International

- Plastic Omnium

- Sanden

- Siemens

- Schaeffler

- Toyoda Gosei

- Toyota Boshoku

- Valeo

- Yazaki

The Global Automotive Fender Wheel House Panel Parts Market was valued at USD 13.3 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 28.9 billion by 2034. The market is experiencing steady expansion as automakers increasingly focus on vehicle efficiency, safety features, and design innovation. Fender components, including liners, front and rear fenders, and wheel house panels, are essential for both visual appeal and functional performance. These parts not only help reduce wind resistance and increase aerodynamics but also protect vehicles' underbodies from road elements and debris. Stricter crash safety regulations and design demands have made them more critical in new vehicle platforms, especially as carmakers aim for stronger, more aerodynamic vehicle builds.

Automotive manufacturers are transitioning from steel to lighter alternatives like composites, thermoplastics, and aluminum to reduce overall vehicle weight. This shift plays a critical role in supporting fuel efficiency, which is especially vital in the electric vehicle space, where lighter structures can boost driving range. The trend toward aerodynamic paneling is also shaping product development, as smooth fender contours and integrated wheel arches improve airflow and reduce energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.3 Billion |

| Forecast Value | $28.9 Billion |

| CAGR | 8.5% |

These enhancements are particularly beneficial for electric and high-performance models, where noise reduction and efficiency are selling points. As manufacturers continue adapting to international energy standards, modular assembly techniques are also gaining ground, allowing multiple components to be integrated into single units for quicker manufacturing and easier installation.

The passenger vehicles segment generated USD 9.1 billion in 2024. This segment continues to thrive, particularly in regions like Latin America and the Asia Pacific, where personal mobility is on the rise. Passenger vehicle types such as sedans, SUVs, and hatchbacks increasingly rely on sleek designs, aerodynamic styling, and lighter materials, driving up demand for enhanced fender systems. The rise of electric and hybrid passenger models is also reshaping Fender design requirements, as newer vehicles require lighter and structurally unique panel configurations. Additionally, the need to meet strict noise standards and provide better protection from road debris is encouraging manufacturers to develop multilayered fender panels that serve both functional and safety roles.

In 2024, the aftermarket segment held a 60% share. This sector continues to grow due to the consistent demand for replacement parts following minor accidents, aging vehicles, or wear and tear. Exterior body parts like wheel house panels and fenders are among the most replaced, especially in areas prone to harsh weather or heavy traffic. Consumers are drawn to the wide selection of cost-effective aftermarket options offered through online channels, independent shops, and local suppliers. The aftermarket also enables consumers to customize or repair their vehicles affordably, particularly in areas with high car ownership but limited warranties.

China Automotive Fender Wheel House Panel Parts Market generated USD 2.4 billion in 2024. The country remains a powerhouse in vehicle manufacturing, particularly in the passenger and EV categories, fueled by growing consumer demand and continued investment in automotive production. China's push toward electric mobility, backed by strong government support and national energy goals, is encouraging the use of advanced materials and aerodynamic designs in vehicle parts. The country's robust supply chain and cost-effective production capabilities are key advantages, making it a leading exporter of both metal and composite fender parts.

Notable market participants in the Global Automotive Fender Wheel House Panel Parts Market include Kostal Group, Valeo S.A., Yazaki Corporation, Flex-N-Gate Corporation, Lear Corporation, Magna International Inc., Aisin Seiki Co., Ltd., among others. Leading companies in the automotive fender wheel house panel parts market are focusing on innovative material development and advanced manufacturing techniques to stay competitive. Many are investing in lightweight composite technologies and modular panel systems that improve assembly time and vehicle aerodynamics. Partnerships with EV manufacturers allow suppliers to tailor parts to electric drivetrains and structural layouts. Firms are also expanding production in emerging markets to meet growing regional demand and reduce costs. To cater to the aftermarket, businesses are diversifying their offerings by introducing customizable, durable, and affordable components.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Vehicle

- 2.2.5 End Use

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing vehicle complexity and integration of electronic control units

- 3.2.1.2 Advancements in ADAS and sensor-based safety systems

- 3.2.1.3 Growth in connected car technologies enabling remote diagnostics

- 3.2.1.4 Rising adoption of electric and hybrid vehicles requiring specialized maintenance

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment in advanced diagnostic tools and equipment

- 3.2.2.2 Shortage of skilled technicians trained in EVs and ADAS technologies

- 3.2.3 Market Opportunities

- 3.2.3.1 Development of AI-based predictive maintenance systems

- 3.2.3.2 Expansion of mobile platforms with smart diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Front fender panels

- 5.3 Fender liners

- 5.4 Rear fender panels

- 5.5 Wheel house panels

- 5.6 Inner fender panels

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Plastic

- 6.4 Aluminum

- 6.5 Composite

- 6.6 Carbon Fiber

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Sedans

- 7.2.2 Hatchbacks

- 7.2.3 SUV

- 7.3 Commercial Vehicles

- 7.3.1 Light Commercial Vehicles

- 7.3.2 Medium Commercial Vehicles

- 7.3.3 Heavy Commercial Vehicles

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Automotive part distributor and wholesaler

- 8.3 Fleet operators

- 8.4 Government and municipal bodies

- 8.5 Specialty vehicle manufacturers

- 8.6 DIY enthusiasts and hobbyists

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Aftermarket

- 9.3 OEM

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aisin Seiki

- 11.2 Dongfeng Liuzhou

- 11.3 Dongfeng Motor

- 11.4 Ficosa International

- 11.5 Flex-N-Gate

- 11.6 Gestamp Automocion

- 11.7 Hyundai Mobis

- 11.8 Inteva Products

- 11.9 Kostal

- 11.10 Lear Corporation

- 11.11 Magna International

- 11.12 Martinrea International

- 11.13 Plastic Omnium

- 11.14 Sanden

- 11.15 Siemens

- 11.16 Schaeffler

- 11.17 Toyoda Gosei

- 11.18 Toyota Boshoku

- 11.19 Valeo

- 11.20 Yazaki