|

市场调查报告书

商品编码

1773390

低程式码开发平台市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Low Code Development Platform Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

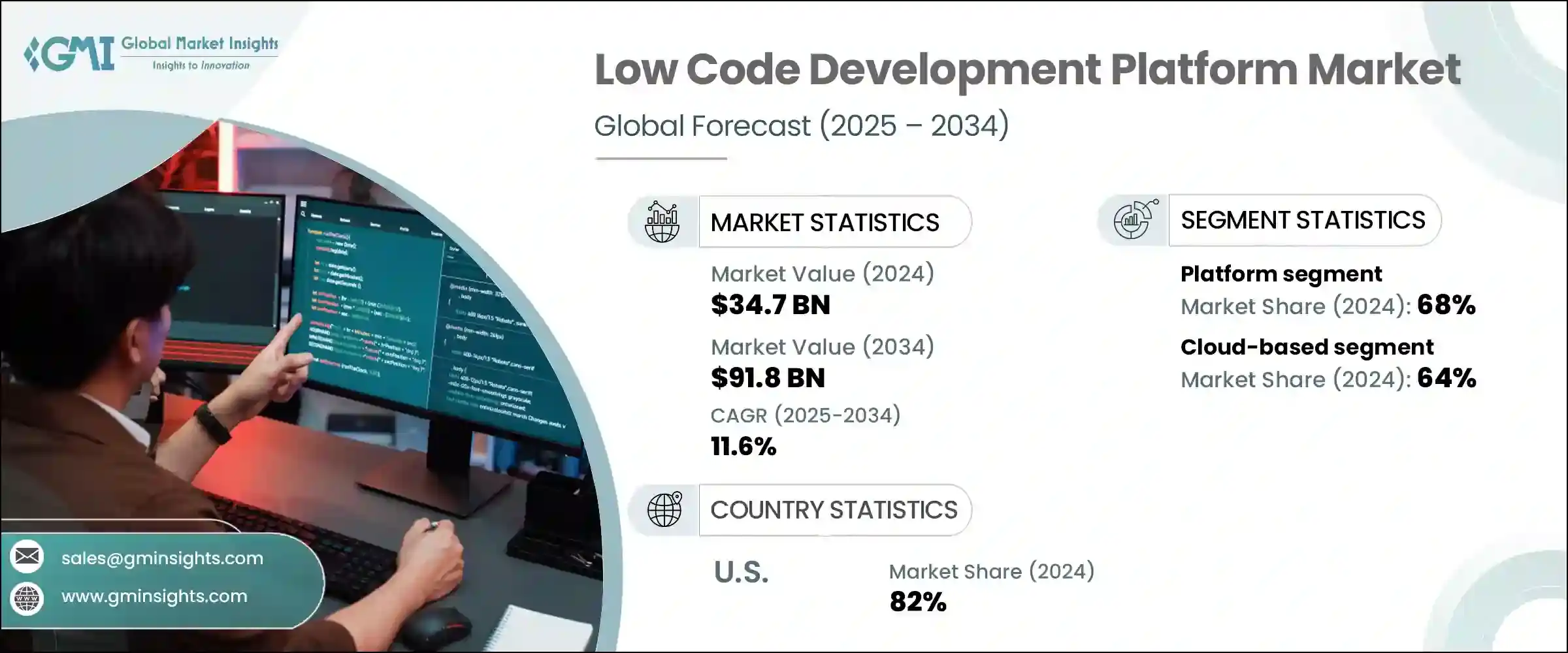

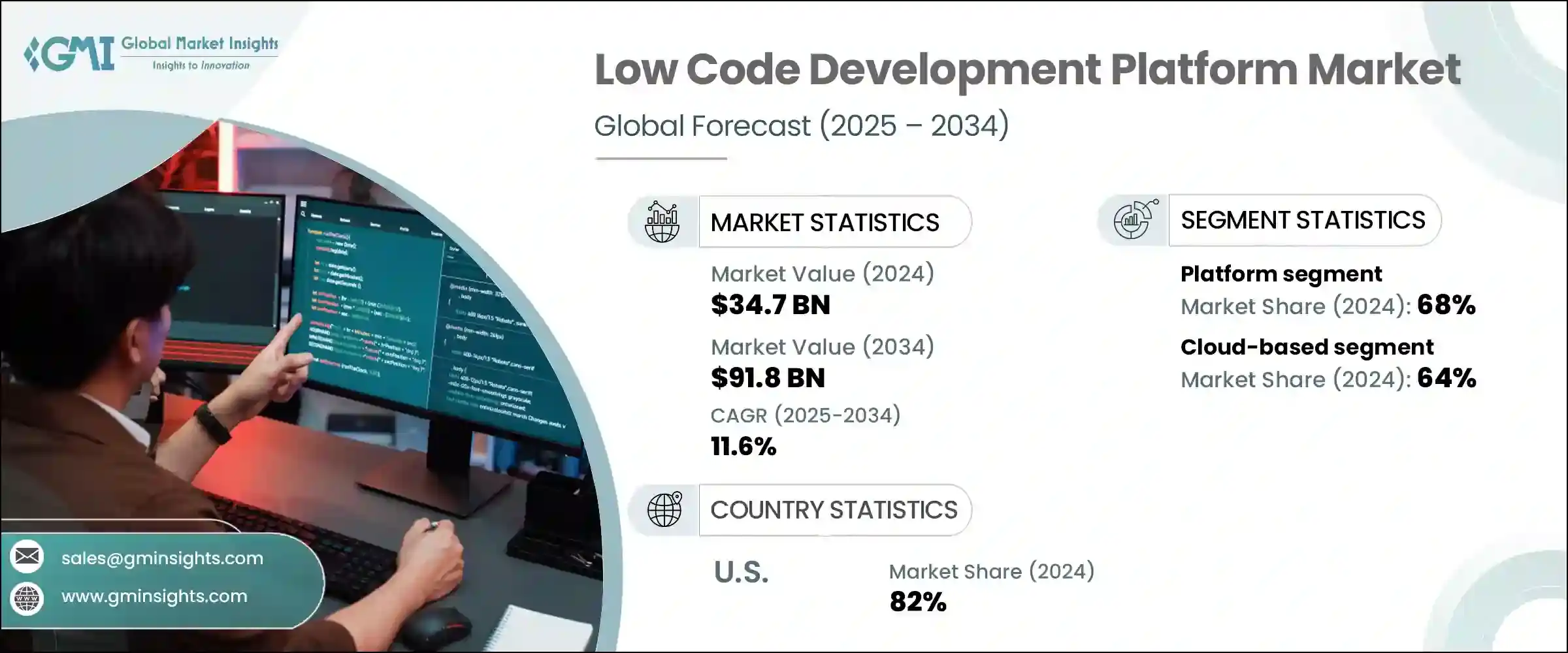

2024 年全球低程式码开发平台市场规模达 347 亿美元,预计到 2034 年将以 11.6% 的复合年增长率成长,达到 918 亿美元。这一增长反映了在快速发展的数位世界中,对快速软体部署日益增长的需求。随着企业加大对数位转型的关注,对能够以最少编码实现更快开发的工具的需求也日益增长。低程式码平台透过减少对手动程式设计的依赖、使用视觉化介面和拖放功能,提供了一种简化的开发路径。这简化了开发流程,加快了产品上市时间,降低了成本,并使新功能更快地惠及使用者。这些平台对于人力资源、供应链和客户服务等部门尤其重要,因为这些部门的适应性和速度至关重要。

低程式码工具赋能非技术使用者的能力也带来了颠覆性的改变。这些平台让IT部门以外的员工能够建立功能性应用程序,从而减轻软体团队的压力并提高组织的回应能力。在开发人员短缺、营运复杂性不断上升的时代,企业可以从允许公民开发者建立客製化工具中获益,这些工具可以提高效率并激发创新。在适当的培训和治理支援下,这些解决方案有助于将开发能力扩展到传统IT界限之外。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 347亿美元 |

| 预测值 | 918亿美元 |

| 复合年增长率 | 11.6% |

2024年,平台解决方案细分市场占据68%的市场份额,预计到2034年将以12%的复合年增长率成长。这些平台正在从基础开发环境发展成为整合介面设计、业务逻辑和部署功能的全端系统。这种整合使得从创意到功能性软体的快速发展成为可能,即使是低程式码使用者也能在极少的技术监督下建立可扩展的应用程式。提供全面、端到端解决方案的公司将继续引领市场。

基于云端的部署领域占据了 64% 的份额,预计到 2034 年将以 13% 的复合年增长率成长。云端原生低程式码平台透过根据需求自动调整运算资源来提供弹性,从而最大限度地降低延迟和成本,同时提升用户体验。这些系统减轻了基础设施管理的负担,并支援数位解决方案的无缝扩展。无伺服器执行和容器化等技术增加了另一层灵活性,使基于云端的低程式码系统成为动态全球化应用程式的理想选择。

美国低程式码开发平台市场占82%的市场份额,2024年市场规模达98亿美元。国内企业正优先考虑数位化创新,以提高营运效率、提升服务品质并保持竞争敏捷性。低程式码工具能够提供比传统开发更快、更具成本效益的替代方案,与这些策略完美契合。美国在将人工智慧和超自动化等新兴技术融入低程式码环境方面继续保持领先地位,进一步加速了企业采用低程式码技术的速度。

该行业的主要市场参与者包括 Zoho Corporation、微软、Appian Corporation、SAP SE、ServiceNow、甲骨文和 Salesforce。为了巩固其市场地位,领先的公司正专注于透过嵌入人工智慧和机器学习功能来持续增强平台,以提高自动化程度和使用者个人化。他们正在透过第三方整合和应用市场扩展其生态系统,以增强平台功能。云端原生产品仍然是重中之重,各公司正在优化基础架构以提高效能和可扩展性。此外,供应商正在投资教育和支援计划,以赋能公民开发者并扩大采用范围。策略性收购也被用于拓宽产品组合併加速上市策略,尤其是在特定垂直用例中。企业级安全和合规性支援日益集成,以吸引受监管行业。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 加速数位转型

- 对业务敏捷性的需求增加

- 云端运算需求不断成长

- 远距工作和协作日益增多

- 产业陷阱与挑战

- 安全和治理问题

- 客製化程度有限且应用复杂

- 市场机会

- 与人工智慧和自动化的集成

- 在特定行业应用中的使用日益增多

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 成本細項分析

- 软体开发和授权成本

- 部署和整合成本

- 维护和支援成本

- 网路安全与合规成本

- 培训和变更管理成本

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 平台

- 服务

- 咨询

- 整合与实施

- 支援与维护

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 基于网路

- 基于行动装置

- 桌面

- 资料库

第八章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第九章:市场估计与预测:依产业垂直,2021-2034

- 主要趋势

- 金融服务业

- 资讯科技和电信

- 政府与国防

- 卫生保健

- 零售与电子商务

- 製造业

- 能源与公用事业

- 教育

- 其他的

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 商业用户

- 开发者

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- AgilePoint

- Appian Corporation

- Betty Blocks

- Creatio

- DWKit

- Google Cloud

- Joget

- Kissflow

- LANSA

- Mendix

- Microsoft

- Nintex

- Oracle

- OutSystems

- Quick Base

- Salesforce

- SAP SE

- ServiceNow

- Zoho Corporation

The Global Low Code Development Platform Market was valued at USD 34.7 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 91.8 billion by 2034. This growth reflects the rising need for rapid software deployment in a fast-evolving digital world. As businesses intensify their focus on digital transformation, there's increasing demand for tools that allow for quicker development with minimal coding. Low-code platforms offer a streamlined path by reducing reliance on manual programming, using visual interfaces and drag-and-drop capabilities. This simplifies the development process, speeds up time to market, reduces costs, and allows new functionality to reach users more quickly. These platforms are especially vital in departments like HR, supply chain, and customer service, where adaptability and speed are critical.

The ability of low-code tools to empower non-technical users is also a game changer. These platforms let employees outside of IT build functional applications, relieving pressure on software teams and improving organizational responsiveness. In times of developer shortages and rising operational complexity, businesses benefit from allowing citizen developers to craft tailored tools that improve efficiency and spark innovation. When supported with appropriate training and governance, these solutions help scale development capacity beyond traditional IT boundaries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.7 Billion |

| Forecast Value | $91.8 Billion |

| CAGR | 11.6% |

In 2024, the platform solutions segment held 68% share and is expected to grow at a CAGR of 12% through 2034. These platforms are evolving beyond basic development environments into full-stack systems that integrate interface design, business logic, and deployment functions. This integration allows rapid progression from idea to functional software, helping even low-code users build scalable applications with minimal technical oversight. Companies that offer comprehensive, end-to-end solutions continue to lead the market.

Cloud-based deployment segment held a 64% share and is forecasted to grow at a CAGR of 13% through 2034. Cloud-native low-code platforms offer elasticity by automatically adjusting compute resources based on demand, which minimizes latency and costs while improving user experience. These systems remove the burden of infrastructure management and support seamless scaling for digital solutions. Technologies like serverless execution and containerization add another layer of flexibility, making cloud-based low-code systems ideal for dynamic, global applications.

U.S. Low Code Development Platform Market held an 82% share and generated USD 9.8 billion in 2024. Domestic firms are prioritizing digital innovation to boost operational efficiency, elevate service quality, and maintain competitive agility. Low-code tools fit well into these strategies by offering faster, more cost-effective alternatives to traditional development. The country continues to lead in the integration of emerging technologies like artificial intelligence and hyper-automation into low-code environments, further accelerating enterprise adoption.

Key market players in this industry include Zoho Corporation, Microsoft, Appian Corporation, SAP SE, ServiceNow, Oracle, and Salesforce. To strengthen their presence in the market, leading companies are focusing on continuous platform enhancements by embedding AI and machine learning capabilities to improve automation and user personalization. They're expanding their ecosystem through third-party integrations and app marketplaces to increase platform functionality. Cloud-native offerings remain a central priority, with firms optimizing infrastructure for performance and scalability. Additionally, vendors are investing in education and support programs to empower citizen developers and expand adoption. Strategic acquisitions are also being used to broaden product portfolios and accelerate go-to-market strategies, particularly across vertical-specific use cases. Enterprise-grade security and compliance support are increasingly integrated to attract regulated industries.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Application

- 2.2.5 Enterprise Size

- 2.2.6 Industry Vertical

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Accelerated digital transformation

- 3.2.1.2 Increased demand for business agility

- 3.2.1.3 Rising demand for cloud computing

- 3.2.1.4 Rising remote work and collaboration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Security and governance concern

- 3.2.2.2 Limited customization and complex applications

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI and automation

- 3.2.3.2 Growing use in industry specific application

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Platform

- 5.3 Services

- 5.3.1 Consulting

- 5.3.2 Integration & implementation

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Web-based

- 7.3 Mobile-based

- 7.4 Desktop

- 7.5 Database

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large Enterprises

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021- 2034 (USD Million)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT & Telecom

- 9.4 Government & Defense

- 9.5 Healthcare

- 9.6 Retail & E-commerce

- 9.7 Manufacturing

- 9.8 Energy & utilities

- 9.9 Education

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021- 2034 (USD Million)

- 10.1 Key trends

- 10.2 Business user

- 10.3 Developers

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AgilePoint

- 12.2 Appian Corporation

- 12.3 Betty Blocks

- 12.4 Creatio

- 12.5 DWKit

- 12.6 Google Cloud

- 12.7 Joget

- 12.8 Kissflow

- 12.9 LANSA

- 12.10 Mendix

- 12.11 Microsoft

- 12.12 Nintex

- 12.13 Oracle

- 12.14 OutSystems

- 12.15 Quick Base

- 12.16 Salesforce

- 12.17 SAP SE

- 12.18 ServiceNow

- 12.19 Zoho Corporation