|

市场调查报告书

商品编码

1773396

系留无人机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tethered Drone Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

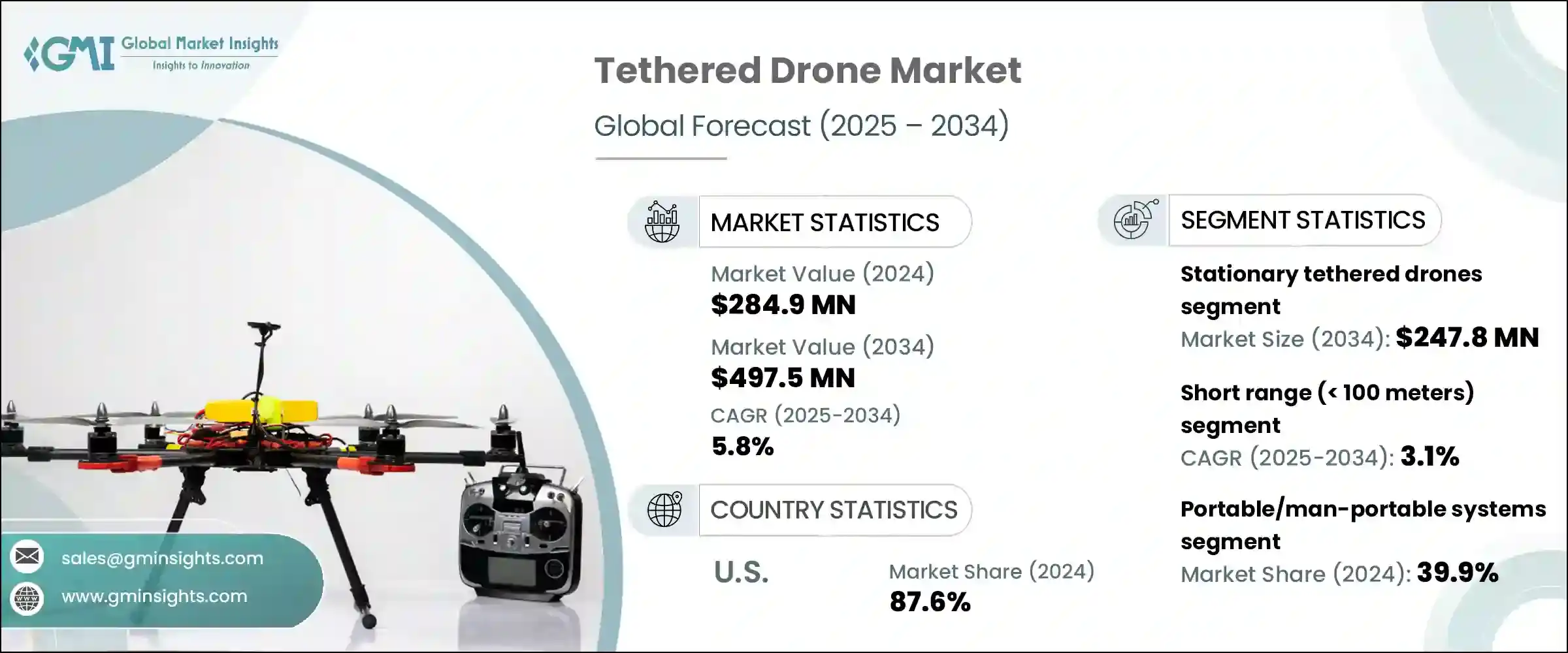

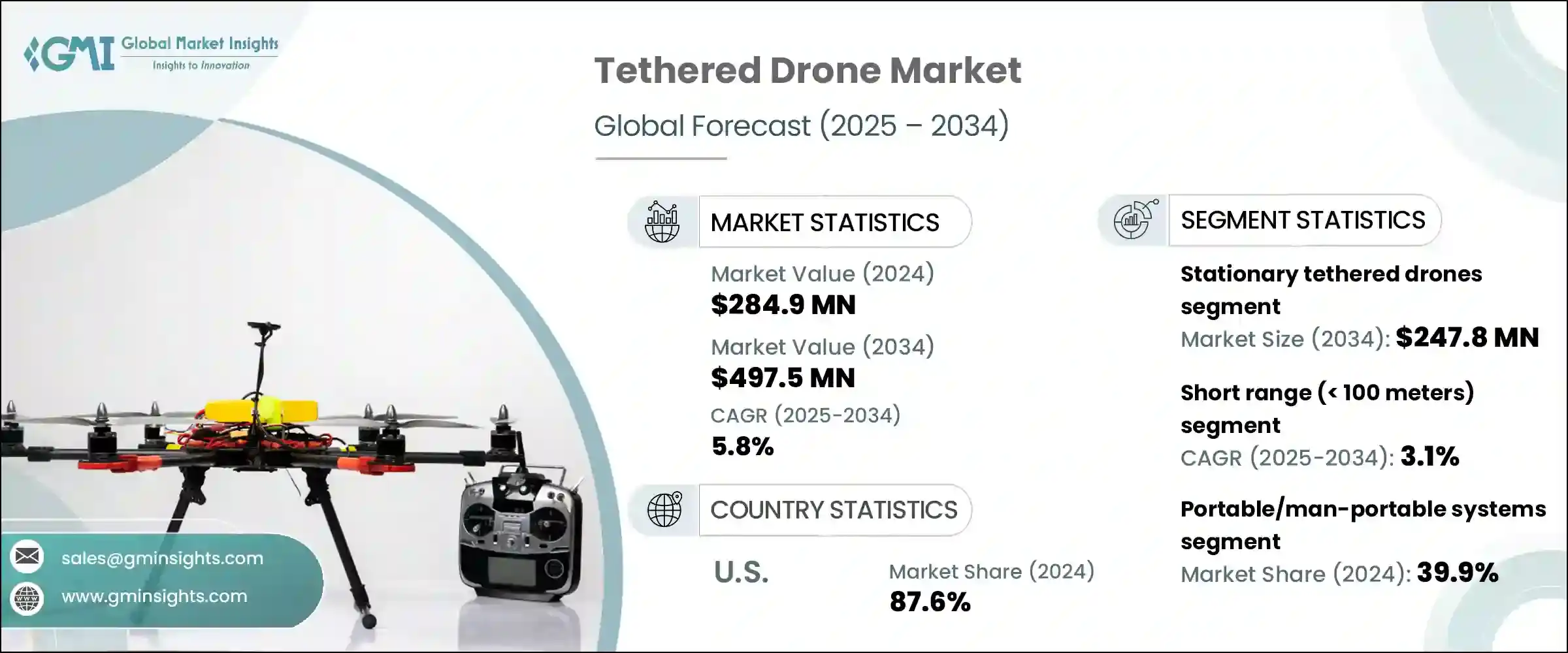

2024年,全球系留无人机市场规模达2.849亿美元,预计到2034年将以5.8%的复合年增长率成长,达到4.975亿美元。这一增长主要得益于系留无人机在国防、国土安全和监视行动的广泛应用。世界各地的安全部队越来越多地采用系留系统,因为它们能够支援持续的空中观察和战术通讯。由于其持续飞行能力和即时资料传输能力,这些无人机是关键任务行动的首选。政府对国家安全和基础设施保护的大量投资,并继续在推动各地区需求方面发挥核心作用。

贸易政策变化,例如美国对进口电子元件征收关税,对无人机製造供应链产生了重大影响。这些限制扰乱了感测器和通讯模组等必需品的流通,延误了研究,阻碍了创新,并限制了小型科技驱动型企业在太空领域的发展。这导致研发支出暂时下降,并影响了整个系留无人机领域的商业化进程,减缓了创新週期,并推迟了下一代系统的推出。小型企业面临预算限制,导致原型设计、测试阶段和产品发布中断。因此,许多公司不得不重新评估其生产策略,寻找关键零件的替代来源,并应对供应链中断,最终阻碍了市场扩张和技术进步的步伐。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.849亿美元 |

| 预测值 | 4.975亿美元 |

| 复合年增长率 | 5.8% |

混合系留无人机细分市场预计到2034年将以8.1%的复合年增长率成长。它们具备系留和非系留两种操作模式,使其能够灵活应用于各种国防和紧急情况。这些无人机兼具强大的续航力和机动性,非常适合需要快速部署且不影响使用寿命的任务。自动繫留和能源管理系统的突破也推动了其在陆、海、空等复杂作战环境的应用。

短距离(< 100 公尺)市场预计在 2025-2034 年期间以 3.1% 的复合年增长率成长。其易于部署和紧凑的外形使其在城市监控、事件管理和关键基础设施监控方面极具吸引力。由于其机动性和便利性,这些系统在地方执法、紧急服务和安全检查中得到了广泛的应用。

2024年,美国系留无人机市场占了87.6%的市场。军事和国土安全应用领域投资的不断增长推动了美国的发展,尤其是在长期监视、边境管控和灾害应变等领域。国内技术供应商的领先地位,加上联邦政府强有力的采购计划,继续巩固了美国在先进系留无人机系统领域的地位。

活跃于全球市场的知名企业包括 Fotokite、FlyFocus、Bharat Electronics、Easy Aerial、Elistair、Acecore Technologies 和 Aerial IQ。为了巩固市场地位,繫留无人机产业的公司正在推动围绕能源效率、自主系留和人工智慧追踪系统的研发工作。许多公司正在实现产品线多元化,包括能够在系留和非系留模式之间切换的混合系统。与国防机构和国土安全机构的合作在获得高价值合约方面发挥关键作用。各公司也专注于有效载荷的小型化和模组化无人机架构,以适应各种任务配置。一些供应商正在透过与当地製造能力相结合并利用政府对国防技术本地化的激励措施进行全球扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 空中监控解决方案的监管支持

- 在国防和国土安全领域的应用日益广泛

- 工业基础设施监控需求的扩大

- 增加灾害管理和紧急应变部署

- 智慧城市和公共安全计画的投资不断增加

- 产业陷阱与挑战

- 机动性和作战范围有限

- 对地面电源的依赖

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- 固定式繫留无人机

- 移动系留无人机

- 混合系留无人机

第六章:市场估计与预测:依范围,2021-2034

- 主要趋势

- 短距离(<100公尺)

- 中距离(100 – 300公尺)

- 远距离(> 300公尺)

第七章:市场估计与预测:依部署模式,2021-2034

- 主要趋势

- 手提/单兵携带系统

- 车载系统

- 固定地面站系统

- 海上

第八章:市场估计与预测:依技术整合,2021-2034 年

- 主要趋势

- 支持人工智慧的系留无人机

- 电脑视觉增强系统

- 自动启动和恢復

- 即时边缘运算系统

- 加密通讯和网路安全功能

- 其他的

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 国防和安全

- 边境监视

- 军事通信

- 战术行动

- 其他的

- 公共安全与紧急应变

- 回覆

- 灾害监测

- 消防支援

- 人群监控

- 其他的

- 商业和工业

- 基础设施和资产检查

- 广播和媒体报道

- 休閒娱乐

- 其他的

- 环境监测

- 空气品质测量

- 野生动物观察

- 自然灾害评估

- 其他的

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Acecore Technologies

- Aerial IQ

- Bharat Electronics

- Easy Aerial

- Elistair

- FlyFocus

- Fotokite

- Hoverfly Technologies

- Maverick Drones and Technologies

- Menet Aero

- Mistral Solutions

- Spooky Action

- Teledyne FLIR

- Unmanned Systems and Solutions

- Volarious

- Yuneec International

- Zenith Aerotech

The Global Tethered Drone Market was valued at USD 284.9 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 497.5 million by 2034. This rise is fueled by the expanding use of tethered drones in defense, homeland security, and surveillance operations. Security forces worldwide are increasingly turning to tethered systems for their ability to support persistent aerial observation and tactical communication. These drones are preferred for mission-critical operations due to their continuous flight capabilities and real-time data transfer. Substantial government investment in national security and infrastructure protection continues to play a central role in boosting demand across regions.

Trade policy shifts, such as the US-imposed tariffs on imported electronic components, significantly impacted the drone manufacturing supply chain. These restrictions disrupted the flow of essential items like sensors and communications modules, delaying research, stalling innovation, and constraining smaller tech-driven firms in space. This led to a temporary dip in R&D spending and affected commercialization efforts across the tethered drone landscape, slowing innovation cycles and delaying the rollout of next-generation systems. Smaller firms faced budgetary constraints that disrupted prototyping, testing phases, and product launches. As a result, many companies had to reassess their production strategies, seek alternative sourcing for key components, and navigate supply chain disruptions that ultimately hindered the pace of market expansion and technological progress.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $284.9 Million |

| Forecast Value | $497.5 Million |

| CAGR | 5.8% |

Hybrid tethered drones segment a projected to grow at a CAGR of 8.1% through 2034. Their dual capability to operate both in tethered and untethered modes makes them versatile for a range of defense and emergency scenarios. These drones provide a strong mix of endurance and mobility, ideal for missions that require rapid deployment without compromising on operational longevity. Breakthroughs in automated tethering and energy management systems are also fueling adoption in complex operational environments that span land, sea, and air domains.

Short range ( < 100 meters) segment is projected to grow at a CAGR of 3.1% during 2025-2034. Their ease of deployment and compact form factor make them highly attractive for urban surveillance, event management, and critical infrastructure monitoring. These systems are becoming widely used in local law enforcement, emergency services, and safety inspections due to their maneuverability and convenience.

United States Tethered Drone Market held an 87.6% share in 2024. Rising investments in military and homeland security applications have pushed the country ahead, especially in areas focused on long-duration surveillance, border control, and disaster response. The leadership of domestic technology providers, combined with strong federal procurement initiatives, continues to reinforce the country's position in the advanced tethered unmanned systems sector.

Notable players active in the global market include Fotokite, FlyFocus, Bharat Electronics, Easy Aerial, Elistair, Acecore Technologies, and Aerial IQ. To strengthen market positioning, companies in the tethered drone industry are advancing their R&D efforts around energy efficiency, autonomous tethering, and AI-powered tracking systems. Many are diversifying product lines to include hybrid systems capable of switching between tethered and untethered modes. Partnerships with defense agencies and homeland security bodies play a key role in securing high-value contracts. Firms are also focusing on miniaturization of payloads and modular drone architecture to adapt to a variety of mission profiles. Several vendors are expanding globally by aligning with local manufacturing capabilities and leveraging government incentives for defense tech localization.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Regulatory support for aerial monitoring solutions

- 3.3.1.2 Growing adoption in defense and homeland security

- 3.3.1.3 Expansion of industrial infrastructure monitoring needs

- 3.3.1.4 Increased deployment for disaster management and emergency response

- 3.3.1.5 Growing investments in smart city and public safety initiatives

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited mobility and operational range

- 3.3.2.2 Dependence on ground power sources

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Stationary tethered drones

- 5.3 Mobile tethered drones

- 5.4 Hybrid tethered drones

Chapter 6 Market Estimates & Forecast, By Range, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Short-range (< 100 meters)

- 6.3 Mid- range (100 – 300 meters)

- 6.4 Long- range (> 300 meters)

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Portable/man-portable systems

- 7.3 Vehicle-mounted systems

- 7.4 Fixed ground station-based systems

- 7.5 Maritime

Chapter 8 Market Estimates & Forecast, By Technology Integration, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 AI-enabled tethered drones

- 8.3 Computer vision-enhanced systems

- 8.4 Automated launch & recovery

- 8.5 Real-time edge computing systems

- 8.6 Encrypted communication & cybersecurity features

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Defense & security

- 9.2.1 Border surveillance

- 9.2.2 Military communications

- 9.2.3 Tactical operations

- 9.2.4 Others

- 9.3 Public safety & emergency response

- 9.3.1 Response

- 9.3.2 Disaster monitoring

- 9.3.3 Firefighting support

- 9.3.4 Crowd monitoring

- 9.3.5 Others

- 9.4 Commercial & industrial

- 9.4.1 Infrastructure & asset inspection

- 9.4.2 Broadcasting and media coverage

- 9.4.3 Recreational

- 9.4.4 Others

- 9.5 Environmental monitoring

- 9.5.1 Air quality measurement

- 9.5.2 Wildlife observation

- 9.5.3 Natural disaster assessment

- 9.5.4 Others

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Acecore Technologies

- 11.2 Aerial IQ

- 11.3 Bharat Electronics

- 11.4 Easy Aerial

- 11.5 Elistair

- 11.6 FlyFocus

- 11.7 Fotokite

- 11.8 Hoverfly Technologies

- 11.9 Maverick Drones and Technologies

- 11.10 Menet Aero

- 11.11 Mistral Solutions

- 11.12 Spooky Action

- 11.13 Teledyne FLIR

- 11.14 Unmanned Systems and Solutions

- 11.15 Volarious

- 11.16 Yuneec International

- 11.17 Zenith Aerotech