|

市场调查报告书

商品编码

1773399

商用车柴油引擎排气门市场机会、成长动力、产业趋势分析及2025-2034年预测Commercial Vehicle Diesel Engine Exhaust Valve Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

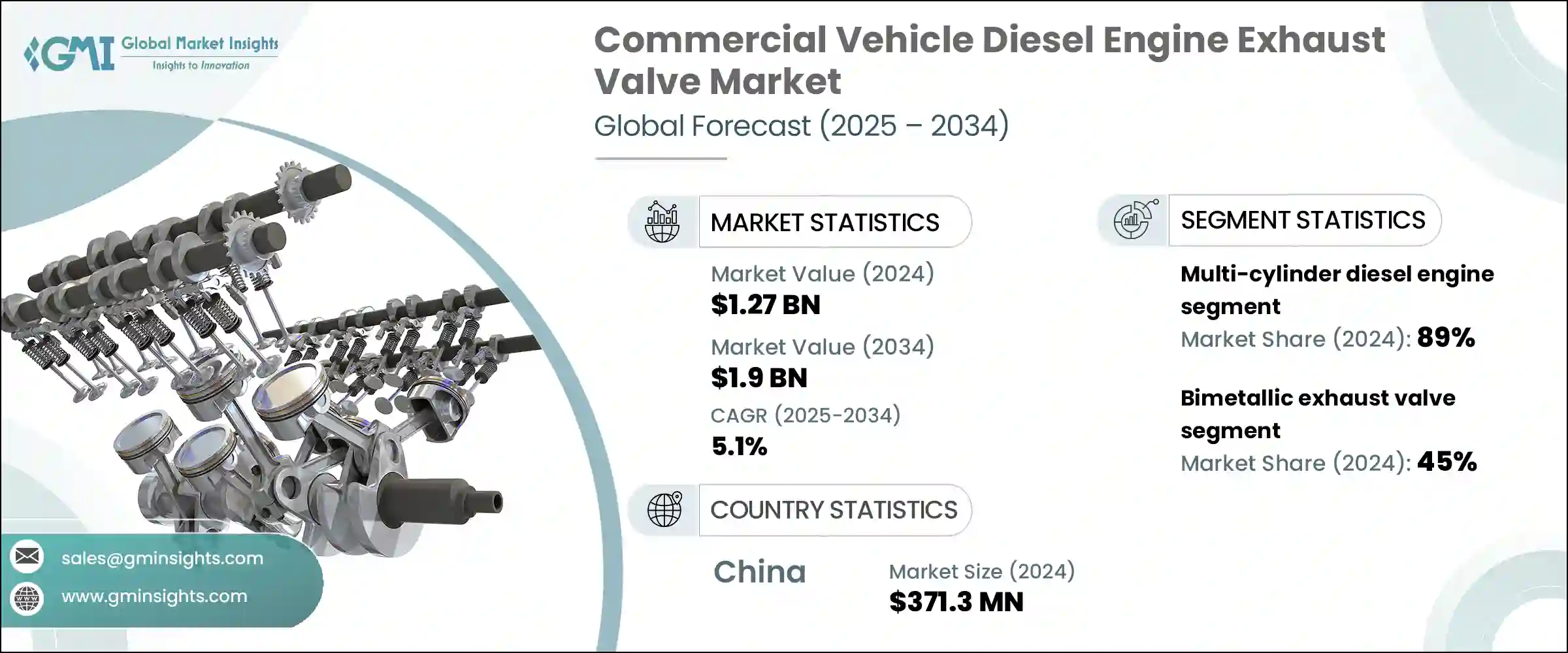

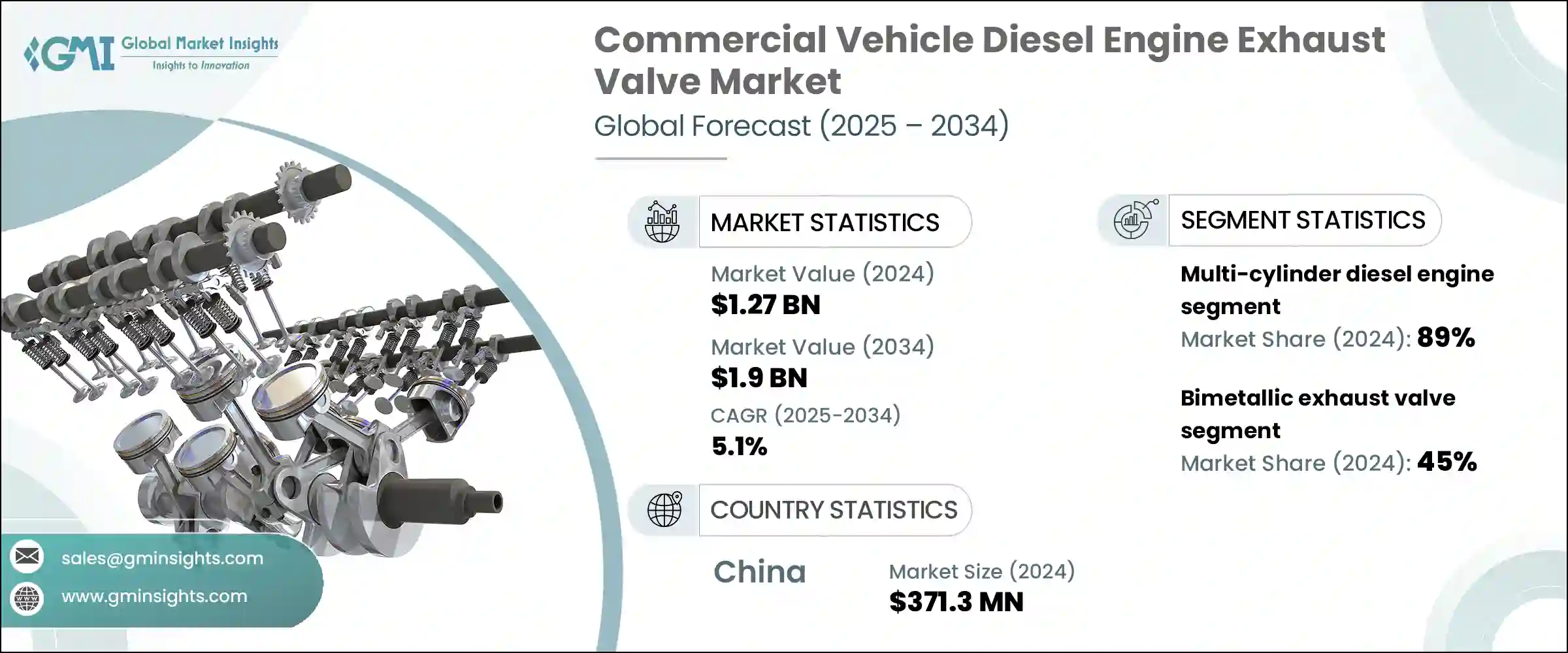

2024 年全球商用车柴油引擎排气门市场价值为 12.7 亿美元,预计到 2034 年将以 5.1% 的复合年增长率成长,达到 19 亿美元。商用车製造业的稳定成长和柴油引擎使用寿命的延长是推动该市场成长的两个最重要因素。柴油卡车和巴士仍然是货运和建筑作业的基石,排气门对于保持高效的引擎性能和排放合规性至关重要。由于这些车辆承受着巨大的运行负荷,坚固的排气门系统对于确保长期耐用性、减少引擎磨损和遵守监管标准至关重要。随着排放法规的日益严格以及正常运行时间变得比以往任何时候都更加重要,原始设备製造商 (OEM) 和车队运营商正在转向技术先进的耐热阀门解决方案,以满足不断变化的需求。

全球商用车产量的快速成长是推动该市场扩张的关键因素之一。从送货卡车到建筑设备,北美、亚洲和欧洲部分地区的原始设备製造商 (OEM) 都在增加产量,以满足不断增长的物流需求。这些车辆依赖能够承受长距离高工作温度、压力循环和机械应力的排气阀。製造商目前正致力于开发高耐用性的排气阀组件,采用先进的材料和设计技术,以最大限度地降低故障率并提高整体系统效率。可靠的排气阀性能与柴油引擎的健康状况直接相关,进而影响停机时间、油耗和排放。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12.7亿美元 |

| 预测值 | 19亿美元 |

| 复合年增长率 | 5.1% |

2024年,多缸柴油引擎市场占了89%的市场份额,预计2025年至2034年的复合年增长率为5.2%。多缸引擎在该领域占据主导地位,因为它们在中型和重型商用车中应用广泛,而这些车辆对耐用性、持续的动力输出和引擎平衡至关重要。这些引擎的设计旨在应对长时间运行和多变的地形条件,其性能在很大程度上取决于精确的排气门回馈机制。适当的气门控制有助于维持燃烧效率,改善排放状况,并降低机械故障风险。这些成果对于开发下一代卡车的原始设备製造商(OEM)和管理数千辆车辆性能的车队营运商都至关重要。

双金属排气阀市场在2024年占据45%的市场份额,预计在2025-2034年期间的复合年增长率为6.7%。这些阀门采用两种不同的金属——通常为耐热合金製造阀头,耐腐蚀钢製造阀桿——以平衡成本效益和耐用性。它们特别适用于商用柴油发动机,因为它们能够承受高温和腐蚀性化学物质的侵蚀,且不会影响结构强度。双金属阀门具有卓越的抗氧化性能和导热性,并在高强度工作条件下支援更长的引擎循环。对于注重营运效率和最大程度减少计画外维护的车队来说,这些阀门兼具性能和使用寿命。

2024年,中国商用车柴油引擎排气门市场规模达3.713亿美元,占57%。中国在该地区的主导地位源于其庞大的商用车队规模、严格的柴油引擎排放标准执行以及数位技术在动力总成系统中的日益融合。领先的中国主机厂正在将感测器驱动的排气门嵌入柴油机平台,以促进预测性维护、减少排放并在高产量营运中保持合规性。这些技术还能实现更精准的诊断,并支持更清洁的燃烧过程。商用运输基础设施的持续发展和监管执法进一步扩大了该市场的需求。

全球商用车柴油引擎排气阀市场的主要参与者包括日立、大陆集团、电装株式会社、伊顿公司、克诺尔煞车股份有限公司、马勒集团和中国重汽引擎气门。这些公司正在采取各种方法来巩固其市场地位并适应不断变化的行业需求。为了扩大市场占有率,该领域的领先公司正在大力投资研发,使用先进的合金和涂层技术设计高效能排气阀。他们还与主要原始设备製造商签订了长期供应合同,以确保在全球市场上保持稳定的销售。一个关键的策略重点包括在关键需求区域附近建立在地化生产设施,以实现更快的交付和更高的成本效益。此外,参与者正在透过数位和感测器整合阀门系统增强产品组合,以满足日益增长的预测性维护和排放监测需求。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率分析

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 商用车产量上升

- 柴油车寿命延长

- 阀门材料的技术进步

- 货运及物流业的扩张

- 产业陷阱与挑战

- 转向电动和替代燃料汽车

- 先进阀门材料成本高

- 市场机会

- 老旧车队售后市场的扩张

- 非公路用车需求激增

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 成本細項分析

- 软体开发和授权成本

- 部署和整合成本

- 维护和支援成本

- 网路安全与合规成本

- 培训和变更管理成本

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

- 用例

- 最佳情况

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按引擎,2021 - 2034 年

- 主要趋势

- 单缸柴油机

- 多缸柴油发动机

第六章:市场估计与预测:Valve,2021 - 2034

- 主要趋势

- 单金属排气阀

- 双金属排气阀

- 空心桿阀

- 充钠阀

第七章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 钢

- 钛

- 镍基合金

- 其他高温合金

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 运输与物流

- 建筑和采矿

- 农业

- 大众运输

- 紧急救援和公用事业服务

- 军事与国防

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧人

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Anhui Yuxi Industrial

- AVR Valves

- Continental AG

- Delphi Automotive AG

- Denso Corporation

- Eaton Corporation

- Federal-Mogul Holding Corp

- FTE Automotive

- FUJI OOZX

- Hitachi

- Knorr-Bremse

- Mahle Group

- MS Motorservice International

- Nanjing Shengpai Auto Parts

- Riken Corporation

- Shijiazhuang Advanced Valve

- Sinotruck Engine Valve

- Tenneco

- TRW Automotive

- Wuxi Volex Auto Parts

The Global Commercial Vehicle Diesel Engine Exhaust Valve Market was valued at USD 1.27 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.9 billion by 2034. The steady rise in commercial vehicle manufacturing and extended diesel engine lifespans are two of the most significant factors driving this market's growth. Diesel-powered trucks and buses remain the cornerstone of freight and construction operations, and exhaust valves are critical for maintaining efficient engine performance and emissions compliance. As these vehicles endure intense operational loads, robust exhaust valve systems are essential to ensure long-term durability, reduce engine wear, and uphold regulatory standards. With emission regulations tightening and uptime becoming more critical than ever, OEMs and fleet operators are turning to technologically advanced, heat-resistant valve solutions to meet evolving demands.

One of the key forces behind this market's expansion is the rapid increase in production of commercial vehicles globally. From delivery trucks to construction equipment, OEMs across North America, Asia, and parts of Europe are ramping up output to keep pace with rising logistics demand. These vehicles rely on exhaust valves that can withstand intense operating temperatures, pressure cycles, and mechanical stress over long distances. Manufacturers are now focused on developing high-durability valve components using advanced materials and design techniques that minimize failure rates and boost overall system efficiency. Dependable exhaust valve performance is directly tied to diesel engine health, which in turn affects downtime, fuel consumption, and emission output.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.27 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 5.1% |

In 2024, the multi-cylinder diesel engines segment accounted for 89% share and is forecast to grow at a CAGR of 5.2% from 2025 through 2034. Multi-cylinder engines dominate this space due to their prominent use in medium and heavy commercial vehicles, where durability, consistent power delivery, and engine balance are essential. These engines are built to manage extended operating hours and variable terrain conditions, and their performance heavily depends on precise exhaust valve feedback mechanisms. Proper valve control helps maintain combustion efficiency, improve emissions profiles, and reduce the risk of mechanical failure. These outcomes are vital for both OEMs developing next-gen trucks and fleet operators managing performance across thousands of vehicles.

The bimetallic exhaust valves segment held a 45% share in 2024 and is projected to register a CAGR of 6.7% during 2025-2034. These valves use two different metals-typically a heat-resistant alloy for the valve head and corrosion-resistant steel for the stem-to balance cost-efficiency and durability. They are especially suitable for commercial diesel engines due to their ability to endure both high temperatures and aggressive chemical exposure without compromising structural strength. Bimetallic valves offer superior resistance to oxidation, enable better thermal conductivity, and support prolonged engine cycles in the face of intensive work conditions. For fleets that prioritize operational efficiency and minimal unplanned maintenance, these valves deliver both performance and longevity.

China Commercial Vehicle Diesel Engine Exhaust Valve Market generated USD 371.3 million in 2024, representing a 57% share. China's dominance in the regional landscape stems from its massive commercial fleet, the enforcement of strict diesel emission standards, and the increased integration of digital technologies within powertrains. Leading Chinese OEMs are embedding sensor-enabled exhaust valves into diesel platforms to facilitate predictive maintenance, reduce emissions, and maintain compliance across high-volume operations. These technologies also enable better diagnostics and support cleaner combustion processes. The ongoing development of commercial transport infrastructure and regulatory enforcement further amplifies demand in this market.

Key players in the Global Commercial Vehicle Diesel Engine Exhaust Valve Market include Hitachi, Continental, Denso Corporation, Eaton Corporation, Knorr-Bremse AG, Mahle Group, and Sinotruck Engine Valve. These companies are adopting diverse approaches to strengthen their market position and adapt to evolving industry needs. To expand their market footprint, leading companies in this sector are investing heavily in R&D to engineer high-efficiency exhaust valves using advanced alloys and coating technologies. They are also forming long-term supply contracts with major OEMs to ensure consistent volume sales across global markets. A key strategic focus includes localizing production facilities near key demand zones, which allows for faster delivery and cost efficiency. Additionally, players are enhancing product portfolios with digital and sensor-integrated valve systems to meet the rising demand for predictive maintenance and emission monitoring.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Engine

- 2.2.3 Valve

- 2.2.4 Material Type

- 2.2.5 Sales Channel

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising commercial vehicle production

- 3.2.1.2 Growing diesel vehicle lifespan

- 3.2.1.3 Technological advancements in valve materials

- 3.2.1.4 Expansion of freight & logistics industry

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Shift toward electric and alternative fuel vehicles

- 3.2.2.2 High cost of advanced valve materials

- 3.2.3 Market opportunities

- 3.2.3.1 Aftermarket expansion in aging vehicle fleets

- 3.2.3.2 Surge in off-highway vehicle demand

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Single cylinder diesel engine

- 5.3 Multi-cylinder diesel engine

Chapter 6 Market Estimates & Forecast, By Valve, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Mono-metallic exhaust valve

- 6.3 Bimetallic exhaust valve

- 6.4 Hollow stem valve

- 6.5 Sodium-filled valve

Chapter 7 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Titanium

- 7.4 Nickel-based alloys

- 7.5 Other high-temperature alloys

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Transportation & logistics

- 9.3 Construction & mining

- 9.4 Agriculture

- 9.5 Public transportation

- 9.6 Emergency & utility services

- 9.7 Military & defense

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Anhui Yuxi Industrial

- 11.2 AVR Valves

- 11.3 Continental AG

- 11.4 Delphi Automotive AG

- 11.5 Denso Corporation

- 11.6 Eaton Corporation

- 11.7 Federal-Mogul Holding Corp

- 11.8 FTE Automotive

- 11.9 FUJI OOZX

- 11.10 Hitachi

- 11.11 Knorr-Bremse

- 11.12 Mahle Group

- 11.13 MS Motorservice International

- 11.14 Nanjing Shengpai Auto Parts

- 11.15 Riken Corporation

- 11.16 Shijiazhuang Advanced Valve

- 11.17 Sinotruck Engine Valve

- 11.18 Tenneco

- 11.19 TRW Automotive

- 11.20 Wuxi Volex Auto Parts