|

市场调查报告书

商品编码

1773403

手术缝合线市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Surgical Sutures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

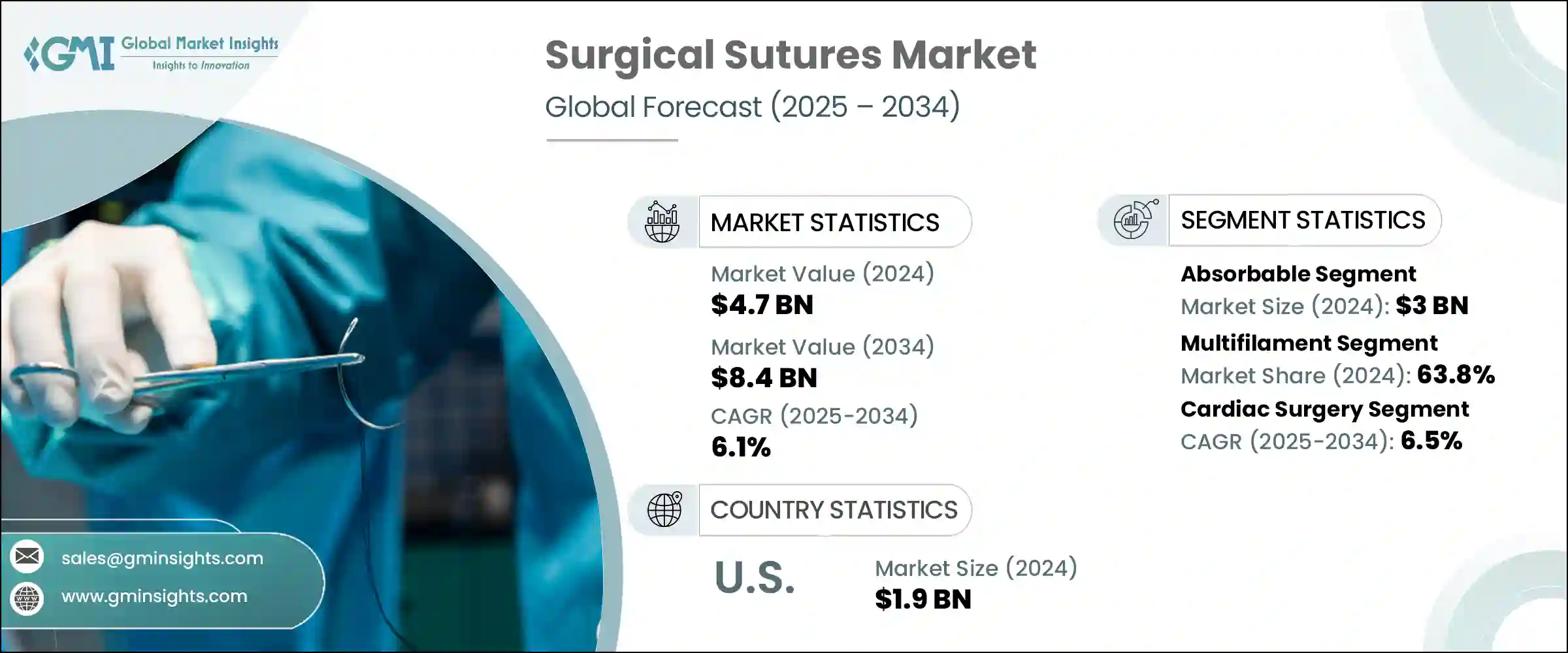

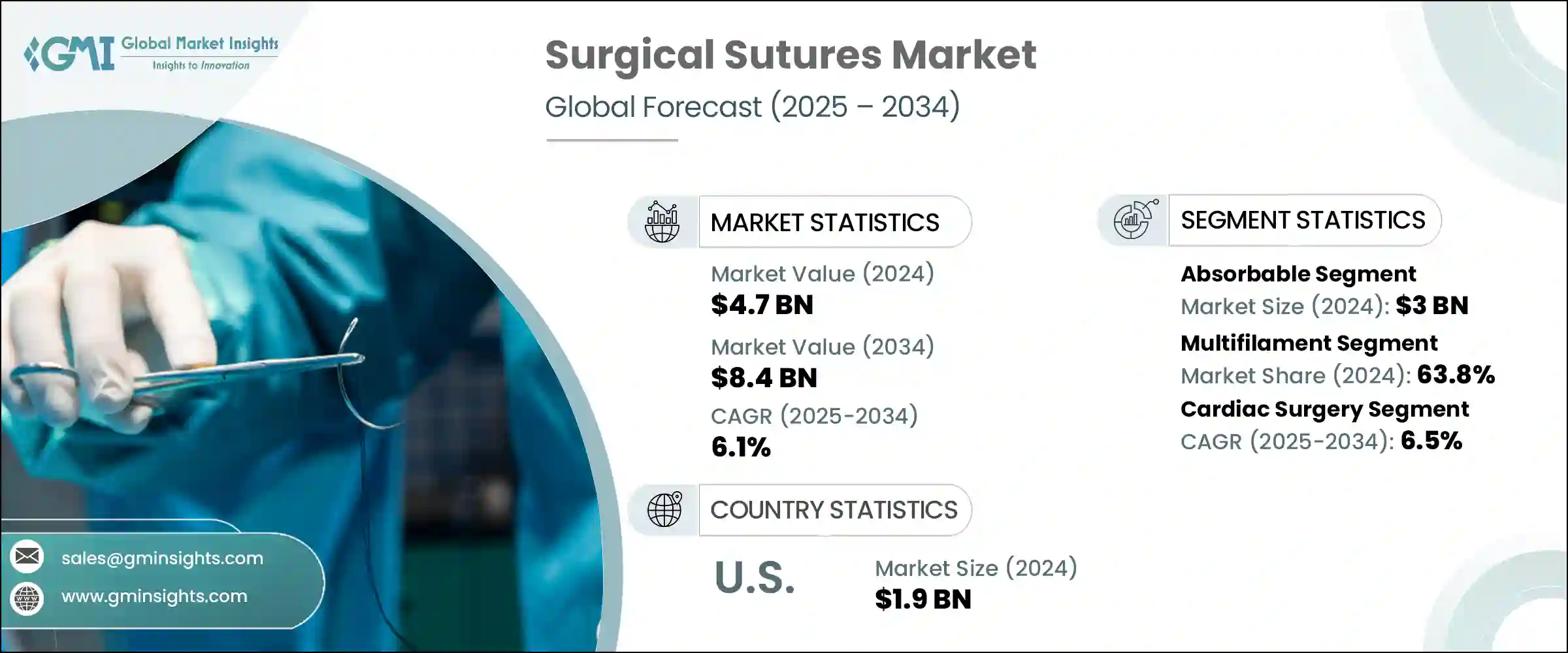

2024年,全球外科缝合线市场规模达47亿美元,预计2034年将以6.1%的复合年增长率成长,达到84亿美元。市场成长的动力源自于老龄人口的成长以及与老化相关的手术数量的增加,例如骨科和腹部手术。随着糖尿病、心血管疾病和肥胖等慢性疾病在全球持续攀升,外科手术的需求也随之增长,这直接刺激了缝线的需求。新一代手术工具的出现,加上微创手术的日益流行,正在加速该行业的创新。

合成可吸收材料的进步也正在改变伤口管理实践。医院和外科中心正在扩大其基础设施,以支持不断增长的手术量,从而进一步促进了采购。越来越多的医护人员采用涂层缝线来降低感染风险,这反映出人们更广泛地转向感染控制和加速癒合速度。传统和现代缝线在外科专业领域的需求都在不断增长,这为市场持续的长期成长奠定了基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 47亿美元 |

| 预测值 | 84亿美元 |

| 复合年增长率 | 6.1% |

2024年,可吸收缝线市场规模达30亿美元。其受欢迎程度源自于其能够在体内组织内自然降解,无需物理性拔除。这项特性提升了患者的舒适度,并缩短了术后护理时间,尤其是在无法拆线的内部手术中。由于可吸收缝合线感染风险更低且生物相容性更好,外科医生在软组织手术和儿科手术中越来越倾向于使用可吸收缝合线。此外,人们对微创治疗的认识不断提高,以及需要手术治疗的慢性疾病负担日益加重,也推动了该市场的发展动能。这些因素共同推动了医院采购策略向可吸收、可生物降解缝线的转变。

2024年,复丝缝合线市场占有63.8%的份额。这些缝合线由编织或绞线组成,具有卓越的抗拉强度、良好的结扎安全性和柔韧性——这些关键特性使其成为需要可靠缝合的手术的理想选择。其结构使其在复杂的手术中能够实现更精确的控制和轻鬆的操作,这对于涉及肌肉、胃肠道组织或生殖器官的手术至关重要。复丝缝合线因其能够有效固定伤口并在压力下防止断裂的能力,广泛应用于一般外科、骨科、妇科和胃肠道手术。

2024年,美国外科缝线市场产值达19亿美元。这一增长得益于美国先进的医疗基础设施、人口老化以及高手术量。美敦力、爱惜康(强生公司)和泰利福等全球领导企业的市场影响力,确保医院和外科中心能够及时获得创新的缝合解决方案。这些企业透过完善的分销网络运营,使新技术在公立和私人医疗系统中快速应用。在美国,术后效果、病人安全和降低感染率的重视,正在推动住院和门诊手术环境中对先进涂层和可吸收缝线的需求。

影响外科缝合线市场的知名公司包括 Dolphin Sutures、Boston Scientific、Corza Medical、Smith and Nephew、B. Braun Melsungen、Kono Seisakusho、Integra Lifesciences、Advanced Medical Solutions、Teleflex、Zimmer Biomet、Healthium Medtech、Peters Surgical、Ethunx(强生)、CONatMED、MIT Gx朋友、EthMEDx), GCONx)、CONatMEDing 和 GCONx), GxCON准备。这些製造商深深植根于价值链,并透过创新和全球合作不断扩大其影响力。

外科缝合线市场的主要参与者正致力于持续研发,以改善缝合线材料的性能,从而提高强度、生物降解性和抗菌性能。各公司正积极扩展其产品组合,包括涂层缝合线、倒钩缝合线和药物嵌入缝合线,以支持感染控制并加速癒合。策略性收购和合作伙伴关係有助于领先公司进入新的区域市场并加强分销。製造和供应链的本地化正在被采用,以降低成本并确保高需求地区的产品供应。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 手术数量不断增长

- 创伤发生率上升

- 缝合设计和材料的技术进步

- 老年人口不断增加

- 产业陷阱与挑战

- 高级缝合类型报销不一致

- 替代伤口闭合方法的可用性

- 市场机会

- 对客製化和特定手术缝合线的需求不断增长

- 越来越倾向微创外科手术

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 专利分析

- 定价分析

- 依产品类型

- 按地区

- 差距分析

- 波特的分析

- PESTLE 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 可吸收缝线

- 天然缝合线

- 合成缝合线

- 不可吸收缝合线

- 尼龙

- 普理灵

第六章:市场估计与预测:按灯丝,2021 年至 2034 年

- 主要趋势

- 单丝

- 复丝

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 眼科手术

- 心臟手术

- 骨科手术

- 神经外科

- 妇科手术

- 其他手术

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 医院

- 门诊手术中心

- 专科诊所

- 其他最终用途

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Advanced Medical Solutions

- B. Braun Melsungen

- Boston Scientific

- CONMED

- Corza Medical

- Dolphin Sutures

- Ethicon (Johnson & Johnson)

- GPC Medical

- Healthium Medtech

- Integra Lifesciences

- Kono Seisakusho

- Medtronic

- Peters Surgical

- Smith and Nephew

- Stryker

- Teleflex

- Zimmer Biomet

The Global Surgical Sutures Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 8.4 billion by 2034. Market growth is being driven by a rising elderly population and an increasing number of surgeries related to aging, such as orthopedic and abdominal procedures. As chronic conditions, including diabetes, cardiovascular disorders, and obesity, continue to climb globally, so does the demand for surgical interventions, directly fueling the need for sutures. The availability of next-generation surgical tools, combined with the growing trend toward minimally invasive operations, is accelerating innovation in the industry.

Advancements in synthetic absorbable materials are also transforming wound management practices. Hospitals and surgical centers are expanding their infrastructure to support rising procedure volumes, further boosting procurement. Healthcare professionals are increasingly adopting coated sutures that reduce infection risks, reflecting a broader shift toward infection control and faster healing. Both traditional and modern suture types are experiencing elevated demand across surgical specialties, positioning the market for sustained long-term expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 6.1% |

The absorbable sutures segment generated USD 3 billion in 2024. Their popularity lies in their ability to naturally degrade within body tissues, removing the need for physical extraction. This feature enhances patient comfort and shortens post-operative care, especially in internal procedures where suture removal is impractical. Surgeons increasingly prefer absorbable sutures in soft tissue operations and pediatric surgeries due to reduced infection risks and better biocompatibility. The segment's momentum is also supported by growing awareness around minimally invasive treatments and the rising burden of chronic diseases that require surgical resolution. These factors collectively support a shift in hospital procurement strategies toward absorbable, biodegradable options.

The multifilament sutures segment held a 63.8% share in 2024. These sutures are composed of braided or twisted strands, delivering superior tensile strength, knot security, and flexibility-key attributes that make them ideal for surgeries that demand reliable closure. Their structure allows for more precise control and easy handling during intricate operations, which is essential for procedures involving muscle, gastrointestinal tissue, or reproductive organs. Multifilament sutures are used extensively in general, orthopedic, gynecological, and gastrointestinal surgeries due to their ability to secure wounds effectively and resist breakage under pressure.

U.S. Surgical Sutures Market generated USD 1.9 billion in 2024. This growth is supported by the country's advanced healthcare infrastructure, an aging population, and high surgical volumes. The market presence of global leaders such as Medtronic, Ethicon (Johnson & Johnson), and Teleflex ensures that hospitals and surgical centers have prompt access to innovative suturing solutions. These players operate through well-established distribution networks, enabling rapid adoption of new technologies across public and private health systems. In the U.S., emphasis on post-operative outcomes, patient safety, and reduced infection rates is pushing demand for advanced coated and absorbable sutures across both inpatient and outpatient surgical settings.

Notable companies influencing the Surgical Sutures Market include Dolphin Sutures, Boston Scientific, Corza Medical, Smith and Nephew, B. Braun Melsungen, Kono Seisakusho, Integra Lifesciences, Advanced Medical Solutions, Teleflex, Zimmer Biomet, Healthium Medtech, Peters Surgical, Ethicon (Johnson & Johnson), CONMED, Medtronic, Stryker, and GPC Medical. These manufacturers are deeply embedded in the value chain and continue to expand their reach through innovation and global partnerships.

Major players in the surgical sutures market are focusing on continuous R&D to improve suture material properties-enhancing strength, biodegradability, and antimicrobial performance. Companies are actively expanding their portfolios to include coated, barbed, and drug-embedded sutures that support infection control and accelerate healing. Strategic acquisitions and partnerships help leading firms enter new regional markets and strengthen distribution. Localization of manufacturing and supply chains is being adopted to reduce costs and ensure product availability in high-demand areas.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Filament

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing growth in surgeries

- 3.2.1.2 Rising incidence of trauma

- 3.2.1.3 Technological advances in suture design and material

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Inconsistency in reimbursement for advanced suture types

- 3.2.2.2 Availability of alternative wound closure methods

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for customized and procedure specific sutures

- 3.2.3.2 Increasing preference toward minimally invasive surgical procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product type

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Absorbable sutures

- 5.2.1 Natural sutures

- 5.2.2 Synthetic sutures

- 5.3 Non-absorbable sutures

- 5.3.1 Nylon

- 5.3.2 Prolene

Chapter 6 Market Estimates and Forecast, By Filament, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Monofilament

- 6.3 Multifilament

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Ophthalmic surgery

- 7.3 Cardiac surgery

- 7.4 Orthopaedic surgery

- 7.5 Neurological surgery

- 7.6 Gynaecology surgery

- 7.7 Other surgeries

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Hospitals

- 8.2 Ambulatory surgical centers

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profile

- 10.1 Advanced Medical Solutions

- 10.2 B. Braun Melsungen

- 10.3 Boston Scientific

- 10.4 CONMED

- 10.5 Corza Medical

- 10.6 Dolphin Sutures

- 10.7 Ethicon (Johnson & Johnson)

- 10.8 GPC Medical

- 10.9 Healthium Medtech

- 10.10 Integra Lifesciences

- 10.11 Kono Seisakusho

- 10.12 Medtronic

- 10.13 Peters Surgical

- 10.14 Smith and Nephew

- 10.15 Stryker

- 10.16 Teleflex

- 10.17 Zimmer Biomet