|

市场调查报告书

商品编码

1773406

磁砖胶黏剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tile Adhesive Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

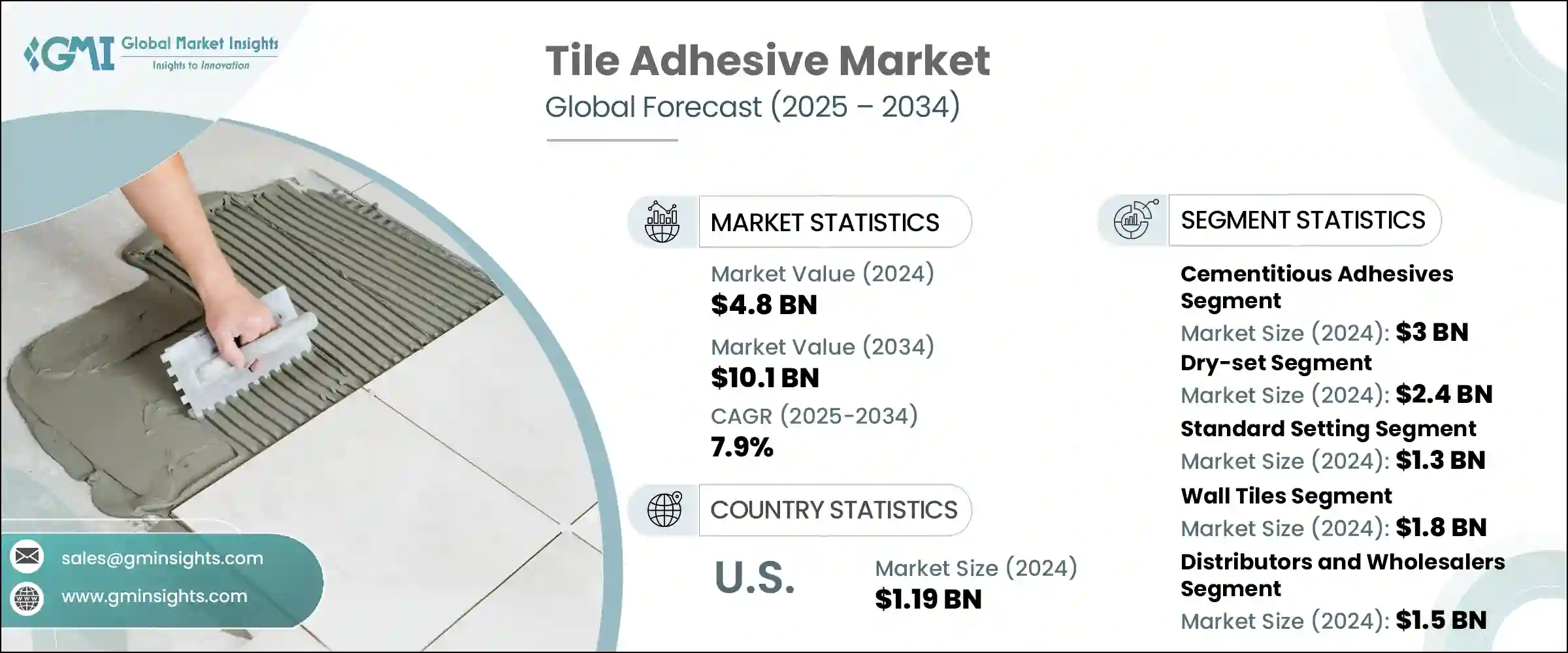

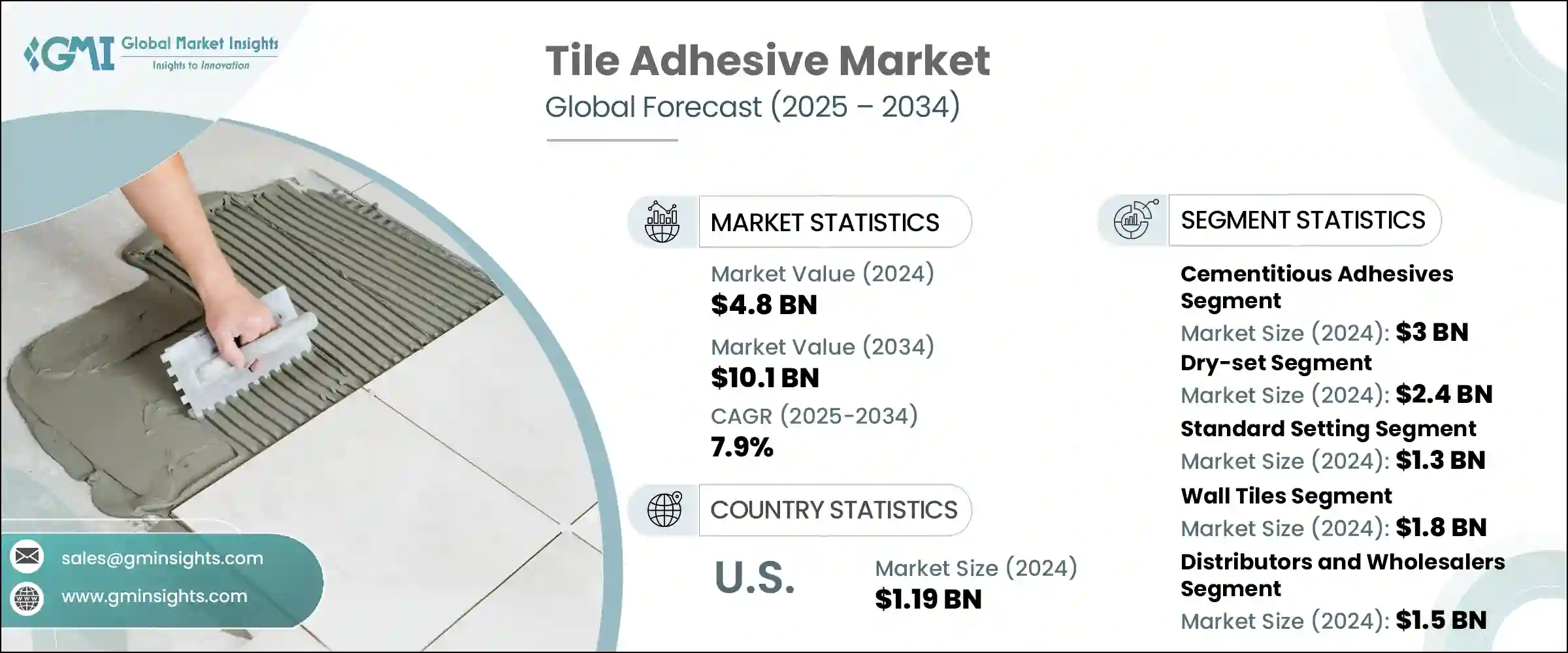

2024年,全球磁砖胶黏剂市场规模达48亿美元,预计到2034年将以7.9%的复合年增长率成长,达到101亿美元。这一增长主要受到发展中和已开发地区建筑活动成长的影响。随着城市基础设施的扩张以及新的商业和住宅项目的破土动工,对高性能、省时的建筑材料的需求持续增长。磁砖胶黏剂凭藉其卓越的黏结强度、便利的施工和高效的施工效率,正迅速取代传统的水泥基解决方案。大规模的城市化进程,尤其是在中东和亚太地区快速发展的地区,使得瓷砖胶合剂成为现代建筑实践中不可或缺的产品。

在美国和欧洲,家居装修和翻新工程(尤其是在老旧房屋中)的激增也推动了需求。由于磁砖胶合剂具有防潮性能且与多种材料相容,翻新工程中越来越多地在厨房、浴室和人流量大的室内空间中使用磁砖胶合剂。此外,胶合剂配方(尤其是聚合物配方)的创新,使得产品更轻、干燥时间更快、柔韧性更强、耐热性更高。这些进步不仅减少了安装时间和材料浪费,还透过降低施工过程中的能耗来支持环保目标。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 48亿美元 |

| 预测值 | 101亿美元 |

| 复合年增长率 | 7.9% |

2024年,水泥基胶黏剂市场规模达30亿美元,预计到2034年将维持强劲成长,复合年增长率预计为7.1%。这些胶合剂因其成本效益高、经久耐用且适用于商业和住宅建筑,仍然是建筑业的首选。它们在发展中国家的广泛应用反映了其经济实惠的价格和久经考验的强度。聚合物改质胶黏剂已变得越来越普遍,为涉及大尺寸瓷砖或易受潮区域的安装提供了更佳的性能。其更高的柔韧性和防水性使其成为现代建筑应用的理想选择。随着施工方法不断发展以满足更严苛的性能标准,这些升级版水泥基胶黏剂正在多个专案类型和地理市场中占据主导地位。

标准型胶合剂市场在2024年的市值为13亿美元,预计2034年的复合年增长率将达到5.9%。标准型胶合剂和速凝型胶合剂的选择很大程度上取决于专案的性质和所需的工期。在工期允许的典型施工中,标准型胶合剂因其强大的黏合力和充足的施工时间而被广泛使用。然而,在时间敏感的环境中,例如商业翻新或公共设施升级,速凝型胶合剂因其能够加快竣工速度并减少停机时间而更受青睐。由于商业场所和零售店通常要求尽量减少营运中断,因此对高性能、快速固化胶合剂的需求将持续成长。

2024年,美国磁砖胶黏剂市场规模达11.9亿美元,预计到2034年将以7.6%的复合年增长率成长。住宅和商业建筑活动的增加,以及国家对永续建筑实践的重视,共同推动了这一成长。随着老旧建筑的更新换代,对高效环保的胶合剂产品的需求日益增长。美国消费者越来越重视那些不仅能提升室内装潢效果,还能持久耐用的产品。这种转变促使製造商更加重视先进环保的胶合剂,这些胶合剂既符合现代性能标准,又符合绿建筑倡议。

全球磁砖胶黏剂市场的竞争格局由 Ardex Group、Sika AG、Laticrete International, Inc.、Saint-Gobain Weber 和 Mapei SpA 等主要参与者塑造,这些公司以其对产品开发和市场扩张的持续投资而闻名。

磁砖胶黏剂市场的领导者正积极透过创新、合作和区域扩张等多种方式巩固其市场地位。产品开发是重中之重,许多企业正在投资先进的聚合物改质胶合剂,以提高其耐用性、防水性和柔韧性。这些新配方通常针对现代建筑需求量身定制,包括轻质瓷砖和潮湿区域安装。同时,企业正在透过与承包商和分销商建立策略合作伙伴关係来增强其全球分销网络。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依化学类型,2021-2034

- 主要趋势

- 水泥基黏合剂

- 标准水泥基(C1)

- 改良水泥基材 (C2)

- 速凝水泥基材料

- 其他的

- 分散黏合剂

- 标准色散(D1)

- 改善分散性(D2)

- 其他的

- 反应树脂胶合剂

- 环氧基

- 聚氨酯基

- 其他的

- 其他的

第六章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 干固

- 即用型

- 双组分

- 其他的

第七章:市场估计与预测:依功能,2021-2034

- 主要趋势

- 标准制定

- 快速设定

- 灵活/可变形

- 防滑

- 防水

- 抗霜冻

- 其他的

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 墙砖

- 内墙

- 外墙

- 其他的

- 地砖

- 室内地板

- 室外地板

- 其他的

- 天花板

- 游泳池和潮湿区域

- 其他的

第九章:市场估计与预测:依磁砖类型,2021-2034

- 主要趋势

- 磁砖

- 磁砖

- 天然石材磁砖

- 大理石

- 花岗岩

- 石板

- 其他的

- 玻璃砖

- 马赛克瓷砖

- 大尺寸磁砖

- 其他的

第十章:市场估计与预测:依最终用途领域,2021-2034

- 主要趋势

- 住宅

- 新建筑

- 装修和改造

- 其他的

- 商业的

- 办公大楼

- 零售空间

- 饭店业

- 医疗保健设施

- 教育机构

- 其他的

- 工业的

- 生产设施

- 仓库

- 其他的

- 机构

- 政府大楼

- 宗教建筑

- 其他的

- 其他的

第 11 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 分销商和批发商

- 家居装饰店

- 专卖店

- 网路零售

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十三章:公司简介

- Sika AG

- Mapei SpA

- Ardex Group

- Laticrete International, Inc.

- Saint-Gobain Weber

- HB Fuller Company

- Bostik SA (Arkema Group)

- Henkel AG & Co. KGaA

- Pidilite Industries Ltd.

- Wacker Chemie AG

- Custom Building Products

- Parex Group (Sika AG)

- Fosroc International Ltd.

- Kerakoll SpA

- 3M Company

The Global Tile Adhesive Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 10.1 billion by 2034. This growth is strongly influenced by rising construction activity across both developing and developed regions. As urban infrastructure expands and new commercial and residential projects break ground, demand for high-performance, time-saving building materials continues to rise. Tile adhesives are rapidly replacing conventional cement-based solutions due to their superior bond strength, easier application, and efficiency. Large urbanization efforts, especially in fast-growing areas across the Middle East and Asia-Pacific, have made these products essential for modern building practices.

In the U.S. and Europe, a surge in home improvement and remodeling efforts, particularly in aging properties, is also contributing to demand. Renovation projects are increasingly using tile adhesives in kitchens, bathrooms, and high-traffic interiors due to their resistance to moisture and their compatibility with a range of materials. Additionally, innovation in adhesive formulations-especially with polymers-has resulted in lighter products with faster drying times, enhanced flexibility, and improved thermal resistance. These advancements not only reduce installation time and material waste but also support environmental goals by lowering energy use during application.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 7.9% |

In 2024, the cementitious adhesives segment generated USD 3 billion and is expected to maintain strong growth with a projected CAGR of 7.1% through 2034. These adhesives remain a preferred choice due to their cost-effectiveness, durability, and adaptability for both commercial and residential construction. Their widespread use in developing nations reflects their affordability and proven strength. Polymer-modified variants have become increasingly common, offering enhanced performance for installations involving large-format tiles or moisture-prone areas. Their improved flexibility and water resistance make them ideal for modern building applications. As construction methods evolve to meet more demanding performance criteria, these upgraded cementitious adhesives are securing a dominant role across multiple project types and geographic markets.

The standard-setting adhesives segment was valued at USD 1.3 billion in 2024 and is expected to grow at a CAGR of 5.9% during 2034. The choice between standard and fast-setting adhesives depends heavily on the nature of the project and the required timelines. For typical construction where schedules allow, standard-setting adhesives are widely used because they provide strong adhesion and ample working time. However, in time-sensitive environments-such as commercial refurbishments or public facility upgrades-fast-setting adhesives are preferred for their ability to expedite completion and reduce downtime. As commercial spaces and retail outlets often demand minimal operational disruption, the demand for high-performance, quick-curing adhesives will continue to rise.

United States Tile Adhesive Market was valued at USD 1.19 billion in 2024 and is expected to grow at a CAGR of 7.6% through 2034. This expansion is fueled by increasing residential and commercial construction activity, coupled with a national emphasis on sustainable building practices. As older buildings are updated and replaced, there is a growing demand for efficient, environmentally conscious adhesive products. U.S. consumers are placing a higher value on products that not only enhance the appearance of interiors but also offer long-lasting durability. This shift is pushing manufacturers to focus more on advanced, eco-friendly adhesives that meet modern performance standards while aligning with green construction initiatives.

The competitive landscape in the Global Tile Adhesive Market is shaped by major players such as Ardex Group, Sika AG, Laticrete International, Inc., Saint-Gobain Weber, and Mapei S.p.A. These companies are known for their consistent investment in product development and market expansion.

Leading companies in the tile adhesive market are actively working to strengthen their market foothold through a mix of innovation, partnerships, and regional expansion. Product development is a top priority, with many firms investing in advanced polymer-modified adhesives that offer greater durability, water resistance, and flexibility. These new formulations are often tailored for modern building requirements, including lightweight tiles and wet-area installations. In parallel, companies are enhancing their global distribution networks by forming strategic partnerships with contractors and distributors.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Chemical Type

- 2.2.3 Type

- 2.2.4 Feature

- 2.2.5 Application

- 2.2.6 Tile Type

- 2.2.7 End Use Sector

- 2.2.8 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Chemical Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cementitious Adhesives

- 5.2.1 Standard Cementitious (C1)

- 5.2.2 Improved Cementitious (C2)

- 5.2.3 Fast-Setting Cementitious

- 5.2.4 Others

- 5.3 Dispersion Adhesives

- 5.3.1 Standard Dispersion (D1)

- 5.3.2 Improved Dispersion (D2)

- 5.3.3 Others

- 5.4 Reaction Resin Adhesives

- 5.4.1 Epoxy-Based

- 5.4.2 Polyurethane-Based

- 5.4.3 Others

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dry-Set

- 6.3 Ready-to-Use

- 6.4 Two-Component

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Feature, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Standard Setting

- 7.3 Fast Setting

- 7.4 Flexible/Deformable

- 7.5 Slip-Resistant

- 7.6 Water-Resistant

- 7.7 Frost-Resistant

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Wall Tiles

- 8.2.1 Interior Walls

- 8.2.2 Exterior Walls

- 8.2.3 Others

- 8.3 Floor Tiles

- 8.3.1 Interior Floors

- 8.3.2 Exterior Floors

- 8.3.3 Others

- 8.4 Ceiling

- 8.5 Swimming Pools and Wet Areas

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Tile Type, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Ceramic Tiles

- 9.3 Porcelain Tiles

- 9.4 Natural Stone Tiles

- 9.4.1 Marble

- 9.4.2 Granite

- 9.4.3 Slate

- 9.4.4 Others

- 9.5 Glass Tiles

- 9.6 Mosaic Tiles

- 9.7 Large Format Tiles

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By End Use Sector, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Residential

- 10.2.1 New Construction

- 10.2.2 Renovation and Remodeling

- 10.2.3 Others

- 10.3 Commercial

- 10.3.1 Office Buildings

- 10.3.2 Retail Spaces

- 10.3.3 Hospitality

- 10.3.4 Healthcare Facilities

- 10.3.5 Educational Institutions

- 10.3.6 Others

- 10.4 Industrial

- 10.4.1 Manufacturing Facilities

- 10.4.2 Warehouses

- 10.4.3 Others

- 10.5 Institutional

- 10.5.1 Government Buildings

- 10.5.2 Religious Buildings

- 10.5.3 Others

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 Direct Sales

- 11.3 Distributors and Wholesalers

- 11.4 Home Improvement Stores

- 11.5 Specialty Stores

- 11.6 Online Retail

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Rest of Europe

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Rest of Asia Pacific

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Rest of Latin America

- 12.6 Middle East & Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

- 12.6.4 Rest of Middle East & Africa

Chapter 13 Company Profiles

- 13.1 Sika AG

- 13.2 Mapei S.p.A.

- 13.3 Ardex Group

- 13.4 Laticrete International, Inc.

- 13.5 Saint-Gobain Weber

- 13.6 H.B. Fuller Company

- 13.7 Bostik SA (Arkema Group)

- 13.8 Henkel AG & Co. KGaA

- 13.9 Pidilite Industries Ltd.

- 13.10 Wacker Chemie AG

- 13.11 Custom Building Products

- 13.12 Parex Group (Sika AG)

- 13.13 Fosroc International Ltd.

- 13.14 Kerakoll S.p.A.

- 13.15 3M Company