|

市场调查报告书

商品编码

1773408

循环原油、中间体和胶市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cyclic Crude, Intermediate, and Gum Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

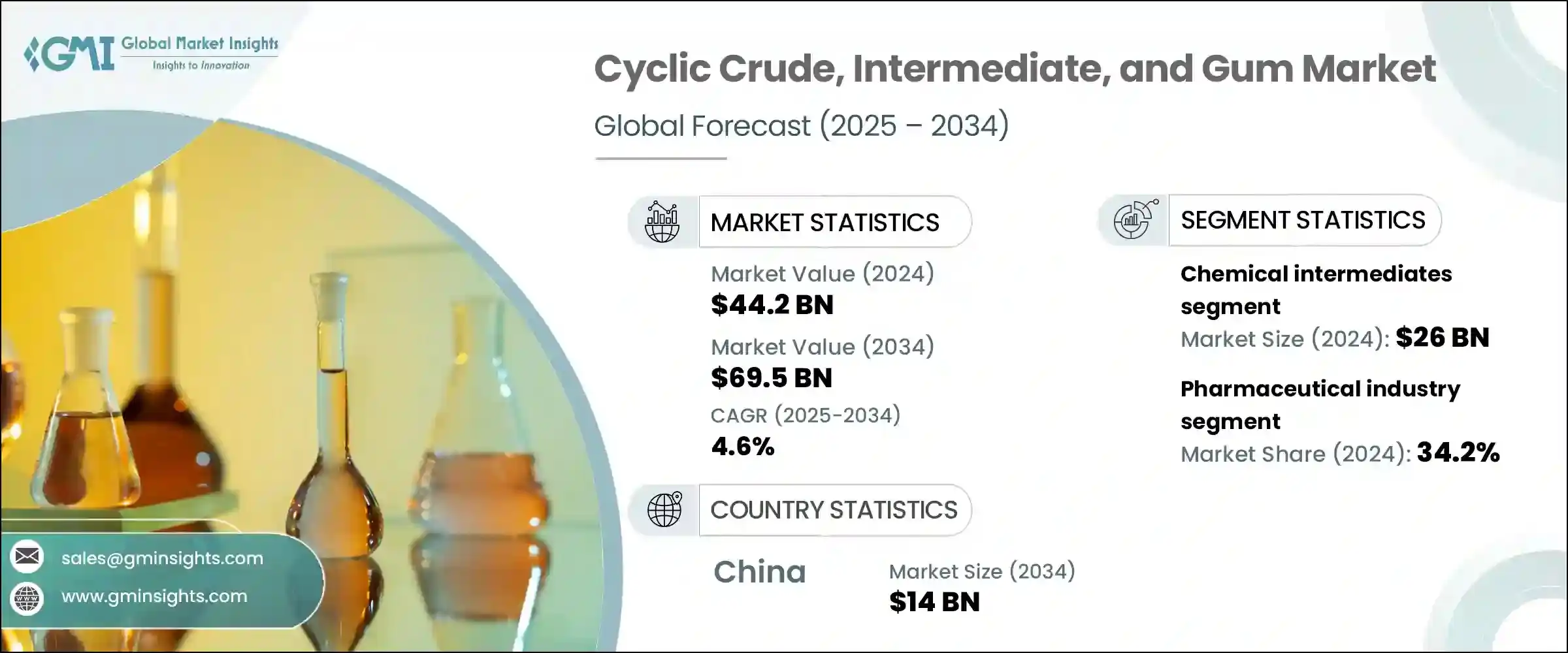

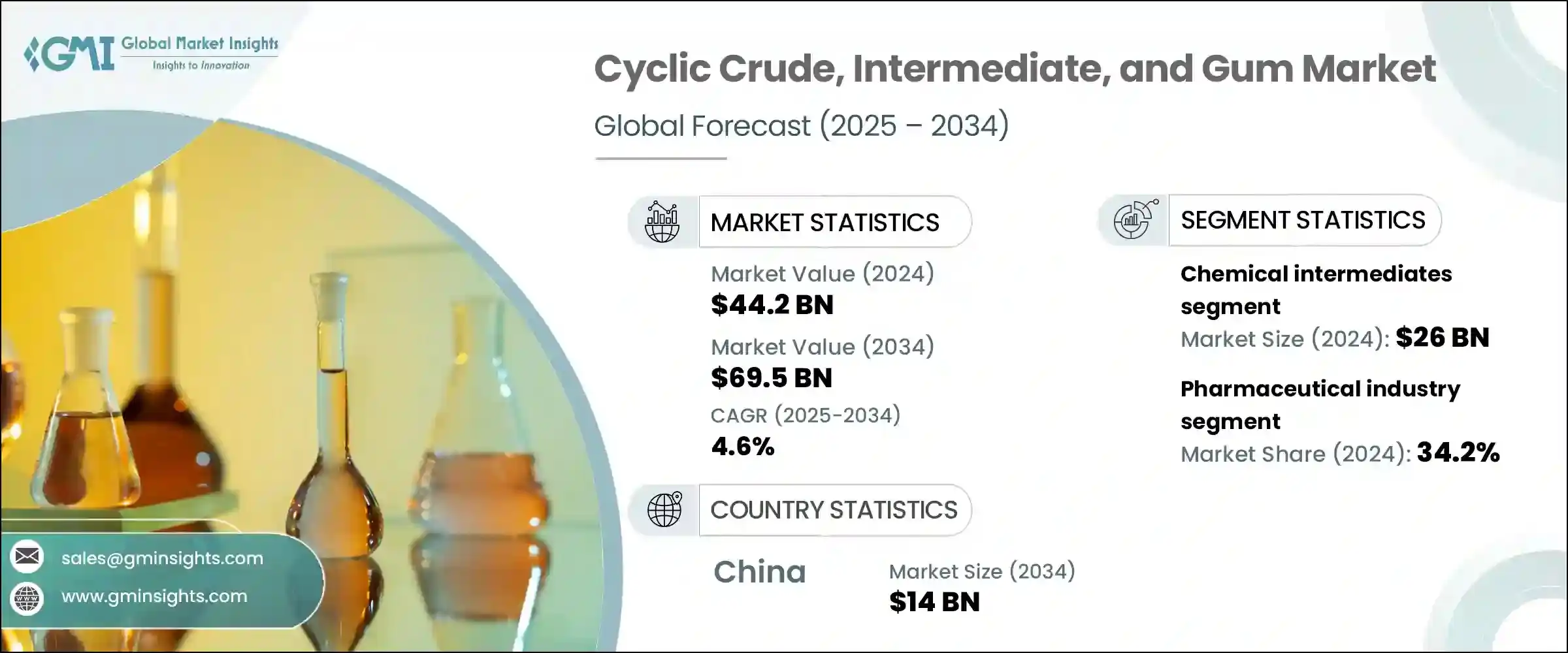

2024年,全球环状原油、中间体及胶状物市场规模达442亿美元,预计2034年将以4.6%的复合年增长率成长,达到695亿美元。市场扩张主要得益于製药、食品加工、个人护理和化学品製造等行业的持续需求。这些材料在生产流程中发挥着至关重要的作用,它们作为核心成分、溶剂和乳化剂,可以简化加工流程并提高配方品质。随着工业生产采用更复杂的生产规程和更严格的产品要求,对环状原油中间体和胶状物的依赖持续上升。尤其值得一提的是,市场正朝着环保解决方案和高性能添加剂的方向转变,製造商越来越多地选择符合环保标准、能够实现高效、精准效果的材料。

推动该市场发展的最显着趋势之一是转向天然和植物来源的投入。各公司正积极投资于产品创新和製程优化,以提供生物基中间体和可生物降解胶,以满足日益增长的监管要求和消费者偏好。这些材料目前广泛应用于对稳定性和一致性要求极高的特殊配方中。尤其是天然胶,作为用途广泛、功能多样的成分,在一系列下游应用中越来越受到青睐,进一步巩固了其市场地位。同时,在一致性和精确度至关重要的行业中,开发符合严格技术规格的环状中间体正变得越来越重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 442亿美元 |

| 预测值 | 695亿美元 |

| 复合年增长率 | 4.6% |

在市场中,化学中间体是最主要且成长最快的产品类别。该领域在2024年创造了260亿美元的收入,预计到2034年将达到410亿美元,预测期内的复合年增长率为4.7%。这些中间体是生产各种高价值产品(例如黏合剂、聚合物、特殊溶剂和医药製剂)不可或缺的一部分。它们广泛应用于各个领域,对众多工业和商业运营至关重要。随着石化公司持续从以燃料为中心的营运转向特种化学品生产,中间体在其产品组合策略中的重要性显着提升。这种演变反映了全球化工业的广泛趋势,即创新和增值已成为关键的成长动力。

就终端产业而言,製药业在2024年成为环状原油、中间体和胶的主要消费产业,占据全球市场份额的34.2%。其需求源自于这些材料在药物合成、配方和稳定过程中所扮演的重要角色。环状中间体对于生产复杂的有机化合物至关重要,其高纯度标准使其成为製药生产中不可或缺的材料。此外,对先进药物传输系统的日益依赖,以及生物技术衍生活性成分的广泛使用,持续推动市场需求。天然胶也因其作为稳定剂、赋形剂和释放调节剂的特性,广泛应用于製药领域。随着全球医疗支出的成长和人口老化,预计该领域将在预测期内保持市场主导地位。

中国作为一个重要的区域市场脱颖而出,2024年贡献了89亿美元的收入。中国市场预计的复合年增长率为4.7%,到2034年将达到140亿美元。中国市场正处于机会与不确定性并存的阶段。儘管房地产行业低迷等宏观经济因素导致工业采购趋于谨慎,但环状碳氢化合物的产量仍表现出强劲的韧性。 2024年产量大幅成长,显示儘管面临外部经济压力,製造业动能依然强劲。中国对化学品製造和製程效率的持续投资预计将推动中间体和天然胶的未来成长。

在竞争方面,全球市场由大型跨国公司和区域性企业共同塑造,每家企业都采取独特的策略来维持成长。产业参与者高度重视清洁标籤产品的开发,使其产品与消费者日益增长的对健康和永续消费的偏好相一致。合併、收购以及与技术供应商的合作等策略性措施在塑造竞争格局方面发挥关键作用。这些合作旨在加速创新週期,增强原料采购能力,并确保为各个应用领域提供充足的先进原料供应。随着产业应对不断变化的消费者需求和严格的环保法规,创新和策略敏捷性仍然是长期市场成功的关键。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 终端使用产业的需求不断增长

- 製药领域的应用日益增多

- 特种化学品需求不断成长

- 生产工艺的技术进步

- 产业陷阱与挑战

- 原物料价格波动

- 环境问题和法规

- 替代品的可用性

- 生产成本高

- 成长动力

- 成长潜力分析

- 监理框架分析

- 国际法规

- 区域监管标准

- FDA对口香糖产品的规定

- 环境合规要求

- 品质认证体系

- 技术格局

- 当前的技术趋势

- 生产中的新兴技术

- 製造业中的自动化与机器人技术

- 研发措施与创新管道

- 定价分析

- 价格趋势分析

- 成本结构分析

- 影响定价的因素

- 区域价格差异

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

- 战略仪表板

- 主要利害关係人和市场定位

- 竞争基准测试

- 竞争策略

- 新产品开发

- 併购

- 伙伴关係和合作

- 产能扩张

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 环状原油

- 芳香烃

- 脂环烃

- 杂环化合物

- 化学中间体

- 环状中间体

- 环己酮

- 环己烷

- 环戊烷

- 其他环状中间体

- 医药中间体

- 农业化学品中间体

- 其他中间体

- 口香糖及相关产品

- 天然牙龈

- 阿拉伯胶

- 瓜尔胶

- 黄原胶

- 茄替胶

- 其他天然树胶

- 合成胶

- 口香糖胶基

- 羧甲基纤维素(CMC)

- 其他合成胶

- 木材化学品

- 妥尔油

- 木炭

- 海军物资

- 其他木材化学品

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 製药

- 活性药物成分 (API)

- 辅料

- 药物输送系统

- 化学品和材料

- 特种化学品

- 聚合物和树脂

- 油漆和涂料

- 黏合剂和密封剂

- 食品和饮料

- 乳化剂和稳定剂

- 增稠剂

- 糖果产品

- 饮料

- 石油和天然气

- 钻井液

- 提高石油采收率

- 燃油添加剂

- 纺织品

- 纤维中间体

- 染料和颜料

- 纺织助剂

- 化妆品和个人护理

- 润肤剂

- 界面活性剂

- 流变改质剂

- 农业

- 杀虫剂和除草剂

- 植物生长调节剂

- 土壤改良剂

- 其他的

第七章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 製药业

- 仿製药

- 品牌药物

- 合约製造

- 化工

- 基础化学品

- 特种化学品

- 精细化学品

- 食品加工业

- 烘焙和糖果

- 乳製品

- 饮料

- 加工食品

- 石油和天然气产业

- 上游

- 中游

- 下游

- 纺织业

- 服饰

- 技术纺织品

- 家纺

- 化妆品和个人护理行业

- 皮肤护理

- 头髮护理

- 口腔护理

- 农业产业

- 作物保护

- 种子处理

- 土壤改良

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- MEA 其余地区

第九章:公司简介

- BASF SE

- Albemarle Corporation

- Alland & Robert

- BioAmber Inc.

- Boc Sciences

- Chevron Phillips Chemical Company

- Clariant AG

- ComWin

- Eastman Chemical Company

- Evonik Industries AG

- ExxonMobil Corporation

- Hefei TNJ Chemical

- Invista

- Kantilal Brothers

- Kerry Group

- Koninklijke DSM NV

- Lonza Group

- Manus Aktteva Biopharma LLP

- Myriant Corporation

- Nexira Inc.

- Realsun Chemical

- Reliance Industries Limited

- Reverdia

- Royal Dutch Shell plc

- Sinopec Limited

- Succinity GmbH

- The Dow Chemical Company

- TIC Gums

- Topas Advanced Polymers Inc.

- Wuxi Gum Base Manufacture Co., Ltd.

The Global Cyclic Crude, Intermediate, and Gum Market was valued at USD 44.2 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 69.5 billion by 2034. The market expansion is largely fueled by consistent demand from industries such as pharmaceuticals, food processing, personal care, and chemical manufacturing. These materials play a crucial role in production workflows by acting as core ingredients, solvents, and emulsifying agents that simplify processing and enhance formulation quality. As industrial operations adopt more sophisticated production protocols and stricter product requirements, the reliance on cyclic crude intermediates and gums continues to rise. In particular, the market is witnessing a shift toward eco-friendly solutions and higher-performing additives, with manufacturers increasingly opting for materials that align with environmental standards and deliver efficient, targeted results.

One of the most notable trends driving this market is the movement toward natural and plant-derived inputs. Companies are actively investing in product innovation and process optimization to offer bio-based intermediates and biodegradable gums that meet growing regulatory and consumer preferences. These materials are now widely used in specialized formulations that demand both stability and consistent performance. Natural gums, in particular, are gaining traction as versatile, multifunctional components in a range of downstream applications, further strengthening their market position. At the same time, the development of cyclic intermediates that meet exacting technical specifications is becoming more important in industries where consistency and precision are non-negotiable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.2 Billion |

| Forecast Value | $69.5 Billion |

| CAGR | 4.6% |

Within the market, chemical intermediates represent the most dominant and fastest-growing product category. This segment generated USD 26 billion in revenue in 2024 and is anticipated to reach USD 41 billion by 2034, expanding at a CAGR of 4.7% during the forecast period. These intermediates are integral to the production of a wide range of high-value goods such as adhesives, polymers, specialty solvents, and medical formulations. Their widespread applicability across various sectors makes them essential for numerous industrial and commercial operations. As petrochemical companies continue to pivot from fuel-centric operations toward specialty chemical production, the importance of intermediates in their portfolio strategies has grown considerably. This evolution reflects broader trends in the global chemical sector, where innovation and value addition have become key growth drivers.

In terms of end-use industries, the pharmaceutical sector emerged as the leading consumer of cyclic crude, intermediates, and gums in 2024, accounting for 34.2% of the global market share. The demand stems from the essential role these materials play in drug synthesis, formulation, and stabilization. Cyclic intermediates are critical for producing complex organic compounds, and their high purity standards make them indispensable in pharmaceutical manufacturing. Additionally, the increasing reliance on advanced drug delivery systems, along with the expanding use of biotechnologically derived active ingredients, continues to drive market demand. Natural gums are also widely used in pharmaceutical applications due to their properties as stabilizers, excipients, and release-modifying agents. As healthcare spending grows globally and the population ages, this segment is expected to maintain its market dominance through the forecast period.

China stands out as a key regional market, contributing USD 8.9 billion in revenue in 2024. The country is projected to grow at a CAGR of 4.7% and is expected to reach USD 14 billion by 2034. The market in China is undergoing a mixed phase of opportunity and uncertainty. While macroeconomic factors such as a subdued real estate sector have introduced caution in industrial procurement, the production volume of cyclic hydrocarbons showed strong resilience. Output saw a sharp rise in 2024, suggesting that manufacturing momentum remains intact despite external economic pressures. The country's continued investment in chemical manufacturing and process efficiency is expected to fuel future growth across both intermediates and natural gums.

On the competitive front, the global market is shaped by a blend of large multinational firms and regional players, each adopting distinct approaches to sustain growth. Industry participants are focusing heavily on clean-label product development, aligning their offerings with the increasing consumer inclination toward health-conscious and sustainable options. Strategic moves such as mergers, acquisitions, and partnerships with technology providers are playing a critical role in shaping the competitive landscape. These collaborations aim to drive faster innovation cycles, enhance raw material sourcing, and ensure a robust supply of advanced ingredients across various application sectors. As the industry navigates through evolving consumer demands and stringent environmental mandates, innovation and strategic agility remain central to long-term market success.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing demand from end use industries

- 3.7.1.2 Increasing applications in pharmaceuticals

- 3.7.1.3 Rising demand for specialty chemicals

- 3.7.1.4 Technological advancements in production processes

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in raw material prices

- 3.7.2.2 Environmental concerns and regulations

- 3.7.2.3 Availability of substitutes

- 3.7.2.4 High production costs

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Regulatory framework analysis

- 3.9.1 International regulations

- 3.9.2 Regional regulatory standards

- 3.9.3 FDA regulations for gum products

- 3.9.4 Environmental compliance requirements

- 3.9.5 Quality certification systems

- 3.10 Technology landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies in production

- 3.10.3 Automation and robotics in manufacturing

- 3.10.4 R&D initiatives and innovation pipeline

- 3.11 Pricing analysis

- 3.11.1 Price trend analysis

- 3.11.2 Cost structure analysis

- 3.11.3 Factors affecting pricing

- 3.11.4 Regional price variations

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Strategic dashboard

- 4.6 Key stakeholders and market positioning

- 4.7 Competitive benchmarking

- 4.8 Competitive strategies

- 4.8.1 New product developments

- 4.8.2 Mergers and acquisitions

- 4.8.3 Partnerships and collaborations

- 4.8.4 Capacity expansions

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Cyclic crude

- 5.2.1 Aromatic hydrocarbons

- 5.2.2 Alicyclic hydrocarbons

- 5.2.3 Heterocyclic compounds

- 5.3 Chemical intermediates

- 5.3.1 Cyclic intermediates

- 5.3.2 Cyclohexanone

- 5.3.3 Cyclohexane

- 5.3.4 Cyclopentane

- 5.3.5 Other cyclic intermediates

- 5.3.6 Pharmaceutical intermediates

- 5.3.7 Agrochemical intermediates

- 5.3.8 Other intermediates

- 5.4 Gums and related products

- 5.4.1 Natural gums

- 5.4.2 Gum arabic

- 5.4.3 Guar gum

- 5.4.4 Xanthan gum

- 5.4.5 Ghatti gum

- 5.4.6 Other natural gums

- 5.4.7 Synthetic gums

- 5.4.8 Chewing gum base

- 5.4.9 Carboxymethyl cellulose (CMC)

- 5.4.10 Other synthetic gums

- 5.5 Wood chemicals

- 5.6 Tall oil

- 5.7 Charcoal

- 5.8 Naval stores

- 5.9 Other wood chemicals

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Pharmaceuticals

- 6.2.1 Active pharmaceutical ingredients (APIs)

- 6.2.2 Excipients

- 6.2.3 Drug delivery systems

- 6.3 Chemicals and materials

- 6.3.1 Specialty chemicals

- 6.3.2 Polymers and resins

- 6.3.3 Paints and coatings

- 6.3.4 Adhesives and sealants

- 6.4 Food and beverages

- 6.4.1 Emulsifiers and stabilizers

- 6.4.2 Thickening agents

- 6.4.3 Confectionery products

- 6.4.4 Beverages

- 6.5 Oil and gas

- 6.5.1 Drilling fluids

- 6.5.2 Enhanced oil recovery

- 6.5.3 Fuel additives

- 6.6 Textiles

- 6.6.1 Fiber intermediates

- 6.6.2 Dyes and pigments

- 6.6.3 Textile auxiliaries

- 6.7 Cosmetics and personal care

- 6.7.1 Emollients

- 6.7.2 Surfactants

- 6.7.3 Rheology modifiers

- 6.8 Agriculture

- 6.8.1 Pesticides and herbicides

- 6.8.2 Plant growth regulators

- 6.8.3 Soil conditioners

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Pharmaceutical industry

- 7.2.1 Generic drugs

- 7.2.2 Branded drugs

- 7.2.3 Contract manufacturing

- 7.3 Chemical industry

- 7.3.1 Basic chemicals

- 7.3.2 Specialty chemicals

- 7.3.3 Fine chemicals

- 7.4 Food processing industry

- 7.4.1 Bakery and confectionery

- 7.4.2 Dairy products

- 7.4.3 Beverages

- 7.4.4 Processed foods

- 7.5 Oil and gas industry

- 7.5.1 Upstream

- 7.5.2 Midstream

- 7.5.3 Downstream

- 7.6 Textile industry

- 7.6.1 Apparel

- 7.6.2 Technical textiles

- 7.6.3 Home textiles

- 7.7 Cosmetics and personal care industry

- 7.7.1 Skin care

- 7.7.2 Hair care

- 7.7.3 Oral care

- 7.8 Agricultural industry

- 7.8.1 Crop protection

- 7.8.2 Seed treatment

- 7.8.3 Soil enhancement

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of MEA

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Albemarle Corporation

- 9.3 Alland & Robert

- 9.4 BioAmber Inc.

- 9.5 Boc Sciences

- 9.6 Chevron Phillips Chemical Company

- 9.7 Clariant AG

- 9.8 ComWin

- 9.9 Eastman Chemical Company

- 9.10 Evonik Industries AG

- 9.11 ExxonMobil Corporation

- 9.12 Hefei TNJ Chemical

- 9.13 Invista

- 9.14 Kantilal Brothers

- 9.15 Kerry Group

- 9.16 Koninklijke DSM N.V.

- 9.17 Lonza Group

- 9.18 Manus Aktteva Biopharma LLP

- 9.19 Myriant Corporation

- 9.20 Nexira Inc.

- 9.21 Realsun Chemical

- 9.22 Reliance Industries Limited

- 9.23 Reverdia

- 9.24 Royal Dutch Shell plc

- 9.25 Sinopec Limited

- 9.26 Succinity GmbH

- 9.27 The Dow Chemical Company

- 9.28 TIC Gums

- 9.29 Topas Advanced Polymers Inc.

- 9.30 Wuxi Gum Base Manufacture Co., Ltd.