|

市场调查报告书

商品编码

1773413

汽车整合起动发电机组市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Integrated Starter-Generator Units Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

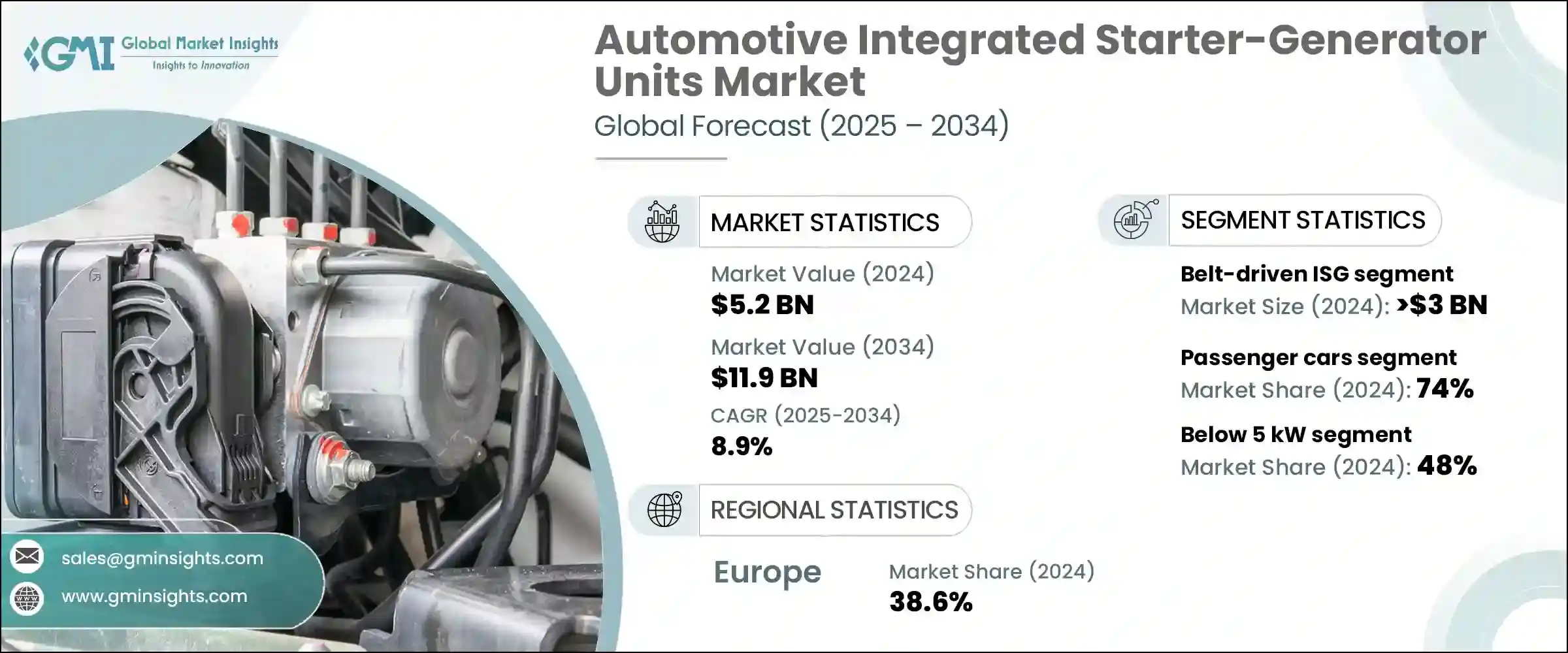

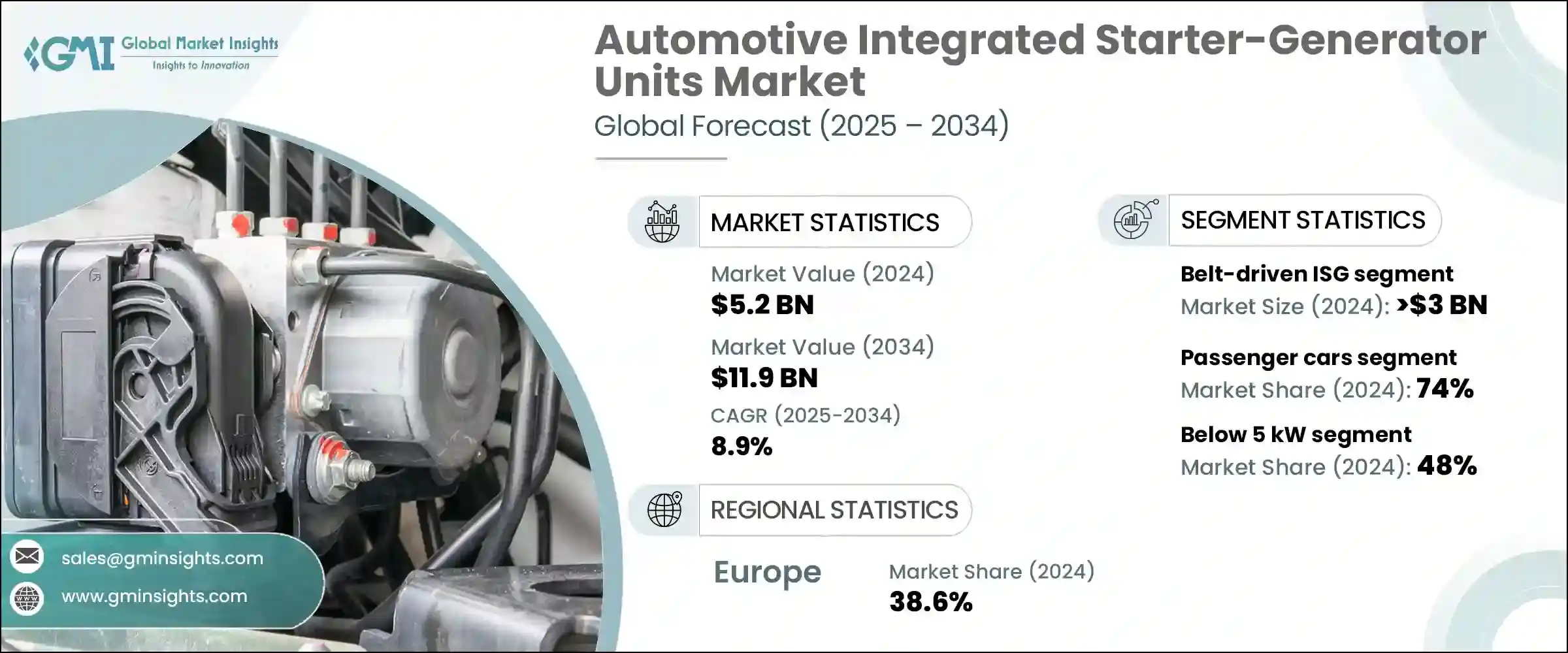

2024年,全球汽车整合起动发电机市场规模达52亿美元,预计到2034年将以8.9%的复合年增长率成长,达到119亿美元。这一增长主要源于对兼具高能源效率和低环境影响的汽车日益增长的需求。随着全球排放法规日益严格,汽车製造商正在加紧推出搭载ISG技术的轻度混合动力车型。这些系统对于那些追求更高燃油经济性,但又不想承担全混合动力或插电式混合动力汽车高昂价格的消费者来说极具吸引力。配备ISG的动力系统提供了一种折衷方案——在显着节省燃油的同时,对传统车辆设计的干扰最小。

人们对高阶高性能车日益增长的需求也加速了ISG装置的普及,因为它们有助于提升引擎启动停止平顺性,并带来低速扭力提升,从而提升驾驶体验。这完全符合高端买家的需求——既追求高效,又不牺牲动力和豪华体验。随着城市交通拥堵加剧,对降低怠速和频繁停车油耗的系统的需求激增。 ISG装置有助于应对这些挑战,同时减少排放,使其成为推动更智慧、更环保的城市交通发展的热门选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 52亿美元 |

| 预测值 | 119亿美元 |

| 复合年增长率 | 8.9% |

2024年,皮带传动ISG系统市场规模达30亿美元,凭藉为汽车製造商提供实用且经济高效的电气化途径,占据了市场主导地位。这些装置安装在引擎前端,并透过皮带连接到曲轴,使製造商无需重新设计主要部件即可整合它们。对于希望快速实现现有车辆平台电气化的品牌而言,这种简化的整合方式是一大优势,可节省时间和金钱。

轻度混合动力车在2024年占据了最大的市场份额,预计仍将是关键的成长领域。这些车辆采用紧凑型电池,并带来驾驶员能够立即感受到的性能优势——从滑行时的安静运行到引擎的无缝重启。低阶扭力提升提升了驾驶性能,尤其是在走走停停的交通中。此外,轻度混合动力车不依赖外部充电,非常适合那些希望在不改变驾驶习惯的情况下获得环保选择的消费者。因此,这些系统在商用车队和个人车辆中正变得越来越普遍。

2024年,德国汽车整合起动发电机组市场规模达4.967亿美元。该国的主导地位得益于其成熟的汽车製造基础以及48伏系统在各车型中的早期应用。领先的製造商已积极在其产品线中应用皮带传动ISG技术,以满足法规要求和消费者期望。德国强大的供应链,包括博世、大陆集团和采埃孚等主要供应商,进一步支持了本地生产和创新,并帮助其在全球ISG市场保持竞争优势。

活跃于全球汽车整合起动发电机组市场的主要参与者包括博世、三菱电机、电装、博格华纳、麦格纳国际、采埃孚、索恩格汽车、大陆集团、日立阿斯泰莫和法雷奥。为了确保在汽车 ISG 市场的领先地位,各公司正专注于几个策略领域。核心策略涉及投资研发,以提高性能、减轻重量并提高 ISG 系统的能源效率。製造商还瞄准平台可扩展性,以允许 ISG 整合到各种车辆类别中。与原始设备製造商的合作在为特定动力传动系统客製化解决方案方面发挥关键作用。此外,公司正在透过在地化製造来增强生产能力,以缩短交货时间并遵守区域采购政策。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 燃油效率需求激增

- 全球排放法规更加严格

- 经济高效的电气化解决方案

- 豪华和中高端市场的需求不断增长

- 产业陷阱与挑战

- 入门级车辆的初始整合成本较高

- 消费者意识和感知价值有限

- 市场机会

- 48V轻度混合动力车在新兴市场的扩张

- 商用车电气化

- 适用于高端/豪华车辆的高性能 ISG

- 售后市场和传统车队的改造

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 皮带传动 ISG(B-ISG)

- 曲轴安装式ISG

- 双离合器变速箱ISG

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- LCV(轻型商用车)

- MCV(中型商用车)

- HCV(重型商用车)

第七章:市场估计与预测:依功率等级,2021 年至 2034 年

- 主要趋势

- 5千瓦以下

- 5–10千瓦

- 10千瓦以上

第八章:市场估计与预测:依推进类型,2021 - 2034 年

- 主要趋势

- 轻度混合动力电动车(MHEV)

- 内燃机(ICE)车辆

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Aisin Corporation

- BorgWarner

- Bosch

- Continental

- Denso Corporation

- Hitachi Astemo

- Hyundai Mobis Co

- Johnson Electric Holdings

- Magna International

- MAHLE Group

- Mando Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- Prestolite Electric Incorporated

- Schaeffler AG

- SEG Automotive

- Toyota Industries

- Woory Industrial Co

- Valeo

- ZF Friedrichshafen

The Global Automotive Integrated Starter-Generator Units Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 11.9 billion by 2034. This growth is largely fueled by rising demand for vehicles that offer both improved efficiency and reduced environmental impact. As global regulations surrounding emissions become stricter, automakers are ramping up the rollout of mild hybrid models that incorporate ISG technology. These systems are attractive to consumers seeking better fuel economy without the steep price tag associated with full or plug-in hybrids. ISG-equipped powertrains provide a middle ground-delivering noticeable fuel savings with minimal disruption to conventional vehicle designs.

The growing appetite for premium and performance vehicles is also accelerating the adoption of ISG units, as they contribute to smoother engine start-stop operations and deliver low-end torque improvements that enhance driving feel. This aligns perfectly with what high-end buyers want-efficiency without sacrificing power or luxury. As congestion increases in urban areas, demand for systems that reduce fuel use during idling and frequent stops has surged. ISG units help manage these challenges while also reducing emissions, making them a favored option in the push for smarter, greener urban transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $11.9 Billion |

| CAGR | 8.9% |

In 2024, the belt-driven ISG systems segment generated USD 3 billion, dominating the market by offering automakers a practical and cost-effective route to electrification. These units are mounted on the engine's front and connected via a belt to the crankshaft, allowing manufacturers to integrate them without redesigning major components. This streamlined integration is a major advantage for brands looking to electrify existing vehicle platforms quickly, saving both time and capital.

Mild hybrid-electric vehicles represented the largest market share in 2024 and are projected to remain a key growth area. These vehicles incorporate a compact battery and deliver performance benefits that drivers can immediately notice-from quiet operation during coasting to seamless engine restarts. The low-end torque boost improves drivability, particularly in stop-and-go traffic. Additionally, mild hybrids do not rely on external charging, making them ideal for consumers who want eco-friendly options without changing their driving habits. As a result, these systems are becoming more common across both commercial fleets and personal vehicles.

Germany Automotive Integrated Starter-Generator Units Market generated USD 496.7 million in 2024. The country's dominant position is supported by a mature automotive manufacturing base and early adoption of 48-volt systems across various vehicle classes. Leading manufacturers have aggressively implemented belt-driven ISG technology across their lineups to meet both regulatory demands and consumer expectations. Germany's robust supply chain, with major contributors such as Bosch, Continental, and ZF Friedrichshafen, further supports local production and innovation, helping the country maintain a competitive edge in the global ISG market.

Key players active in the Global Automotive Integrated Starter-Generator Units Market include Bosch, Mitsubishi Electric, Denso, BorgWarner, Magna International, ZF Friedrichshafen, SEG Automotive, Continental, Hitachi Astemo, and Valeo. To secure a leading position in the automotive ISG market, companies are focusing on several strategic areas. One core strategy involves investment in R&D to enhance performance, reduce weight, and improve the energy efficiency of ISG systems. Manufacturers are also targeting platform scalability to allow ISG integration across various vehicle categories. Collaborations with OEMs play a key role in customizing solutions for specific drivetrains. In addition, firms are strengthening their production capabilities through localized manufacturing to reduce lead times and comply with regional sourcing policies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Power rating

- 2.2.5 Propulsion type

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in demand for fuel efficiency

- 3.2.1.2 Stricter emission regulations worldwide

- 3.2.1.3 Cost-effective electrification solution

- 3.2.1.4 Growing demand in the luxury and mid-premium segment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial integration cost for entry-level vehicles

- 3.2.2.2 Limited consumer awareness and perceived value

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of 48V mild hybrids in emerging markets

- 3.2.3.2 Commercial vehicle electrification

- 3.2.3.3 High-performance ISGs for premium/luxury vehicles

- 3.2.3.4 Aftermarket & retrofits for legacy fleets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Belt-driven ISG (B-ISG)

- 5.3 Crankshaft-mounted ISG

- 5.4 Dual-clutch transmission ISG

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 LCVs (light commercial vehicles)

- 6.3.2 MCVs (medium commercial vehicles)

- 6.3.3 HCVs (heavy commercial vehicles)

Chapter 7 Market Estimates & Forecast, By Power rating, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Below 5 kW

- 7.3 5–10 kW

- 7.4 Above 10 kW

Chapter 8 Market Estimates & Forecast, By Propulsion type, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Mild hybrid electric vehicles (MHEVs)

- 8.3 Internal combustion engine (ICE) vehicles

Chapter 9 Market Estimates & Forecast, By Sales channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aisin Corporation

- 11.2 BorgWarner

- 11.3 Bosch

- 11.4 Continental

- 11.5 Denso Corporation

- 11.6 Hitachi Astemo

- 11.7 Hyundai Mobis Co

- 11.8 Johnson Electric Holdings

- 11.9 Magna International

- 11.10 MAHLE Group

- 11.11 Mando Corporation

- 11.12 Mitsubishi Electric Corporation

- 11.13 Nidec Corporation

- 11.14 Prestolite Electric Incorporated

- 11.15 Schaeffler AG

- 11.16 SEG Automotive

- 11.17 Toyota Industries

- 11.18 Woory Industrial Co

- 11.19 Valeo

- 11.20 ZF Friedrichshafen