|

市场调查报告书

商品编码

1773417

骨内输液设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Intraosseous Infusion Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

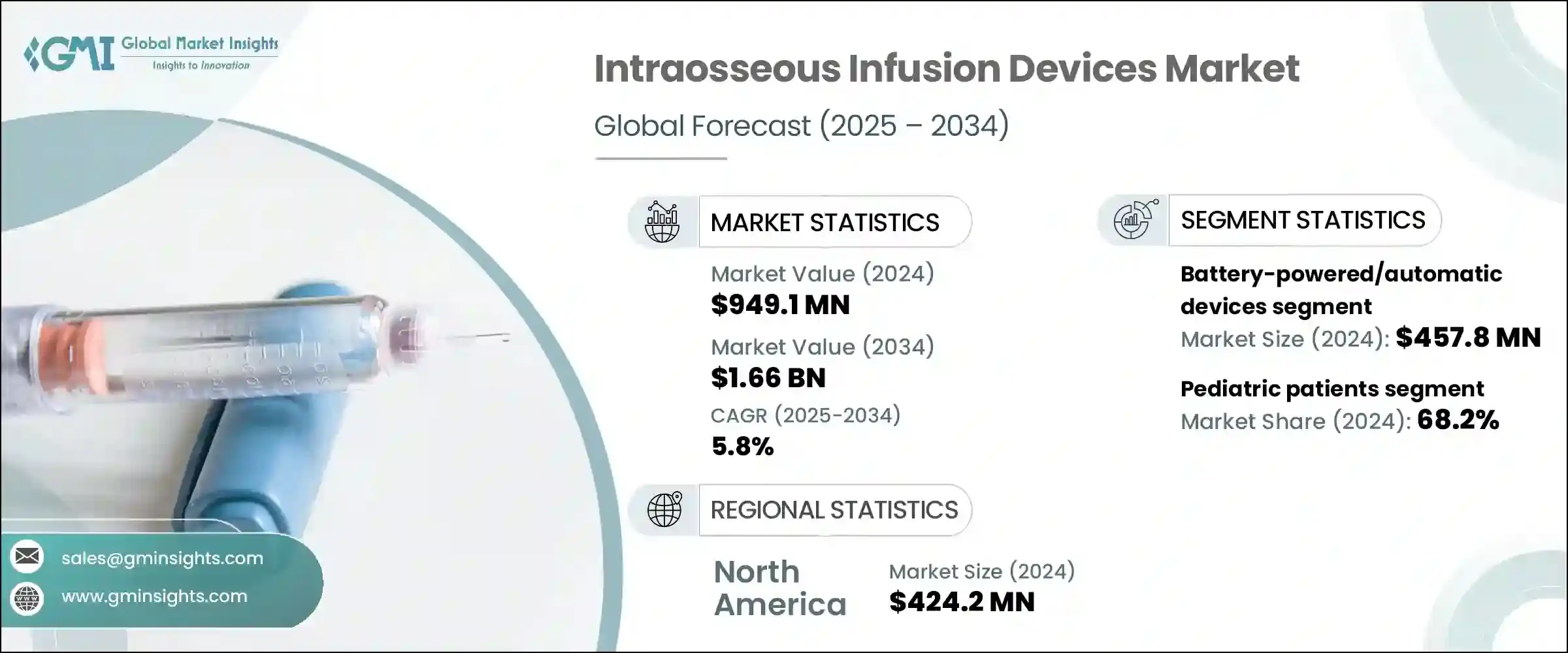

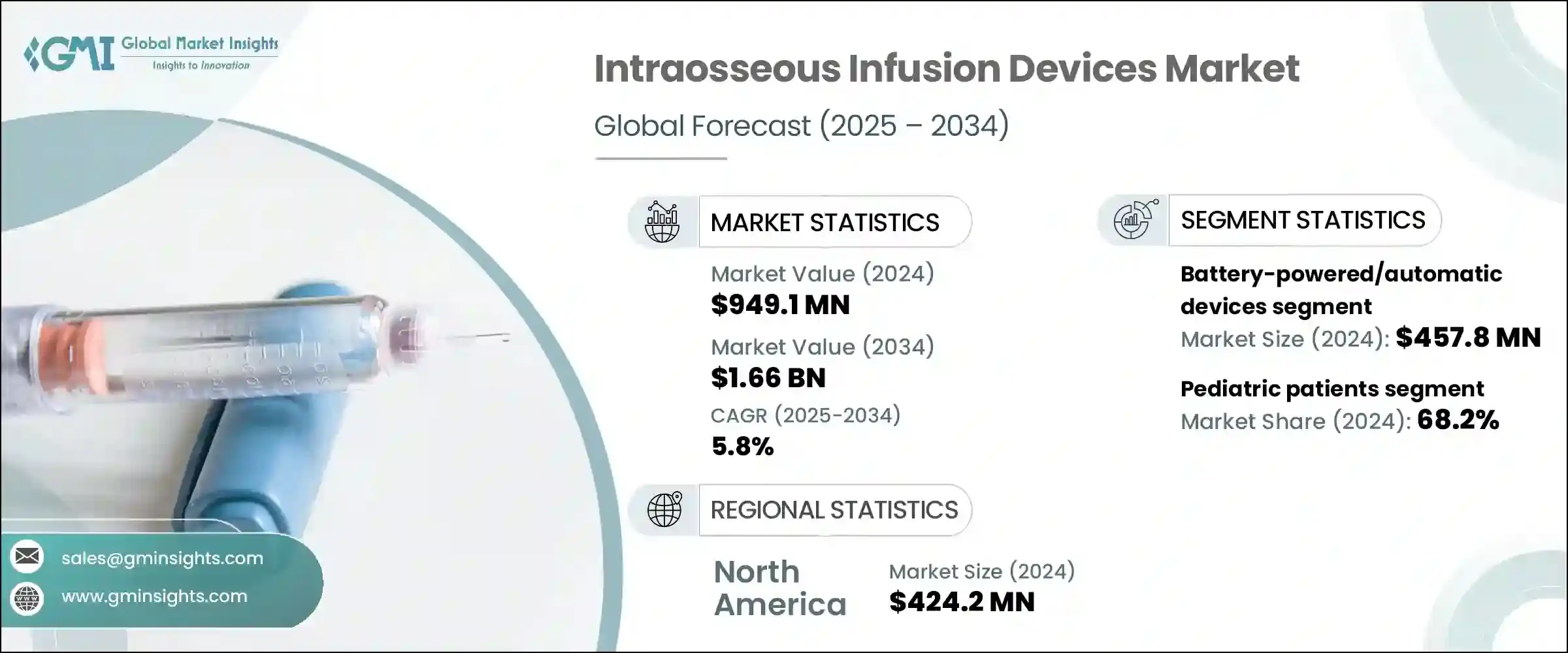

2024年全球骨内输液设备市场规模达9.491亿美元,预计2034年将以5.8%的复合年增长率成长,达到16.6亿美元。骨内输液设备旨在快速将液体、药物和血液製品直接输送至骨髓,尤其适用于传统静脉通路延迟或无效的情况。这些设备在危急的医疗紧急情况下至关重要,在时间有限或因生理限製或患者病情而无法进入周边静脉时,可提供可靠的血管通路。

其快速反应和可靠性使其成为各种医疗环境中紧急医疗方案的基石。它们广泛应用于创伤病例、休克管理和脱水紧急情况,在这些情况下,快速介入可以显着改善患者的预后。急诊室、救护车服务和野战医疗单位的医护人员依靠这些设备进行高效的復苏和药物输送,尤其是在时间紧迫的情况下。骨内通路的广泛应用也得益于民用和军用医疗服务部门对训练计画和方案整合的日益重视。其紧凑的结构、便携性和易用性进一步推动了其在传统医院环境之外的应用,使其能够在远端和院前护理中得到更广泛的部署。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 9.491亿美元 |

| 预测值 | 16.6亿美元 |

| 复合年增长率 | 5.8% |

市场按产品类型细分为电池供电型、手动骨内注射针(或称自动设备)以及衝击驱动系统。 2024年,电池供电/自动设备细分市场占据最大收益份额,达到4.578亿美元。这些设备由于其快速且方便的部署,已成为急救护理的首选解决方案,通常比手动设备更有效率。当传统静脉注射途径不可行时,尤其是在高压环境下,自动骨内系统提供了可靠的替代方案。其设计只需极少的培训,同时仍能提供较高的首次尝试成功率,使其成为急救车辆、空中救护车和军事行动的首选工具。它们在极端条件下的卓越性能推动了全球医疗保健系统的采用,各国政府为加强紧急准备和战斗护理系统而投入的资金也进一步增强了其应用。

依年龄层划分,市场分为成人和儿科患者。 2024年,儿科患者占据了大多数市场份额,占总市场份额的68.2%。由于幼童(尤其是婴儿和新生儿)的静脉细小且脆弱,建立血管通路往往面临独特的挑战。骨内输液提供了一种有效的替代方案,使医护人员能够快速可靠地实施挽救生命的治疗。因此,重症监护病房、门诊和急诊对儿科专用骨内器械的需求不断增长。全球儿科急救标准越来越多地将骨内通路纳入第一线干预措施,这鼓励了医疗机构投资于相容的设备和以儿科护理为重点的综合培训计画。

就最终用途而言,市场细分为医院和诊所、门诊手术中心和其他场所。医院和诊所细分市场在2024年占据领先地位,预计未来几年将保持强劲成长。创伤、心臟骤停以及败血症和低血容量性休克等重症疾病病例的增加,加剧了住院和急诊环境中对快速可靠的血管通路解决方案的需求。在静脉通路延迟或无法建立的情况下,骨内输液已成为关键选择,尤其对于病情危重或静脉难以定位的患者。各大医疗机构已将骨内输液设备纳入其急救方案,进一步加速了其在全球医院和创伤中心的普及。

2024年,北美领先全球市场,总估值达4.242亿美元。这一领先地位得益于该地区先进的医疗基础设施和大量的急救程序。在美国,该市场规模从2023年的3.655亿美元成长至2024年的3.829亿美元。高需求源自于各种需要立即建立血管通路的紧急情况,尤其是对于无法进行静脉注射的患者。这些设备已成为紧急医疗方案的重要组成部分,为各种临床应用提供了可靠的替代方案。

全球竞争格局呈现成熟企业与新创企业交织的局面。 Pyng Medical、Teleflex、Dickinson and Company、PerSys Medical、Becton 和 Cardinal Health 等主要参与者合计占了 2024 年全球约 70% 的收入。这些公司正积极透过收购、产品创新和策略合作进行扩张,以巩固其市场份额。同时,一些区域和本地製造商正透过提供经济高效的替代方案来渗透市场。为了扩大客户群并提高产品可近性,併购、新产品的推出以及区域扩张计画的激增进一步加剧了竞争态势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 紧急情况和创伤病例发生率上升

- 军事和紧急医疗服务(EMS)的采用率不断提高

- 设备设计的技术进步

- 医疗保健专业人员的意识和培训不断提高

- 产业陷阱与挑战

- 先进的骨内输液装置成本高昂

- 因放置不当而导致併发症的风险

- 市场机会

- 新兴市场对创伤护理的投入不断增加

- 加强与院前和救护车护理方案的整合

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 专利分析

- 定价分析

- 依产品类型

- 按地区

- 差距分析

- 波特的分析

- PESTLE 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 手动骨内注射针

- 电池供电/自动设备

- 衝击驱动装置

第六章:市场估计与预测:依年龄组,2021 年至 2034 年

- 主要趋势

- 儿科患者

- 成年患者

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Aero Healthcare

- Becton, Dickinson and Company

- Biopsybell

- Bound Tree Medical

- Cardinal Health

- Cook Medical

- Henry Schein

- Implox

- PAVmed

- PerSys Medical

- Pyng Medical

- SAM Medical

- Sarnova

- Teleflex

- Vidacare

The Global Intraosseous Infusion Devices Market was valued at USD 949.1 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 1.66 billion by 2034.Intraosseous infusion devices are designed for rapid administration of fluids, medications, and blood products directly into the bone marrow, particularly when conventional intravenous access proves to be delayed or ineffective. These devices are essential in critical medical emergencies, offering dependable vascular access when time is limited or peripheral veins are inaccessible due to physiological constraints or patient conditions.

Their rapid action and reliability make them a cornerstone in emergency medical protocols across various healthcare environments. They are widely used in trauma cases, shock management, and dehydration emergencies where quick intervention can significantly impact patient outcomes. Healthcare professionals in emergency departments, ambulance services, and field medical units rely on these devices for efficient resuscitation and drug delivery, especially in time-sensitive scenarios. The expanding use of intraosseous access has also been supported by increasing emphasis on training programs and protocol integration across both civilian and military medical services. Their compact build, portability, and ease of use have further propelled adoption beyond traditional hospital settings, enabling wider deployment in remote and pre-hospital care.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $949.1 Million |

| Forecast Value | $1.66 Billion |

| CAGR | 5.8% |

The market is segmented by product type into battery-powered, manual IO needles, or automatic devices, and impact-driven systems. In 2024, the battery-powered/automatic devices segment captured the largest revenue share, reaching USD 457.8 million. These devices have become the go-to solution in emergency care due to their speed and ease of deployment, often proving more efficient than their manual counterparts. Automatic intraosseous systems offer a reliable alternative when conventional intravenous routes are not an option, especially under high-pressure circumstances. Their design requires minimal training while still delivering high first-attempt success rates, making them a preferred tool in emergency vehicles, air ambulances, and military operations. Their performance in extreme conditions has boosted adoption across healthcare systems worldwide, further reinforced by investments from governments to enhance emergency readiness and combat care systems.

By age group, the market is categorized into adult and pediatric patients. In 2024, pediatric patients accounted for the majority share, commanding 68.2% of the total market. Establishing vascular access in young patients, especially infants and neonates, often presents unique challenges due to small and fragile veins. Intraosseous infusion offers an effective alternative, allowing medical professionals to administer life-saving treatments quickly and reliably. As a result, the demand for pediatric-specific intraosseous devices has grown across intensive care units, ambulatory services, and emergency departments. Global standards for pediatric emergency response increasingly incorporate intraosseous access as a frontline intervention, which has encouraged healthcare facilities to invest in compatible equipment and comprehensive training programs focused on pediatric care.

In terms of end use, the market is segmented into hospitals and clinics, ambulatory surgical centers, and other settings. The hospitals and clinics segment held the leading position in 2024 and is expected to maintain strong growth over the coming years. Rising cases of trauma, cardiac arrest, and critical conditions such as sepsis and hypovolemic shock have intensified the need for swift and reliable vascular access solutions in inpatient and emergency environments. Intraosseous infusion has become a critical option in scenarios where intravenous access is either delayed or unachievable, especially in patients who are critically ill or whose veins are hard to locate. Major healthcare organizations have integrated intraosseous devices into their emergency care protocols, further accelerating their presence across hospitals and trauma centers globally.

North America led the global market in 2024, with a total valuation of USD 424.2 million. This leadership is supported by advanced healthcare infrastructure and a high volume of emergency procedures across the region. In the United States, the market grew from USD 365.5 million in 2023 to USD 382.9 million in 2024. High demand stems from the need to handle a wide range of emergency cases that require immediate vascular access, especially in patients for whom intravenous methods are not viable. These devices have become a vital component of emergency medical protocols, offering a dependable alternative across a spectrum of clinical use cases.

The global competitive landscape features a mix of well-established players and emerging companies. Key participants such as Pyng Medical, Teleflex, Dickinson and Company, PerSys Medical, Becton, and Cardinal Health collectively accounted for around 70% of global revenue in 2024. These companies are actively expanding through acquisitions, product innovations, and strategic partnerships to reinforce their market share. At the same time, several regional and local manufacturers are penetrating the market by offering cost-effective alternatives. Competitive dynamics are further intensified by a surge in mergers, new product rollouts, and regional expansion initiatives aimed at broadening customer bases and enhancing product accessibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Age group

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of emergency conditions and trauma cases

- 3.2.1.2 Increased adoption by military and emergency medical services (EMS)

- 3.2.1.3 Technological advancements in device design

- 3.2.1.4 Growing awareness and training among healthcare professionals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced intraosseous infusion devices

- 3.2.2.2 Risk related to complications due to improper placements

- 3.2.3 Market opportunities

- 3.2.3.1 Growing investments in trauma care across emerging markets

- 3.2.3.2 Increased integration into pre-hospital and ambulance care protocols

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product type

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Manual IO needles

- 5.3 Battery-powered/automatic devices

- 5.4 Impact-driven devices

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric patients

- 6.3 Adult patients

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profile

- 9.1 Aero Healthcare

- 9.2 Becton, Dickinson and Company

- 9.3 Biopsybell

- 9.4 Bound Tree Medical

- 9.5 Cardinal Health

- 9.6 Cook Medical

- 9.7 Henry Schein

- 9.8 Implox

- 9.9 PAVmed

- 9.10 PerSys Medical

- 9.11 Pyng Medical

- 9.12 SAM Medical

- 9.13 Sarnova

- 9.14 Teleflex

- 9.15 Vidacare