|

市场调查报告书

商品编码

1773421

兽医除颤器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Veterinary Defibrillators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

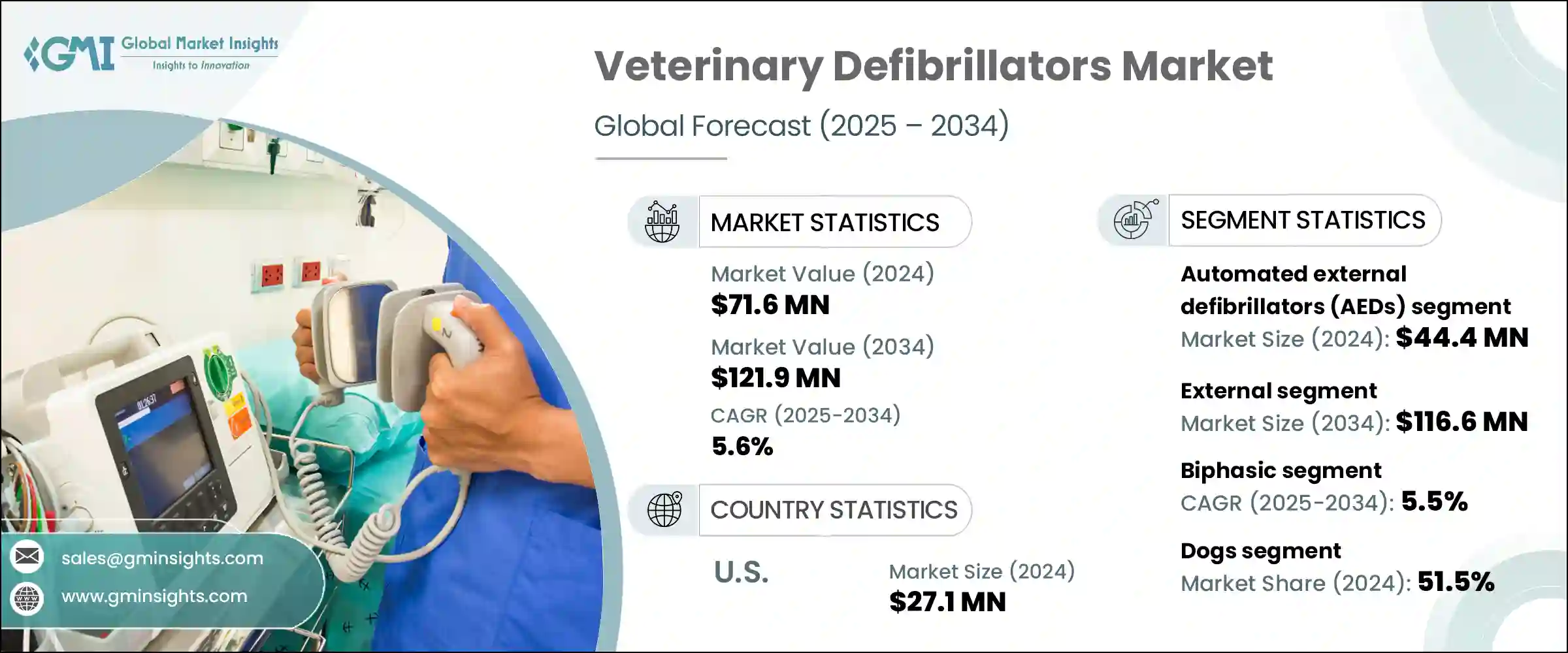

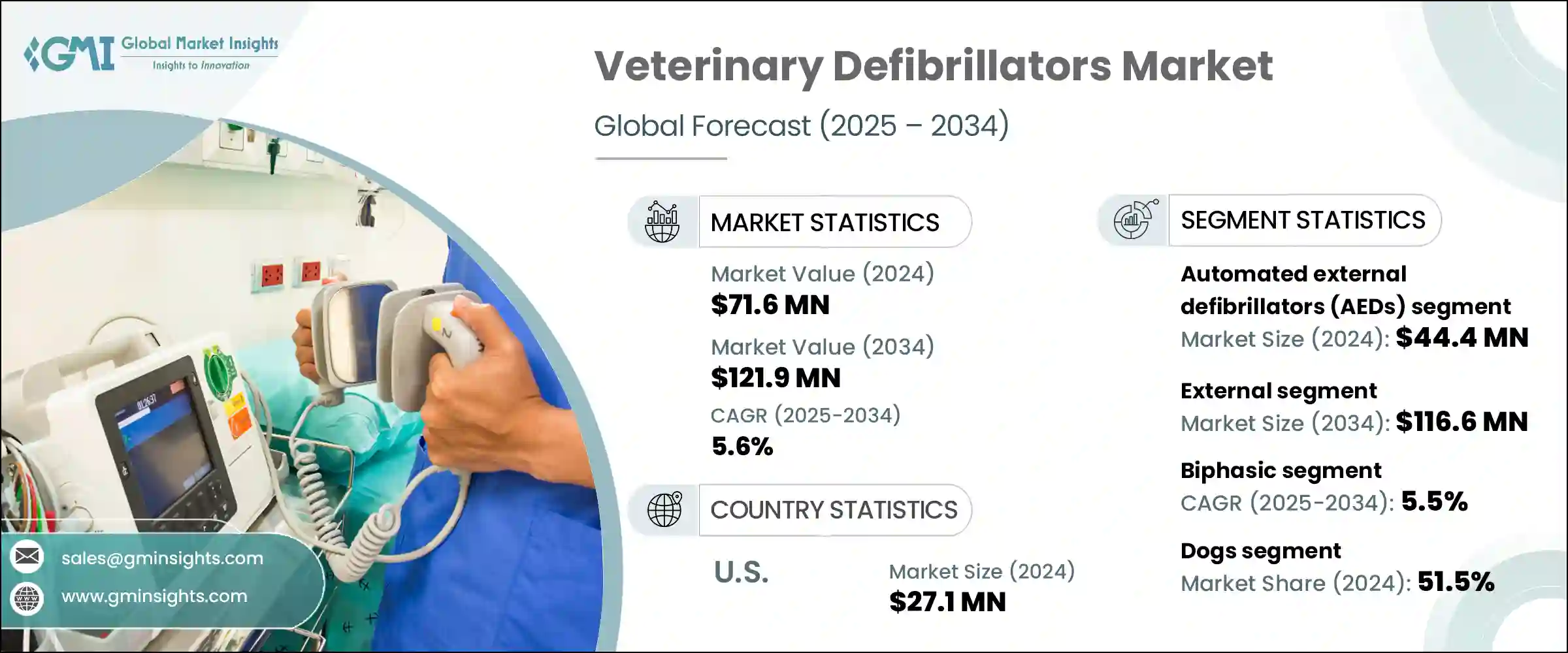

2024年,全球兽用去颤器市场规模达7,160万美元,预计2034年将以5.6%的复合年增长率成长,达到1.219亿美元。动物心血管疾病发生率的不断上升是推动市场需求的主要驱动力。兽医院、诊所和急救机构数量的不断增加也进一步推动了市场的成长。全天候动物急救服务和专业的心臟护理增加了对去颤器的需求,尤其是配备多参数功能的除颤器。紧凑、便携且易于使用的自动体外除颤器 (AED) 的最新进展,使其覆盖范围扩展到小型诊所和流动诊所,使更多人能够获得救生技术。

更便捷的可及性、更便捷的操作以及与现代监测工具的集成,正推动其在更广泛的兽医应用中得到应用。随着越来越多的宠物主人重视心臟健康,以及人们越来越意识到紧急情况下及时除颤的益处,兽医诊所也逐渐认识到这些救生设备的重要性。宠物收养率的提高和动物照护标准的不断提升,正在推动对手动和自动化解决方案的长期需求,尤其是在基础设施完善且不断扩展的已开发市场。兽医除颤器可在动物出现心律不整或心臟骤停时,对其施加治疗性电击。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7160万美元 |

| 预测值 | 1.219亿美元 |

| 复合年增长率 | 5.6% |

2024年,自动体外心臟去颤器 (AED) 细分市场收入达4,440万美元。 AED的高普及率主要归功于其直觉的设计和使用者引导功能。内建演算法可协助兽医完成除颤过程,这促使其在中小型诊所以及行动医疗单位中得到广泛应用。 AED能够即时评估心律并给予必要的电击,使其成为快速反应场景中不可或缺的一部分。紧凑的外形、可充电电源和整合监控功能使其用途广泛。 AED的应用范围已逐渐超越传统诊所,扩展到行动兽医服务、救援行动以及偏远地区的动物卫生机构,这极大地促进了该细分市场的持续成长。

预计到2034年,双相除颤器市场将以5.5%的复合年增长率成长。这些设备采用双相电击输送,使电流更有效率、更可控地流经心臟,对心血管系统敏感的动物尤其有益。较低的能量需求降低了组织损伤风险,这在治疗小型宠物时至关重要。双相技术增强的安全性和有效性使其成为兽医的首选。该市场的成长还得益于其与现代多参数监视器的高度相容性,以及与ICU和外科病房等重症监护环境的整合。由于其先进的电击演算法和在高强度医疗环境中的适应性,兽医专家和教学医院越来越青睐这些系统。

2024年,美国兽医除颤器市场规模达2,710万美元。这一持续增长反映了宠物饲养量的不断增长、兽医基础设施的改善以及对动物紧急护理的日益重视。宠物保险的普及也促进了高端技术的普及,使更多宠物主人能够负担得起双相除颤器和自动体外心臟去颤器(AED)等设备。对宠物心臟护理的追求,正在推动兽医诊所建立更强大、技术更精良的紧急应变系统。

影响全球兽用除颤器市场的关键参与者包括迈瑞医疗国际有限公司、Avante Animal Health、武汉协和医疗技术公司、新一代医疗系统、Shinova Medical、ARI Medical Technology、Infinium Medical、深圳科曼医疗器材公司、Promed Technology、重庆远星光学、Kalstein、Digicare Biomedical、Meditech Equiicalt、Meditech Epment、科学技术。为了巩固和加强其市场地位,领先的兽用去颤器製造商正在积极投资开发紧凑、便携的设备,将易用性与先进的临床功能相结合。将智慧电击演算法和多参数监控整合到手动和 AED 系统中有助于提升产品价值。与兽医院和急救护理提供者建立策略合作伙伴关係使品牌能够了解现实世界的需求并相应地客製化解决方案。此外,该公司正在扩大其全球分销网络,并进入兽医护理基础设施仍在发展的服务不足地区。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 宠物拥有量增加以及宠物人性化

- 宠物心臟病发生率不断上升

- 兽医医疗技术的进步

- 产业陷阱与挑战

- 除颤器成本高昂

- 缺乏意识和培训

- 机会

- 紧急和重症护理服务需求不断增长

- 发展中地区兽医基础设施投资不断增加

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 当前的技术趋势

- 新兴技术

- 未来市场趋势

- 消费者行为分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与协作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 自动体外去颤器(AED)

- 手动去颤器

第六章:市场估计与预测:依模式,2021 年至 2034 年

- 主要趋势

- 外部的

- 内部的

第七章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 双相

- 单相

第八章:市场估计与预测:依动物类型,2021 年至 2034 年

- 主要趋势

- 狗

- 猫

- 马匹

- 其他动物类型

第九章:市场估计与预测:按功能,2021 年至 2034 年

- 主要趋势

- 标准

- 多参数能力

第 10 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 兽医医院和诊所

- 兽医研究机构

- 其他最终用途

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- ARI Medical Technology

- Avante Animal Health

- Chongqing Vision Star Optical

- Digicare Biomedical

- Hefei Eur Vet Technology

- Infinium Medical

- Kalstein

- Meditech Equipment

- Mindray Medical International Limited

- New Gen Medical Systems

- Promed Technology

- Shenzhen Comen Medical Instruments

- Shinova Medical

- Wuhan Union Medical Technology

The Global Veterinary Defibrillators Market was valued at USD 71.6 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 121.9 million by 2034. Increasing occurrences of cardiovascular issues in animals are a major driver fueling market demand. The growth is further supported by the rising number of veterinary hospitals, clinics, and emergency care facilities. Around-the-clock animal emergency services and specialized cardiac care are increasing the need for defibrillators, particularly those equipped with multiparameter functionalities. Recent advancements in compact, portable, and easy-to-use automated external defibrillators (AEDs) are extending their reach to smaller clinics and mobile practices, enabling broader access to life-saving technologies.

Enhanced accessibility, combined with improvements in ease of operation and integration with modern monitoring tools, is helping drive adoption across a wider range of veterinary applications. As more pet owners prioritize cardiac health, and as awareness spreads regarding the benefits of timely defibrillation during emergencies, veterinary practices are recognizing the importance of these life-saving devices. Increased pet adoption rates and the rising standards of animal care are contributing to long-term demand for both manual and automated solutions, particularly in developed markets where infrastructure is well-established and continually expanding. Veterinary defibrillators deliver therapeutic electrical shocks to animals in cases of cardiac arrhythmia or sudden cardiac arrest.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $71.6 Million |

| Forecast Value | $121.9 Million |

| CAGR | 5.6% |

In 2024, the automated external defibrillators (AEDs) segment generated USD 44.4 million. The high adoption rate of AEDs is largely due to their intuitive design and user-guided functionality. Built-in algorithms that assist veterinarians through the defibrillation process are encouraging their use in small and mid-size practices, as well as in mobile units. Their ability to instantly assess heart rhythms and deliver the necessary shock makes them essential for rapid-response scenarios. Compact form, rechargeable power, and integrated monitoring capabilities support their versatility. AEDs are being increasingly used beyond traditional clinics, in mobile veterinary services, rescue operations, and animal health facilities in remote areas, which contributes significantly to the segment's ongoing expansion.

The biphasic defibrillators segment is projected to grow at a CAGR of 5.5% through 2034. These devices utilize dual-phase shock delivery, allowing more efficient and controlled current flow through the heart, which is particularly beneficial for animals with sensitive cardiovascular systems. Lower energy requirements reduce tissue damage risks, which is crucial when treating small pets. The enhanced safety and effectiveness of biphasic technology are positioning it as a preferred option among veterinarians. The segment's growth is also driven by its high compatibility with contemporary multiparameter monitors and integration into critical care environments like ICUs and surgical units. Veterinary specialists and teaching hospitals increasingly favor these systems due to their advanced shock algorithms and adaptability in high-intensity medical settings.

United States Veterinary Defibrillators Market reached USD 27.1 million in 2024. This consistent increase reflects growing pet ownership, improvements in veterinary infrastructure, and a heightened focus on emergency animal care. Pet insurance adoption is also supporting access to high-end technologies, enabling more pet owners to afford devices like biphasic defibrillators and AEDs. The push for better cardiac care in pets is fostering a more robust and technologically equipped emergency response system in veterinary practices.

Key players shaping the Global Veterinary Defibrillators Market include Mindray Medical International Limited, Avante Animal Health, Wuhan Union Medical Technology, New Gen Medical Systems, Shinova Medical, ARI Medical Technology, Infinium Medical, Shenzhen Comen Medical Instruments, Promed Technology, Chongqing Vision Star Optical, Kalstein, Digicare Biomedical, Meditech Equipment, Hefei Eur Vet Technology, and Zucami Medical. To secure and strengthen their market position, leading veterinary defibrillator manufacturers are actively investing in the development of compact, portable devices that combine ease of use with sophisticated clinical features. Integration of intelligent shock algorithms and multiparameter monitoring into both manual and AED systems is helping enhance product value. Strategic partnerships with veterinary hospitals and emergency care providers allow brands to understand real-world needs and tailor solutions accordingly. Additionally, companies are broadening their global distribution networks and entering underserved regions where veterinary care infrastructure is still evolving.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Modality

- 2.2.4 Technology

- 2.2.5 Animal type

- 2.2.6 Functionality

- 2.2.7 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership and humanization of pets

- 3.2.1.2 Increasing incidence of cardiac disorders in pets

- 3.2.1.3 Advancements in veterinary medical technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of defibrillators

- 3.2.2.2 Lack of awareness and training

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for emergency and critical care services

- 3.2.3.2 Growing investments in veterinary infrastructure in developing regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Consumer behaviour analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automated external defibrillators (AEDs)

- 5.3 Manual defibrillators

Chapter 6 Market Estimates and Forecast, By Modality, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 External

- 6.3 Internal

Chapter 7 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Biphasic

- 7.3 Monophasic

Chapter 8 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Dogs

- 8.3 Cats

- 8.4 Horses

- 8.5 Other animal types

Chapter 9 Market Estimates and Forecast, By Functionality, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Standard

- 9.3 Multiparameter-capability

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospitals and clinics

- 10.3 Veterinary research institutes

- 10.4 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 ARI Medical Technology

- 12.2 Avante Animal Health

- 12.3 Chongqing Vision Star Optical

- 12.4 Digicare Biomedical

- 12.5 Hefei Eur Vet Technology

- 12.6 Infinium Medical

- 12.7 Kalstein

- 12.8 Meditech Equipment

- 12.9 Mindray Medical International Limited

- 12.10 New Gen Medical Systems

- 12.11 Promed Technology

- 12.12 Shenzhen Comen Medical Instruments

- 12.13 Shinova Medical

- 12.14 Wuhan Union Medical Technology