|

市场调查报告书

商品编码

1773422

医疗科技塑胶注塑机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Plastic Injection Molding Machine for MedTech Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

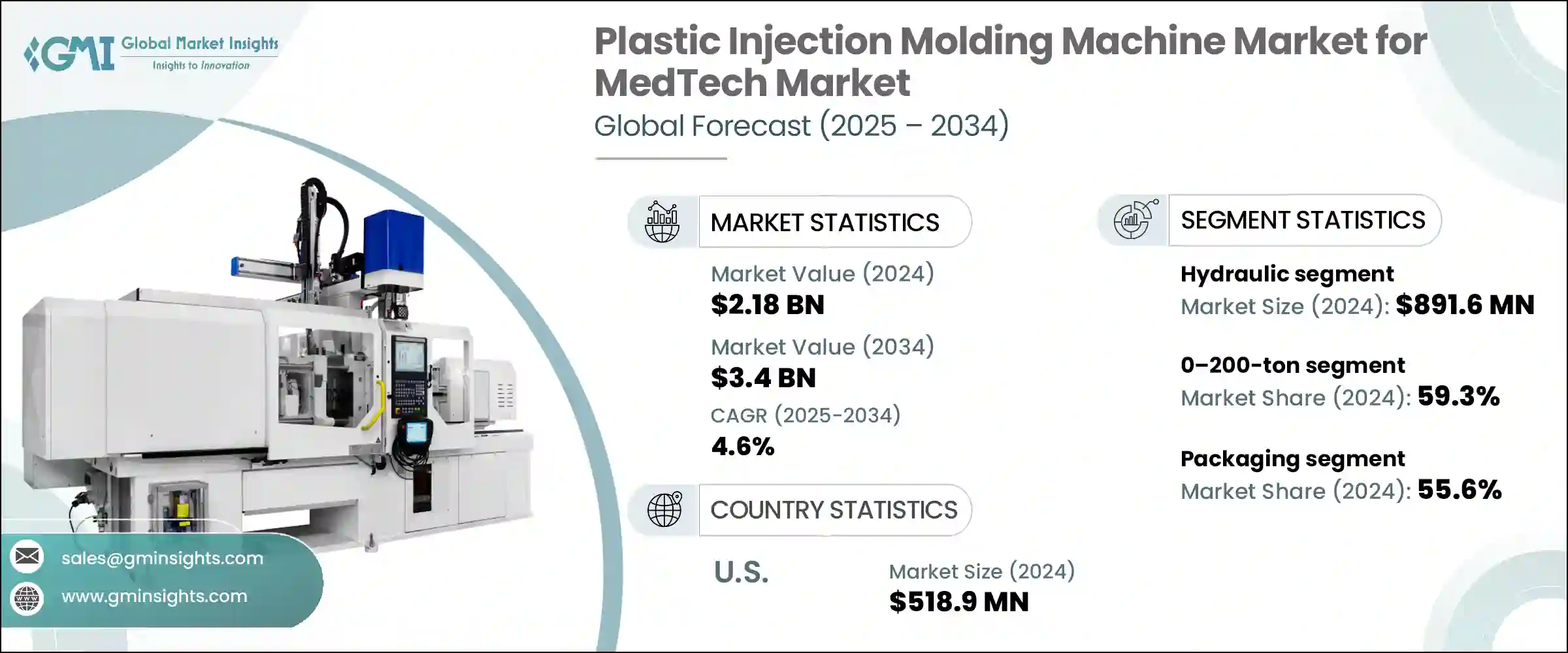

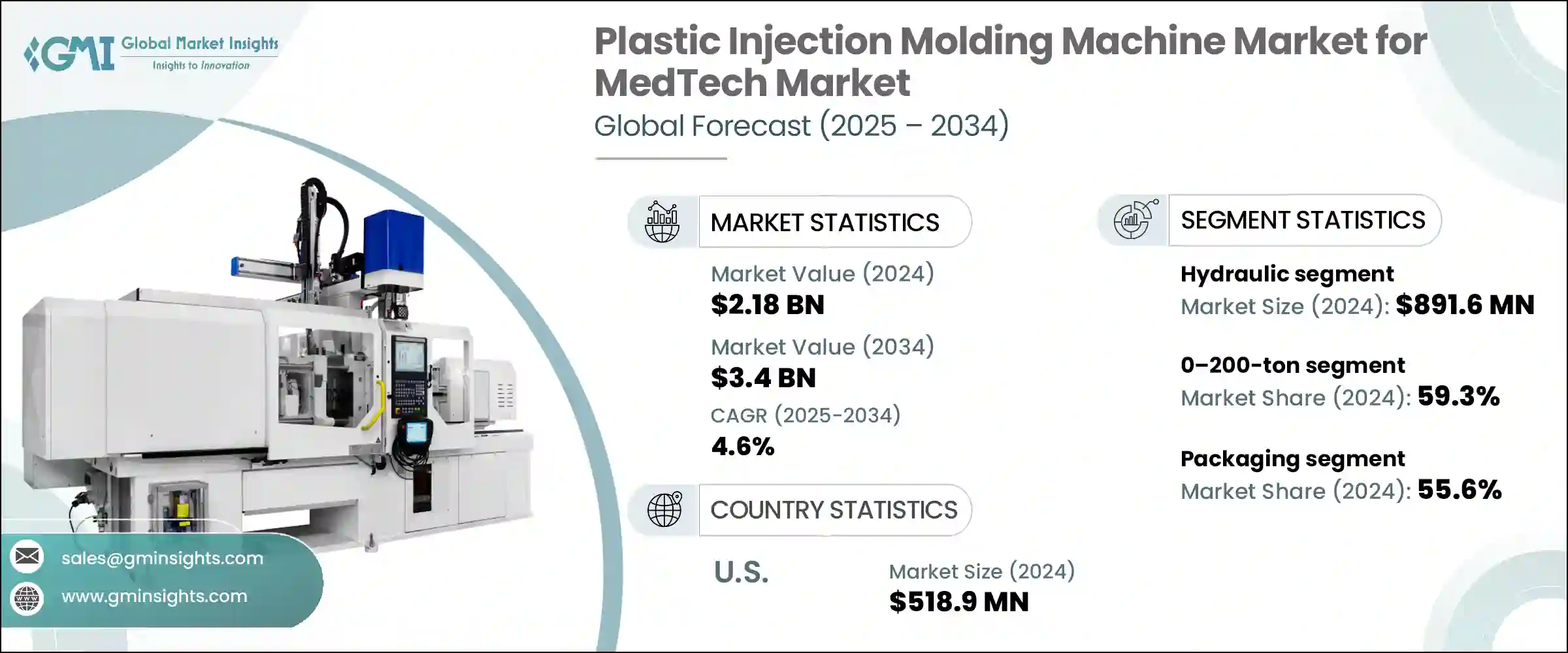

2024 年全球医疗技术市场塑胶注塑机的价值为 21.8 亿美元,预计到 2034 年将以 4.6% 的复合年增长率增长至 34 亿美元。人口老化和美国和欧洲慢性病激增推动了这一需求,导致对高品质、可靠医疗设备的需求增加。这些设备通常需要专为长期照护和慢性病管理设计的复杂包装组件。新兴市场医疗保健产业的扩张为美国和欧洲的机器製造商带来了诱人的成长前景,无论是透过出口还是透过为满足这些地区需求的国内医疗技术原始设备製造商提供服务。此外,亚太、拉丁美洲、东欧和中东部分地区等地区不断增长的医疗保健支出,也提高了对经济高效且精确的医疗设备生产的需求。

製造业在岸化趋势和合约製造网路的快速扩张正在积极重塑全球医疗科技生产格局,为塑胶射出成型机供应商创造新的发展动力。随着製造商寻求减少对海外供应链的依赖,并降低地缘政治和物流风险,许多製造商正在将生产迁移到更靠近北美和欧洲等关键市场的地方。这种转变推动了对高度自动化、高精度注塑机的需求,这些注塑机支援精益生产模式并符合无尘室标准。此外,合约製造合作伙伴正在扩大生产规模,以处理医疗科技原始设备製造商 (OEM) 的多样化产品组合,这推动了对能够高效、大批量生产复杂部件的多功能注塑机的需求。这些不断发展的动态正在为专注于医疗级应用的机器製造商开闢长期成长途径。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21.8亿美元 |

| 预测值 | 34亿美元 |

| 复合年增长率 | 4.6% |

2024年,液压领域产值达到8.916亿美元,预计2034年将以3.9%的复合年增长率成长。儘管液压系统能耗高,但其高注射压力、卓越的锁模力和耐用性使其非常适合复杂生物医学零件的大量生产。它们在高温下成型高黏度材料时表现出色,使其成为关键医疗零件生产的可靠选择。

2024年,0-200吨锁模力的射出成型机占据了59.3%的市场份额,预计到2034年将以5.1%的复合年增长率成长。这些紧凑型系统能够在洁净室内精确成型小型一次性零件,例如手术和牙科器械。其节能、更短的成型週期以及大批量生产精密零件的能力使其成为医疗科技领域不可或缺的一部分。

美国医疗科技市场塑胶射出成型机在2024年创下了5.189亿美元的产值,预计到2034年将以3.1%的复合年增长率成长。由于液压注塑机成本效益高,且能够生产大量、复杂的零件,尤其是在合约製造领域,因此国内市场对液压注塑机的偏好强烈。电动注塑机也因其快速循环、低噪音和低维护成本的特点,在中小企业和研究实验室中越来越受到青睐。美国医疗科技公司越来越重视能源效率、清洁操作和精度,从而推动液压和电动平台之间的市场平衡。

全球医疗科技市场塑胶射出成型机的领导製造商包括美联(Million)、JSW、住友德马格(Sumitomo Demag)、日精塑胶工业株式会社(Nissei Plastic Industrial Co., Ltd.)、泰瑞机械(Tederic Machinery)、威猛巴顿菲尔(Wittmann Bats, Ltd.)、泰瑞机械(Tederic Machinery)、威猛巴顿菲尔(Wittmann Battenfeld)、阿博克龙Milacron)、博乐机械(Bohle Machinery)、内格里博西(Negri Bossi)、震雄集团(Chen Hsong Holdings Limited)、恩格尔(Engel)、巴顿菲尔(Battenfeld)和赫斯基注塑系统(Husky Injection Molding Systems)。在这个专业设备市场中营运的公司正在采取策略性措施来巩固其竞争地位。他们专注于开发专为医疗级零件设计的精密工程机器,同时投资研发以提高能源效率和循环速度。

与医疗科技原始设备製造商 (OEM) 的合作有助于验证机器在高要求应用中的效能,而全球服务网路则可确保快速的支援和维护。此外,製造商正在客製化产品以符合区域洁净室标准和监管需求,并透过预测性维护和远端监控等智慧製造功能增强数位化能力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 医疗器材需求不断成长

- 医疗保健领域的技术进步

- 人口老化与慢性疾病

- 转向微创手术

- 产业陷阱与挑战

- 初期投资成本高

- 监理合规挑战

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按机器类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计(HS编码847710)

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按机器类型,2021 - 2034 年

- 主要趋势

- 油压机

- 电动机

- 油电混合机器

- 微型机器

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 热流道系统与冷流道系统

- 多腔和系列模具设计

- 迭模技术

- 伺服驱动模具系统

- 高精度模具技术

第七章:市场预估与预测:依锁模力,2021 - 2034

- 主要趋势

- 0-200吨力

- 201-500吨力

- 500吨以上力

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 包装

- 无菌包装组件

- 瓶盖和封口

- 保护性包装

- 其他的

- 诊断

- 外科

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- B2B医疗科技公司

- 大的

- 中小企业

- 药品和组合产品製造商

- 合约製造组织(CMO)

- 研发机构

- 医学研究机构

- 医疗孵化器与创新中心

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第 11 章:公司简介

- Arburg

- Billion

- BOLE Machinery

- Chen Hsong Holdings Limited

- Engel

- Ferromatik Milacron

- Husky Injection Molding Systems

- JSW

- KraussMaffei

- Negri Bossi

- Nissei Plastic Industrial Co., Ltd.

- Netstal

- Sumitomo Demag

- Tederic Machinery

- Wittmann Battenfeld

The Global Plastic Injection Molding Machine for MedTech Market was valued at USD 2.18 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 3.4 billion by 2034. Demand is being driven by aging demographics and a surge in chronic diseases across the U.S. and Europe, resulting in increased requirements for high-quality, reliable medical devices. These devices often require intricate packaging components designed for long-term care and chronic disease management. Expansion in emerging market healthcare sectors presents compelling growth prospects for U.S. and European machine manufacturers, both through exports and through servicing domestic MedTech OEMs catering to these geographies. Additionally, rising healthcare expenditures in regions like Asia-Pacific, Latin America, Eastern Europe, and parts of the Middle East are elevating demand for cost-effective yet precise medical device production.

A broader trend toward onshoring and the rapid expansion of contract manufacturing networks is actively reshaping the global MedTech production landscape, creating new momentum for plastic injection molding machine suppliers. As manufacturers seek to reduce reliance on overseas supply chains and mitigate geopolitical and logistical risks, many are relocating production closer to key markets such as North America and Europe. This shift is fueling demand for highly automated, precision-focused molding machines that support lean manufacturing models and cleanroom compliance. Additionally, contract manufacturing partners are scaling up facilities to handle diverse product portfolios for MedTech OEMs, driving the need for versatile molding platforms capable of producing intricate components efficiently and at high volumes. These evolving dynamics are opening long-term growth avenues for machine makers specializing in medical-grade applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.18 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 4.6% |

The hydraulic segment generated USD 891.6 million in 2024 and is projected to grow at a CAGR of 3.9% through 2034. Though energy-intensive, their high injection pressures, exceptional clamping force, and durability suit large-batch production of complex biomedical components. Their consistent performance in molding high-viscosity materials under high temperatures makes them a dependable choice for critical medical parts production.

Machines with 0-200-ton clamping force segment held a 59.3% share in 2024 and are forecast to grow at a CAGR of 5.1% through 2034. These compact systems enable precise molding of small, disposable components-such as surgical and dental devices-within cleanroom settings. Their energy efficiency, shorter cycle times, and ability to produce high volumes of precision parts make them indispensable for the MedTech sector.

U.S. Plastic Injection Molding Machine for MedTech Market generated USD 518.9 million in 2024 and is expected to grow at a 3.1% CAGR through 2034. Domestic preference for hydraulic machines is strong due to their cost-effectiveness and capability for large-shot, complex part production, especially in contract manufacturing. Electric machines are also gaining traction in SMEs and research labs for their fast cycles, low noise, and minimal upkeep. U.S. MedTech firms increasingly value energy efficiency, clean operation, and precision, driving a balanced market between hydraulic and electric platforms.

Leading manufacturers in the Global Plastic Injection Molding Machine for MedTech Market include Million, JSW, Sumitomo Demag, Nissei Plastic Industrial Co., Ltd., Tederic Machinery, Wittmann Battenfeld, Arburg, Netstal, Ferromatik Milacron, Bohle Machinery, Negri Bossi, Chen Hsong Holdings Limited, Engel, Battenfeld, and Husky Injection Molding Systems. Companies operating in this specialized equipment market are employing strategic initiatives to reinforce their competitive positions. They focus on developing precision-engineered machines designed for medical-grade components while investing in R&D to improve energy efficiency and cycle speed.

Collaborations with MedTech OEMs help validate machine performance for demanding applications, while global service networks ensure rapid support and maintenance. Furthermore, manufacturers are customizing products to match regional cleanroom standards and regulatory needs and are enhancing digital capabilities through smart manufacturing features like predictive maintenance and remote monitoring.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Technology

- 2.2.4 Clamping Force

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for medical devices

- 3.2.1.2 Technological advancements in healthcare

- 3.2.1.3 Aging population and chronic diseases

- 3.2.1.4 Shift towards minimally invasive procedures

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Regulatory compliance challenges

- 3.2.3 opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code 847710)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Hydraulic machines

- 5.3 Electric machines

- 5.4 Hybrid machines

- 5.5 Micro machines

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Hot runner systems and cold runner systems

- 6.3 Multi-cavity and family mold designs

- 6.4 Stack mold technology

- 6.5 Servo-actuated mold systems

- 6.6 High-precision mold technologies

Chapter 7 Market Estimates & Forecast, By Clamping Force, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 0-200 ton force

- 7.3 201-500 ton force

- 7.4 Above 500 ton force

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Packaging

- 8.2.1 Sterile packaging components

- 8.2.2 Caps and closures

- 8.2.3 Protective packaging

- 8.2.4 Others

- 8.3 Diagnostic

- 8.4 Surgical

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 B2B MedTech Companies

- 9.2.1 Large

- 9.2.2 SME

- 9.3 Pharmaceutical and Combination Product Manufacturers

- 9.4 Contract Manufacturing Organizations (CMOs)

- 9.5 Research and Development Organizations

- 9.5.1 Medical Research Institutions

- 9.5.2 Medical Incubators and Innovation Centers

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Arburg

- 11.2 Billion

- 11.3 BOLE Machinery

- 11.4 Chen Hsong Holdings Limited

- 11.5 Engel

- 11.6 Ferromatik Milacron

- 11.7 Husky Injection Molding Systems

- 11.8 JSW

- 11.9 KraussMaffei

- 11.10 Negri Bossi

- 11.11 Nissei Plastic Industrial Co., Ltd.

- 11.12 Netstal

- 11.13 Sumitomo Demag

- 11.14 Tederic Machinery

- 11.15 Wittmann Battenfeld