|

市场调查报告书

商品编码

1773423

蒸汽气炸锅市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Steam Air Fryer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球蒸汽气炸锅市场规模达 4.2 亿美元,预计到 2034 年将以 4.5% 的复合年增长率成长至 6.395 亿美元。这一增长主要源于消费者对健康烹饪方式的日益偏好。随着人们对肥胖、心臟病和生活方式相关疾病的认识不断提高,越来越多的人开始寻求能够低脂、营养丰富的烹饪厨房电器。蒸气气炸锅将对流加热与保湿蒸气结合,在酥脆口感和营养保留之间取得平衡。这些产品吸引了众多人群——从寻求快速健康膳食的忙碌专业人士,到希望以最少的油烹调均衡饮食的家庭。注重健康的人士尤其被这些电器所吸引,因为它们能够有效保留维生素并减少有害的烹饪副产品。

根据营养资料显示,蒸气烹饪可保留90%至95%的水溶性维生素,远胜于通常仅保留60%至70%的传统烘焙。与传统油炸相比,光是气炸锅一项就能减少高达80%的用油量。这些优势促使零售商和製造商优先考虑蒸汽气炸锅。诸如空气-蒸汽组合技术、内建食谱平台和智慧烹饪预设等创新技术正在不断开发,以提高烹饪的便利性和营养价值。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.2亿美元 |

| 预测值 | 6.395亿美元 |

| 复合年增长率 | 4.5% |

数位蒸汽气炸锅市场在2024年创造了1.773亿美元的收入,预计到2034年将以4.1%的复合年增长率成长。这些机型因其直觉的功能(例如LED显示器、数位触控萤幕和预设烹饪模式)而备受青睐。消费者欣赏其简便性、准确性以及提供一致结果的能力。与手动机型不同,数位炸锅可让使用者立即启动「酥脆蒸气」功能,确保更好地保留营养成分并均匀烹饪。它们尤其受到注重健康和高效备餐的用户的欢迎。

塑胶机身蒸汽气炸锅在2024年占据58.1%的市场份额,占据市场领先地位,预计2025年至2034年的复合年增长率将达到5%。这些机型以其经济实惠、便携性和紧凑的设计吸引消费者,非常适合小型厨房和城市家庭。製造商使用高级耐热塑胶来降低生产成本,使其更容易被注重预算的消费者所接受。轻巧的机身和美观的多功能性进一步提升了它们的吸引力,尤其是在年轻房主群体中。零售业也支持了它们的受欢迎程度,商店促销和较高的货架曝光度使其领先于金属机身的替代品。

2024年,美国蒸汽气炸锅市场规模达9,550万美元,持续维持北美领先地位。健康饮食习惯的兴起以及对智慧厨房电器需求的不断增长,推动了该市场的成长。由于大量家庭已经配备了现代化的烹饪工具,美国消费者寻求小巧、无油且不影响风味的电器。大型零售连锁店和线上平台的支援确保了产品的广泛供应,有助于推动所有人群的消费者采用该产品。

引领蒸汽气炸锅行业的知名企业包括 Cuisinart、美的集团、Tovala、Cosori、飞利浦、Breville、Ninja、Geepas、Anova、夏普、Duronic、Ciarra、Secura、Instant Brands 和 Gourmia。领先的製造商正致力于创新,整合先进的蒸汽和空气循环技术,在提升口感的同时保留营养。各大品牌也推出了智慧应用程式连接功能和自动烹饪预设,以吸引精通科技的消费者。为了提升知名度和普及度,各大公司正与零售巨头合作,并利用影响力行销。此外,产品线也日趋多样化,涵盖各种尺寸、款式和饰面,以满足更广泛的人群需求。永续性是另一个重点,越来越多的品牌采用环保包装和节能设计。有针对性的促销活动和向高成长市场的扩张进一步增强了它们的竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 对健康烹饪解决方案的需求不断增长

- 多功能厨房电器日益普及

- 拓展电子商务与D2C通路

- 可支配所得增加和都市化

- 产业陷阱与挑战

- 与传统气炸锅相比价格更高

- 认知度低且产品供应有限

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 贸易统计数据

- 主要进口国

- 主要出口国

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东非洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 手动蒸汽气炸锅

- 数位蒸汽气炸锅

- 智慧蒸气气炸锅

第六章:市场估计与预测:依抽屉分类,2021 年至 2034 年

- 主要趋势

- 单身的

- 双倍的

第七章:市场估计与预测:依资料,2021 年至 2034 年

- 主要趋势

- 塑胶机身

- 不銹钢机身

第八章:市场估计与预测:依产能,2021 年至 2034 年

- 主要趋势

- 小号(3公升以下)

- 中号(3-5公升)

- 大号(5公升以上)

第九章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 住宅

- 商业的

第 10 章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 在线的

- 电子商务

- 品牌网站

- 离线

- 专业家电商店

- 消费性电子产品商店

- 超市/大卖场

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第十二章:公司简介

- Anova

- Breville

- Ciarra

- Cosori

- Cuisinart

- Duronic

- Geepas

- Gourmia

- Instant Brands

- Midea Group

- Ninja

- Philips

- Secura

- Sharp

- Tovala

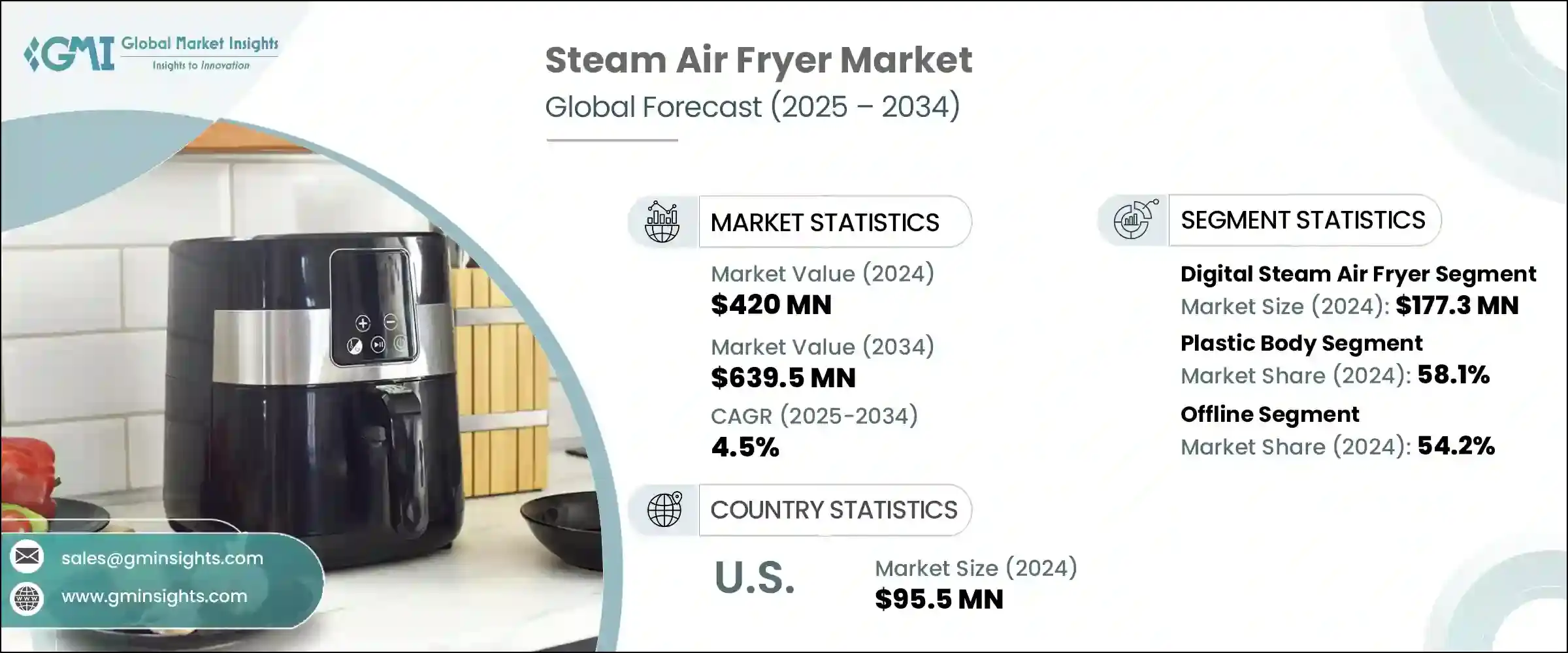

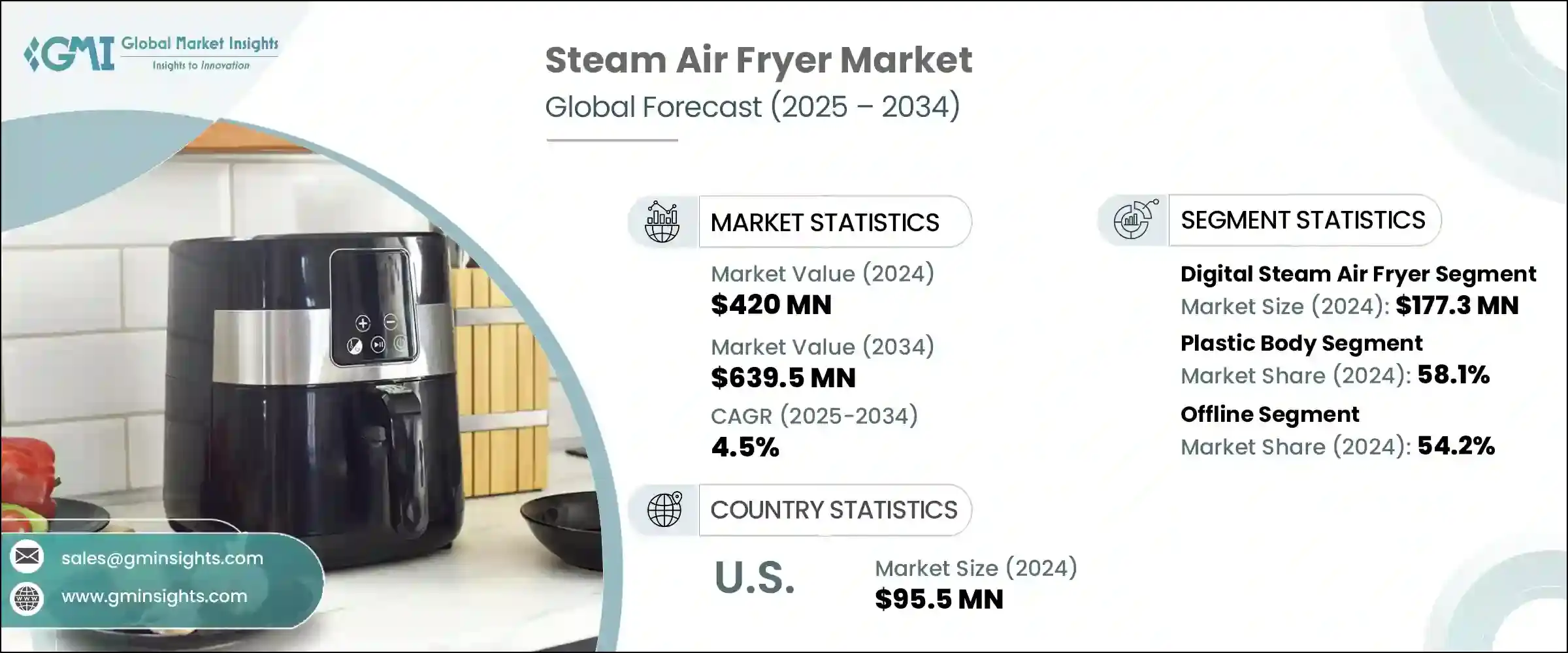

The Global Steam Air Fryer Market was valued at USD 420 million in 2024 and is estimated to grow at a CAGR of 4.5% to reach USD 639.5 million by 2034. This growth is primarily driven by increasing consumer preference for healthier cooking methods. Rising awareness around obesity, heart disease, and lifestyle-related conditions is prompting more individuals to look for kitchen appliances that promote low-fat, nutrient-rich cooking. Steam air fryers combine convection heating with moisture-retaining steam, offering a balance of crispness and nutrition retention. These products are appealing to various demographics-from busy professionals looking for quick, health-focused meals to families aiming to prepare balanced diets with minimal oil. Health-conscious individuals are especially drawn to these appliances for their ability to preserve vitamins and reduce harmful cooking by-products.

According to nutritional data, steam retains between 90% to 95% of water-soluble vitamins, far outperforming conventional baking, which typically retains just 60% to 70%. Air frying alone can cut oil use by up to 80% when compared to traditional frying. These benefits are prompting both retailers and manufacturers to prioritize steam air fryers in their offerings. Innovations such as air-steam combination technology, built-in recipe platforms, and smart cooking presets are being developed to improve convenience and nutritional outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $420 Million |

| Forecast Value | $639.5 Million |

| CAGR | 4.5% |

Digital steam air fryers segment generated USD 177.3 million in 2024 and is projected to grow at a CAGR of 4.1% through 2034. These models are favored for their intuitive features like LED displays, digital touch panels, and pre-set cooking modes. Consumers appreciate their simplicity, accuracy, and ability to deliver consistent results. Unlike manual models, digital fryers allow users to activate a "crisp and steam" function instantly, ensuring better nutrient retention and uniform cooking. They are particularly popular among users prioritizing health and time efficiency in meal preparation.

Plastic-body steam air fryers segment led the market by capturing 58.1% share in 2024 and is expected to grow at a CAGR of 5% from 2025 to 2034. Consumers are drawn to these models for their affordability, portability, and compact design-ideal for smaller kitchens and urban households. Manufacturers use high-grade heat-resistant plastic to reduce production costs, making them more accessible to budget-conscious buyers. Their lightweight and aesthetic versatility further boost appeal, particularly among younger homeowners. Their popularity is also supported by the retail sector, with store promotions and high shelf visibility pushing them ahead of metal-bodied alternatives.

U.S. Steam Air Fryer Market accounted for USD 95.5 million in 2024 and remains the leading market in North America. Growth is fueled by a surge in wellness-driven food habits and rising demand for smart kitchen appliances. With a large share of households already equipped with modern cooking tools, American consumers seek compact, oil-free appliances that don't compromise flavor. Support from major retail chains and online platforms ensures wide product availability, helping to drive consumer adoption across all demographics.

Noteworthy companies shaping the Steam Air Fryer Industry include Cuisinart, Midea Group, Tovala, Cosori, Philips, Breville, Ninja, Geepas, Anova, Sharp, Duronic, Ciarra, Secura, Instant Brands, and Gourmia. Leading manufacturers are prioritizing innovation through the integration of advanced steam and air-circulation technologies that support nutrient retention while enhancing taste. Brands are also introducing smart, app-connected features with automated cooking presets to attract tech-savvy consumers. To boost visibility and adoption, companies are collaborating with retail giants and leveraging influencer marketing. Additionally, product lines are being diversified to include various sizes, styles, and finishes, catering to a wider demographic. Sustainability is another key focus, with more brands incorporating eco-friendly packaging and energy-efficient designs. Targeted promotional campaigns and expansion into high-growth markets further reinforce their competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Drawer

- 2.2.4 Material

- 2.2.5 Capacity

- 2.2.6 End use

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for healthy cooking solutions

- 3.2.1.2 Rising popularity of multifunctional kitchen appliances

- 3.2.1.3 Expansion of e-commerce and D2C channels

- 3.2.1.4 Rising disposable income & urbanization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Higher price compared to traditional air fryers

- 3.2.2.2 Low awareness & limited product availability

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Manual steam air fryers

- 5.3 Digital steam air fryers

- 5.4 Smart steam air fryers

Chapter 6 Market Estimates & Forecast, By Drawer, 2021 – 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Single

- 6.3 Double

Chapter 7 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic body

- 7.3 Stainless steel body

Chapter 8 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Small (below 3 liters)

- 8.3 Medium (3–5 liters)

- 8.4 Large (above 5 liters)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Brand websites

- 10.3 Offline

- 10.3.1 Specialty appliance store

- 10.3.2 Consumer electronics stores

- 10.3.3 Supermarkets/hypermarkets

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Anova

- 12.2 Breville

- 12.3 Ciarra

- 12.4 Cosori

- 12.5 Cuisinart

- 12.6 Duronic

- 12.7 Geepas

- 12.8 Gourmia

- 12.9 Instant Brands

- 12.10 Midea Group

- 12.11 Ninja

- 12.12 Philips

- 12.13 Secura

- 12.14 Sharp

- 12.15 Tovala