|

市场调查报告书

商品编码

1773431

导管稳定装置市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Catheter Stabilization Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

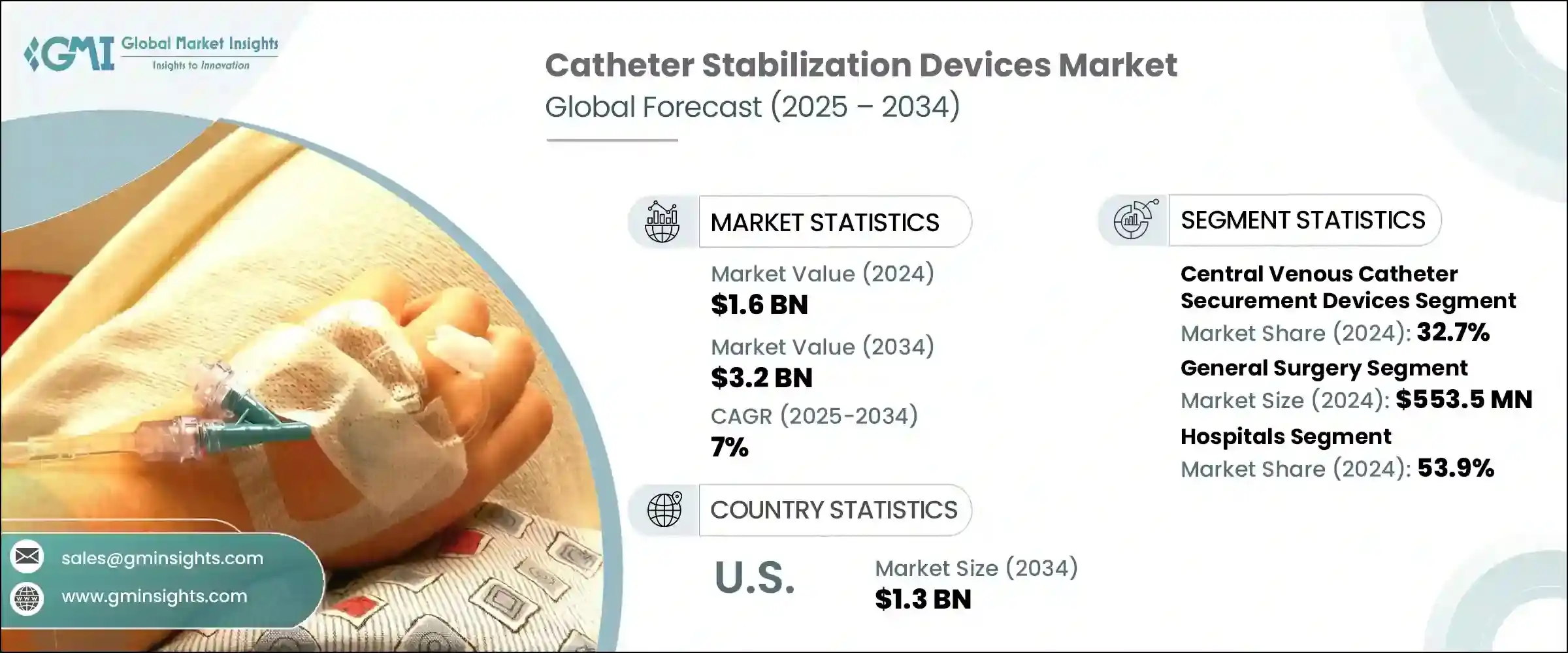

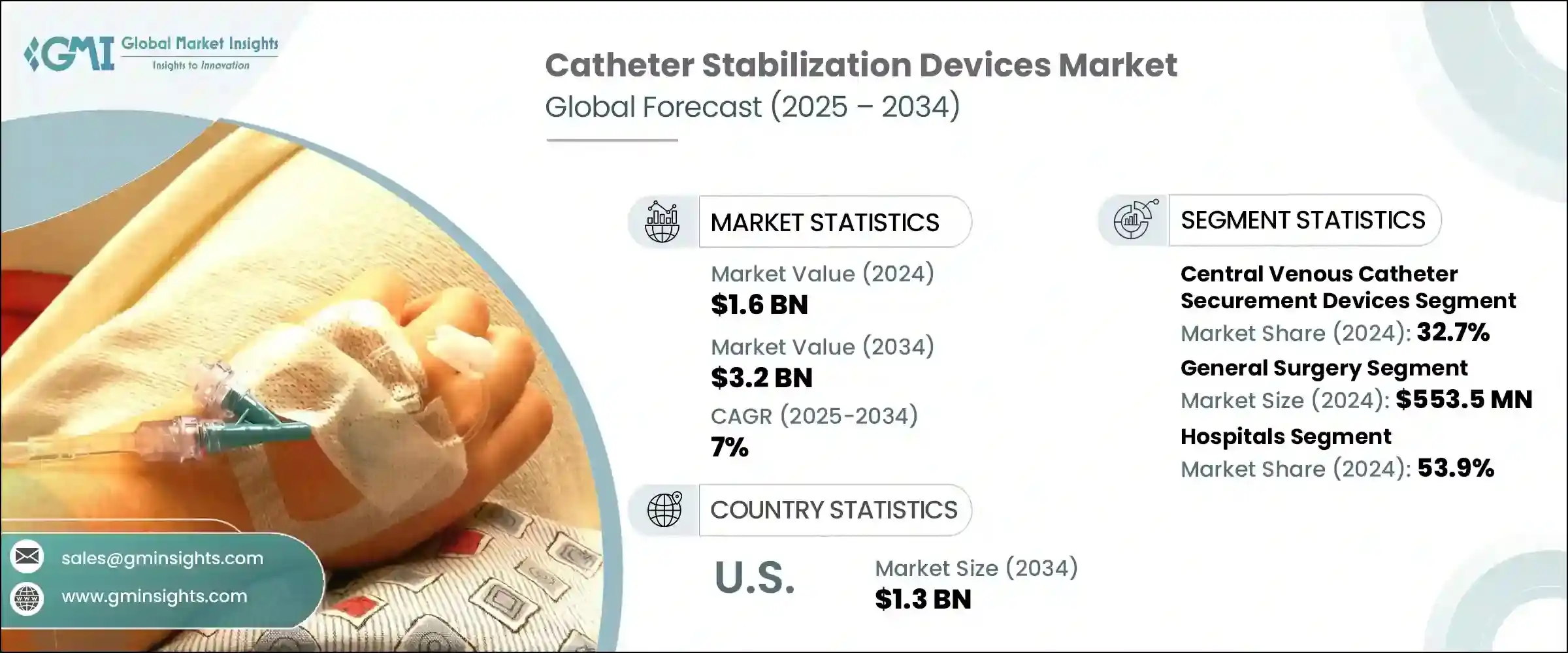

2024年,全球导管稳定装置市场规模达16亿美元,预计到2034年将以7%的复合年增长率成长,达到32亿美元。导管稳定装置是临床护理中必不可少的工具,旨在将各种类型的导管牢固地固定在身体上,减少移动、防止移位并降低移位风险。这种稳定性不仅保护了患者,还能确保医疗治疗的准确与不间断。癌症、肾衰竭、糖尿病和心血管疾病等慢性疾病在全球的盛行率不断上升,推动了临床环境中对长期导管使用的需求。

此外,随着感染控制在医院中日益成为优先事项,人们越来越重视透过改进固定方法来预防导管相关感染。老年人群频繁需要导管相关手术和家庭护理支持,这进一步促进了这个市场的扩张。老年人皮肤脆弱且易受感染,这加剧了对安全舒适的导管固定的需求。因此,对高品质、易于使用的稳定装置的需求正在快速增长,尤其是在提供长期和居家医疗保健服务的机构中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 32亿美元 |

| 复合年增长率 | 7% |

2024年,导管设备领域占32.7%的市占率。这些导管广泛应用于重症监护、肿瘤科和急诊,用于药物给药和营养支持等关键治疗。随着这些临床领域对先进疗法的需求不断增长,固定装置已成为最大程度减少併发症(例如由导管移动或污染引起的血流感染、心内膜炎和败血症)的关键。为了降低这些风险,医疗机构和管理机构实施了更严格的感染控制规程,其中许多规程强制使用导管固定工具。这些监管变化正在推动固定装置在多种护理环境中的普及。

2024年,一般外科手术市场规模达5.535亿美元。导管在外科手术中被广泛用于麻醉、体液监测和生命征象追踪。稳定装置对于确保导管在手术和术后护理期间(尤其是在从手术室到恢復室的过渡期间)保持完整至关重要。医院面临降低中心静脉导管相关血流感染和手术部位感染发生率的压力,这些感染通常发生在外科手术过程中。这加剧了对符合医院安全计画并能改善手术效果的稳定解决方案的需求。

2024年,美国导管稳定装置市场规模达6.675亿美元,预计2034年将达到13亿美元。美国各地慢性病病例的增加推动了导管治疗的需求,进而推动了稳定装置的普及。美国医院遵守各医疗机构制定的严格安全法规,这些法规要求各机构采用标准化的感染控制措施。不遵守这些安全基准可能会导致报销额度减少和经济处罚,促使供应商投资于固定装置。这些趋势正使美国牢牢占据全球导管稳定装置领域关键成长区域的地位。

目前,BD、3M、Cardinal Health、ConvaTec 和 B. Braun 等公司占据着该行业的主导地位,合计占据约 65% 的市场份额。导管稳定装置市场的领导者正在利用多种策略来提升其市场份额并确保长期成长。主要重点在于开发先进的、患者友善产品,以降低感染风险并提高使用便利性。

公司正在加强研发力度,以提供满足特定医疗需求并适应老年人等弱势患者群体的创新设计。透过合作伙伴关係、本地製造和策略性分销协议进行地理扩张,有助于扩大其产品线的覆盖范围。监管合规性也是一个重点,因为公司需要与不断发展的临床标准保持一致,以提升机构信任。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 慢性病发生率不断上升

- 全球人口老化

- 导管稳定技术的持续创新

- 固定装置的成本效益

- 产业陷阱与挑战

- 替代产品的可用性

- 严格的监管要求

- 市场机会

- 外科手术量增加

- 预防医院内感染的需求日益增长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 报销场景

- 报销政策对市场成长的影响

- 专利分析

- 波特的分析

- PESTEL分析

- 消费者行为分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 动脉固定装置

- 中心静脉导管固定装置

- 週边固定装置

- 导尿管固定装置

- 胸腔引流管固定装置

- 其他产品

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 心血管手术

- 一般外科

- 泌尿外科手术

- 肿瘤科手术

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 居家照护环境

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- B. Braun

- Baxter International

- Becton, Dickinson and Company

- Cardinal Health

- Centurion Medical Products

- ConvaTec

- Dale Medical Products

- DeRoyal Industries

- Merit Medical Systems

- Pepper Medical

- Smiths Medical

- TIDI Products

- VYGON

- Zibo Qichuang Medical Products

- 3M

The Global Catheter Stabilization Devices Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 3.2 billion by 2034. Catheter stabilization devices are essential tools in clinical care, designed to securely anchor various types of catheters to the body, reducing movement, preventing dislodgement, and lowering the risk of migration. This stability not only safeguards the patient but also ensures accurate and uninterrupted delivery of medical treatments. The increasing global prevalence of chronic illnesses such as cancer, kidney failure, diabetes, and cardiovascular conditions is driving the need for long-term catheter use in clinical settings.

In addition, as infection control becomes a growing priority in hospitals, there is an increasing focus on preventing catheter-related infections through improved securement methods. An aging population that frequently requires catheter-based procedures and home care support further contributes to this market's expansion. Fragile skin and susceptibility to infections in older adults heighten the need for secure and comfortable catheter fixation. The demand for high-quality, easy-to-apply stabilization devices is therefore rising rapidly, especially across facilities providing long-term and in-home healthcare services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 7% |

In 2024, the devices segment held a 32.7% share. These catheters are widely applied in intensive care, oncology, and emergency care for critical treatments such as drug administration and nutritional support. With the rise in demand for advanced therapies in these clinical areas, securement devices have become essential in minimizing complications like bloodstream infections, endocarditis, and septic conditions that stem from catheter movement or contamination. To reduce these risks, healthcare institutions and governing bodies have enforced stricter infection control protocols, many of which mandate the use of catheter securement tools. These regulatory shifts are boosting the adoption of securement devices across multiple care settings.

The general surgery segment generated USD 553.5 million in 2024. Catheters are used extensively in surgical procedures for delivering anesthesia, monitoring fluids, and tracking vital signs. Stabilization devices are indispensable in ensuring catheter placement remains intact during surgeries and post-operative care, especially during transitions from operating theaters to recovery areas. Hospitals are under pressure to lower rates of central line-associated bloodstream infections and surgical site infections, which often occur during surgical interventions. This is intensifying the demand for stabilization solutions that align with hospital safety initiatives and improve procedural outcomes.

U.S. Catheter Stabilization Devices Market was valued at USD 667.5 million in 2024 and is expected to reach USD 1.3 billion by 2034. Rising chronic disease cases across the country are driving the need for catheter-based treatments, and in turn, increasing the adoption of stabilization devices. U.S. hospitals follow stringent safety regulations set by various healthcare bodies, which require institutions to use standardized infection control practices. Failure to comply with these safety benchmarks could lead to reduced reimbursement and financial penalties, prompting providers to invest in securement devices. These trends are firmly positioning the U.S. as a key growth region in the global catheter stabilization space.

Companies such as BD, 3M, Cardinal Health, ConvaTec, and B. Braun currently dominate the industry and collectively hold around 65% of the total market share. Leading players in the catheter stabilization devices market are leveraging multiple strategies to boost their presence and secure long-term growth. A primary focus lies in the development of advanced, patient-friendly products that reduce infection risk and enhance application ease.

Companies are strengthening their R&D efforts to deliver innovative designs that cater to specific medical needs and accommodate fragile patient populations, such as the elderly. Geographic expansion through partnerships, local manufacturing, and strategic distribution agreements helps widen access to their product lines. Regulatory compliance is also a major focus, as firms align with evolving clinical standards to increase institutional trust.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of chronic diseases

- 3.2.1.2 Global aging population

- 3.2.1.3 Continuous innovations in catheter stabilization technology

- 3.2.1.4 Cost-benefits of securement devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative products

- 3.2.2.2 Stringent regulatory requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in surgical procedure volume

- 3.2.3.2 Growing demand for preventing hospital acquired infections

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Price trends

- 3.5.1 By region

- 3.5.2 By product

- 3.6 Future market trends

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behaviour analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Arterial securement devices

- 5.3 Central venous catheter securement devices

- 5.4 Peripheral securement devices

- 5.5 Urinary catheters securement devices

- 5.6 Chest drainage tubes securement devices

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiovascular procedures

- 6.3 General surgery

- 6.4 Urological procedures

- 6.5 Oncology procedures

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B. Braun

- 9.2 Baxter International

- 9.3 Becton, Dickinson and Company

- 9.4 Cardinal Health

- 9.5 Centurion Medical Products

- 9.6 ConvaTec

- 9.7 Dale Medical Products

- 9.8 DeRoyal Industries

- 9.9 Merit Medical Systems

- 9.10 Pepper Medical

- 9.11 Smiths Medical

- 9.12 TIDI Products

- 9.13 VYGON

- 9.14 Zibo Qichuang Medical Products

- 9.15 3M