|

市场调查报告书

商品编码

1773432

工业木箱市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial Wooden Crates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

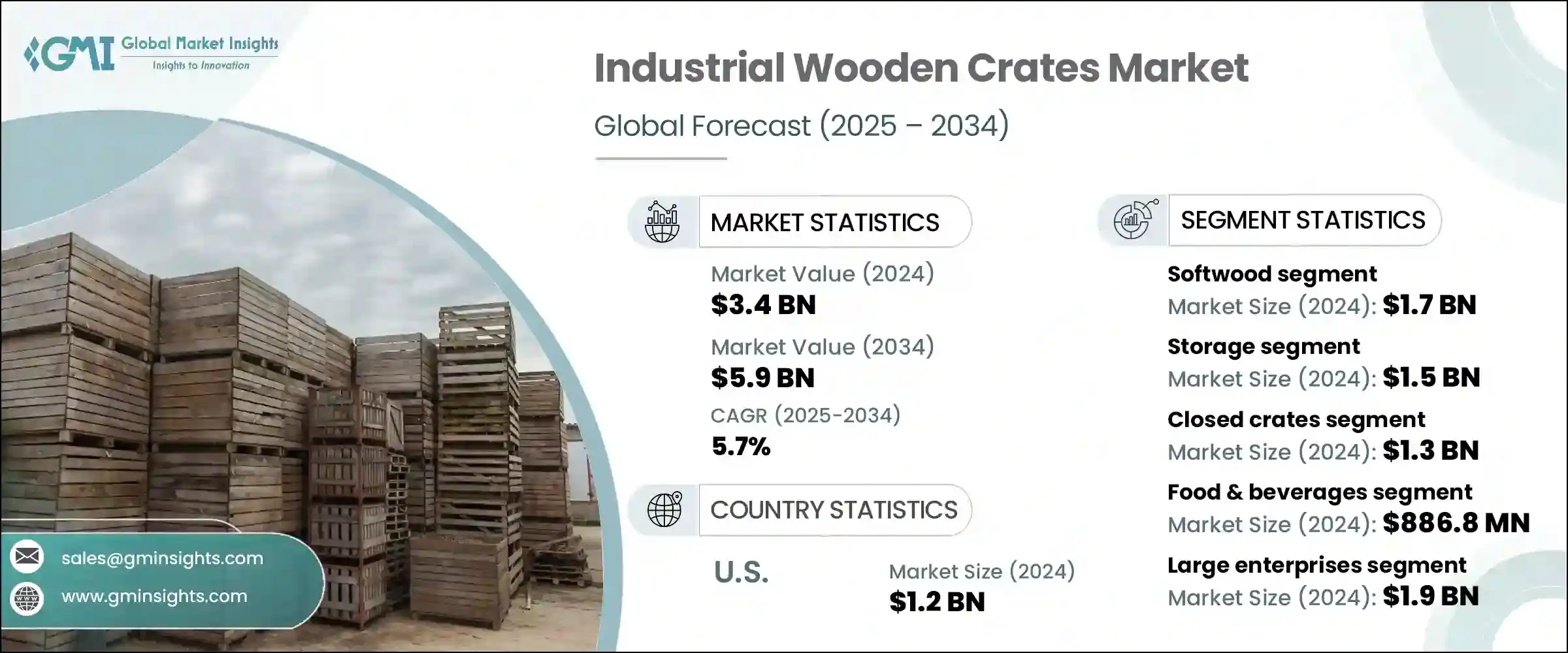

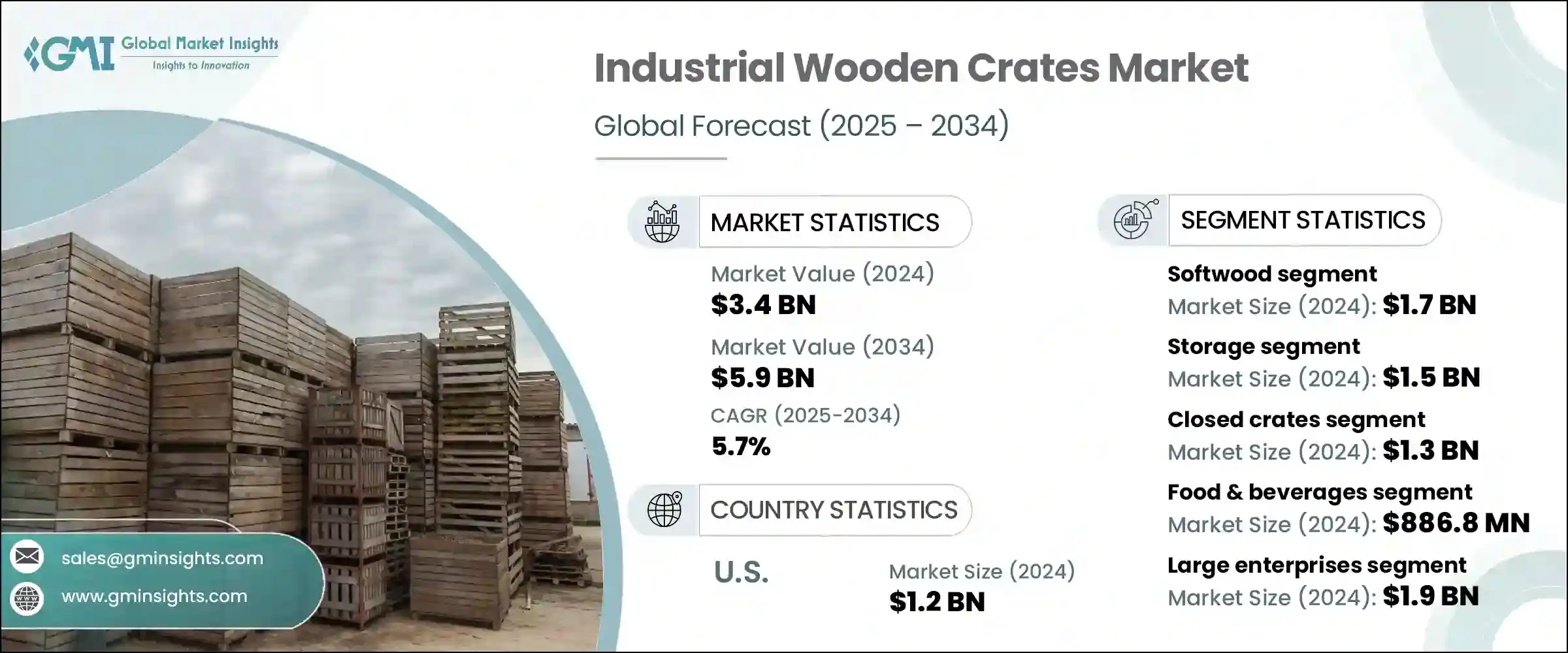

2024年,全球工业木质包装箱市场价值为34亿美元,预计到2034年将以5.7%的复合年增长率成长,达到59亿美元。工业木质包装箱市场的成长可归因于几个关键因素,包括全球贸易和出口业务的激增,尤其是在农业、汽车和工业机械等行业。在这些行业中,木质包装箱对于货物的安全高效处理至关重要。

另一个因素是人们对永续包装解决方案的日益青睐,木质包装箱因其可回收和可生物降解的特性而越来越受欢迎。此外,企业正大力选择环保包装材料,以减少碳足迹,也推动了木质包装箱的需求。木质包装箱和包装箱生产者物价指数 (PPI) 的上涨也使製造商受益,这表明越来越多的客户愿意为高品质的包装解决方案支付溢价。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 34亿美元 |

| 预测值 | 59亿美元 |

| 复合年增长率 | 5.7% |

这一趋势凸显了人们日益重视确保产品安全可靠地运输,从而降低运输过程中损坏的风险。随着供应链日益复杂和全球化,企业越来越意识到使用包装解决方案的重要性,这些解决方案不仅能保护产品,还能提升整体客户体验。随着各行各业竞争的加剧,人们对包装的耐用性和高效性的期望也日益增长,最终能够保障产品的完整性,并避免代价高昂的损失。

2024年,软木市场产值达17亿美元。松木、冷杉和云杉等软木品种因其丰富、价格实惠且重量轻而占据市场主导地位,是生产木质板条箱的理想选择。美国农业部 (USDA) 报告称,软木供应持续强劲,尤其是来自美国南部的供应,确保了板条箱製造商的稳定原材料供应。

运输业是市场中成长最快的领域,预计到2034年复合年增长率将达到6.1%。木质包装箱因其耐用性和在运输过程中保持产品品质的能力而成为货物运输的首选,尤其是新鲜农产品。随着全球对新鲜农产品需求的不断增长,对木质包装箱等可靠高效的包装解决方案的需求也在不断增长。

美国工业木箱市场在2024年创造了12亿美元的产值,这得益于其完善的物流基础设施和日益增长的环保包装需求。美国林务局也指出,硬木供应的改善为木箱製造商提供了稳定的原料供应。此外,美国农业部批准农产品出口使用木质包装,进一步推动了美国对工业木箱的需求。

工业木箱产业的主要参与者包括 Brambles Limited (CHEP)、Greif Inc.、Interlake Mecalux、Poole & Sons 和 Universal Forest Products Inc.。为了巩固市场地位,工业木箱市场的公司正致力于提高产能并拓展原料供应链。与物流和运输公司建立策略伙伴关係及合作,正在增强其分销网络,确保及时交付和扩大市场覆盖范围。此外,製造商正在投资永续生产实践,采用环保材料,并遵守不断发展的环境法规,这使其在註重环保的市场中占据有利地位。为了满足日益增长的需求,该公司还透过开发针对特定行业(例如农业、汽车和製药)需求的客製化包装解决方案来丰富其产品线。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 川普政府关税政策的中断

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球贸易和出口活动不断增加

- 物流和仓储产业的需求不断增长

- 木质包装的可持续性和可回收性

- 重型机械和汽车运输中的使用增加

- 成本效益和高承载能力

- 产业陷阱与挑战

- 木材价格波动与供应链波动

- 严格的农业生物安全规范和监管义务

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 历史价格分析(2021-2024)

- 价格趋势驱动因素

- 区域价格差异

- 价格预测(2025-2034年)

- 定价策略

- 新兴商业模式

- 合规性要求

- 永续性措施

- 永续材料评估

- 碳足迹分析

- 循环经济实施

- 永续性认证和标准

- 永续性投资报酬率分析

- 全球消费者情绪分析

- 专利分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 打开箱子

- 封闭的板条箱

- 板条箱

- 订製板条箱

第六章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 软木

- 松树

- 云杉

- 雪松

- 其他

- 硬木

- 橡木

- 枫

- 桦木

- 其他的

- 工程木材

- 合板

- OSB(定向刨花板)

- 单板层积材

第七章:市场估计与预测:按功能,2021 - 2034 年

- 主要趋势

- 贮存

- 运输

- 国内物流

- 国际出口

第八章:市场估计与预测:按行业,2021 - 2034 年

- 主要趋势

- 农业

- 製造业

- 食品和饮料

- 製药

- 物流和运输

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Brambles Limited (CHEP)

- C&K Box Company

- FoamCraft Packaging Inc

- Greif Inc.

- Herwood Inc

- Interlake Mecalux

- LJB Timber Packaging Pty

- Loscam Ltd.

- Nelson Company LLC

- Ongna Wood Products

- PalletOne Inc.

- PGS Group

- Poole & Sons

- Tree Brand Packaging

- Universal Forest Products Inc.

The Global Industrial Wooden Crates Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 5.9 billion by 2034. The growth of the industrial wooden crates market can be attributed to several key factors, including the surge in global trade and export operations, especially in sectors such as agriculture, automotive, and industrial machinery. In these industries, wooden crates are essential for the safe and efficient handling of goods.

Another contributing factor is the growing preference for sustainable packaging solutions, with wooden crates becoming increasingly appealing due to their recyclability and biodegradability. In addition, companies are making significant efforts to reduce their carbon footprints by opting for eco-friendly packaging materials, which is boosting demand for wooden crates. Manufacturers are also benefiting from the rise in the Producer Price Index (PPI) for wood boxes and crates, indicating a growing customer base willing to pay a premium for high-quality packaging solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 5.7% |

This trend highlights the growing emphasis on ensuring that products are transported safely and securely, reducing the risks of damage during transit. As supply chains become more complex and global, businesses are recognizing the importance of using packaging solutions that not only protect their goods but also enhance the overall customer experience. With heightened competition in various industries, there is a growing expectation for packaging to offer both durability and efficiency, ultimately safeguarding the integrity of the product and preventing costly losses.

In 2024, the softwood segment generated USD 1.7 billion. Softwood varieties like pine, fir, and spruce dominate the market due to their abundance, affordability, and lightweight nature, making them ideal for use in wooden crate production. The U.S. Department of Agriculture (USDA) reports a continuous strong supply of softwood lumber, especially from the Southern U.S., ensuring a steady raw material flow for crate manufacturers.

The transportation sector is the fastest-growing segment in the market, expected to grow at a CAGR of 6.1% through 2034. Wooden crates are favored for transporting goods, particularly fresh produce, due to their durability and ability to maintain product quality during transit. As global demand for fresh produce increases, the need for reliable and efficient packaging solutions, like wooden crates, is also on the rise.

United States Industrial Wooden Crates Market generated USD 1.2 billion in 2024 due to its well-developed logistics infrastructure and growing focus on eco-friendly packaging. The U.S. Forest Service has also noted improved availability of hardwood, which supports a steady supply of raw materials for crate manufacturers. Additionally, the USDA's endorsement of wooden packaging for agricultural exports further drives the demand for industrial wooden crates in the country.

Key players in the Industrial Wooden Crates Industry include Brambles Limited (CHEP), Greif Inc., Interlake Mecalux, Poole & Sons, and Universal Forest Products Inc. To strengthen their market position, companies in the industrial wooden crates market are focusing on increasing their production capacity and expanding their raw material supply chains. Strategic partnerships and collaborations with logistics and transportation firms are enhancing their distribution networks, ensuring timely delivery and market reach. Moreover, manufacturers are investing in sustainable production practices, incorporating eco-friendly materials, and complying with evolving environmental regulations, which positions them favorably in an eco-conscious market. To meet the growing demand, companies are also diversifying their product offerings by developing custom packaging solutions tailored to specific industry needs, such as agriculture, automotive, and pharmaceuticals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Product type trends

- 2.2.3 Material trends

- 2.2.4 Function trends

- 2.2.5 Industry trends

- 2.2.6 End use trends

- 2.2.7 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.2 Disruptions Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global trade and export activities

- 3.3.1.2 Growing demand from logistics and warehousing sectors

- 3.3.1.3 Sustainability and recyclability of wooden packaging

- 3.3.1.4 Increased use in heavy machinery and automotive shipments

- 3.3.1.5 Cost-effectiveness and high load-bearing capacity

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Fluctuating timber prices and supply chain volatility

- 3.3.2.2 Strict agricultural biosecurity norms and regulatory obligations

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 Historical price analysis (2021-2024)

- 3.9.2 Price trend drivers

- 3.9.3 Regional price variations

- 3.9.4 Price forecast (2025-2034)

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Sustainability measures

- 3.13.1 Sustainable materials assessment

- 3.13.2 Carbon footprint analysis

- 3.13.3 Circular economy implementation

- 3.13.4 Sustainability certifications and standards

- 3.13.5 Sustainability ROI analysis

- 3.14 Global consumer sentiment analysis

- 3.15 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Open crates

- 5.3 Closed crates

- 5.4 Slatted crates

- 5.5 Customized crates

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Softwood

- 6.2.1 Pine

- 6.2.2 Spruce

- 6.2.3 Cedar

- 6.2.4 Other

- 6.3 Hardwood

- 6.3.1 Oak

- 6.3.2 Maple

- 6.3.3 Birch

- 6.3.4 Others

- 6.4 Engineered Wood

- 6.4.1 Plywood

- 6.4.2 OSB (Oriented Strand Board)

- 6.4.3 Laminated veneer lumber

Chapter 7 Market Estimates and Forecast, By Function, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Storage

- 7.3 Transportation

- 7.3.1 Domestic logistics

- 7.3.2 International export

Chapter 8 Market Estimates and Forecast, By Industry, 2021 - 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Agriculture

- 8.3 Manufacturing

- 8.4 Food and beverages

- 8.5 Pharmaceuticals

- 8.6 Logistics and shipping

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 Small & medium enterprises

- 9.3 Large enterprises

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Brambles Limited (CHEP)

- 11.2 C&K Box Company

- 11.3 FoamCraft Packaging Inc

- 11.4 Greif Inc.

- 11.5 Herwood Inc

- 11.6 Interlake Mecalux

- 11.7 LJB Timber Packaging Pty

- 11.8 Loscam Ltd.

- 11.9 Nelson Company LLC

- 11.10 Ongna Wood Products

- 11.11 PalletOne Inc.

- 11.12 PGS Group

- 11.13 Poole & Sons

- 11.14 Tree Brand Packaging

- 11.15 Universal Forest Products Inc.