|

市场调查报告书

商品编码

1773433

户外太阳能 LED 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Outdoor Solar LED Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

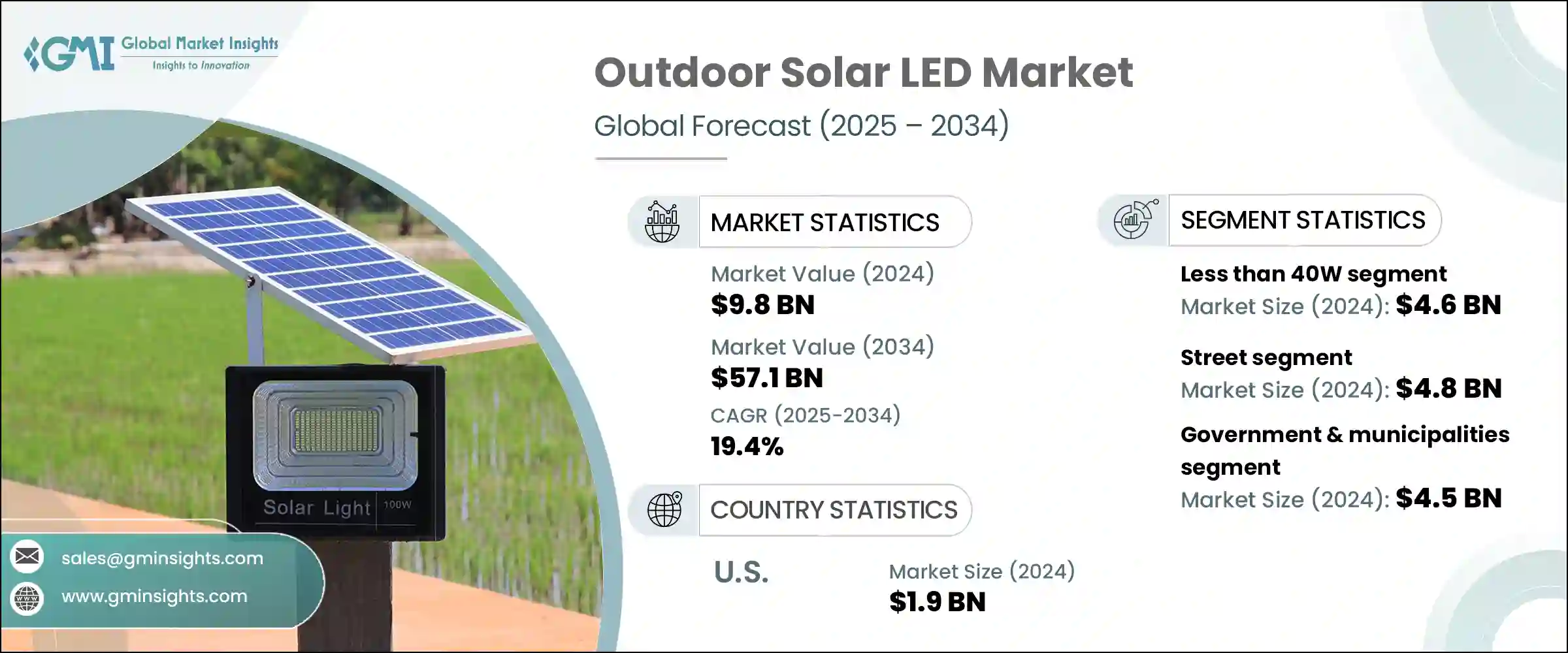

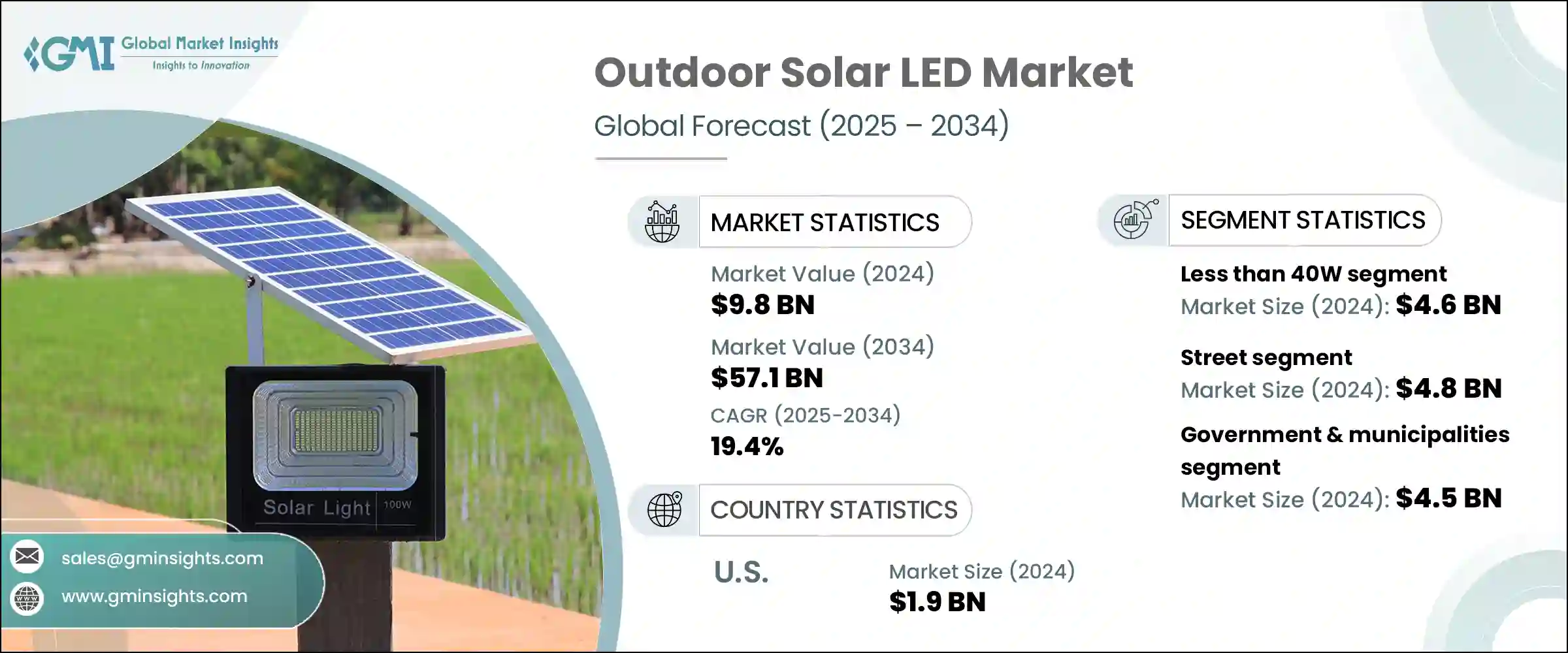

2024年,全球户外太阳能LED市场规模达98亿美元,预计2034年将以19.4%的复合年增长率成长,达到571亿美元。强劲成长主要源自于全球对节能照明替代品日益增长的需求。随着永续发展目标在全球日益受到重视,机构和终端消费者都越来越倾向于环保解决方案。与传统照明技术相比,户外太阳能LED灯凭藉其更长的使用寿命和更低的功耗,正逐渐成为人们青睐的选择。

这些系统正广泛应用于基础设施和智慧城市建设,而能源优化在这些领域至关重要。在美国等地区,节能照明(尤其是经过认证的家用LED产品)的功耗显着降低,使用寿命也远超白炽灯,因此在市政当局和私人用户中得到广泛采用。这些节能措施正在推动各行各业的强劲成长,并持续推动太阳能LED技术的发展。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 98亿美元 |

| 预测值 | 571亿美元 |

| 复合年增长率 | 19.4% |

全球各国政府正在推出激励措施和监管措施,以促进太阳能的应用。户外太阳能LED在为农村和服务欠缺地区提供可靠照明方面发挥关键作用,有助于改善公共安全和基本服务的可及性。它们也被纳入国家农村电气化、紧急准备和低碳基础设施扩建项目。随着公共机构在优惠政策和资金支持下越来越多地采用太阳能係统,无论是在发展中地区还是发达地区,太阳能係统的部署都在迅速扩大。

2024年,40瓦以下市场产值达46亿美元。这些低功率设备经济高效、安装简便,且所需基础设施极少,是电网存取受限的发展中国家和地区的理想选择。它们在阳光直射较少的情况下也能保持良好性能,并且使用尺寸较小的面板,因此非常适合紧凑且阴凉的城市区域。在装饰性景观和周边照明领域,这类产品的使用也日益增多,因为设计和价格都至关重要。随着城市地区寻求经济高效的永续照明覆盖,郊区和乡村照明计画对40瓦以下产品的需求持续成长。

2024年,街道照明市场规模达48亿美元。街道照明是城市发展的重要组成部分,因为它影响安全、交通和环境目标。不断扩张的城市优先考虑太阳能街道照明,以降低能源成本并减少碳排放。这些系统提供可扩展的分散式部署,非常适合缺乏成熟电网基础架构的地区。智慧调光、运动感测器和远端监控等功能正日益集成,尤其是在全球智慧城市计画的推动下。这种转变进一步推动了用于道路和公共区域照明的户外太阳能LED的成长。

2024年,美国户外太阳能LED市场规模达19亿美元,这得益于全国范围内的节能减排任务和城市创新项目推动的太阳能照明解决方案的广泛应用。各州和市政府正积极以太阳能照明方案取代传统照明,以降低能源成本和碳排放。联邦和州政府的财政支持持续为太阳能照明改造计画提供资金。此外,对能源韧性的重视,尤其是在极端天气事件频繁的地区,正在刺激对独立运作的太阳能LED系统的需求。这些因素正在巩固美国作为太阳能LED部署领先和先进市场的地位。

户外太阳能LED市场的知名公司包括BISOL集团、松下控股公司、Wipro照明、Signify控股和Sunna Design。为了在户外太阳能LED领域获得竞争优势,各公司都优先考虑创新、垂直整合和全球扩张。主要参与者正在开发智慧太阳能LED解决方案,这些解决方案具有运动侦测、无线连接和自适应亮度等功能,以配合智慧城市基础设施的目标。许多公司也致力于提高其照明系统中太阳能电池板和电池储能係统的效率。与市政机构和基础设施公司建立策略合作伙伴关係有助于确保大型专案的成功,尤其是在新兴经济体。各公司正在投资模组化和可扩展的产品线,以满足不同的功率和设计需求,从而实现更高程度的客製化。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 对节能照明解决方案的需求不断增长

- 政府对太阳能利用的措施和补贴

- 农村及偏远地区离网电气化发展

- 太阳能板和LED技术成本下降

- 都市化和基础建设不断推进

- 产业陷阱与挑战

- 依赖天气条件和地理限制

- 初始安装和基础设施成本高

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 物联网与太阳能照明系统的集成

- 扩展智慧和自适应照明控制

- 使用高效能 LED 和储能技术

- 新兴技术

- 人工智慧驱动的太阳能灯预测性维护的开发

- 太阳能照明与城市智慧电网基础设施的融合

- 薄膜和钙钛矿太阳能板技术的进步

- 当前的技术趋势

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准化分析

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各地区市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:按瓦数,2021 年至 2034 年

- 主要趋势

- 小于40W

- 40W至150W

- 超过150W

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 街道

- 花园

- 途径

- 其他的

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 政府和市政当局

- 商业企业

- 住宅消费者

- 工业和基础设施

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- BISOL Group

- Crompton Greaves Consumer Electricals Limited

- Greenshine New Energy

- Guangzhou Anern Energy Technology Co., Ltd.

- Havells India Limited

- LEADSUN

- Panasonic Holdings Corporation

- Polybrite Solar Co., Ltd.

- Sensol Technologies

- Signify Holding

- SOKOYO Solar Lighting Co., Ltd.

- Solar Lighting International, Inc.

- Sunna Design

- Suntech-Solar-Enterprises

- URJA SAUR ELECTRONICS

- Wipro Lighting

The Global Outdoor Solar LED Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 19.4% to reach USD 57.1 billion by 2034. This robust growth is primarily driven by rising demand for energy-efficient lighting alternatives worldwide. As sustainability goals gain traction globally, both institutions and end consumers are gravitating toward eco-conscious solutions. Outdoor solar LED lights are becoming a favored option due to their extended service life and reduced power consumption when compared to conventional lighting technologies.

These systems are being widely adopted across infrastructure and smart city developments where energy optimization is critical. In regions like the United States, energy-efficient lighting-particularly certified residential LED products-consumes significantly less power and offers drastically longer lifespan than incandescent bulbs, leading to widespread adoption among municipalities and private users. These savings are contributing to strong uptake across diverse sectors, fueling continued momentum for solar LED technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 billion |

| Forecast Value | $57.1 billion |

| CAGR | 19.4% |

Globally, governments are introducing incentives and regulatory measures to promote solar adoption. Outdoor solar LEDs are playing a key role in bringing dependable lighting to rural and underserved areas, helping improve public safety and access to basic services. They are also being integrated into national programs focused on rural electrification, emergency preparedness, and low-carbon infrastructure expansion. With public institutions increasingly adopting solar-based systems under favorable policies and financial backing, deployment is scaling quickly across both developing and developed regions.

The less than 40W segment generated USD 4.6 billion in 2024. These lower-wattage units are cost-effective, simple to install, and require minimal infrastructure, making them ideal for developing countries and regions with limited grid access. Their ability to perform well under less direct sunlight and operate with smaller panels makes them suitable for compact and shaded urban zones. They are also seeing increased usage in decorative landscaping and perimeter lighting where both design and affordability are important. As urban areas seek sustainable lighting coverage that's cost-efficient, demand for under-40W products continues to rise across suburban and rural lighting initiatives.

Street lighting segment generated USD 4.8 billion in 2024. Street illumination is a vital part of urban development as it impacts security, transportation, and environmental goals. Expanding cities are prioritizing solar-powered street lighting as a solution to reduce energy bills and carbon emissions. These systems offer scalable and decentralized deployment, ideal for areas lacking established grid infrastructure. Features like smart dimming, motion sensors, and remote monitoring are being increasingly integrated, especially under global smart city programs. This shift is further boosting the growth of outdoor solar LEDs for roadway and public area lighting.

U.S. Outdoor Solar LED Market was valued at USD 1.9 billion in 2024, driven by broad adoption of solar lighting solutions under nationwide energy efficiency mandates and urban innovation projects. State and municipal governments are actively replacing conventional lights with solar options to lower energy expenses and carbon output. Financial support from both federal and state programs continues to fund solar lighting conversions. Additionally, heightened focus on energy resilience, particularly in areas prone to extreme weather events, is spurring demand for standalone solar LED systems that operate independently of the grid. These factors are strengthening the U.S. position as a leading and advanced market for solar LED deployment.

Notable companies in the Outdoor Solar LED Market include BISOL Group, Panasonic Holdings Corporation, Wipro Lighting, Signify Holding, and Sunna Design. To gain a competitive edge in the outdoor solar LED space, companies are prioritizing innovation, vertical integration, and global expansion. Major players are developing smart-enabled solar LED solutions featuring motion detection, wireless connectivity, and adaptive brightness to align with smart city infrastructure goals. Many firms are also focusing on enhancing the efficiency of solar panels and battery storage within their lighting systems. Strategic partnerships with municipal bodies and infrastructure firms help secure large-scale projects, particularly in emerging economies. Companies are investing in modular and scalable product lines to meet varying wattage and design needs, allowing greater customization.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for energy-efficient lighting solutions

- 3.3.1.2 Government initiatives and subsidies for solar energy adoption

- 3.3.1.3 Growing off-grid electrification in rural and remote areas

- 3.3.1.4 Declining costs of solar panels and LED technology

- 3.3.1.5 Increasing urbanization and infrastructure development

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Dependence on weather conditions and geographic limitations

- 3.3.2.2 High initial installation and infrastructure costs

- 3.3.3 Market opportunities

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Integration of IoT with solar lighting systems

- 3.8.1.2 Expansion of smart and adaptive lighting controls

- 3.8.1.3 Use of high-efficiency LED and energy storage technologies

- 3.8.2 Emerging technologies

- 3.8.2.1 Development of AI-driven predictive maintenance for solar lights

- 3.8.2.2 Integration of solar lighting with urban smart grid infrastructure

- 3.8.2.3 Advancements in thin-film and perovskite solar panel technologies

- 3.8.1 Current technological trends

- 3.9 Emerging business models

- 3.10 Compliance requirements

- 3.11 Sustainability measures

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Wattage, 2021 – 2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Less than 40W

- 5.3 40W to 150W

- 5.4 More than 150W

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Street

- 6.3 Garden

- 6.4 Pathway

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 Government & municipalities

- 7.3 Commercial enterprises

- 7.4 Residential consumers

- 7.5 Industrial & infrastructure

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BISOL Group

- 9.2 Crompton Greaves Consumer Electricals Limited

- 9.3 Greenshine New Energy

- 9.4 Guangzhou Anern Energy Technology Co., Ltd.

- 9.5 Havells India Limited

- 9.6 LEADSUN

- 9.7 Panasonic Holdings Corporation

- 9.8 Polybrite Solar Co., Ltd.

- 9.9 Sensol Technologies

- 9.10 Signify Holding

- 9.11 SOKOYO Solar Lighting Co., Ltd.

- 9.12 Solar Lighting International, Inc.

- 9.13 Sunna Design

- 9.14 Suntech-Solar-Enterprises

- 9.15 URJA SAUR ELECTRONICS

- 9.16 Wipro Lighting