|

市场调查报告书

商品编码

1773434

变速箱及齿轮马达市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gearbox and Gear Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

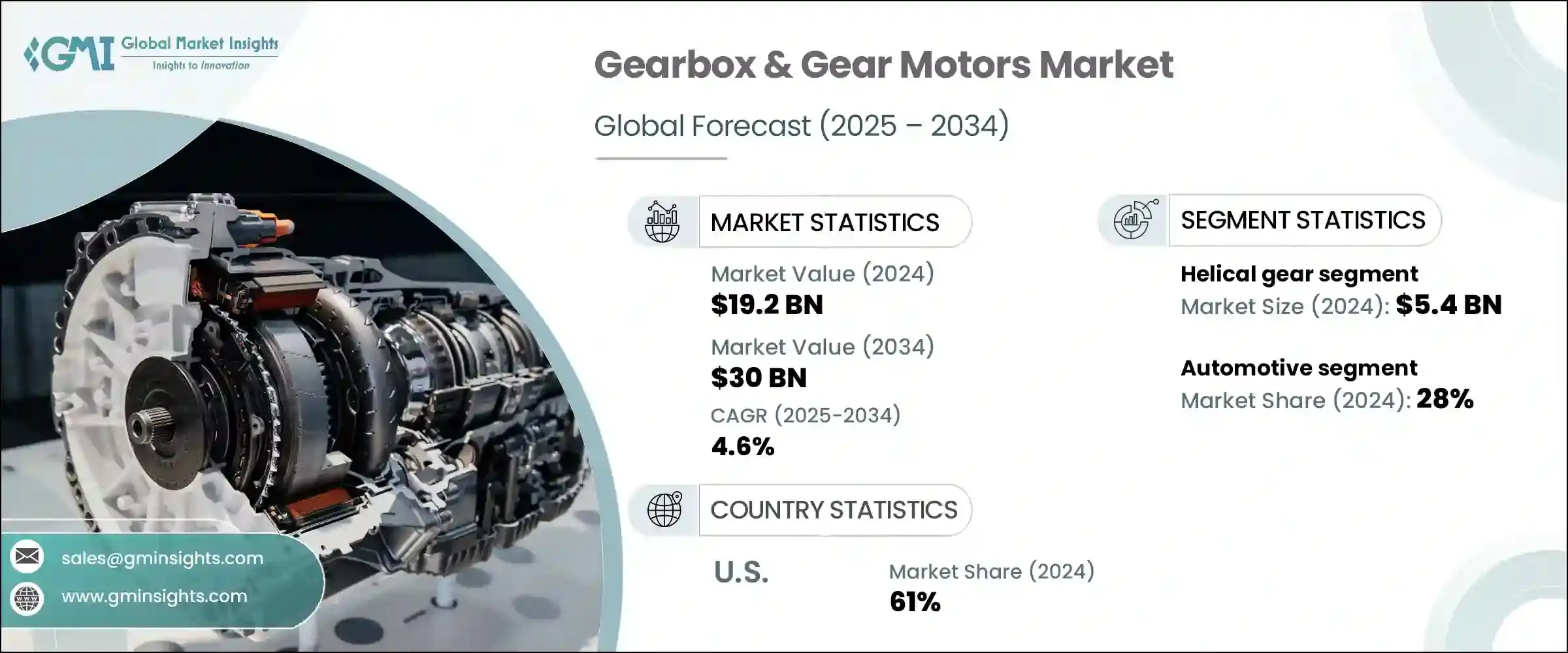

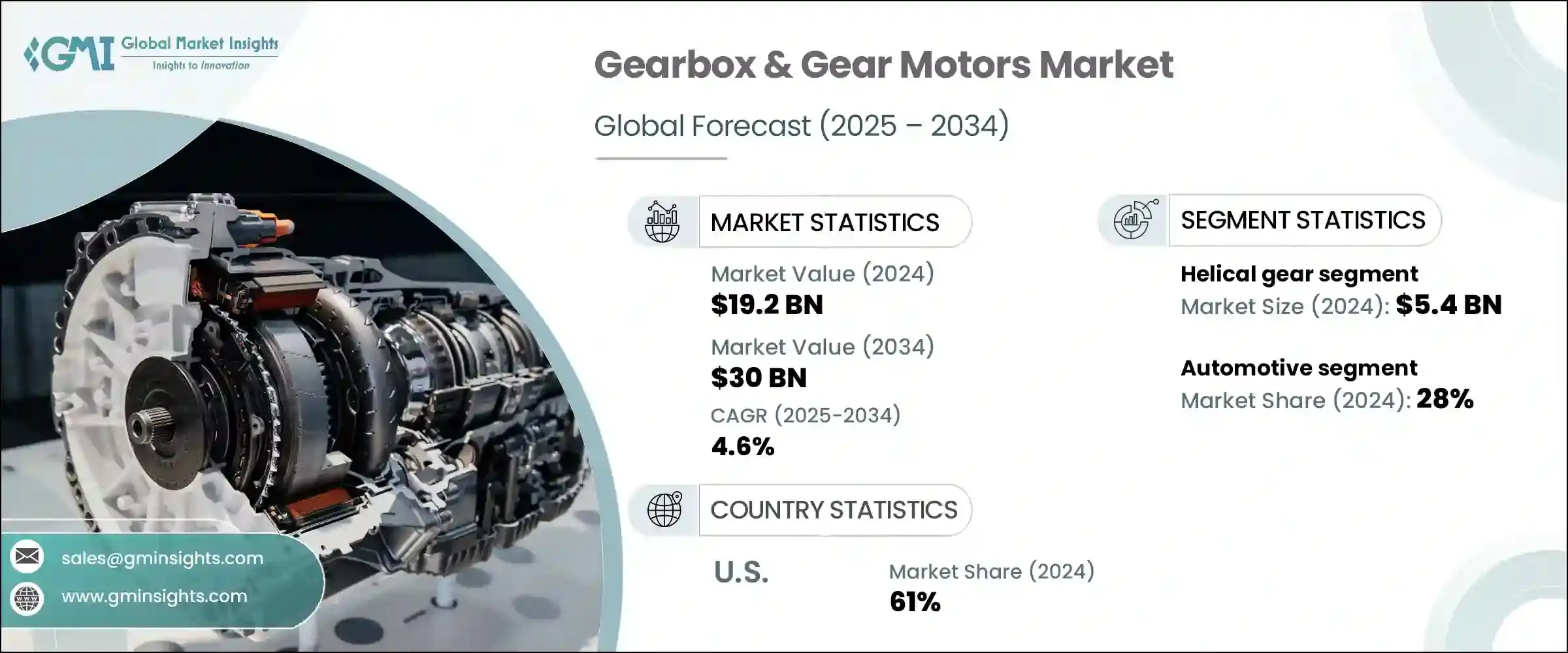

2024年,全球齿轮箱和齿轮马达市场规模达192亿美元,预计2034年将以4.6%的复合年增长率成长,达到300亿美元。电动车的日益普及,以及工业自动化的不断扩展和机器人技术的进步,持续推动市场需求。对清洁能源(尤其是风能)的投资不断增长,进一步推动了各种电力应用领域对可靠、高性能齿轮马达的需求。随着全球各行各业致力于基础设施现代化和能源效率的提高,对创新齿轮箱技术的需求也日益增长。

齿轮马达,尤其是在能源领域,因其能够增强能量捕获和优化旋转效率而变得越来越重要。因此,该市场在多个终端应用垂直领域(包括汽车、製造业和发电业)正呈现强劲成长。然而,儘管市场规模不断扩大,高昂的维护费用仍然是一个显着的障碍。齿轮组件、马达和控制系统的整合特性增加了复杂性,通常需要专业的维护。零件价格波动以及对专业维护的需求也导致营运成本上升,这可能会阻碍其在成本敏感型市场的广泛应用。儘管如此,持续的研发和产品改进正在帮助减少长期维护的担忧。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 192亿美元 |

| 预测值 | 300亿美元 |

| 复合年增长率 | 4.6% |

斜齿轮领域在2024年创造了54亿美元的市场规模。这些马达采用斜齿设计,可最大限度地降低振动和运行噪音,并提高效率。它们通常用于需要平稳运动和高负载能力的行业,例如起重机、起重系统、输送机械和重型工业工具。这些齿轮解决方案非常适合需要安静运作和高扭力性能的环境,包括製造、自动化系统和医疗设备中的高精度应用。它们能够承受高负载并提供高扭矩,也使其在物料搬运、采矿和基础设施等行业中备受青睐。

2024年,汽车产业占据了28%的市场。每年,各类汽车产量达数百万辆,汽车产业对齿轮传动系统的需求持续保持巨大且稳定。无论是电动、混合动力还是传统的内燃机配置,变速箱对于实现最佳动力输出至关重要。汽车行业的快速创新进一步增加了对齿轮部件的需求,这些部件能够支援更高的燃油效率、先进的安全技术和流畅的驾驶体验。现代车辆配备了多速系统和智慧齿轮机构,以满足不断变化的排放法规和性能要求。

2024年,美国变速箱和齿轮马达市场占61%的市场。工业自动化和智慧製造概念的广泛应用推动了该市场的成长。包括建筑、包装、食品生产和製药在内的多个行业正日益采用高效的动力传输技术。此外,工业机器人和能源基础设施投资的不断增加也创造了新的机会。美国製造商注重效率、可靠性和紧凑型设计,透过提供可客製化的产品线、低维护设计以及能够进行状态监测和预测性维护的智慧系统来推动创新。

影响全球变速箱和齿轮马达市场的关键公司包括邦飞利 (Bonfiglioli SpA)、Elecon Engineering Co. Ltd.、Portescap、诺德驱动系统集团 (NORD Drivesystems Group)、Shanthi Gears Limited、日本电产 (Nidec Corporation)、Top Gear Transmissions、Dunkermoto CorporationReconn. (Siemens AG)、弗兰德国际有限公司 (Flender International GmbH)、ABB、住友重工 (Sumitomo Heavy Industries Ltd.) 和 NGL。为了巩固市场地位,领先的变速箱和齿轮马达製造商正在采取一系列积极主动的策略。

许多企业正在大力投资产品开发,以打造高效能、低噪音、更长使用寿命和更少维护需求的解决方案。企业也在增强其全球供应链,并建立本地生产设施,以确保更好地回应区域需求。策略合作伙伴关係和收购正在帮助企业开拓新市场并扩展产品组合。此外,一些製造商正在整合智慧监控系统,用于即时诊断和预测性维护,以顺应转型为工业4.0的步伐。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 电动车需求不断成长

- 再生能源领域的成长

- 工业自动化和机器人技术的进步

- 产业陷阱与挑战

- 维护成本高

- 原料成本波动

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 斜齿轮

- 行星齿轮

- 锥齿轮

- 蜗轮

- 其他的

第六章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 变速箱

- 齿轮马达单元

第七章:市场估计与预测:按额定功率,2021 - 2034 年

- 主要趋势

- 高达 7.5 千瓦

- 7.5千瓦至75千瓦

- 75千瓦以上

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 物料处理

- 汽车

- 食品和饮料

- 医疗的

- 风力

- 金属和采矿业

- 其他的

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- ABB

- Bonfiglioli SpA

- Dunkermotoren

- Elecon Engineering Co. Ltd.

- Flender International GmbH

- NGL

- Nidec Corporation

- NORD Drivesystems Group

- Portescap

- Regal Rexnord Corporation

- SEW-EURODRIVE GmbH & Co. KG

- Shanthi Gears Limited

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- Top Gear Transmissions

The Global Gearbox & Gear Motors Market was valued at USD 19.2 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 30 billion by 2034. The rising popularity of electric vehicles, along with expanding industrial automation and advancements in robotics, continues to drive market demand. Growing investments in clean energy sources, particularly wind energy, are further boosting the need for dependable and high-performing gear motors across various power applications. As industries worldwide focus on modernizing infrastructure and improving energy efficiency, the demand for innovative gearbox technologies is surging.

Gear motors, especially in energy sectors, are becoming increasingly critical due to their ability to enhance energy capture and optimize rotational efficiency. As a result, the market is witnessing strong growth in several end-use verticals, including automotive, manufacturing, and power generation. However, despite this expansion, high upkeep expenses remain a notable barrier. The integrated nature of gear assemblies, motors, and control systems increases complexity, often requiring specialized servicing. Variability in component prices and the need for expert maintenance also contribute to elevated operational costs, which can deter broader adoption in cost-sensitive markets. Nevertheless, ongoing R&D and product enhancements are helping reduce long-term maintenance concerns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.2 Billion |

| Forecast Value | $30 Billion |

| CAGR | 4.6% |

The helical gear segment generated USD 5.4 billion in 2024. These motors are designed with angled teeth, minimizing vibration and operating noise and boosting efficiency. They're commonly found in industries requiring smooth motion and load capacity, such as cranes, hoisting systems, conveyor machinery, and heavy industrial tools. These gear solutions are well-suited for environments where quiet operation and torque performance are vital, including high-precision applications in manufacturing, automation systems, and medical devices. Their capacity to manage significant loads and deliver high torque also makes them favorable for sectors such as material handling, mining, and infrastructure.

In 2024, the automotive segment accounted for a 28% share. With millions of vehicles produced each year across various categories, the sector continues to generate a massive and consistent demand for gear-driven systems. Whether in electric, hybrid, or traditional internal combustion engine configurations, gearboxes remain essential for optimal power delivery. Rapid innovation within the automotive industry is further increasing the need for gear components that support enhanced fuel efficiency, advanced safety technologies, and seamless driving experiences. Modern vehicles are being equipped with multi-speed systems and smart gear mechanisms tailored for evolving emission regulations and performance requirements.

United States Gearbox & Gear Motors Market held a 61% share in 2024. Growth in this market is supported by the widespread implementation of industrial automation and smart manufacturing concepts. Multiple sectors-including construction, packaging, food production, and pharmaceuticals-are increasingly adopting efficient power transmission technologies. Additionally, rising investments in industrial robotics and energy infrastructure are creating new opportunities. With an emphasis on efficiency, reliability, and compact design, US manufacturers push innovation by offering customizable product lines, reduced-maintenance designs, and intelligent systems capable of condition monitoring and predictive maintenance.

Key companies shaping the Global Gearbox & Gear Motors Market include Bonfiglioli S.p.A., Elecon Engineering Co. Ltd., Portescap, NORD Drivesystems Group, Shanthi Gears Limited, Nidec Corporation, Top Gear Transmissions, Dunkermotoren, SEW-EURODRIVE GmbH & Co. KG, Regal Rexnord Corporation, Siemens AG, Flender International GmbH, ABB, Sumitomo Heavy Industries Ltd., and NGL. To strengthen their market standing, leading gearbox, and gear motor manufacturers are adopting a range of proactive strategies.

Many are investing significantly in product development to create high-efficiency and low-noise solutions with longer lifespans and reduced maintenance needs. Companies are also enhancing their global supply chains and establishing local production facilities to ensure better responsiveness to regional demands. Strategic partnerships and acquisitions are helping firms tap into new markets and extend product portfolios. Additionally, several manufacturers are incorporating smart monitoring systems for real-time diagnostics and predictive maintenance, aligning with the shift toward Industry 4.0.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Product Type

- 2.2.4 Rated Power

- 2.2.5 End use Industry

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for electrical vehicles

- 3.2.1.2 Growth in renewable energy sector

- 3.2.1.3 Advancements in industrial automation and robotics

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High maintenance costs

- 3.2.2.2 Fluctuations in raw material costs

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Helical gear

- 5.3 Planetary gear

- 5.4 Bevel gear

- 5.5 Worm gear

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Gearbox

- 6.3 Gear motor unit

Chapter 7 Market Estimates and Forecast, By Rated Power, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 7.5 kW

- 7.3 7.5 kW to 75 kW

- 7.4 Above 75 kW

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Material handling

- 8.3 Automotive

- 8.4 Food and beverages

- 8.5 Medical

- 8.6 Wind power

- 8.7 Metals and mining

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Bonfiglioli S.p.A.

- 11.3 Dunkermotoren

- 11.4 Elecon Engineering Co. Ltd.

- 11.5 Flender International GmbH

- 11.6 NGL

- 11.7 Nidec Corporation

- 11.8 NORD Drivesystems Group

- 11.9 Portescap

- 11.10 Regal Rexnord Corporation

- 11.11 SEW-EURODRIVE GmbH & Co. KG

- 11.12 Shanthi Gears Limited

- 11.13 Siemens AG

- 11.14 Sumitomo Heavy Industries Ltd.

- 11.15 Top Gear Transmissions