|

市场调查报告书

商品编码

1773435

弹性输液帮浦市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Elastomeric Infusion Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

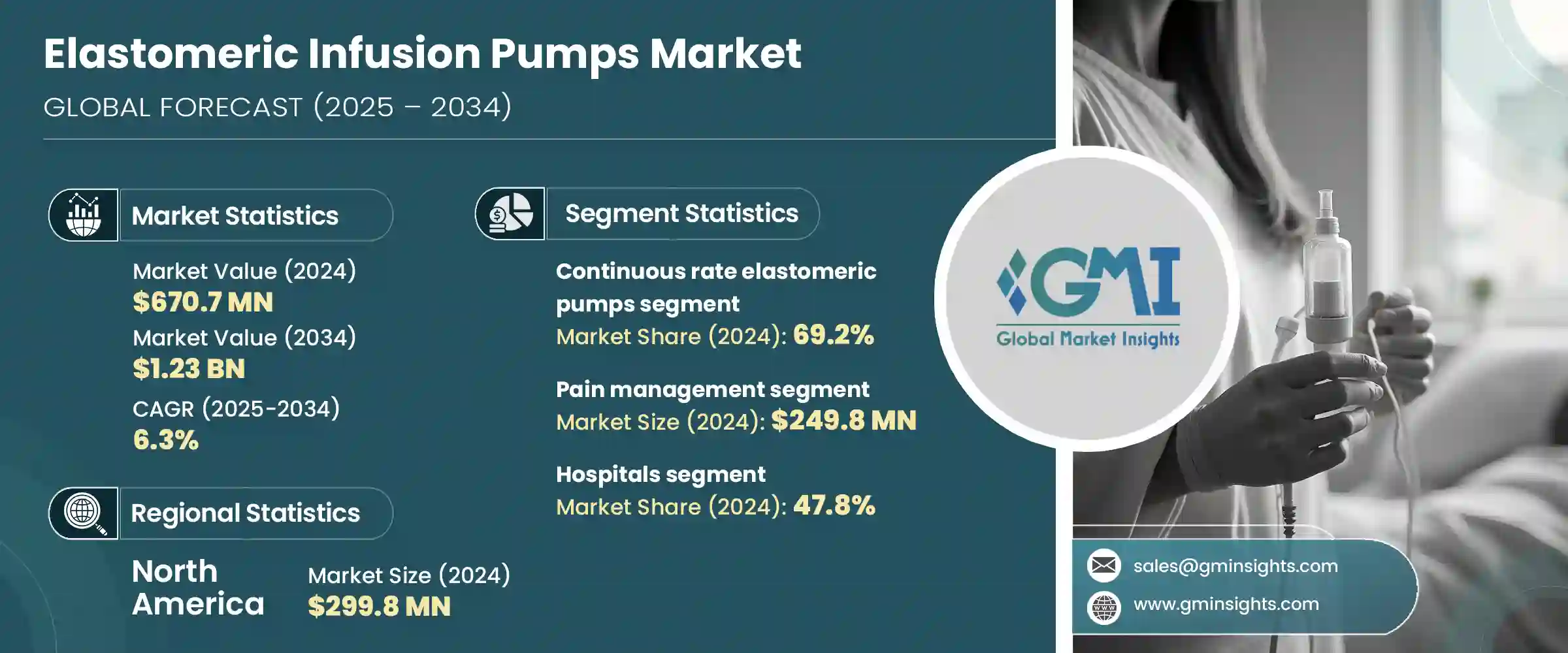

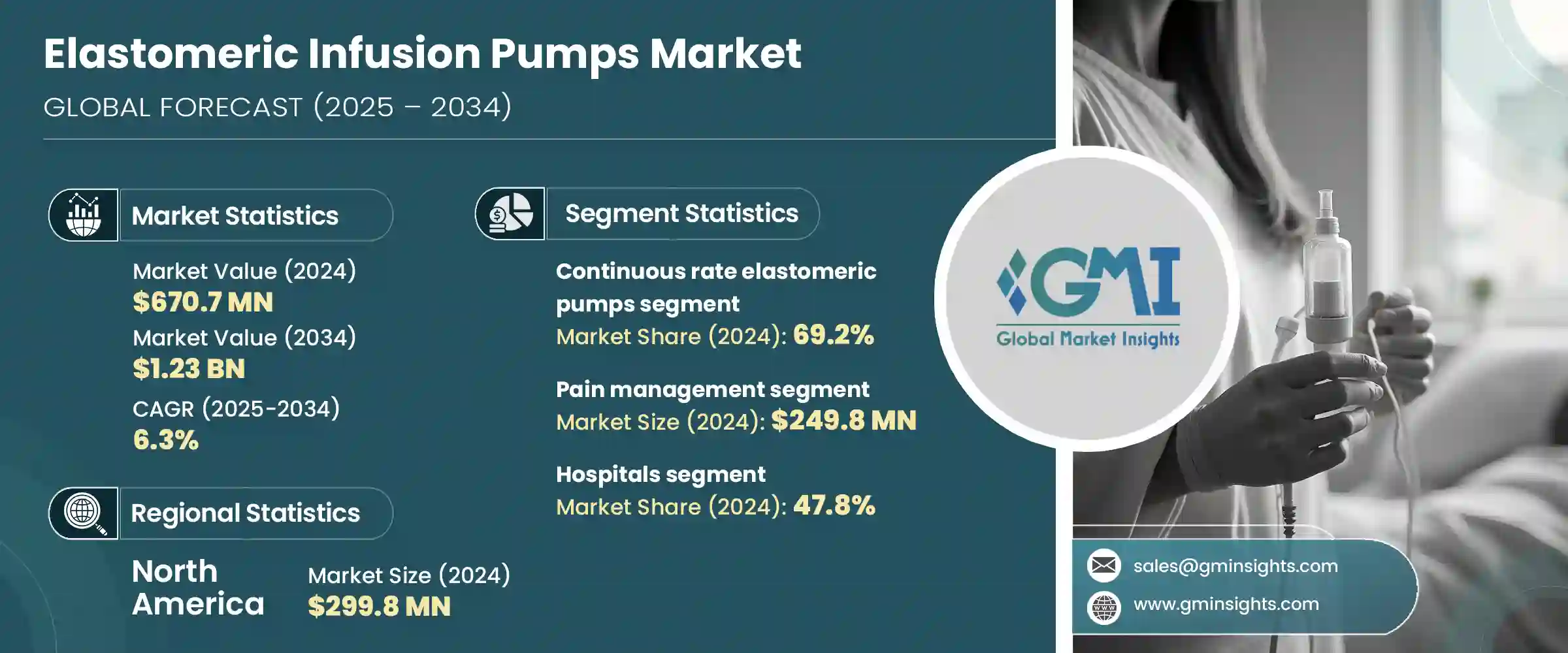

2024年,全球弹性输液帮浦市场规模达6.707亿美元,预估年复合成长率为6.3%,到2034年将达到12.3亿美元。居家照护和门诊服务日益普及,这持续重塑着医疗保健服务模式,减少了对长期住院的依赖,并降低了医疗成本。弹性输液帮浦凭藉其用户友好、无需用电的操作和可靠的药物输送,已成为推动这一转变的关键因素。这些一次性设备广泛用于在医院以外的场所注射抗生素、化疗药物和止痛药。

慢性病病例的增加、持续用药的需求以及家庭输液治疗的兴起,都推动了此类输液帮浦的需求成长。其便携性和易用性,加上患者对家庭护理的偏好日益增长以及就诊次数的减少,使得弹性输液泵在现代治疗方案中占据重要地位。疫情过后,人们对基于价值的照护和患者独立性的持续重视,正在推动其长期需求,尤其是在癌症、自体免疫疾病和地中海贫血等需要频繁输液的疾病领域。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.707亿美元 |

| 预测值 | 12.3亿美元 |

| 复合年增长率 | 6.3% |

随着家庭护理治疗的日益普及,医疗保健提供者越来越多地使用弹性泵来输送化疗、免疫疗法和铁螯合疗法的药物。这些帮浦无需复杂的机械装置即可维持稳定的药物水平,非常适合居家治疗,尤其是在患者监测受限的情况下。居家输液解决方案现已成为管理长期疾病的标准方案之一,尤其是在患者寻求更多自主性和舒适性的情况下。这些帮浦也已被证明对门诊治疗有益,使医疗保健专业人员能够支持护理的连续性,同时最大限度地减少医院资源。它们的一次性使用特性也符合感染控制规范,使其成为患者和临床医生的便利选择。

2024年,持续速率弹性帮浦市场占有69.2%的份额。这些帮浦提供可靠、不间断的药物输注,对于在慢性病管理中维持稳定的治疗水准至关重要。无论是控制感染、癌症症状或疼痛,恆定的流速都能减少给药错误,并帮助患者坚持遵医嘱服药。无需电力或程式即可运行,使这些帮浦可供广大患者使用,尤其是居家治疗的患者。其简便性有助于提高依从性,培养患者独立性,并减轻护理人员和临床医生的工作负担。长期治疗中对可预测给药方案的需求日益增长,也进一步增强了人们对这些帮浦的青睐。

2024年,疼痛管理细分市场规模达2.498亿美元。微创手术和增强型復健方案的广泛应用,进一步强化了对术后有效疼痛控制的重视。弹性输注装置常用于持续给药局部麻醉药或鸦片类止痛药,确保持续缓解疼痛,无需依赖电子设备。其便携性使其能够在门诊护理中心和门诊手术环境中部署,从而支持快速出院和更快的康復时间。弹性泵的简便性和有效性,使其在全球范围内继续成为强化术后护理策略的一部分。

预计到2034年,美国弹性输液帮浦市场规模将达到5.047亿美元,这得益于美国民众日益青睐门诊治疗模式和高效的出院后照护。过去仅限于住院的医疗程序,如今越来越多地透过门诊中心和家庭保健服务进行管理。弹性输液帮浦凭藉其便携性、安全性和易用性,在这转变过程中发挥关键作用。它们常用于缓解疼痛、化疗和抗生素给药。美国的报销框架,包括医疗保险对耐用医疗设备的覆盖,增强了医疗机构在家庭输液项目中采用这些设备的商业理由。在强有力的政策推动下,这些输液帮浦致力于缩短住院时间和提高护理效率,能够为医疗机构提供支持,使其与价值导向模式保持一致。

全球弹性输液帮浦市场的领导者包括 ICU Medical、Ambu、Terumo、Baxter、B. Braun、Woo Young Medical、Nipro、Avanos、Smiths Medical、ACE Medical、Halyard、JMS、Leventon、KB Medical 和 Fresenius Kabi。弹性输液帮浦市场的主要企业正在大力投资产品创新,以提高输液帮浦的准确性、舒适度以及居家和门诊病患使用的安全性。

各公司正致力于拓展家用输液产品线,提供多样化的流量选择、防篡改设计和更符合人体工学的设计。与医疗保健提供者和家庭健康机构的策略合作正帮助企业加强分销网络,拓宽病患用药管道。许多企业也在优化生产工艺,以保持产品价格合理和可扩展性。此外,各公司也正在申请国际监管部门的批准,以进入尚未开发的地区。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 越来越多地采用门诊和家庭护理

- 癌症和地中海贫血等慢性病发生率上升

- 成本效益高,不依赖电力或电池

- 泵浦设计和材料技术的进步

- 产业陷阱与挑战

- 限制体积和流量控制

- 剂量错误的风险

- 市场机会

- 便携式输液帮浦在门诊化疗的应用日益增多

- 对生物相容性和环保材料的需求不断增加

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 报销场景

- 报销政策对市场成长的影响

- 未来市场趋势

- 消费者行为分析

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 连续速率弹性泵

- 可变速率弹性泵

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 疼痛管理

- 化疗

- 抗生素输送

- 抗病毒治疗

- 其他应用

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 居家照护环境

- 其他最终用途

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- ACE Medical

- Ambu

- Avanos

- B. Braun

- Baxter

- Fresenius Kabi

- Halyard

- ICU Medical

- JMS

- KB Medical

- Leventon

- Nipro

- Smiths Medical

- Terumo

- Woo Young Medical

The Global Elastomeric Infusion Pumps Market was valued at USD 670.7 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 1.23 billion by 2034. The increasing shift toward home-based care and outpatient services continues to reshape the healthcare delivery model, reducing reliance on prolonged hospital admissions and lowering healthcare costs. Elastomeric infusion pumps have become a key enabler of this transition due to their user-friendly, power-free operation and reliable drug delivery. These disposable devices are widely used for administering antibiotics, chemotherapeutic agents, and pain-relief medications in settings beyond the hospital environment.

Rising chronic illness cases, the need for continuous medication delivery, and the growth in home infusion therapy have all contributed to the increasing demand for these pumps. Their portability and ease of use, coupled with growing patient preferences for home care options and fewer clinic visits, have established elastomeric infusion pumps as an asset in modern treatment protocols. The continued emphasis on value-based care and patient independence post-pandemic is driving long-term demand, especially for conditions requiring frequent infusions like cancer, autoimmune disorders, and thalassemia.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $670.7 Million |

| Forecast Value | $1.23 Billion |

| CAGR | 6.3% |

As homecare treatment becomes more prevalent, healthcare providers are increasingly using elastomeric pumps to deliver medication for chemotherapy, immunotherapy, and iron chelation therapy. The ability to maintain steady medication levels without complicated machinery makes these pumps well-suited for home-based therapies, particularly in cases where patient monitoring is limited. Home infusion solutions are now part of standard protocols for managing long-term diseases, especially as patients seek more autonomy and comfort. These pumps are also proving beneficial for outpatient treatments, enabling healthcare professionals to support continuity of care while minimizing hospital resources. Their disposable nature also aligns with infection control practices and makes them a convenient choice for patients and clinicians alike.

In 2024, the continuous rate elastomeric pumps segment held a 69.2% share. These pumps offer reliable, uninterrupted drug infusion, vital for maintaining stable therapeutic levels in chronic care management. Whether managing infections, cancer symptoms, or pain, a constant flow rate reduces dosing errors and helps patients remain compliant with prescribed regimens. The ability to function without electricity or programming makes these pumps accessible to a broad patient population, especially those receiving treatment at home. Their simplicity encourages adherence, fosters patient independence, and lowers the workload on caregivers and clinicians. The preference for these pumps is also reinforced by the growing demand for predictable dosing schedules in long-term therapies.

The pain management segment accounted for USD 249.8 million in 2024. The widespread adoption of minimally invasive surgeries and enhanced recovery protocols has intensified the focus on efficient post-operative pain control. Elastomeric infusion devices are frequently used to administer continuous doses of local anesthetics or opioid-based analgesics, ensuring consistent pain relief without reliance on electronic devices. Their portability enables deployment in ambulatory care centers and outpatient surgery settings, supporting rapid discharges and faster recovery timelines. The simplicity and effectiveness of elastomeric pumps continue to drive their use as part of enhanced post-surgical care strategies globally.

United States Elastomeric Infusion Pumps Market is projected to reach USD 504.7 million by 2034, supported by the nation's growing preference for outpatient treatment models and efficient post-discharge care. Procedures once confined to inpatient settings are now increasingly managed through ambulatory centers and home health services. Elastomeric infusion pumps are playing a key role in this transition by offering portability, safety, and ease of use. They are regularly utilized for pain relief, chemotherapy, and antibiotic administration. U.S. reimbursement frameworks, including Medicare's coverage for durable medical equipment, have strengthened the business case for providers to adopt these devices across home infusion programs. With a strong policy push toward reducing hospitalization durations and increasing care efficiency, these pumps are well-positioned to support healthcare institutions as they align with value-based models.

Leading players in the Global Elastomeric Infusion Pumps Market include ICU Medical, Ambu, Terumo, Baxter, B. Braun, Woo Young Medical, Nipro, Avanos, Smiths Medical, ACE Medical, Halyard, JMS, Leventon, KB Medical, and Fresenius Kabi. Key players in the elastomeric infusion pumps market are investing heavily in product innovation to enhance pump accuracy, comfort, and safety for patients in home and outpatient settings.

Companies are focusing on expanding their home infusion product lines with versatile flow-rate options, tamper-evident designs, and better ergonomic features. Strategic collaborations with healthcare providers and home health agencies are helping firms strengthen their distribution networks and broaden patient access. Many players are also optimizing manufacturing processes to maintain product affordability and scalability. Alongside this, companies are obtaining international regulatory approvals to enter untapped regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of ambulatory and home-based care

- 3.2.1.2 Rising prevalence of chronic diseases such as cancer and thalassemia

- 3.2.1.3 Cost-effectiveness and non-dependence on electricity or batteries

- 3.2.1.4 Advancements in pump design and material technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited volume and flow rate control

- 3.2.2.2 Risk of dosing errors

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoptions of portable infusion pumps in outpatient chemotherapy

- 3.2.3.2 Increasing demand for biocompatible and eco-friendly materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Reimbursement scenario

- 3.7.1 Impact of reimbursement policies on market growth

- 3.8 Future market trends

- 3.9 Consumer behaviour analysis

- 3.10 Patent analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Continuous rate elastomeric pumps

- 5.3 Variable rate elastomeric pumps

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pain management

- 6.3 Chemotherapy

- 6.4 Antibiotic delivery

- 6.5 Antiviral treatment

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ACE Medical

- 9.2 Ambu

- 9.3 Avanos

- 9.4 B. Braun

- 9.5 Baxter

- 9.6 Fresenius Kabi

- 9.7 Halyard

- 9.8 ICU Medical

- 9.9 JMS

- 9.10 KB Medical

- 9.11 Leventon

- 9.12 Nipro

- 9.13 Smiths Medical

- 9.14 Terumo

- 9.15 Woo Young Medical