|

市场调查报告书

商品编码

1773437

诱饵弹市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Decoy Flares Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

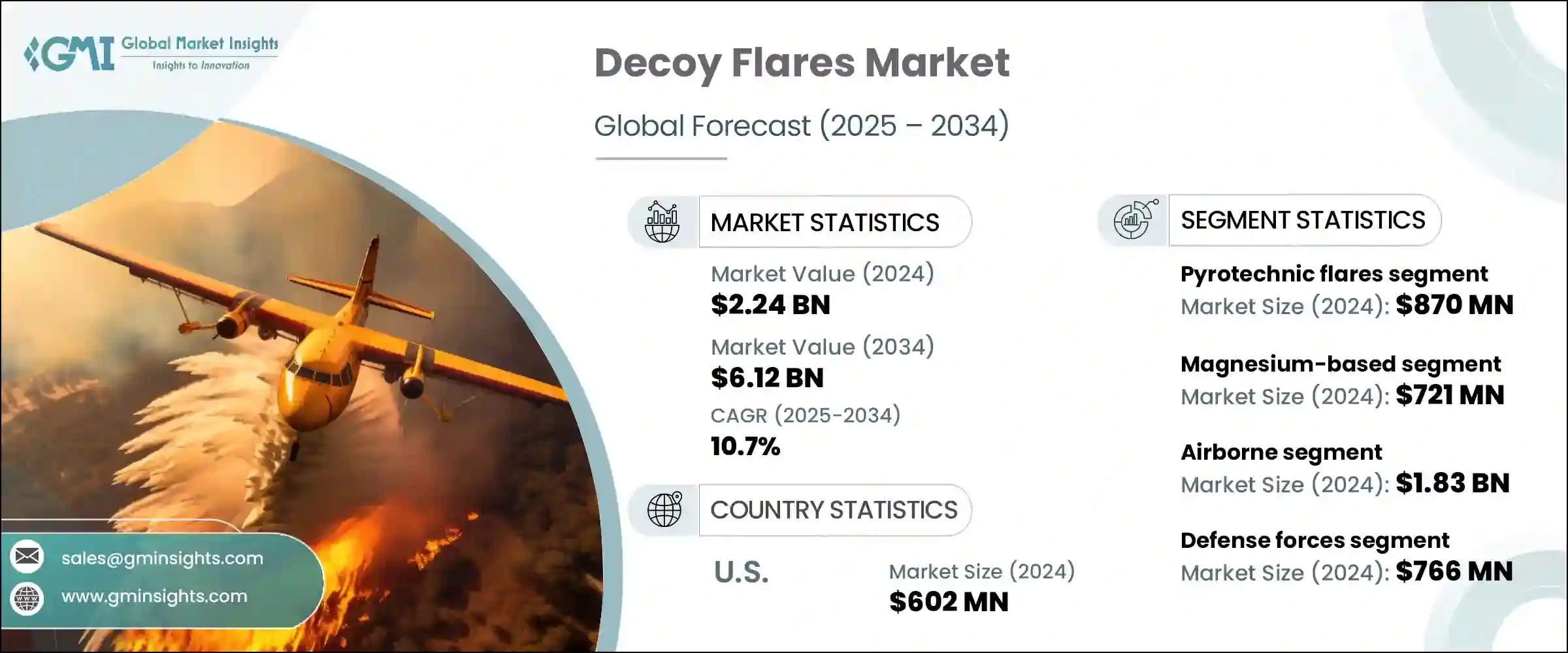

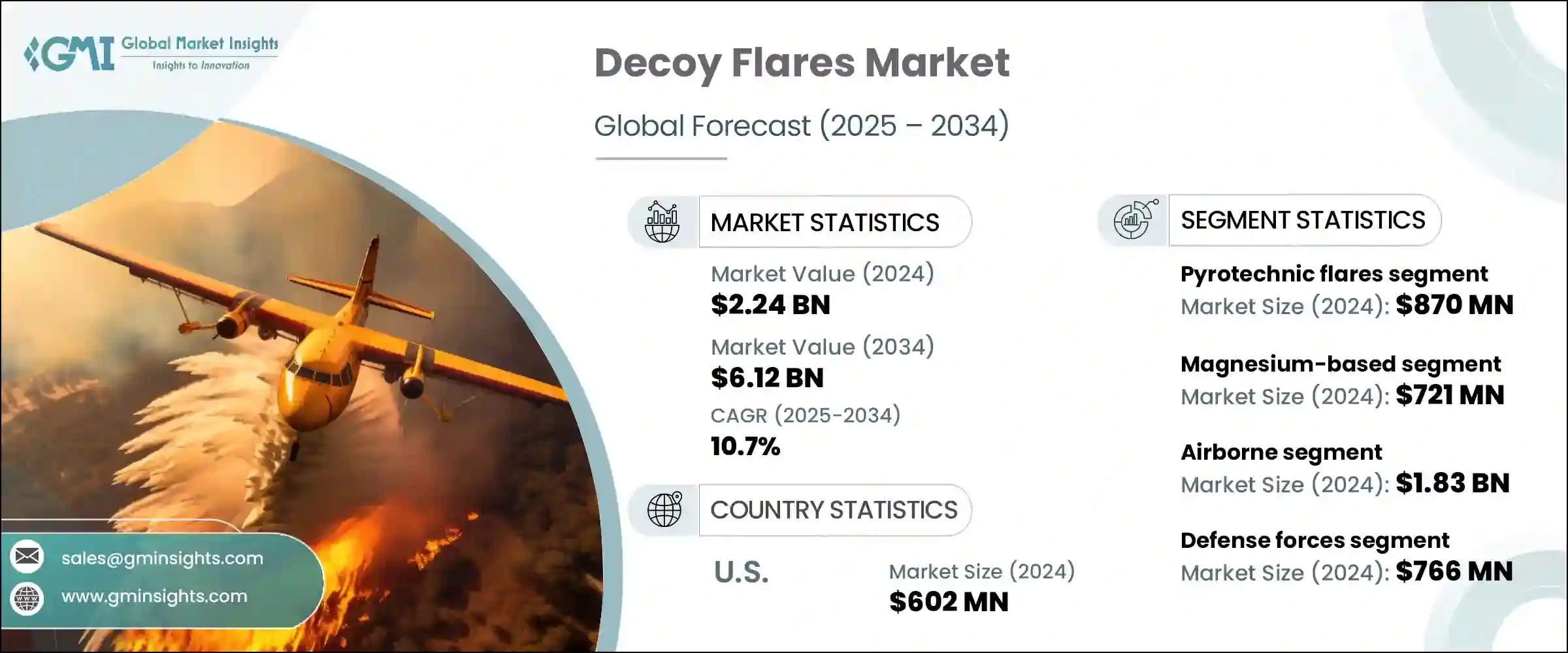

2024年,全球诱饵弹市场规模达22.4亿美元,预计到2034年将以10.7%的复合年增长率成长,达到61.2亿美元。军用飞机队的现代化升级以及地缘政治紧张局势的加剧,共同推动了诱饵弹市场的快速发展。诱饵弹技术的突破,尤其是从传统烟火弹到先进自燃式诱饵弹的转变,正在增强诱饵弹的燃烧时间、辐射覆盖范围和抗风性能。这些最新的诱饵弹对现代飞弹威胁极为有效,目前正被整合到许多军事平台中。成功的实地试验使其得以被空军采用,显着提高了飞机在恶劣环境中的生存能力。同时,新兴国家不断增长的国防预算也刺激了对下一代防御系统的需求。

世界各国都在加大国防开支,以提升空中生存力和战略战备能力,这使得诱饵弹成为现代战争技术的基石。这些对抗措施日益被视为战胜复杂飞弹威胁的重要工具,尤其是在紧张局势不断升级、空域完整性受到重视的地区。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22.4亿美元 |

| 预测值 | 61.2亿美元 |

| 复合年增长率 | 10.7% |

武装部队正在将诱饵弹系统嵌入到传统和下一代飞机平台中,以确保全面防御热寻的威胁。这一趋势在旨在透过经济高效且性能强大的国防技术加强国家安全的军事现代化项目中尤为明显。多光谱诱饵弹系统和下一代诱饵弹部署机制的加入,进一步凸显了这些工具在先进威胁环境中的重要性。

传统烟火发射器在2024年占据市场主导地位,价值达8.7亿美元。其成本效益高且易于集成,使其成为常规测试、训练和低预算采购项目中不可或缺的一部分。它们能够满足紧张地区的大量库存需求,帮助军队在不增加成本的情况下保持战备。

2024年,镁基照明弹市场规模达7.21亿美元。镁因其高发热量和轻量化的外形而备受青睐,其特性与飞机引擎的辐射特征非常相似,可以有效干扰红外线导引飞弹。镁的价格低廉且易于量产,使其成为作战部署和训练演习的理想选择。

受持续的军事现代化和不断扩大的防空投资推动,美国诱饵弹市场在2024年创造了6.02亿美元的市场规模。随着国防资金的持续投入和全球安全挑战的加剧,对先进对抗措施的需求仍然强劲。主要的国防承包商正在改进诱饵弹的成分和部署系统,以实现更快的点火速度和更高的热输出,从而进一步增强飞机的规避能力。

全球诱饵弹市场的领先公司包括莱茵金属股份公司 (Rheinmetall AG)、Chemring Group PLC、Elbit Systems Ltd. 和 L3Harris Technologies, Inc.。诱饵弹领域的顶尖公司正专注于产品创新、策略合作伙伴关係以及扩大全球业务,以提升其市场地位。技术开发的核心是提升自燃弹的性能,包括更快的点火速度、更长的燃烧时间和更强的光谱覆盖范围。

国防承包商与军事机构之间的合作支持了现场测试和认证,从而加速了技术的采用。各公司也正在优化生产设施,以应对更大的产量并降低单位成本,从而满足各地区的高库存需求。透过拓展新兴市场并利用补偿协议,製造商正在加强与新国防客户的关係。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 军用飞机队的现代化

- 地缘政治紧张局势和安全疑虑加剧

- 诱饵弹技术的进步

- 新兴经济体军费开支增加

- 诱饵弹与先进电子战系统的集成

- 产业陷阱与挑战

- 对国防预算和地缘政治稳定的依赖

- 由于快速进步而导致的技术过时

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 国防预算分析

- 全球国防开支趋势

- 区域国防预算分配

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 重点国防现代化项目

- 预算预测(2025-2034)

- 对产业成长的影响

- 各国国防预算

- 国防预算按部门分配

- 人员

- 营运和维护

- 采购

- 研究、开发、测试和评估

- 基础设施和建筑

- 科技与创新

- 永续发展倡议

- 供应链弹性

- 地缘政治分析

- 劳动力分析

- 数位转型

- 合併、收购和策略伙伴关係格局

- 风险评估与管理

- 主要合约授予(2021-2024)

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理位置比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 烟火弹

- 自燃耀斑

- 红外线耀斑

- 光谱诱饵耀斑

第六章:市场估计与预测:依构成,2021 年至 2034 年

- 主要趋势

- 镁基

- 磷基

- 金属化塑胶基

- 其他的

第七章:市场估计与预测:按部署平台,2021 年至 2034 年

- 主要趋势

- 空降

- 战斗机

- 直升机

- 运输飞机

- 其他的

- 海军

- 地面

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 国防军

- 国土安全

- 私人军事承包商

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Alkan SAS

- Aselsan AS

- Bharat Dynamics Limited (BDL)

- Chemring Group PLC

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Leonardo SpA

- MBDA

- Raytheon Technologies Corporation

- Rheinmetall AG

- Saab AB

- Terma A/S

The Global Decoy Flares Market was valued at USD 2.24 billion in 2024 and is estimated to grow at a CAGR of 10.7% to reach USD 6.12 billion by 2034. This rapid momentum is fueled by the modernization of military aircraft fleets alongside increasing geopolitical tensions. Breakthroughs in flare technology, especially the transition from traditional pyrotechnic to advanced pyrophoric flares, are enhancing burn duration, spectrum coverage, and wind resistance. These latest flares are highly effective against modern guided-missile threats and are now being integrated into numerous military platforms. Successful field trials have enabled their adoption by air forces, significantly boosting aircraft survivability in hostile environments. At the same time, rising defense budgets in emerging countries are prompting demand for next-gen defensive systems.

Countries across the globe are ramping up their defense spending to enhance aerial survivability and strategic readiness, making decoy flares a cornerstone of modern warfare technology. These countermeasures are increasingly seen as essential tools to outmaneuver sophisticated missile threats, particularly in regions where tensions are escalating and airspace integrity is a priority.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.24 Billion |

| Forecast Value | $6.12 Billion |

| CAGR | 10.7% |

Armed forces are embedding decoy flare systems into both legacy and next-generation aircraft platforms to ensure comprehensive protection against heat-seeking threats. This trend is especially pronounced in military modernization programs aimed at strengthening national security through cost-effective yet capable defense technologies. The inclusion of multi-spectral flare systems and next-gen flare deployment mechanisms further underlines how critical these tools have become in advanced threat environments.

The traditional pyrotechnic flares segment led the market in 2024 and was valued at USD 870 million. Their cost-effectiveness and ease of integration make them indispensable in routine testing, training, and low-budget procurement programs. They support high-volume inventory needs in tense regions, helping militaries sustain readiness without escalating costs.

Magnesium-based flares segment held a market share worth USD 721 million in 2024. Magnesium remains favored due to its intense heat output and lightweight profile, closely mimicking aircraft engine signatures to distract IR-guided missiles. Its affordability and ease of lightweight mass production make it ideal for both operational deployment and training exercises.

U.S. Decoy Flares Market generated USD 602 million in 2024, driven by sustained military modernization and expanding aerial defense investments. With consistent defense funding and global security challenges, demand for sophisticated countermeasures remains strong. Major national defense contractors are refining flare compositions and deployment systems to achieve quicker ignition and higher thermal output, further enhancing aircraft evasion capabilities.

Leading companies in the Global Decoy Flares Market include Rheinmetall AG, Chemring Group PLC, Elbit Systems Ltd., and L3Harris Technologies, Inc. Top firms in the decoy flares sector are focusing on product innovation, strategic partnerships, and expanding global footprints to enhance their market positions. Technology development is centered on improving pyrophoric flare performance, including faster ignition, extended burn time, and enhanced spectral coverage.

Collaborations between defense contractors and military agencies support field testing and certification, accelerating adoption. Companies are also optimizing production facilities to handle larger volumes and reduce unit costs, responding to high inventory demands across regions. By expanding into emerging markets and leveraging offset agreements, manufacturers are strengthening relationships with new defense clients.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.3 Product type trends

- 2.4 Composition trends

- 2.5 Deployment platform trends

- 2.6 End use trends

- 2.7 Regional

- 2.8 TAM Analysis, 2025-2034 (USD Billion)

- 2.9 CXO perspectives: Strategic imperatives

- 2.9.1 Executive decision points

- 2.9.2 Critical Success Factors

- 2.10 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Modernization of military aircraft fleets

- 3.2.1.2 Rising geopolitical tensions and security concerns

- 3.2.1.3 Advancements in decoy flare technology

- 3.2.1.4 Increased military expenditures in emerging economies

- 3.2.1.5 Integration of decoy flares with advanced electronic warfare systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dependency on defense budgets and geopolitical stability

- 3.2.2.2 Technological obsolescence due to rapid advancements

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.14.3 Defense budget allocation by segment

- 3.14.4 Personnel

- 3.14.5 Operations and maintenance

- 3.14.6 Procurement

- 3.14.7 Research, development, test and evaluation

- 3.14.8 Infrastructure and construction

- 3.14.9 Technology and innovation

- 3.15 Sustainability initiatives

- 3.16 Supply chain resilience

- 3.17 Geopolitical analysis

- 3.18 Workforce analysis

- 3.19 Digital transformation

- 3.20 Mergers, acquisitions, and strategic partnerships landscape

- 3.21 Risk assessment and management

- 3.22 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Pyrotechnic flares

- 5.3 Pyrophoric flares

- 5.4 Infrared flares

- 5.5 Spectral decoy flares

Chapter 6 Market Estimates and Forecast, By Composition, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Magnesium-based

- 6.3 Phosphorus-based

- 6.4 Metalized plastic-based

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Deployment Platform, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Airborne

- 7.2.1 Fighter jets

- 7.2.2 Helicopters

- 7.2.3 Transport aircraft

- 7.2.4 Others

- 7.3 Naval

- 7.4 Ground-based

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 Defense forces

- 8.3 Homeland security

- 8.4 Private military contractors

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alkan SAS

- 10.2 Aselsan A.S.

- 10.3 Bharat Dynamics Limited (BDL)

- 10.4 Chemring Group PLC

- 10.5 Elbit Systems Ltd.

- 10.6 L3Harris Technologies, Inc.

- 10.7 Leonardo S.p.A.

- 10.8 MBDA

- 10.9 Raytheon Technologies Corporation

- 10.10 Rheinmetall AG

- 10.11 Saab AB

- 10.12 Terma A/S