|

市场调查报告书

商品编码

1773440

切削刀具市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cutting Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

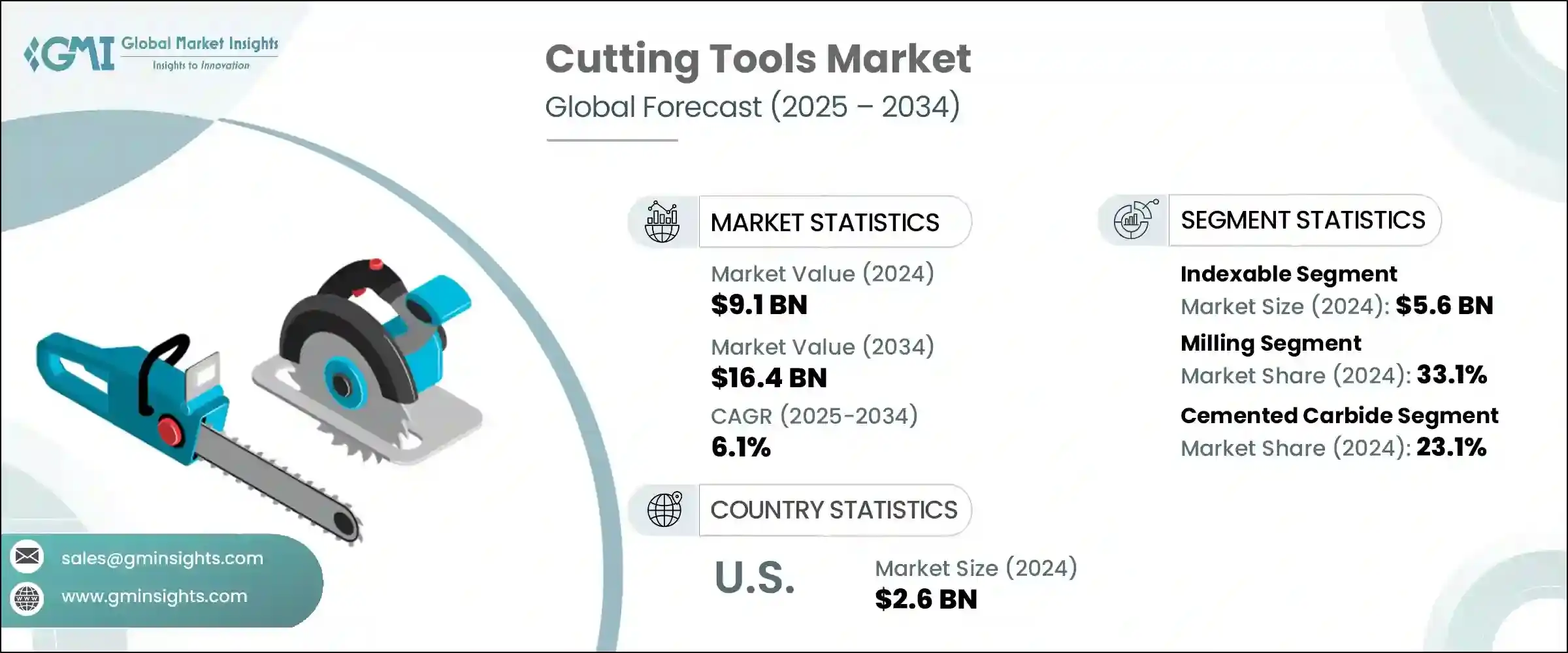

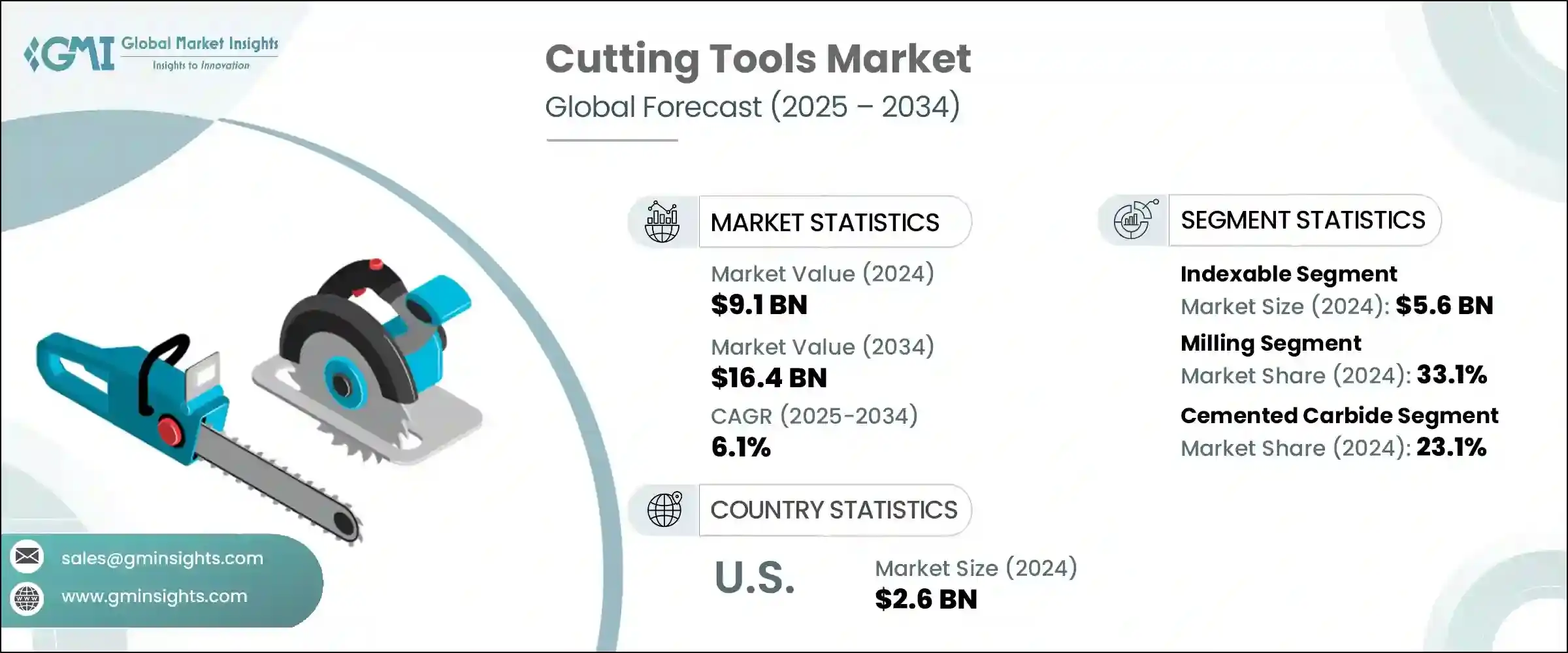

2024年,全球切削刀具市场规模达91亿美元,预计到2034年将以6.1%的复合年增长率成长,达到164亿美元。该市场正在经历显着成长,这主要得益于製造流程的进步。随着自动化和工业4.0实践的兴起,对能够生产无缺陷零件的精密刀具的需求日益增长。汽车、航太和电子等产业尤其受益于这种精确度。

此外,随着复合材料和高强度合金等更轻更硬的材料的应用,需要更先进的切削刀具来处理这些坚韧的材料。另一个关键驱动因素是持续的基础设施建设热潮,尤其是在快速发展的经济体中,这增加了对适用于大型机器和现场设备的刀具的需求。此外,对优化原材料使用和减少浪费的关注也不断推动製造商寻求更耐用、更经济高效的切削刀具。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 91亿美元 |

| 预测值 | 164亿美元 |

| 复合年增长率 | 6.1% |

此外,随着企业越来越重视永续性和性能,切削刀具产业对更环保生产方法的追求也正在加速。製造商在从原材料采购到提高製造过程中的能源效率的各个环节都采取了环保措施。切削刀具涂层和材料的进步不仅延长了刀具的使用寿命,减少了浪费,还提高了切割效率。此外,人们越来越重视切削刀具的回收和再利用,以减少整体环境足迹。许多公司也致力于减少有害排放,并最大限度地减少生产过程中有害化学物质的使用。

2024年,可转位刀具市场规模达56亿美元。该领域因其成本效益和多功能性而日益受到欢迎。可转位刀具允许使用者更换磨损的刀片,而无需丢弃整个刀具,这有助于降低营运成本,使其在汽车和航太等精密驱动行业中极具吸引力。这些刀具还支援高速加工,从而提高效率和耐用性,这对製造商至关重要。向永续发展的转变进一步增强了它们的吸引力,因为使用可更换刀片可以减少废金属的产生和浪费,这与日益增长的绿色製造工艺需求相一致。

2024年,铣削刀具细分市场占据33.1%的市占率。此细分市场的快速扩张得益于铣削刀具在多个行业中能够处理的各种任务。这些刀具对于生产高精度复杂轮廓至关重要,并且常用于汽车、航太和电子产品。随着产品设计对更轻巧耐用零件的需求不断增长,铣削刀具因其能够切割先进材料的能力而日益受到欢迎。多功能设计和改进的涂层等创新技术也透过延长刀具寿命和降低营运成本促进了该细分市场的成长。

2024年,美国切削刀具市场规模达26亿美元,位居全球领先地位。美国製造业涵盖众多产业,是推动其主导的关键因素。汽车和航太产业对符合严格品质标准的高精度刀具的需求不断增长。此外,机器人、感测器和云端分析技术在製造业中的集成,透过提高营运效率,进一步促进了市场成长。

切削刀具产业的主要公司包括 Ceratizit SA、Cougar Cutting Tools、Emuge Corporation、Greenleaf Corporation、Ingersoll Cutting Tools、Iscar Ltd.、Kennametal Inc.、Mapal Inc.、三菱综合材料株式会社、Mohawk Special Cutting Tools、OSG Corporation、山特维克可乐满、Tungak Technologies Corporation, Walter、Tunga。为了满足对尖端产品日益增长的需求,切削刀具市场的公司正专注于技术进步,以提升其市场地位。

领先的企业正在大力投资研发,以提高其工具的性能并延长其使用寿命。他们也积极探索永续製造技术,以满足环境法规和消费者对更环保产品的需求。此外,他们还利用策略伙伴关係、併购来扩大产品供应并强化供应链。企业也正在整合智慧感测器和物联网设备等数位工具,以提高製造的精度和营运效率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按工具类型

- 监管格局

- 标准和合规性要求

- 区域监理框架

- 认证标准

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- MEA

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依工具类型,2021-2034

- 主要趋势

- 可转位

- 实心圆形

第六章:市场估计与预测:依工艺,2021-2034

- 主要趋势

- 铣削

- 钻孔

- 无聊的

- 转弯

- 研磨

- 其他的

第七章:市场估计与预测:依材料类型,2021-2034

- 主要趋势

- 硬质合金

- 高速钢(HSS)

- 陶瓷

- 立方氮化硼(CBN)

- 聚晶钻石(PCD)

- 特殊材料

- 不銹钢

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 汽车

- 航太与国防

- 建造

- 电子产品

- 发电

- 石油和天然气

- 木工

- 模具製造

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直接的

- 间接

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 马来西亚

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Ceratizit SA

- Cougar Cutting Tools

- Emuge Corporation

- Greenleaf Corporation

- Ingersoll Cutting Tools

- Iscar Ltd.

- Kennametal Inc.

- Mapal Inc.

- Mitsubishi Materials Corporation

- Mohawk Special Cutting Tools

- OSG Corporation

- Sandvik Coromant

- Seco Tools AB

- Tungaloy Corporation

- Walter Technologies

The Global Cutting Tools Market was valued at USD 9.1 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 16.4 billion by 2034. This market is experiencing significant growth, driven largely by advancements in manufacturing methods. With the rise of automation and Industry 4.0 practices, there is an increasing demand for precision tools that can produce defect-free parts. Industries like automotive, aerospace, and electronics particularly benefit from such accuracy.

Additionally, the shift toward using lighter and stronger materials, including composites and high strength alloys, necessitates more advanced cutting tools that can handle these tough materials. Another key driver is the ongoing infrastructure boom, especially in rapidly developing economies, which raises the need for tools suitable for large machines and site equipment. Along with this, the focus on optimizing raw material use and minimizing waste continues to push manufacturers toward more durable, cost-effective cutting tools.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.1 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 6.1% |

Furthermore, the drive for greener production methods is accelerating within the cutting tools industry, as companies increasingly prioritize sustainability alongside performance. Manufacturers are adopting eco-friendly practices at every stage, from sourcing raw materials to improving energy efficiency during the manufacturing process. Advances in cutting tool coatings and materials are enabling longer tool lifespans and reduced waste, while also enhancing cutting efficiency. Additionally, there is a growing emphasis on recycling and reusing cutting tools, reducing the overall environmental footprint. Many companies are also focusing on reducing hazardous emissions and minimizing the use of harmful chemicals during the production process.

In 2024, the indexable tools segment generated USD 5.6 billion. This segment is growing in popularity due to its cost-effectiveness and versatility. Indexable tools allow users to replace worn-out inserts instead of discarding the entire tool, which helps lower operational costs, making them highly attractive in precision-driven industries like automotive and aerospace. These tools also support high-speed machining, enhancing efficiency and durability, which are crucial for manufacturers. The shift toward sustainability further adds to their appeal, as using replaceable inserts generates less scrap metal and reduces waste, aligning with the growing demand for greener manufacturing processes.

The milling tools segment accounted for a 33.1% share in 2024. The rapid expansion of this segment can be attributed to the wide range of tasks milling tools are capable of handling in multiple industries. These tools are essential for producing complex profiles with high precision, and they are commonly used in automotive, aerospace, and electronics. As product designs demand lighter yet more durable parts, milling tools are gaining popularity due to their ability to cut through advanced materials. Innovations, such as multi-purpose designs and improved coatings, have also contributed to the segment's growth by extending tool life and reducing operational costs.

United States Cutting Tools Market was valued at USD 2.6 billion in 2024, leading the global market. The U.S. manufacturing sector, which spans a wide range of industries, is a key factor driving this dominance. The automotive and aerospace sectors fuel the demand for highly accurate tools that meet stringent quality standards. Additionally, the integration of robotics, sensors, and cloud analytics in manufacturing further boosts market growth by enhancing operational efficiency.

Key companies in the Cutting Tools Industry include Ceratizit S.A., Cougar Cutting Tools, Emuge Corporation, Greenleaf Corporation, Ingersoll Cutting Tools, Iscar Ltd., Kennametal Inc., Mapal Inc., Mitsubishi Materials Corporation, Mohawk Special Cutting Tools, OSG Corporation, Sandvik Coromant, Seco Tools AB, Tungaloy Corporation, and Walter Technologies. In response to the increasing demand for cutting-edge products, companies in the cutting tools market are focusing on technological advancements to enhance their market position.

Leading players are investing heavily in research and development to improve the performance of their tools and increase their lifespan. They are also actively exploring sustainable manufacturing techniques to meet environmental regulations and consumer demands for greener products. Additionally, strategic partnerships, mergers, and acquisitions are being utilized to expand product offerings and strengthen supply chains. Companies are also incorporating digital tools, such as smart sensors and IoT-enabled devices, to enhance precision and operational efficiency in manufacturing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Tool type

- 2.2.3 Process

- 2.2.4 Material Type

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By tool type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Tool Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Indexable

- 5.3 Solid Round

Chapter 6 Market Estimates & Forecast, By Process, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Milling

- 6.3 Drilling

- 6.4 Boring

- 6.5 Turning

- 6.6 Grinding

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Cemented Carbide

- 7.3 High-Speed Steel (HSS)

- 7.4 Ceramics

- 7.5 Cubic Boron Nitride (CBN)

- 7.6 Polycrystalline Diamond (PCD)

- 7.7 Exotic Materials

- 7.8 Stainless Steel

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace & Defense

- 8.4 Construction

- 8.5 Electronics

- 8.6 Power Generation

- 8.7 Oil & Gas

- 8.8 Woodworking

- 8.9 Die and Mold Manufacturing

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Ceratizit S.A.

- 11.2 Cougar Cutting Tools

- 11.3 Emuge Corporation

- 11.4 Greenleaf Corporation

- 11.5 Ingersoll Cutting Tools

- 11.6 Iscar Ltd.

- 11.7 Kennametal Inc.

- 11.8 Mapal Inc.

- 11.9 Mitsubishi Materials Corporation

- 11.10 Mohawk Special Cutting Tools

- 11.11 OSG Corporation

- 11.12 Sandvik Coromant

- 11.13 Seco Tools AB

- 11.14 Tungaloy Corporation

- 11.15 Walter Technologies