|

市场调查报告书

商品编码

1773442

糖尿病足溃疡治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Diabetic Foot Ulcer Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

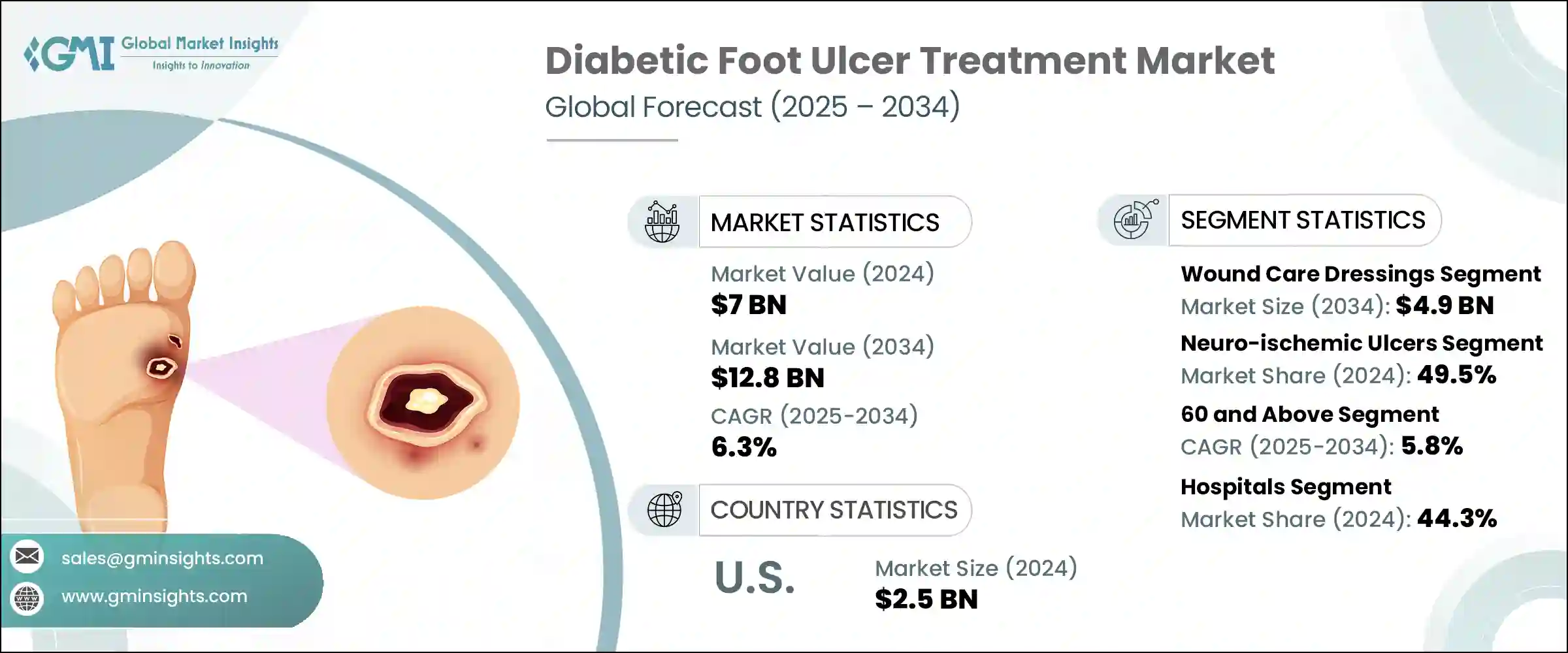

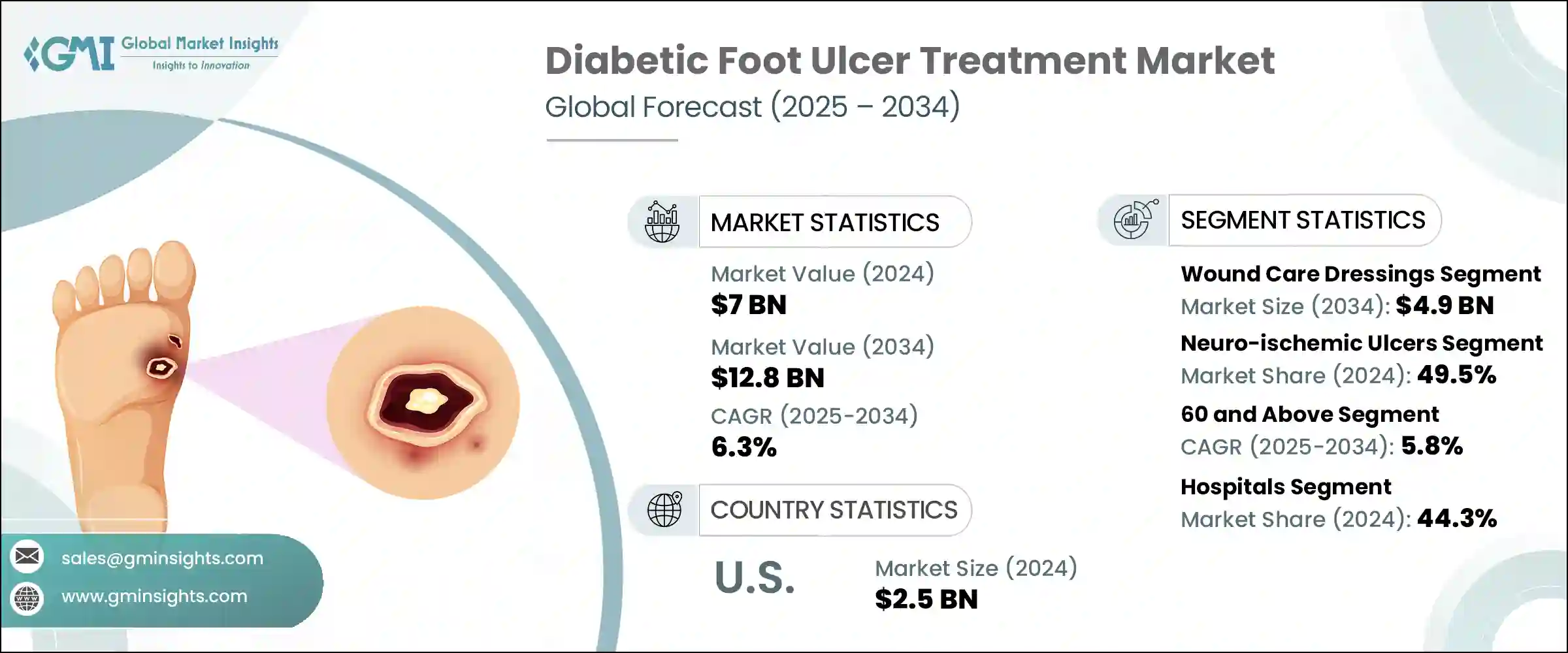

2024年,全球糖尿病足溃疡治疗市场规模达70亿美元,预计2034年将以6.3%的复合年增长率成长至128亿美元。慢性伤口病例增加、全球人口老化以及医疗支出不断增长等因素共同推动了这一增长。先进伤口护理领域的创新,包括工程皮肤替代品、再生组织产品和先进的伤口治疗设备,正在显着改善治疗效果并缩短癒合时间。针对糖尿病相关肢体缺失的政府支持和报销计划正在推动先进护理的普及。此外,患者对早期诊断的认识不断提高,尤其是在低收入地区,也正在推动治疗需求的成长。预计这些动态将在未来几年有力地支持全球糖尿病足溃疡干预措施的成长。

糖尿病足溃疡治疗着重于临床管理因糖尿病併发症(包括神经损伤、血液循环减慢和长期受压)而在足部形成的开放性伤口或溃疡。治疗方法包括医用级抗生素、伤口清洁程序(例如清创术)、生物製剂疗法以及更新的先进癒合技术。其核心目标是促进伤口闭合,避免感染或截肢等严重併发症,并改善整体復原效果。生物工程移植、压力治疗系统以及水凝胶和抗菌剂等智慧敷料等疗法的快速发展,有助于提高此类复杂伤口治疗的成功率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 70亿美元 |

| 预测值 | 128亿美元 |

| 复合年增长率 | 6.3% |

糖尿病足溃疡治疗市场中的伤口照护敷料细分市场在2024年创收27亿美元,预计2034年将达到49亿美元,复合年增长率为6.1%。此细分市场涵盖多种敷料类型,例如泡棉、水胶体、藻酸盐、水凝胶和抗菌溶液。随着消费者和临床医生对专用敷料益处的认识不断提高,其使用率也随之提高。此外,产品审批数量的增加以及智慧伤口护理材料领域强大的研发支持创新——旨在创造最佳癒合环境并预防感染——也推动了其在市场上的主导地位不断增强。

神经缺血性溃疡领域在2024年占了49.5%的最高份额。这种溃疡常见于同时患有神经损伤和血液循环不良的糖尿病患者。由于这类溃疡的复杂性,它们很容易出现癒合延迟和併发症,需要更个人化和积极的干预措施。随着糖尿病在全球范围内日益流行,越来越多的患者面临神经缺血的风险,这增强了对有效、有针对性的治疗的需求,并确保了该领域在市场上的稳固地位。

北美糖尿病足溃疡治疗市场规模预计在2024年达到28亿美元,到2034年预计将达52亿美元,复合年增长率为6.5%。该地区糖尿病发病率高、医疗保健体係成熟,以及包括Organogenic、Smith & Nephew和3M Healthcare在内的多家关键企业的存在,共同支撑了其在该地区的领先地位。此外,广泛的保险覆盖、稳定的临床试验资金以及完善的医疗服务网络,也使该治疗方案在医院和门诊的广泛应用保持着强劲的势头。

全球糖尿病足溃疡治疗市场中的知名公司包括康乐保 (Coloplast)、康德乐 (Cardinal Health)、LifeNet Health、康维泰 (Convatec)、Organogenic、辉瑞 (Pfizer)、StimLabs、捷迈邦美 (Zimmer Biomet)、强生爱乐康 (Ethicon) 医疗部门、百特 (3000) 医疗部门健康 (M. Nephew)、贝朗 (B. Braun)、Medline、MIMEDX、BioTissue、Molnlycke Health Care、Integra LifeSciences、AHA Hyperbarics 和 Ipca Laboratories。为了扩大市场份额,糖尿病足溃疡治疗领域的公司正在采用多种重点策略。许多公司正在将资金投入研发,以开发下一代伤口癒合产品,包括生物製剂和再生疗法。与专科诊所和医院的策略性合併与合作扩大了产品的覆盖范围并提高了临床医生的熟悉度。企业也在加大力度,以在多个地区更快获得监管部门的批准。此外,企业正在加强宣传力度,尤其是在渗透率较低的市场,同时扩大生产能力以满足日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 糖尿病盛行率上升

- 伤口护理技术日益进步

- 扩大政府和非政府组织的预防措施

- 老年人口不断增加

- 产业陷阱与挑战

- 治疗费用高

- 市场机会

- 扩大居家伤口管理

- 不断成长的合作伙伴关係、研发

- 成长动力

- 成长潜力分析

- 技术格局

- 糖尿病流行病学

- 按药物进行管道分析

- 监管格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係和合作

- 扩张计划

第五章:市场估计与预测:依治疗类型,2021 年至 2034 年

- 主要趋势

- 伤口护理敷料

- 海藻酸盐敷料

- 泡棉敷料

- 水胶体敷料

- 水凝胶敷料

- 薄膜敷料

- 抗菌敷料

- 其他伤口护理敷料

- 生物製剂

- 皮肤替代品

- 生长因子

- 组织工程产品

- 血小板衍生疗法

- 伤口治疗设备

- 负压伤口治疗

- 高压氧治疗

- 压力释放装置

- 其他伤口治疗设备

- 抗生素药物

- 其他治疗类型

第六章:市场估计与预测:按溃疡类型,2021 年至 2034 年

- 主要趋势

- 神经性溃疡

- 缺血性溃疡

- 神经缺血性溃疡

第七章:市场估计与预测:依年龄组,2021 年至 2034 年

- 主要趋势

- 18 - 39

- 40 - 59

- 60岁以上

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心(ASC)

- 长期照护机构

- 专科诊所

- 其他最终用途

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- 3M Healthcare

- AHA Hyperbarics

- B. Braun

- Baxter

- BioTissue

- Cardinal Health

- Coloplast

- Convatec

- Ethicon (Johnson and Johnson)

- Integra LifeSciences

- Ipca Laboratories

- LifeNet Health

- Medline

- MIMEDX

- Molnlycke Health Care

- Organogenesis

- Pfizer

- Smith & Nephew

- StimLabs

- Zimmer Biomet

The Global Diabetic Foot Ulcer Treatment Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 12.8 billion by 2034. This growth is being fueled by a combination of rising chronic wound cases, an aging global population, and increasing healthcare expenditure. Innovations in advanced wound care, including engineered skin substitutes, regenerative tissue products, and state-of-the-art wound therapy devices, are drastically improving treatment outcomes and shortening healing times. Government support and reimbursement schemes targeting diabetes-related limb loss are pushing the adoption of advanced care. Furthermore, expanding patient awareness around early diagnosis, particularly in lower-income regions, is propelling demand for treatment. These dynamics are expected to strongly support the global rise in diabetic foot ulcer interventions in the years ahead.

Diabetic foot ulcer treatment focuses on clinically managing open wounds or sores that form on the feet due to complications of diabetes, including nerve damage, reduced circulation, and prolonged pressure. Treatment methods include medical-grade antibiotics, wound-cleaning procedures like debridement, biologic-based therapies, and newer advanced healing technologies. The core objective is to promote wound closure, avoid serious complications such as infections or amputations, and improve overall recovery outcomes. Rapid progress in therapies such as bioengineered grafts, pressure therapy systems, and intelligent dressings like hydrogels and antimicrobials has helped elevate success rates in managing these complex wounds.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $12.8 Billion |

| CAGR | 6.3% |

The wound care dressings segment in the diabetic foot ulcer treatment market generated USD 2.7 billion in 2024 and is projected to reach USD 4.9 billion by 2034, growing at a CAGR of 6.1%. This segment includes several dressing types, such as foam, hydrocolloids, alginates, hydrogels, and antimicrobial-based solutions. Rising consumer and clinical awareness of the benefits of specialized dressing materials has increased their utilization. Additionally, an uptick in product approvals and strong research-backed innovation in smart wound care materials-designed to create optimal healing environments while preventing infections-has contributed to their growing dominance in the market.

The neuro-ischemic ulcer segment captured the highest share of 49.5% in 2024. This ulcer type is frequently seen in patients with diabetes who suffer from combined nerve damage and poor blood circulation. Due to the complex nature of these ulcers, they are highly prone to delayed healing and complications, requiring more personalized and aggressive interventions. As diabetes becomes more prevalent globally, more patients are at risk of neuro-ischemia, reinforcing the demand for effective, targeted treatments and securing this segment's strong foothold in the market.

North America Diabetic Foot Ulcer Treatment Market with USD 2.8 billion in 2024 and is forecasted to reach USD 5.2 billion by 2034, growing at a CAGR of 6.5%. This regional leadership is supported by the region's high incidence of diabetes, a mature healthcare system, and the presence of several key players including Organogenesis, Smith & Nephew, and 3M Healthcare. Additionally, extensive insurance coverage, steady clinical trial funding, and a well-established provider network are sustaining strong treatment adoption across hospital and outpatient settings.

Notable companies operating within the Global Diabetic Foot Ulcer Treatment Market include Coloplast, Cardinal Health, LifeNet Health, Convatec, Organogenesis, Pfizer, StimLabs, Zimmer Biomet, Johnson & Johnson's Ethicon division, Baxter, 3M Healthcare, Smith & Nephew, B. Braun, Medline, MIMEDX, BioTissue, Molnlycke Health Care, Integra LifeSciences, AHA Hyperbarics, and Ipca Laboratories. To expand their market presence, companies in the diabetic foot ulcer treatment segment are employing several focused strategies. Many are channeling investments into R&D to develop next-generation wound healing products, including biologics and regenerative therapies. Strategic mergers and collaborations with specialty clinics and hospitals have enhanced product reach and clinician familiarity. Businesses are also increasing efforts to secure faster regulatory approvals across multiple regions. Moreover, firms are amplifying awareness campaigns, particularly in underpenetrated markets, while expanding manufacturing capabilities to meet growing demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Ulcer type

- 2.2.4 Age group

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of diabetes

- 3.2.1.2 Growing advancement in wound care technologies

- 3.2.1.3 Expanding government and NGO initiatives towards preventive measures

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding homecare-based wound management

- 3.2.3.2 Growing partnerships, research and development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Diabetes epidemology

- 3.6 Pipeline analysis by medications

- 3.7 Regulatory landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wound care dressings

- 5.2.1 Alginate dressing

- 5.2.2 Foam dressings

- 5.2.3 Hydrocolloid dressings

- 5.2.4 Hydrogel dressings

- 5.2.5 Film dressings

- 5.2.6 Antimicrobial dressings

- 5.2.7 Other wound care dressings

- 5.3 Biologics

- 5.3.1 Skin substitutes

- 5.3.2 Growth factor

- 5.3.3 Tissue engineered products

- 5.3.4 Platelet-derived therapies

- 5.4 Wound therapy devices

- 5.4.1 Negative pressure wound therapy

- 5.4.2 Hyperbaric oxygen therapy

- 5.4.3 Pressure relief devices

- 5.4.4 Other wound therapy devices

- 5.5 Antibiotic medications

- 5.6 Other treatment types

Chapter 6 Market Estimates and Forecast, By Ulcer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Neuropathic ulcers

- 6.3 Ischemic ulcers

- 6.4 Neuro-ischemic ulcers

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 18 - 39

- 7.3 40 - 59

- 7.4 60 and above

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers (ASCs)

- 8.4 Long-term care facilities

- 8.5 Specialty clinics

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M Healthcare

- 10.2 AHA Hyperbarics

- 10.3 B. Braun

- 10.4 Baxter

- 10.5 BioTissue

- 10.6 Cardinal Health

- 10.7 Coloplast

- 10.8 Convatec

- 10.9 Ethicon (Johnson and Johnson)

- 10.10 Integra LifeSciences

- 10.11 Ipca Laboratories

- 10.12 LifeNet Health

- 10.13 Medline

- 10.14 MIMEDX

- 10.15 Molnlycke Health Care

- 10.16 Organogenesis

- 10.17 Pfizer

- 10.18 Smith & Nephew

- 10.19 StimLabs

- 10.20 Zimmer Biomet