|

市场调查报告书

商品编码

1773446

纤维金属层压板市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fiber-Metal Laminates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

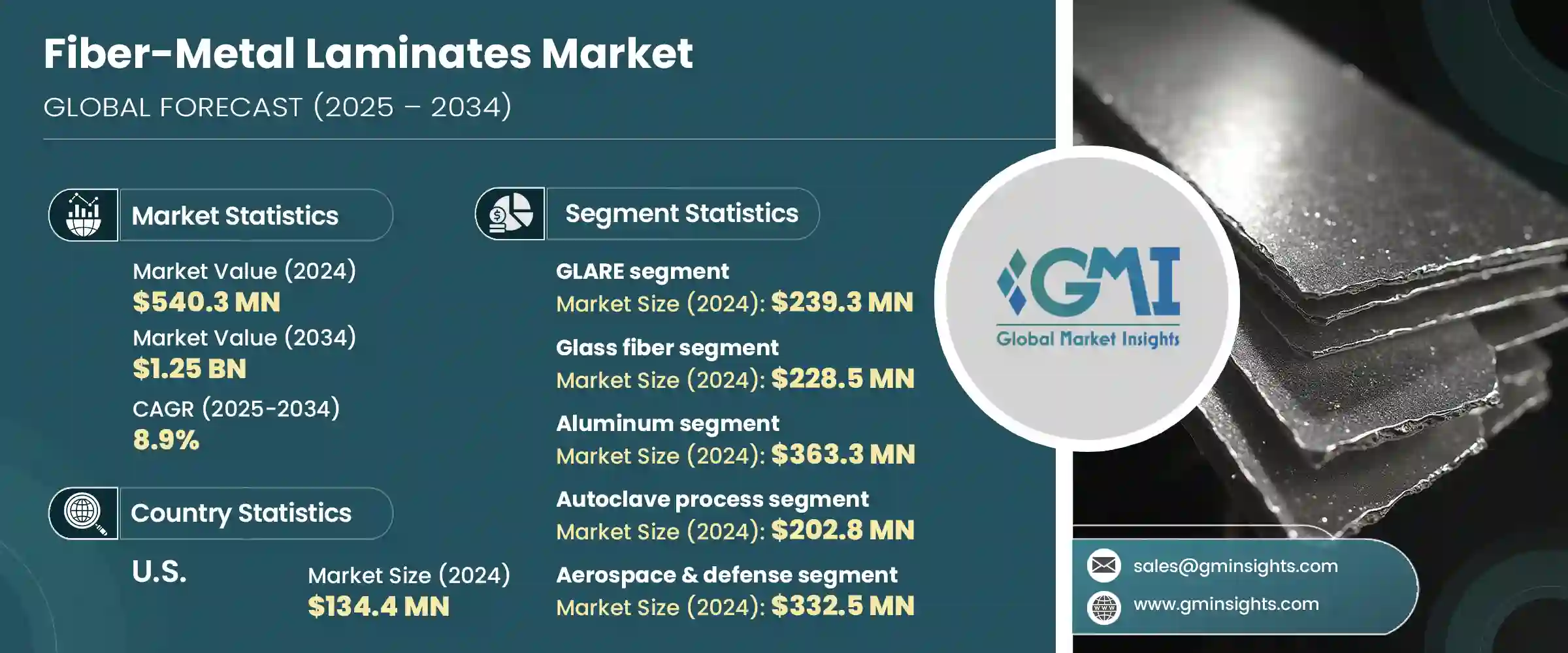

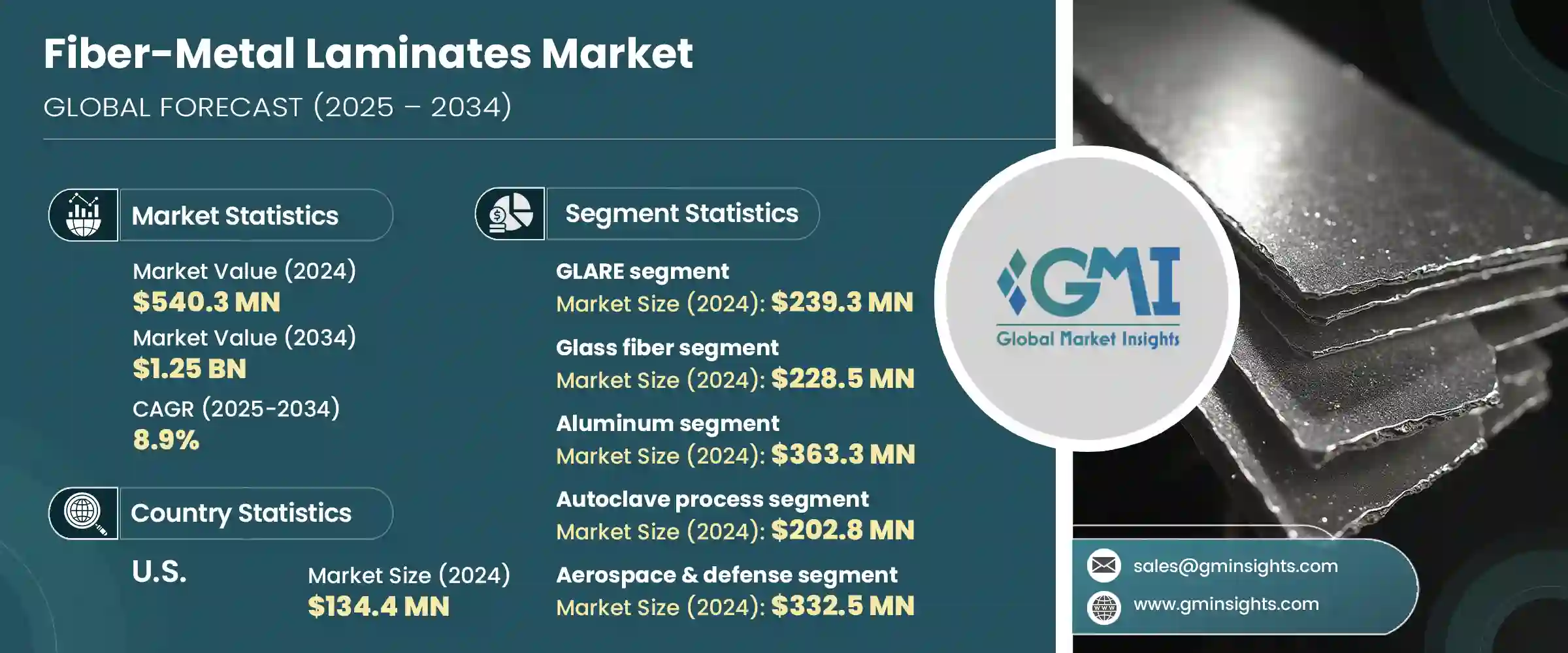

2024 年全球纤维金属层压板市场价值为 5.403 亿美元,预计到 2034 年将以 8.9% 的复合年增长率增长至 12.5 亿美元。对轻质材料的需求不断增长,尤其是在航太,是推动该市场扩张的关键因素。製造商越来越多地转向 FML 来减轻飞机重量、提高燃油效率和增加有效载荷。由于出色的抗疲劳性和极低的维护要求,它们在机身面板、机翼和其他高应力部件等飞机结构中的整合度持续上升。与传统金属不同,FML 具有更好的耐用性和抗疲劳性,从而减少维修并延长使用寿命。随着全球永续发展努力的加强以及更严格的环境法规,节油材料的作用变得更加重要,进一步推动了主要产业对纤维金属层压板的采用。

製造技术的最新进展显着提高了FML生产的精度和可扩展性。高压灭菌、真空袋成型和数位化模具的创新如今能够在保证品质的同时实现大规模生产。随着这些製程的发展,FML的应用范围正在扩展至汽车、船舶和风能领域。这种转变得益于日益增长的混合材料整合趋势,即将复合材料和金属结合在一起,以满足严格的重量、强度和适应性标准。这种混合材料整合正将FML推向聚光灯下,成为各行各业结构设计的首选材料,尤其是在移动出行和基础设施领域,性能重量比是首要考虑因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 5.403亿美元 |

| 预测值 | 12.5亿美元 |

| 复合年增长率 | 8.9% |

GLARE 部门在 2024 年创造了 2.393 亿美元的收入,预计 2025 年至 2034 年的复合年增长率将达到 8.3%。这种由玻璃纤维和铝製成的纤维金属层压板因其耐疲劳、耐腐蚀以及低重量的特点,广泛应用于航太。其在国防和商用航空领域的可靠性持续支撑着市场需求。除 GLARE 外,ARALL 和 CARALL 等其他变体也越来越受到需要更高抗衝击性和刚度的应用的青睐。这些替代方案有助于提供更广泛的工程解决方案,尤其是在必须兼顾减重和结构完整性的领域。

2024年,玻璃纤维基层压板市场规模达2.285亿美元,预计预测期内复合年增长率为8.3%。玻璃纤维凭藉其成本效益、强度和耐腐蚀性,仍是该市场的基石材料。汽车和航太等行业青睐玻璃纤维层压板,因为它们性能均衡且价格实惠。大型企业维护的成熟可靠的供应链有助于确保原材料的持续供应,从而支持该领域的成长和稳定。

美国纤维金属层压板市场在2024年创收1.344亿美元,预计到2034年将以8.6%的复合年增长率成长。国防和航太工业的快速发展是该地区成长的主要驱动力。凭藉包括领先飞机製造商在内的生态系统以及政府在国防和研发方面的强劲投入,美国在纤维金属层压板(FML)的创新和部署方面始终处于领先地位。此外,随着轻量化成为主要设计目标,对电动车生产的日益关注和製造流程的不断改进,FML正在创造新的需求流。

全球纤维金属层压板行业的一些知名企业包括空中巴士公司、洛克希德·马丁公司、东丽工业公司、波音公司和赫氏公司。这些公司正在积极投资下一代纤维金属层压板解决方案,以在技术含量高、竞争激烈的领域中保持领先地位。在纤维金属层压板领域竞争的公司强调持续创新、策略合作和生产可扩展性,以扩大其全球影响力。主要参与者正在大力投资研发具有增强抗疲劳性、防腐蚀性和改进热性能的纤维金属层压板,以用于新兴应用。许多公司正在与航太和汽车原始设备製造商建立合作伙伴关係,共同设计用于高性能用途的材料。另一种常见方法是将生产流程自动化并整合智慧製造,以缩短週期时间和降低成本。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依类型,2021-2034

- 主要趋势

- GLARE(玻璃层压铝增强环氧树脂)

- 眩光 1

- 眩光2

- 眩光 3

- 眩光 4

- 眩光 5

- 眩光 6

- ARALL(芳纶增强铝板)

- 阿拉尔 1

- 阿拉尔 2

- 阿拉尔 3

- 阿拉尔 4

- CARALL(碳纤维增强铝层压板)

- TICARALL(钛碳增强铝层压板)

- 其他 FML 类型

第六章:市场估计与预测:依纤维类型,2021-2034

- 主要趋势

- 玻璃纤维

- 无碱玻璃

- S-玻璃

- 其他玻璃类型

- 碳纤维

- 高强度碳纤维

- 高模量碳纤维

- 超高模量碳纤维

- 芳纶纤维

- 凯夫拉

- 诺梅克斯

- 其他芳纶类型

- 天然纤维

- 混合纤维

第七章:市场估计与预测:依金属类型,2021-2034

- 主要趋势

- 铝

- 2024铝合金

- 7075铝合金

- 其他铝合金

- 钛

- 钛-6铝-4钒

- 其他钛合金

- 钢

- 不銹钢

- 碳钢

- 镁

- 其他金属

第 8 章:市场估计与预测:按製造工艺,2021-2034 年

- 主要趋势

- 高压釜工艺

- 加压固化

- 真空袋成型

- 纤维缠绕

- 拉挤成型

- 其他製造工艺

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 航太

- 机身

- 翅膀

- 尾翼

- 控制面

- 其他航太应用

- 汽车

- 车身面板

- 结构部件

- 碰撞箱

- 其他汽车应用

- 海洋

- 船体结构

- 甲板结构

- 其他船舶应用

- 风能

- 涡轮叶片

- 机舱部件

- 其他风能应用

- 运动与休閒

- 其他的

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 航太与国防

- 商业航空

- 军事航空

- 空间应用

- 国防应用

- 汽车

- 搭乘用车

- 商用车

- 电动车

- 海洋

- 商用船舶

- 海军舰艇

- 休閒船

- 活力

- 风能

- 其他能源应用

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十二章:公司简介

- Premium AEROTEC GmbH (Airbus Group)

- Fokker Technologies

- Cytec Solvay Group

- Alcoa Corporation

- 3A Composites

- Comtek Advanced Structures Ltd.

- Bombardier Inc.

- Embraer SA

- Boeing Company

- Airbus SE

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Saab AB

- Leonardo SpA

- Mitsubishi Heavy Industries Ltd.

- Kawasaki Heavy Industries Ltd.

- Toray Industries, Inc.

- Hexcel Corporation

- Teijin Limited

- SGL Carbon SE

The Global Fiber-Metal Laminates Market was valued at USD 540.3 million in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 1.25 billion by 2034. The rising need for lightweight materials, especially in aerospace, is a key factor fueling this market's expansion. Manufacturers are increasingly turning to FMLs to cut down aircraft weight, enhance fuel efficiency, and increase payload capacity. Their integration in aircraft structures like fuselage panels, wings, and other high-stress components continues to rise due to exceptional fatigue resistance and minimal maintenance requirements. Unlike conventional metals, FMLs offer improved durability and fatigue tolerance, leading to fewer repairs and longer service life. As global sustainability efforts intensify, along with stricter environmental regulations, the role of fuel-efficient materials becomes even more vital, further boosting the adoption of fiber-metal laminates across major sectors.

Recent advancements in manufacturing technology have significantly improved the precision and scalability of FML production. Innovations in autoclaving, vacuum bagging, and digital tooling now enable large-scale manufacturing while maintaining quality. As these processes evolve, applications for FMLs are expanding into the automotive, marine, and wind energy sectors. This shift is supported by the growing trend of hybrid material integration, where composites and metals are combined to meet stringent weight, strength, and adaptability criteria. Such hybridization is pushing FMLs into the spotlight as a preferred material in structural design across diverse industries, especially in mobility and infrastructure, where the performance-to-weight ratio is a primary consideration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $540.3 million |

| Forecast Value | $1.25 billion |

| CAGR | 8.9% |

The GLARE segment generated USD 239.3 million in 2024 and is expected to grow at a CAGR of 8.3% from 2025 to 2034. This fiber-metal laminate, made using glass fibers and aluminum, is widely used in aerospace due to its resistance to fatigue and corrosion, along with its low overall weight. Its reliability in both defense and commercial aviation continues to sustain demand. Alongside GLARE, other variants like ARALL and CARALL are gaining traction for applications that require higher impact resistance and stiffness. These alternatives contribute to a broader range of engineering solutions, especially where weight reduction and structural integrity must go hand in hand.

The glass fiber-based laminates segment accounted for USD 228.5 million in 2024 and is projected to grow at a CAGR of 8.3% during the forecast period. Glass fiber remains a cornerstone material in this market because of its cost-effectiveness, strength, and corrosion resistance. Industries such as automotive and aerospace prefer glass fiber laminates for their balanced performance and affordability. The established and dependable supply chains maintained by major corporations help ensure consistent access to raw materials, supporting growth and stability within the segment.

United States Fiber-Metal Laminates Market generated USD 134.4 million in 2024 and is anticipated to grow at a CAGR of 8.6% through 2034. The rapid pace of development in the defense and aerospace industries is a major driver for regional growth. With an ecosystem that includes leading aircraft producers and robust government investment in defense and R&D, the U.S. remains at the forefront of FML innovation and deployment. Additionally, increased focus on electric vehicle production and enhancements in manufacturing practices are creating new demand streams for FMLs, particularly as lightweight becomes a primary design objective.

Some of the prominent names competing in the Global Fiber-Metal Laminates Industry include Airbus SE, Lockheed Martin Corporation, Toray Industries, Inc., Boeing Company, and Hexcel Corporation. These companies are actively investing in next-generation FML solutions to stay ahead in a highly technical and competitive field. Companies competing in the fiber-metal laminates space are emphasizing continuous innovation, strategic collaborations, and production scalability to expand their global presence. Key players are investing heavily in R&D to develop FMLs with enhanced fatigue resistance, corrosion protection, and improved thermal properties for emerging applications. Many firms are forming partnerships with aerospace and automotive OEMs to co-engineer materials tailored for high-performance use. Another common approach includes automating production processes and integrating smart manufacturing to reduce cycle time and costs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fiber type

- 2.2.4 Metal type

- 2.2.5 Manufacturing process

- 2.2.6 Application

- 2.2.7 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 GLARE (Glass Laminate Aluminum Reinforced Epoxy)

- 5.2.1 GLARE 1

- 5.2.2 GLARE 2

- 5.2.3 GLARE 3

- 5.2.4 GLARE 4

- 5.2.5 GLARE 5

- 5.2.6 GLARE 6

- 5.3 ARALL (ARAMID REINFORCED ALUMINUM LAMINATE)

- 5.3.1 ARALL 1

- 5.3.2 ARALL 2

- 5.3.3 ARALL 3

- 5.3.4 ARALL 4

- 5.4 CARALL (Carbon Reinforced Aluminum Laminate)

- 5.5 TICARALL (Titanium Carbon Reinforced Aluminum Laminate)

- 5.6 Other FML types

Chapter 6 Market Estimates & Forecast, By Fiber Type, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Glass fiber

- 6.2.1 E-glass

- 6.2.2 S-glass

- 6.2.3 Other glass types

- 6.3 Carbon fiber

- 6.3.1 High strength carbon fiber

- 6.3.2 High modulus carbon fiber

- 6.3.3 Ultra-high modulus carbon fiber

- 6.4 Aramid fiber

- 6.4.1 Kevlar

- 6.4.2 Nomex

- 6.4.3 Other aramid types

- 6.5 Natural fiber

- 6.6 Hybrid fiber

Chapter 7 Market Estimates & Forecast, By Metal Type, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Aluminum

- 7.2.1 2024 aluminum alloy

- 7.2.2 7075 aluminum alloy

- 7.2.3 Other aluminum alloys

- 7.3 Titanium

- 7.3.1 Ti-6Al-4V

- 7.3.2 Other titanium alloys

- 7.4 Steel

- 7.4.1 Stainless steel

- 7.4.2 Carbon steel

- 7.5 Magnesium

- 7.6 Other metals

Chapter 8 Market Estimates & Forecast, By Manufacturing Process, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Autoclave process

- 8.3 Press curing

- 8.4 Vacuum bag molding

- 8.5 Filament winding

- 8.6 Pultrusion

- 8.7 Other manufacturing processes

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Aerospace

- 9.2.1 Fuselage

- 9.2.2 Wings

- 9.2.3 Empennage

- 9.2.4 Control surfaces

- 9.2.5 Other aerospace applications

- 9.3 Automotive

- 9.3.1 Body panels

- 9.3.2 Structural components

- 9.3.3 Crash boxes

- 9.3.4 Other automotive applications

- 9.4 Marine

- 9.4.1 Hull structures

- 9.4.2 Deck structures

- 9.4.3 Other marine applications

- 9.5 Wind energy

- 9.5.1 Turbine blades

- 9.5.2 Nacelle components

- 9.5.3 Other wind energy applications

- 9.6 Sports & recreation

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Aerospace & defense

- 10.2.1 Commercial aviation

- 10.2.2 Military aviation

- 10.2.3 Space applications

- 10.2.4 Defense applications

- 10.3 Automotive

- 10.3.1 Passenger vehicles

- 10.3.2 Commercial vehicles

- 10.3.3 Electric vehicles

- 10.4 Marine

- 10.4.1 Commercial vessels

- 10.4.2 Naval vessels

- 10.4.3 Recreational boats

- 10.5 Energy

- 10.5.1 Wind energy

- 10.5.2 Other energy applications

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Premium AEROTEC GmbH (Airbus Group)

- 12.2 Fokker Technologies

- 12.3 Cytec Solvay Group

- 12.4 Alcoa Corporation

- 12.5 3A Composites

- 12.6 Comtek Advanced Structures Ltd.

- 12.7 Bombardier Inc.

- 12.8 Embraer S.A.

- 12.9 Boeing Company

- 12.10 Airbus SE

- 12.11 Lockheed Martin Corporation

- 12.12 Northrop Grumman Corporation

- 12.13 Saab AB

- 12.14 Leonardo S.p.A.

- 12.15 Mitsubishi Heavy Industries Ltd.

- 12.16 Kawasaki Heavy Industries Ltd.

- 12.17 Toray Industries, Inc.

- 12.18 Hexcel Corporation

- 12.19 Teijin Limited

- 12.20 SGL Carbon SE