|

市场调查报告书

商品编码

1773452

运动感测器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Motion Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

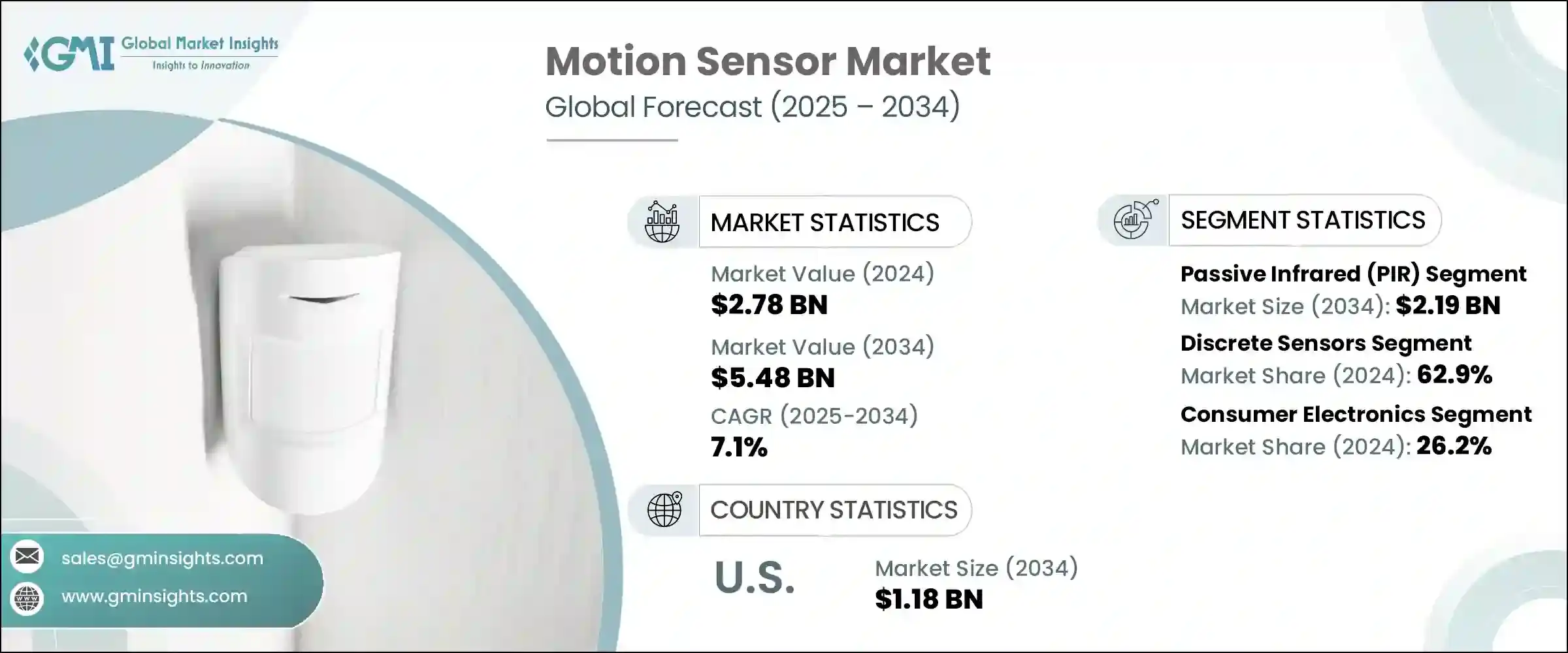

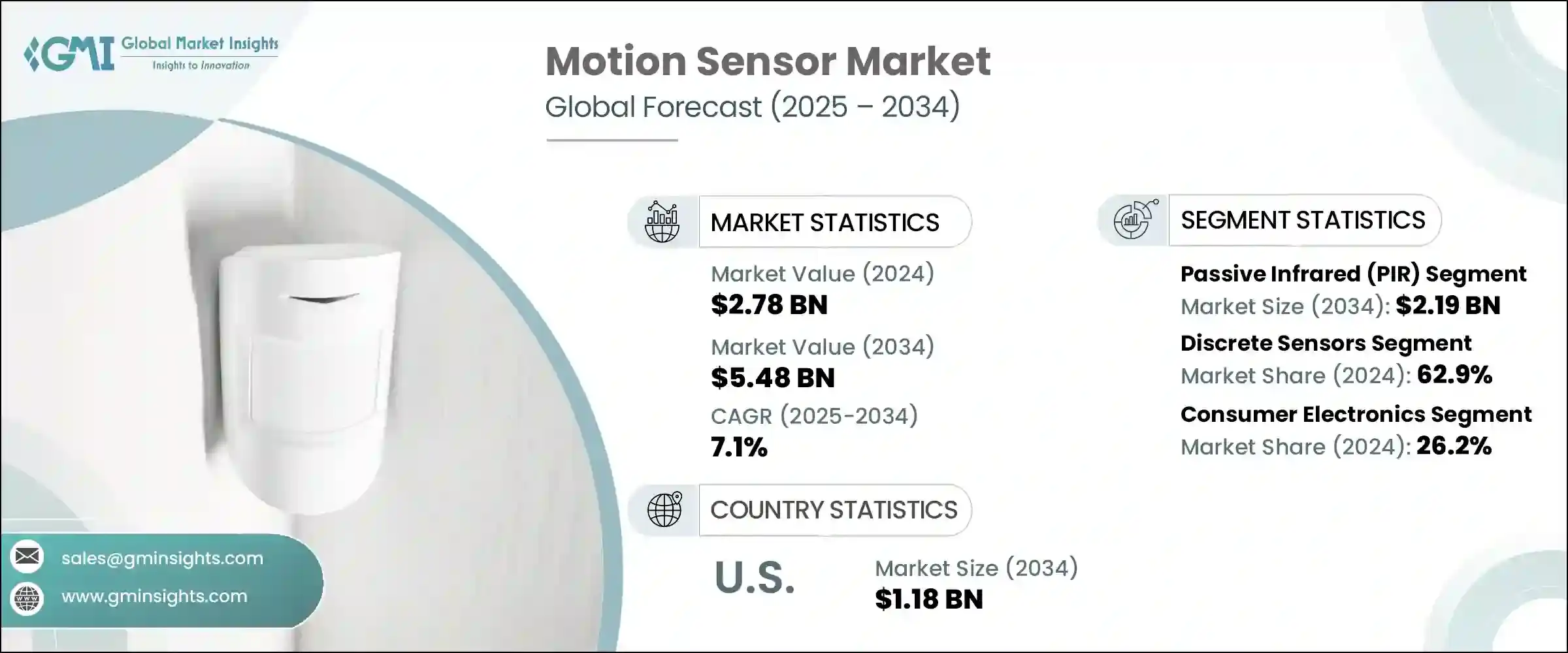

2024年,全球运动感测器市场规模达27.8亿美元,预计到2034年将以7.1%的复合年增长率成长,达到54.8亿美元。智慧电子产品和物联网生活环境的需求日益增长,推动着各行各业的成长。运动感测器如今已成为各行各业创新的核心,尤其是在智慧家庭自动化领域,侦测未经授权的行动或环境风险至关重要。它们的用途远不止照明或警报,它们在建立以安全性、效率和用户响应能力为重点的互联繫统方面发挥着重要作用。随着互联生态系的蓬勃发展,消费者对更智慧、更快速、更安全的科技赋能空间的需求也日益增长。

该市场的一个重要成长动力是现代车辆中运动感测器的日益普及。汽车安全正在经历快速变革,越来越多的汽车配备了旨在预防事故的先进系统。这些安全应用,包括车道导引、碰撞警报和盲点监控,都严重依赖高精度感测器才能有效运作。运动感测单元提供的即时资料使这些智慧车辆系统能够以更高的控制力和精度自主运行,尤其是在半自动驾驶功能不断发展的背景下。此类运动技术与车辆框架的整合反映了自动化和驾驶辅助的更深层趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27.8亿美元 |

| 预测值 | 54.8亿美元 |

| 复合年增长率 | 7.1% |

预计到2034年,微波感测器市场将以8.8%的复合年增长率成长,这得益于其在严苛多变环境中的高效性。这些感测器在能见度低和可穿透物理障碍的情况下也能提供稳定的运动侦测,性能优于传统技术。由于微波运动感测器无论在何种光照或天气条件下都能提供准确可靠的性能,因此在安防、工业和交通基础设施领域正日益普及。其远距离检测能力以及与复杂系统的兼容性使其成为下一代安全应用和智慧感测装置的理想选择。

离散运动感测器市场在2024年占据了62.9%的市场份额,这得益于其在照明、安防和工业控制等日常自动化系统中的广泛应用。其简洁的架构和灵活的设计使其成为成本敏感型专案和旧基础设施改造的理想选择。这些感测器也因其易于维护和与现有硬体平台的交叉相容性而备受青睐。儘管整合系统正在快速发展,但在註重简洁性和成本效益的领域,尤其是在发展中或转型期市场,离散感测器仍将占据主导地位。

预计到2034年,美国运动感测器市场规模将达到11.8亿美元。在美国,人们对家庭自动化、基础设施升级和连网汽车日益增长的兴趣正在推动巨大的需求。运动感测技术不仅应用于消费性电子产品,还应用于可靠性和性能至关重要的关键基础设施网路。随着数位化现代化的加速,这些设备在公用事业、交通系统和智慧能源管理中实现自动化回应方面发挥着至关重要的作用。政府正在努力升级老旧基础设施,这进一步凸显了运动感测器在监控、追踪和保护实体资产方面的重要性。

全球运动感测器市场的领导公司包括德州仪器公司、霍尼韦尔国际公司、博世感测器技术有限公司和意法半导体。为了提升市场地位,运动感测器製造商正在实施各种策略措施。主要参与者正在投资开发微型化、节能型感测器,这些感测器针对穿戴式技术、汽车应用和物联网系统进行了最佳化。加强全球分销网络和进入新兴市场也是利用日益增长的城市化进程的重点。与系统整合商和原始设备製造商 (OEM) 建立策略联盟有助于加速感测器技术在智慧型装置中的应用。此外,各公司正在优先研究混合感测器设计,将微波、红外线和振动等多种检测方法结合到紧凑的多功能单元中。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 智慧消费性电子产品需求不断成长

- 工业应用自动化的成长

- 物联网智慧家庭的扩展

- 汽车安全系统的采用率不断提高

- 穿戴式装置和健身追踪器的普及

- 产业陷阱与挑战

- 先进运动感测器技术成本高昂

- 智慧型应用中的隐私和资料安全问题

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 新兴商业模式

- 合规性要求

- 永续性措施

- 消费者情绪分析

- 专利和智慧财产权分析

- 地缘政治与贸易动态

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 市场集中度分析

- 按地区

- 关键参与者的竞争基准

- 财务绩效比较

- 收入

- 利润率

- 研发

- 产品组合比较

- 产品范围广度

- 科技

- 创新

- 地理分布比较

- 全球足迹分析

- 服务网路覆盖

- 各区域市场渗透率

- 竞争定位矩阵

- 领导者

- 挑战者

- 追踪者

- 利基市场参与者

- 战略展望矩阵

- 财务绩效比较

- 2021-2024 年关键发展

- 併购

- 伙伴关係和合作

- 技术进步

- 扩张和投资策略

- 永续发展倡议

- 数位转型倡议

- 新兴/新创企业竞争对手格局

第五章:市场估计与预测:依技术,2021-2034 年

- 主要趋势

- 被动红外线(PIR)

- 超音波

- 微波

- 基于摄影机

- 振动感测器

- 其他的

第六章:市场估计与预测:按整合度,2021-2034 年

- 主要趋势

- 离散感测器

- 整合感测器

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 消费性电子产品

- 汽车

- 安防与监控

- 智慧家庭和建筑

- 工业的

- 卫生保健

- 零售

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Allegro MicroSystems, Inc.

- Analog Devices, Inc.

- Bosch Sensortec GmbH

- Elmos Semiconductor SE

- Honeywell International Inc.

- InvenSense

- KEMET Corporation

- Littelfuse, Inc.

- NXP Semiconductors

- Panasonic Holdings Corporation

- Schneider Electric

- Siemens AG

- STMicroelectronics

- TE Connectivity

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

The Global Motion Sensor Market was valued at USD 2.78 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 5.48 billion by 2034. Growth across industry is being propelled by increasing demand for smart electronics and IoT-powered living environments. Motion sensors are now central to innovations across a wide spectrum of industries, especially in smart home automation where detecting unauthorized movement or environmental risks is essential. Their use extends far beyond just lighting or alarms-they're instrumental in building interconnected systems that prioritize security, efficiency, and user responsiveness. With connected ecosystems gaining traction, the need for motion-based sensing solutions in homes, offices, and commercial buildings is only expanding, driven by consumers who demand smarter, faster, and safer tech-enabled spaces.

An important growth driver within this market is the increasing deployment of motion sensors in modern vehicles. Automotive safety is undergoing a rapid transformation with more cars incorporating advanced systems designed to prevent accidents. These safety applications, including lane guidance, collision alerts, and blind-spot monitoring, rely heavily on high-precision sensors to operate effectively. Real-time data provided by motion sensing units allows these intelligent vehicle systems to function autonomously with greater control and accuracy, especially as semi-autonomous features continue to evolve. The integration of such motion technology into vehicle frameworks reflects a deeper trend toward automation and driver assistance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.78 Billion |

| Forecast Value | $5.48 billion |

| CAGR | 7.1% |

The microwave sensor segment is expected to grow at a CAGR of 8.8% through 2034, driven by its effectiveness in demanding and variable environments. These sensors outperform conventional technologies by offering stable motion detection in poor visibility conditions and through physical barriers. Because they can deliver accurate and reliable performance regardless of lighting or weather, microwave motion sensors are gaining ground in security, industrial, and transport infrastructure. Their capacity for long-range detection and compatibility with complex systems has made them highly sought-after for next-generation safety applications and intelligent sensing installations.

Discrete motion sensors segment accounted for a 62.9% share in 2024, supported by widespread use in everyday automation systems such as lighting, security, and industrial controls. Their straightforward architecture and flexible design make them ideal for cost-sensitive projects and retrofitting older infrastructure. These sensors are also preferred for their ease of maintenance and cross-compatibility with existing hardware platforms. While integrated systems are advancing rapidly, discrete sensors continue to dominate where simplicity and cost-effectiveness are paramount, especially in developing or transitional markets.

United States Motion Sensor Market is expected to generate USD 1.18 billion by 2034. In the U.S., expanding interest in home automation, infrastructure upgrades, and connected vehicles is driving significant demand. Motion sensing technology is being deployed not just in consumer gadgets, but also across critical infrastructure networks where reliability and performance are essential. As digital modernization accelerates, these devices are proving vital in enabling automated responses across utilities, transportation systems, and smart energy management. Government efforts to upgrade outdated infrastructure further underscore the importance of motion sensors in monitoring, tracking, and securing physical assets.

Leading companies in the Global Motion Sensor Market include Texas Instruments Incorporated, Honeywell International Inc., Bosch Sensortec GmbH, and STMicroelectronics. To enhance their market position, motion sensor manufacturers are implementing a variety of strategic initiatives. Key players are investing in the development of miniaturized, power-efficient sensors optimized for wearable tech, automotive applications, and IoT-enabled systems. Strengthening global distribution networks and entering emerging markets are also high on the agenda to capitalize on growing urbanization. Strategic alliances with system integrators and OEMs help foster faster adoption of sensor technology into smart devices. Additionally, companies are prioritizing research on hybrid sensor designs that combine multiple detection methods-such as microwave, infrared, and vibration-into compact, multifunctional units.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.3 Technology type

- 2.4 Integration level type

- 2.5 End use type

- 2.6 Regional

- 2.7 TAM Analysis, 2025-2034 (USD Billion)

- 2.8 CXO Perspectives: Strategic imperatives

- 2.8.1 Executive decision points

- 2.8.2 Critical Success Factors

- 2.9 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for smart consumer electronics

- 3.2.1.2 Growth in automation across industrial applications

- 3.2.1.3 Expansion of IoT-enabled smart homes

- 3.2.1.4 Increased adoption in automotive safety systems

- 3.2.1.5 Proliferation of wearable devices and fitness trackers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced motion sensor technologies

- 3.2.2.2 Privacy and data security concerns in smart applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Sustainability Measures

- 3.11 Consumer Sentiment Analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Passive infrared (PIR)

- 5.3 Ultrasonic

- 5.4 Microwave

- 5.5 Camera-based

- 5.6 Vibration sensors

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Integration Level, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Discrete sensors

- 6.3 Integrated sensors

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.3 Automotive

- 7.4 Security & surveillance

- 7.5 Smart homes & buildings

- 7.6 Industrial

- 7.7 Healthcare

- 7.8 Retail

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allegro MicroSystems, Inc.

- 9.2 Analog Devices, Inc.

- 9.3 Bosch Sensortec GmbH

- 9.4 Elmos Semiconductor SE

- 9.5 Honeywell International Inc.

- 9.6 InvenSense

- 9.7 KEMET Corporation

- 9.8 Littelfuse, Inc.

- 9.9 NXP Semiconductors

- 9.10 Panasonic Holdings Corporation

- 9.11 Schneider Electric

- 9.12 Siemens AG

- 9.13 STMicroelectronics

- 9.14 TE Connectivity

- 9.15 Texas Instruments Incorporated

- 9.16 Vishay Intertechnology, Inc.