|

市场调查报告书

商品编码

1773453

汽车压电燃油喷射器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Piezoelectric Fuel Injectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

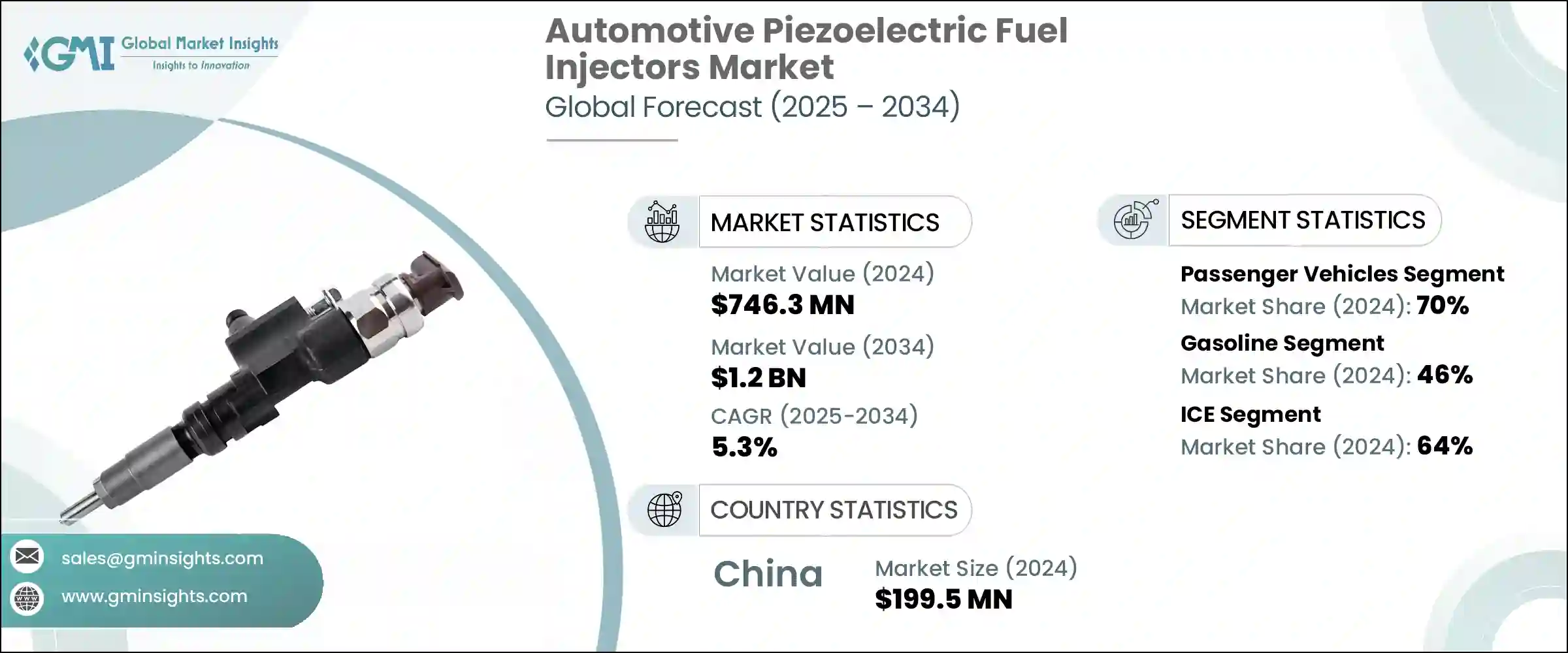

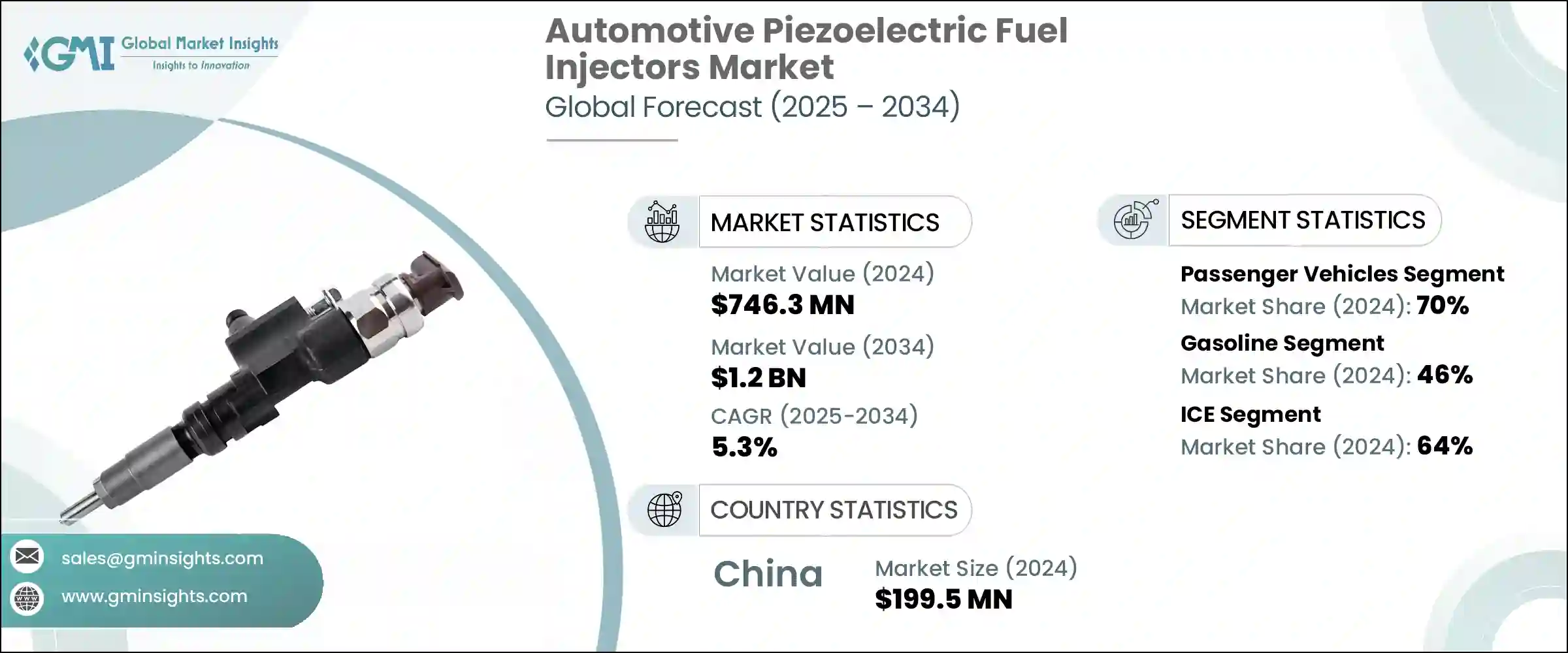

2024年,全球汽车压电燃油喷射器市场规模达7.463亿美元,预计年复合成长率将达5.3%,2034年将达12亿美元。 CRDI和GDI等先进引擎技术的日益普及,以及全球汽车排放法规的日益严格,推动了该市场的成长。这些喷射器能够快速且极为精确地输送燃油,从而显着提高燃烧效率并减少污染物排放。

在环境标准严格的地区,压电式喷油嘴正稳定取代传统的电磁阀喷油嘴。它们与智慧电子控制单元和先进的诊断系统集成,能够即时调节燃油流量,从而优化引擎性能并减少颗粒物排放。向更清洁的出行解决方案的转变也加速了对这些高精度组件的需求,因为它们能够在所有类型车辆平台的内燃机应用中提供更强大的控制力和更高的效率。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.463亿美元 |

| 预测值 | 12亿美元 |

| 复合年增长率 | 5.3% |

压电喷油嘴透过在单一燃烧循环内实现多次超快速燃油喷射,重新定义了引擎管理。这种控制水平有助于工程师以无与伦比的精度微调空燃比,从而提高燃油效率并显着降低排放。随着各国实施欧7、BS-VI Stage II和EPA Tier 3等更严格的排放法规,这些特性变得越来越重要。汽车产业正在快速发展,基于压电的系统能够突破电磁阀喷油嘴的局限性,尤其是在需要更快反应时间和更高喷射射精度的场景中。

2024年,乘用车市场占据主导地位,贡献了70%的市场份额,预计到2034年将以5.5%的复合年增长率成长。这种主导地位源自于全球轿车、轻型卡车和多用途车的高产销量。亚洲、欧洲和北美等地区严格的排放控制措施正推动製造商在这些车型中采用先进的燃油喷射系统。压电式燃油喷射器有助于满足监管门槛,同时提升性能和燃油经济性,满足消费者对动力和环保意识的期望。其在混合动力和插电式混合动力平台上的应用正在不断扩展,在这些平台上,快速的开关循环和启动停止操作需要快速高效响应的喷射器——而压电技术正是能够始终如一地提供这些特性。

汽油车市场占46%的份额,预计2025年至2034年间的复合年增长率为5.7%。随着各大洲的监管机构纷纷限制轻型车辆的排放,汽油引擎因其颗粒物和氮氧化物排放量相对柴油引擎较低而更具吸引力。汽车製造商正倾向于采用配备压电喷油嘴的汽油直喷系统,以满足性能目标和排放基准。汽油引擎因其重量轻、运行更安静、生产成本更低而备受青睐,压电喷油器可帮助这些引擎改善燃烧并提升油门响应,从而巩固其在汽油引擎市场的关键部件地位。

亚太地区汽车压电燃油喷射器市场占67%的市场份额,产值达1.995亿美元。中国庞大的内燃机汽车产量和日益严格的环保法规正在推动高精度喷射技术的广泛应用。中国采用先进的排放标准,进一步加强了对清洁燃烧的重视,从而对压电喷射系统产生了强劲的需求。此外,英飞凌、京瓷、安波福和西门子等一级零件製造商正在加强在该地区的业务力度,与当地企业合作,根据区域市场需求客製化解决方案。这些合作致力于优化商用和乘用车应用的喷射器性能,确保在高压阈值下的耐用性和效率,同时保持具有竞争力的成本。

积极影响全球汽车压电燃油喷射器市场的知名公司包括京瓷、大陆集团、西门子、英飞凌、日立Astemo Indiana、安波福、罗伯特·博世、电装、NGK火星塞公司和村田製作所。这些公司正在不断创新和投资,以跟上行业不断发展的燃油输送要求和排放法规。

汽车压电式燃油喷射器市场的主要製造商正专注于几个战略领域,以建立强大的竞争地位。首先,他们大力投资研发,以改善喷射器的速度、反应精度和燃油雾化效果,以实现更好的排放控制和燃烧效率。其次,他们正在与汽车原始设备製造商合作,开发针对汽油直喷和混合动力系统最佳化的专用喷射器。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- GDI 和 CRDI 引擎的采用率不断上升

- 压电材料的技术进步

- 高檔豪华汽车细分市场的成长

- 更严格的排放法规

- 原始设备製造商及一级供应商增加研发投资

- 产业陷阱与挑战

- 压电喷油嘴成本高

- 改良的电磁喷油嘴的竞争

- 市场机会

- 混合动力系统的采用日益增多

- 商用车柴油引擎优化

- 汽油直喷 (GDI) 引擎的广泛转变

- 数位引擎管理和人工智慧集成

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- SUV

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第六章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 其他的

第七章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第八章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 杂交种

第九章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 直接喷射(DI)

- 共轨直喷(CRDI)

- 汽油直喷(GDI)

- 进气道燃油喷射 (PFI)

第十章:市场估计与预测:依工作压力范围,2021 - 2034 年

- 主要趋势

- 低压(<200 巴)

- 中压(200–1000 bar)

- 高压(>1000 bar)

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- Aptiv

- Continental

- Delphi Technologies

- Denso Corporation

- Edelbrock LLC

- Fuzhou Ruida Machinery

- GB Remanufacturing

- Hitachi Astemo Indiana

- Infineon

- Keihin

- KYOCERA

- Magneti Marelli Parts and Services.

- Mikuni American

- Murata Manufacturing

- Robert Bosch

- Siemens

- Stanadyne

- Valley Fuel Injection & Turbo

- Woodward

- WUZETEM

The Global Automotive Piezoelectric Fuel Injectors Market was valued at USD 746.3 million in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 1.2 billion by 2034. Growth in this market is being fueled by the increasing implementation of advanced engine technologies such as CRDI and GDI, alongside stricter global regulations around vehicle emissions. These injectors allow for rapid and extremely precise fuel delivery, which contributes significantly to enhanced combustion efficiency and reduced pollutants.

Piezoelectric injectors are steadily replacing traditional solenoid types in regions with aggressive environmental standards. Their integration with smart electronic control units and advanced diagnostics enables real-time adjustment of fuel flow, allowing for optimized engine performance and fewer particulate emissions. The shift toward cleaner mobility solutions is also accelerating the need for these high-precision components, as they offer greater control and efficiency in internal combustion applications across all types of vehicle platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $746.3 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 5.3% |

Piezoelectric injectors are redefining engine management by enabling multiple ultra-fast fuel injections within a single combustion cycle. This level of control helps engineers fine-tune the air-fuel mixture with unmatched accuracy, boosting fuel efficiency and significantly lowering emissions. These attributes are becoming increasingly important as countries implement tighter regulations like Euro 7, BS-VI Stage II, and EPA Tier 3. The automotive sector is evolving rapidly, with piezo-based systems positioned to address the limitations of solenoid injectors, especially in scenarios demanding faster response times and higher injection precision.

The passenger vehicles segment led the market in 2024, contributing 70% share, and is projected to grow at a CAGR of 5.5% through 2034. This dominance stems from the high global production and sales volumes of cars, light trucks, and utility vehicles. Stringent emission controls in regions like Asia, Europe, and North America are pushing manufacturers toward incorporating advanced fuel injection systems in these vehicle classes. Piezoelectric fuel injectors help meet regulatory thresholds while improving performance and economy, aligning with consumer expectations for both power and environmental consciousness. Their application is expanding in hybrid and plug-in hybrid platforms, where rapid on-off cycles and start-stop operation demand injectors that respond quickly and efficiently-qualities that piezo technology delivers consistently.

The gasoline vehicle segment held a 46% share, and it is projected to grow at a CAGR of 5.7% between 2025 and 2034. As regulatory bodies across multiple continents move to restrict emissions from light-duty vehicles, gasoline engines are becoming more attractive due to their relatively lower particulate and nitrogen oxide output compared to diesel. Automotive manufacturers are leaning into gasoline direct injection systems, enhanced with piezoelectric injectors, to meet both performance goals and emission benchmarks. With gasoline engines favored for their lighter weight, quieter operation, and lower cost of production, piezo injectors help these engines deliver improved combustion and better throttle response, securing their position as a key component in the gasoline segment.

Asia Pacific Automotive Piezoelectric Fuel Injectors Market held a 67% share, generating USD 199.5 million. The country's massive internal combustion vehicle output and increasingly rigorous environmental mandates are driving the widespread integration of high-precision injection technology. China's adoption of advanced emission standards has intensified the focus on cleaner combustion, creating a strong demand for piezoelectric injector systems. Additionally, Tier-1 component manufacturers such as Infineon, KYOCERA, Aptiv, and Siemens are intensifying their efforts in the region by collaborating with domestic firms to tailor solutions for regional market needs. These partnerships focus on optimizing injector performance for both commercial and passenger applications, ensuring durability and efficiency at elevated pressure thresholds while maintaining competitive costs.

Notable companies actively shaping the Global Automotive Piezoelectric Fuel Injectors Market include KYOCERA, Continental, Siemens, Infineon, Hitachi Astemo Indiana, Aptiv, Robert Bosch, Denso, NGK Spark Plug Co, and Murata Manufacturing. These players are innovating and investing to keep pace with the industry's evolving fuel delivery requirements and emissions legislation.

Major manufacturers in the automotive piezoelectric fuel injectors market are focusing on several strategic areas to build a strong competitive position. First, they are investing heavily in research and development to refine injector speed, response precision, and fuel atomization, enabling better emissions control and combustion efficiency. Second, collaborations with vehicle OEMs are being formed to develop application-specific injectors optimized for gasoline direct injection and hybrid systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Fuel type

- 2.2.4 Sales channel

- 2.2.5 Propulsions

- 2.2.6 Technology

- 2.2.7 Operating pressure range

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of GDI and CRDI engines

- 3.2.1.2 Technological advancements in Piezo materials

- 3.2.1.3 Growth of premium and luxury vehicle segments

- 3.2.1.4 Stricter emission regulations

- 3.2.1.5 Increased R&D investments by OEMs and Tier-1 suppliers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of piezoelectric injectors

- 3.2.2.2 Competition from improved solenoid injectors

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of hybrid powertrains

- 3.2.3.2 Diesel engine optimization in commercial vehicles

- 3.2.3.3 The widespread shift to gasoline direct injection (GDI) engines

- 3.2.3.4 Digital engine management and AI integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Mn, units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.1.1 Gasoline

- 6.1.2 Diesel

- 6.1.3 Others

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Hybrid

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Direct injection (DI)

- 9.3 Common rail direct injection (CRDI)

- 9.4 Gasoline direct injection (GDI)

- 9.5 Port fuel injection (PFI)

Chapter 10 Market Estimates & Forecast, By Operating Pressure Range, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Low pressure (<200 bar)

- 10.3 Medium pressure (200–1000 bar)

- 10.4 High pressure (>1000 bar)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Aptiv

- 12.2 Continental

- 12.3 Delphi Technologies

- 12.4 Denso Corporation

- 12.5 Edelbrock LLC

- 12.6 Fuzhou Ruida Machinery

- 12.7 GB Remanufacturing

- 12.8 Hitachi Astemo Indiana

- 12.9 Infineon

- 12.10 Keihin

- 12.11 KYOCERA

- 12.12 Magneti Marelli Parts and Services.

- 12.13 Mikuni American

- 12.14 Murata Manufacturing

- 12.15 Robert Bosch

- 12.16 Siemens

- 12.17 Stanadyne

- 12.18 Valley Fuel Injection & Turbo

- 12.19 Woodward

- 12.20 WUZETEM