|

市场调查报告书

商品编码

1773456

辐照设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Irradiation Apparatus Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

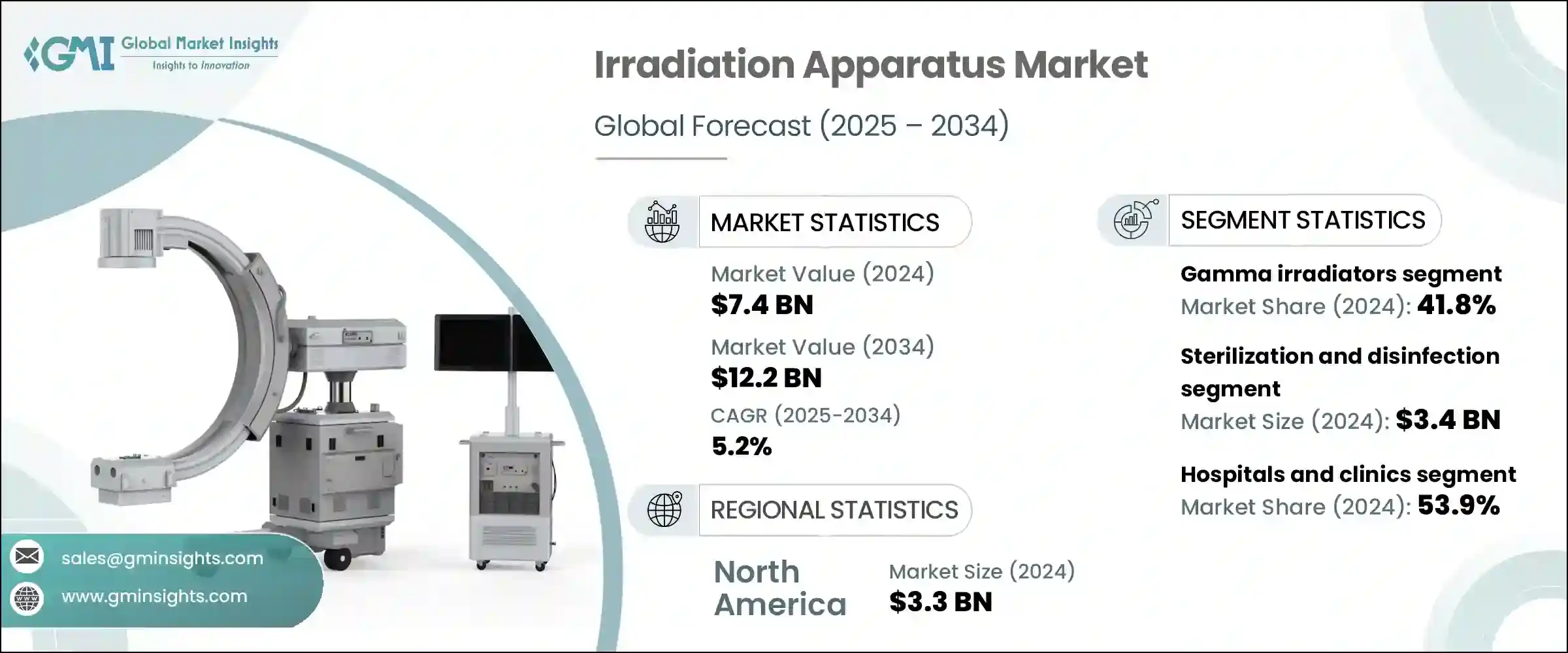

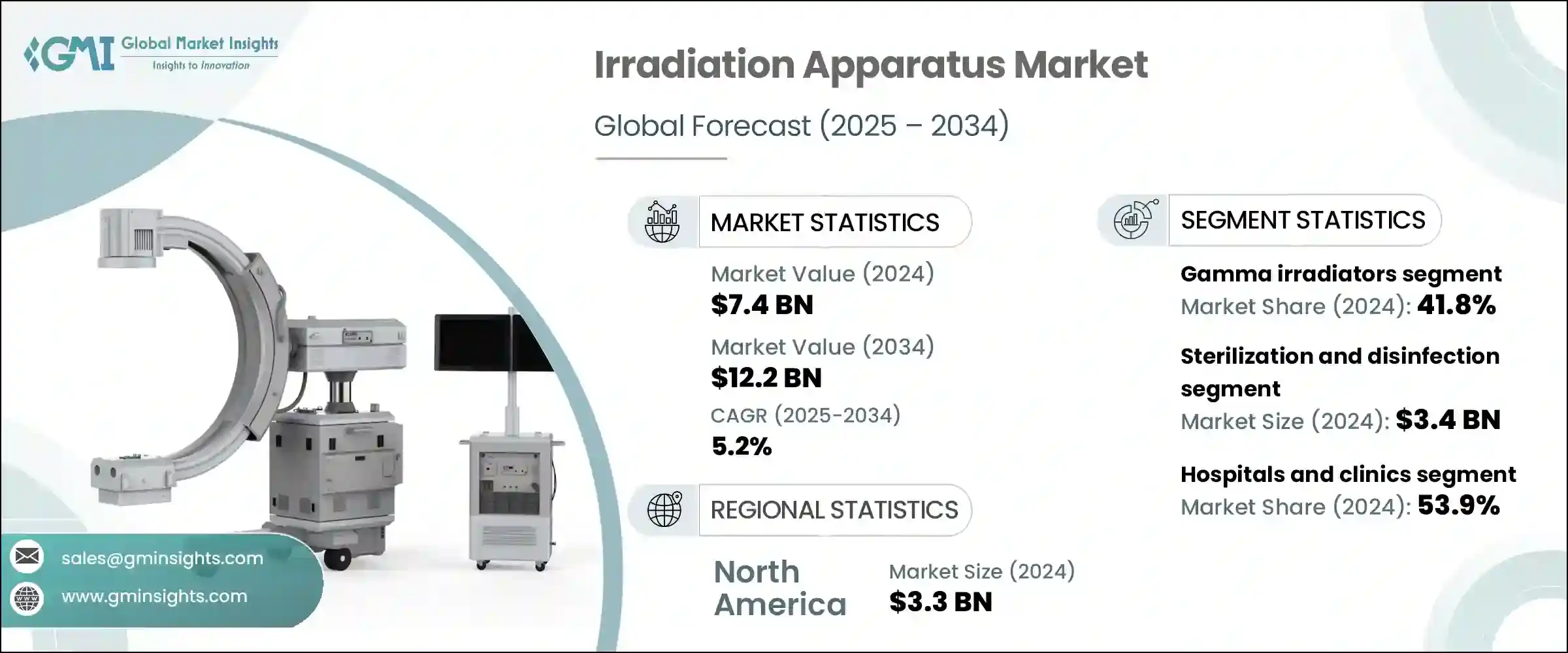

2024年,全球辐照设备市场规模达74亿美元,预计到2034年将以5.2%的复合年增长率成长,达到122亿美元。这一增长主要得益于医疗和工业领域对电离辐射和非电离辐射的日益增长的需求。这些系统主要用于诊断、治疗、灭菌和研究。

放射治疗在癌症治疗中的日益普及是推动市场成长的重要因素,因为精准靶向照射系统能够改善治疗结果和患者体验。对早期发现和即时干预的强烈追求正在推动近距离放射治疗设备和直线加速器等设备的投资不断增加。随着肿瘤诊所和专科医疗中心在全球范围内的扩张,先进照射系统的采用率持续上升,凸显了对高效、便捷的癌症治疗技术的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 74亿美元 |

| 预测值 | 122亿美元 |

| 复合年增长率 | 5.2% |

影像导引放射治疗和人工智慧系统的现代创新正在重塑放射治疗设备的格局。这些平台整合了机器人控制和即时成像技术,能够在保护周围组织的同时,为肿瘤提供精准的剂量。直线加速器和影像导引放射治疗等技术如今正提供更高的精准度和更低的併发症风险,并且正在被医疗机构广泛采用。

更佳的治疗效果、更短的恢復时间和更低的副作用,正激励医院和诊所转型为新一代系统。在新兴地区,公共和私营部门的持续投资正在支持医疗基础设施的升级,从而缩小治疗的可及性差距。随着对基于辐射的治疗和灭菌解决方案的需求不断增长,医疗改革和技术驱动的改进正在推动全球市场的发展。

2024年,伽玛辐照器市场占最大份额,达41.8%。一次性医疗产品消费的不断增长是伽马射线灭菌系统发展的主要驱动力。由于伽马射线能够有效灭菌热敏性和化学易损物品,製造商越来越依赖这种方法来灭菌注射器、导管和手术手套。

使用伽马射线的灭菌过程不会留下有害残留物,在受监管的医疗环境中提供可靠的解决方案。这些系统在处理血液成分以防止输血后不良反应方面也至关重要。随着感染控制和无菌保证日益受到全球监管机构的重视,伽马辐照器将继续成为关键医疗设备和用品製造和加工的首选解决方案。

2024年,医院和诊所市场占据主导地位,份额达53.9%。这些机构是辐照设备的主要用户,广泛用于诊断影像和治疗干预。 X光机、CT系统和透视机等设备在非侵入性评估患者病情方面发挥关键作用。

此外,为了因应医疗相关感染,医院正转向采用基于辐照的灭菌技术对侵入性医疗器材进行灭菌,以确保病患安全并符合卫生法规。与热处理或化学灭菌相比,辐照灭菌为手术器械和其他可重复使用零件的灭菌提供了更快速、更可靠的方法。诊断准确性与感染预防相结合,使得辐照设备在现代医疗机构中不可或缺。

2024年,美国辐照设备市场规模达30亿美元,预计2034年将达49亿美元。慢性疾病(尤其是癌症)的发生率不断上升,推动了美国各地对先进放射治疗解决方案的需求。同时,美国医疗保健产业对门诊手术中心和门诊诊所等分散式治疗场所的重视,也加速了对紧凑高效灭菌系统的需求。

随着这些小型医疗机构寻求高通量且节省空间的解决方案,模组化辐照系统因其速度快、可靠性高且能够保持设备完整性而变得极具吸引力。这种向经济高效且分散式医疗保健模式的转变预计将使辐照技术在城市和农村地区保持强劲成长。

塑造辐照设备市场竞争格局的关键产业参与者包括通用电气医疗集团 (GE HealthCare)、医科达 (Elekta)、西门子医疗集团 (Siemens Healthineers)、迈瑞 (Mindray)、佳能医疗系统 (Canon Medical Systems)、NPB 离子束技术 (NPB Ion Beam Technology)、东大医科医疗系统 (Canon Medical Systems)、NPB 离子束技术 (NPB Ion Beam Technology)、东业软工医疗系统 (Neusoft Medical)、重做家庭工友Heavy Industries)、新华医疗 (Shinva Medical)、荷兰皇家飞利浦 (Koninklijke Philips)、Mevion 医疗系统 (Mevion Medical Systems) 和 Panacea 医疗技术 (Panacea Medical Technologies)。这些公司透过产品创新和策略扩张持续树立产业标竿。

辐照设备领域的领先企业正致力于透过先进的影像引导和人工智慧整合放射系统来扩展产品组合。许多公司正在大力投资研发,以提高治疗准确性、实现工作流程自动化并增强安全性。与癌症治疗中心和医疗机构的合作有助于客製化符合不断变化的临床需求的解决方案。为了满足全球需求,尤其是在医疗资源匮乏的地区,各公司正在开发模组化且经济高效的系统,以降低安装复杂性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 癌症和慢性病发生率上升

- 影像和放射治疗设备的技术进步

- 医疗基础建设投资不断增加

- 提高血液安全意识

- 产业陷阱与挑战

- 资本投资和维护成本高

- 严格的监管审批和合规要求

- 市场机会

- 成像系统中人工智慧和自动化的应用

- 非化学灭菌需求加速成长

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 定价分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利分析

- 波特的分析

- PESTEL分析

- 消费者行为分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 伽玛辐照器

- X射线照射器

- 紫外线 (UV) 和中子辐照器

- 电子束辐照器

- 其他类型

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 诊断影像

- 治疗/放射治疗

- 灭菌消毒

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 研究实验室和研究所

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Accuray

- Canon Medical Systems

- Elekta

- GE HealthCare

- Hitachi

- Koninklijke Philips

- Mevion Medical Systems

- Mindray

- Neusoft Medical Systems

- Panacea Medical Technologies

- Shinva Medical

- Siemens Healthineers

- Sumitomo Heavy Industries

- ViewRay

The Global Irradiation Apparatus Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 12.2 billion by 2034. This growth is driven by the increasing utilization of ionizing and non-ionizing radiation across both medical and industrial applications. These systems are primarily deployed for diagnostics, therapeutic use, sterilization, and research purposes.

The rising adoption of radiotherapy in cancer care is a significant factor propelling the market growth, as precision-targeted irradiation systems improve both outcomes and patient experiences. A strong push toward early detection and immediate intervention is increasing investments in devices such as brachytherapy equipment and linear accelerators. With oncology clinics and specialized medical centers expanding globally, the adoption of advanced irradiation systems continues to rise, underscoring the demand for efficient and accessible cancer treatment technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 5.2% |

Modern innovations in image-guided radiation therapy and AI-enabled systems are reshaping the landscape of irradiation apparatus. Integrated with robotic control and real-time imaging, these platforms provide accurate dose delivery to tumors while safeguarding surrounding tissues. Technologies such as linear accelerators and image-guided radiotherapy are now delivering higher levels of precision and lower complication risks, leading to widespread adoption across healthcare facilities.

Enhanced therapeutic outcomes, reduced recovery times, and minimized side effects are encouraging hospitals and clinics to transition to next-generation systems. In emerging regions, increased investments from both public and private sectors are supporting healthcare infrastructure upgrades, helping close treatment accessibility gaps. As demand grows for radiation-based solutions in both treatment and sterilization, the global market is being fueled by healthcare reforms and technology-driven improvements.

In 2024, the gamma irradiator segment accounted for the largest market share at 41.8%. The growing consumption of disposable medical products has been a major driver for gamma-based sterilization systems. As gamma radiation enables effective sterilization of heat-sensitive and chemically delicate items, manufacturers are increasingly relying on this method for syringes, catheters, and surgical gloves.

Sterilization processes using gamma rays leave no harmful residue, offering a reliable solution in regulated medical environments. These systems are also essential in treating blood components to prevent adverse post-transfusion reactions. With infection control and sterility assurance gaining focus across global regulatory bodies, gamma irradiators continue to be a preferred solution in the manufacture and processing of critical healthcare equipment and supplies.

The hospitals and clinics segment led the market in 2024 with a share of 53.9%. These facilities are primary users of irradiation apparatus, utilizing them extensively for diagnostic imaging and therapeutic interventions. Equipment like X-ray units, CT systems, and fluoroscopy machines play a pivotal role in evaluating patient conditions non-invasively.

Moreover, to combat healthcare-associated infections, hospitals are turning to irradiation-based sterilization for invasive medical tools, ensuring both patient safety and compliance with hygiene regulations. Compared to heat or chemical alternatives, irradiation offers a faster and more dependable method for sterilizing surgical instruments and other reusable components. The combination of diagnostic accuracy and infection prevention is making irradiation apparatus indispensable across modern healthcare facilities.

U.S. Irradiation Apparatus Market was valued at USD 3 billion in 2024 and is estimated to reach USD 4.9 billion by 2034. A growing prevalence of chronic illnesses-particularly cancer-is pushing demand for advanced radiation therapy solutions across the country. In tandem, the U.S. healthcare industry's emphasis on decentralized treatment settings like ambulatory surgical centers and outpatient clinics is accelerating the need for compact, efficient sterilization systems.

As these smaller facilities look for high-throughput and space-saving solutions, modular irradiation systems have become highly attractive due to their speed, reliability, and ability to preserve equipment integrity. This shift toward cost-effective and distributed healthcare models is expected to sustain robust growth for irradiation technologies across both urban and rural settings.

Key industry participants shaping the competitive landscape of the Irradiation Apparatus Market include GE HealthCare, Elekta, Siemens Healthineers, Mindray, Canon Medical Systems, NPB Ion Beam Technology, Neusoft Medical Systems, Accuray, ViewRay, Hitachi, Sumitomo Heavy Industries, Shinva Medical, Koninklijke Philips, Mevion Medical Systems, and Panacea Medical Technologies. These companies continue to set benchmarks through product innovation and strategic expansion.

Leading players in the irradiation apparatus space are focusing on product portfolio expansion through advanced imaging-guided and AI-integrated radiation systems. Many companies are heavily investing in R&D to boost treatment accuracy, automate workflows, and enhance safety. Collaborations with cancer treatment centers and healthcare institutions are helping tailor solutions that match evolving clinical needs. To address global demand, especially in underserved regions, firms are developing modular and cost-effective systems that reduce installation complexity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cancer and chronic diseases

- 3.2.1.2 Technological advancements in imaging and radiotherapy equipment

- 3.2.1.3 Growing investments in healthcare infrastructure

- 3.2.1.4 Increased awareness of blood safety

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment and maintenance costs

- 3.2.2.2 Strict regulatory approvals and compliance requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of AI and automation in imaging systems

- 3.2.3.2 Accelerated demand for non-chemical sterilization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behaviour analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Gamma irradiators

- 5.3 X-ray irradiators

- 5.4 Ultraviolet (UV) and neutron irradiators

- 5.5 Electron-beam irradiators

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostic imaging

- 6.3 Therapy/radiotherapy

- 6.4 Sterilization and disinfection

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Research laboratories and institutes

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Accuray

- 9.2 Canon Medical Systems

- 9.3 Elekta

- 9.4 GE HealthCare

- 9.5 Hitachi

- 9.6 Koninklijke Philips

- 9.7 Mevion Medical Systems

- 9.8 Mindray

- 9.9 Neusoft Medical Systems

- 9.10 Panacea Medical Technologies

- 9.11 Shinva Medical

- 9.12 Siemens Healthineers

- 9.13 Sumitomo Heavy Industries

- 9.14 ViewRay