|

市场调查报告书

商品编码

1773464

永续宠物产品市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Sustainable Pet Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

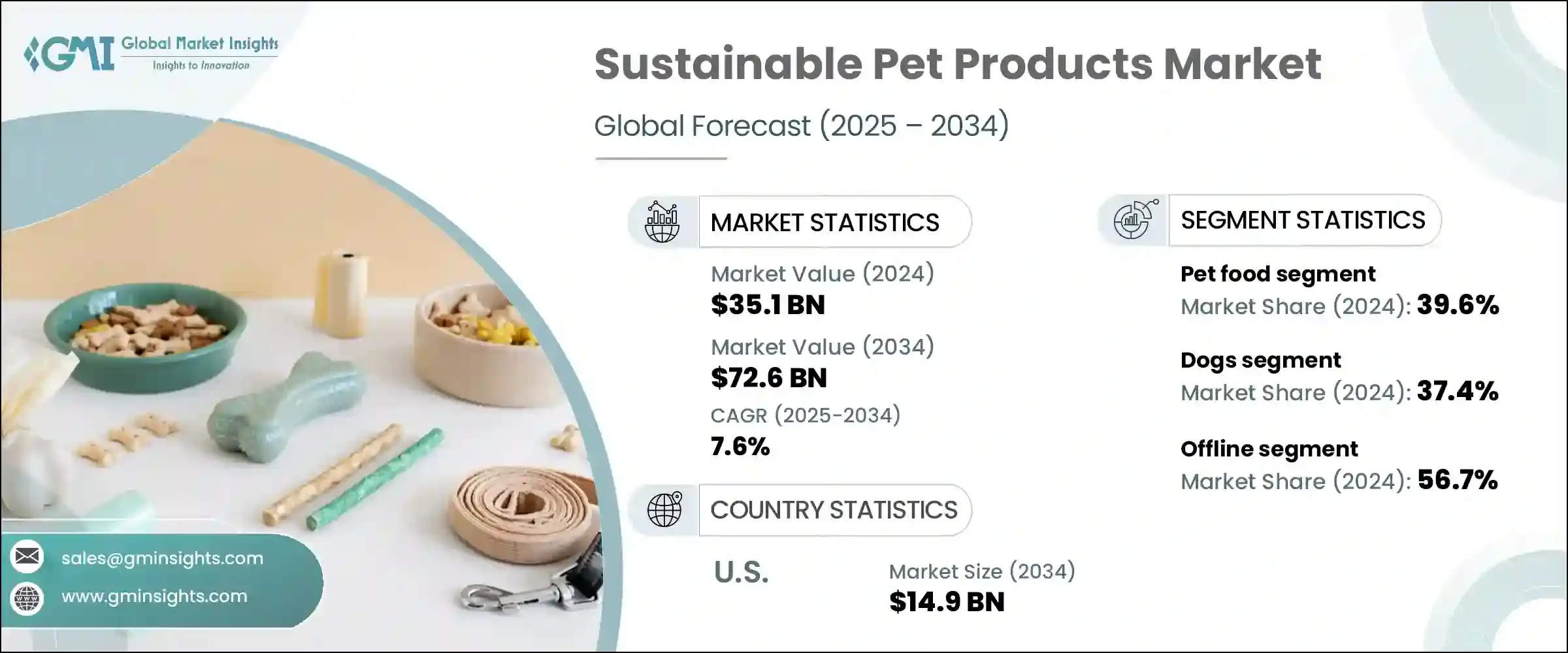

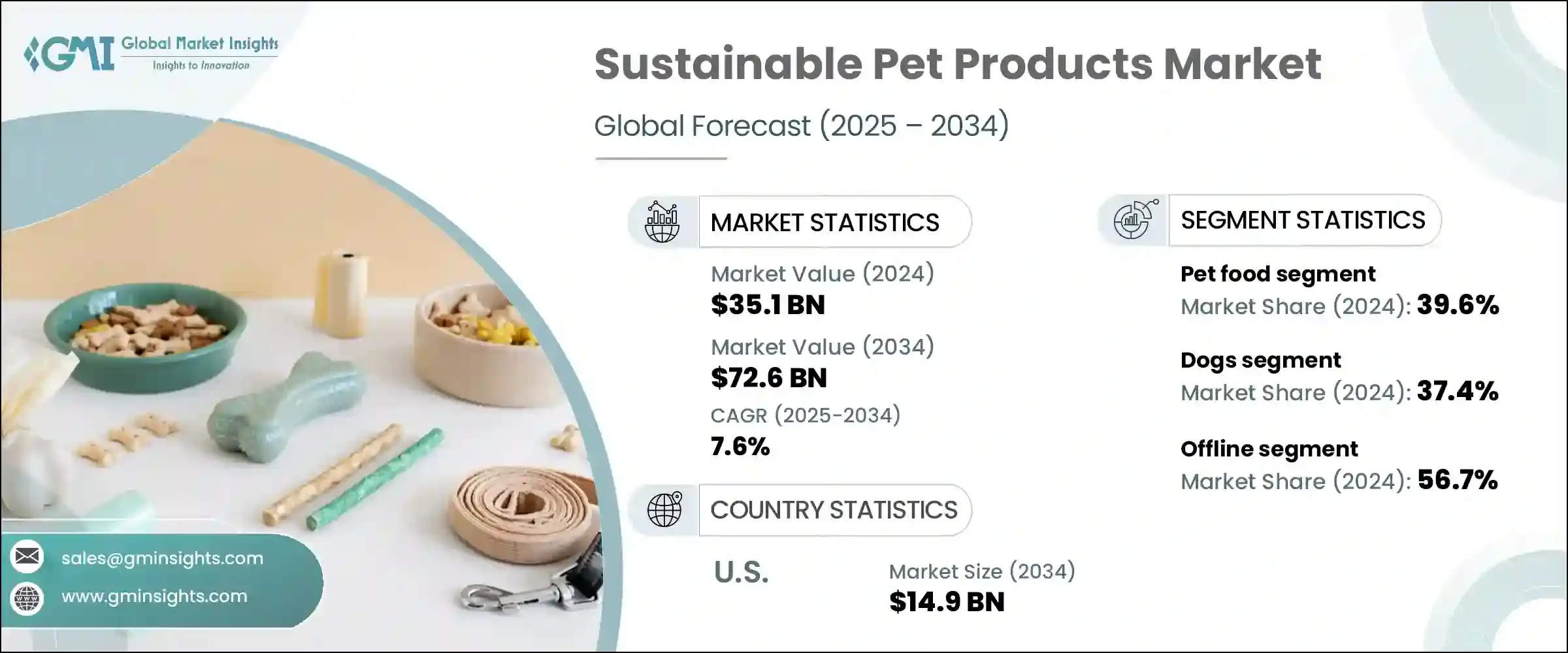

2024年,全球永续宠物产品市场规模达351亿美元,预计到2034年将以7.6%的复合年增长率成长,达到726亿美元。推动这一成长的因素包括日益增强的环保意识,宠物主人将宠物视为家庭成员,并增加对优质、符合道德规范产品的投资。对可生物降解垃圾袋、非塑胶美容用品、负责任采购的宠物食品和可回收包装的需求,反映了人们普遍转向环保宠物护理的趋势。不断增长的可支配收入推动了以健康为重点的宠物产品的支出,新兴和成熟品牌都在材料、配方和包装方面进行创新,以满足这些不断变化的需求。

永续宠物照护的兴起正在重塑整个产业,其核心是健康趋势、环境问题和生活方式的改变。如今,消费者的价值观与宠物选择的产品一致,优先考虑宠物的健康、符合道德的采购以及对环境的最小影响。随着宠物主人环保意识的增强,他们正在积极地用可生物降解、零残忍或可回收材料製成的替代品来取代传统产品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 351亿美元 |

| 预测值 | 726亿美元 |

| 复合年增长率 | 7.6% |

此外,植物性饮食、清洁标籤配方和无毒美容解决方案的日益普及,反映了更广泛的文化向更全面、更理性的生活方式的转变。这种转变并非昙花一现,而是一场长期的变革,永续性将成为宠物护理产品购买决策的标准期望,影响整个产业的产品开发、包装设计和行销策略。

2024年,永续宠物食品市场占39.6%的市场份额,预计复合年增长率为8%。越来越多的宠物主人选择有机、来源可靠且营养丰富的食品,以支持宠物的整体健康和福祉。人们对传统肉类饮食对环境影响的担忧,正激发人们对替代蛋白质的兴趣,例如昆虫蛋白、植物性蛋白质或实验室培育蛋白。消费者重视那些采购透明、标籤清洁且包装环保的品牌。

2024年,狗狗占据宠物类别的主导地位,占据37.4%的份额,预计到2034年将以8.2%的复合年增长率增长。主人与狗狗之间深厚的情感纽带推动了永续产品支出的成长,包括可生物降解的垃圾袋、植物性食品以及由再生材料或环保纺织品製成的配件。这种需求与宠物人性化趋势的兴起直接相关。

美国永续宠物产品市场占60.2%的市场份额,预计到2034年将达到149亿美元。高宠物拥有率以及消费者对环保产品的兴趣(在强劲的零售和电商管道的支持下)正在推动这一成长。美国公司提供植物性宠物食品、可生物降解垃圾袋和永续包装产品,以满足宠物主人不断变化的需求。

该领域的领导企业包括 West Paw、Pawz、Beco Pets、Kurgo、Ruffwear、Spectrum Brands、高露洁棕榄、Jiminy's、Petcurean、Freshpet、Petco、Green Pet Shop、RC Pet Products、Purina 和 Hurtta。永续宠物产品领域的顶级品牌正在大力投资环保创新和供应链透明度,以赢得消费者的忠诚度。他们正在扩展产品组合,包括植物组成、可生物降解材料和可回收包装。与永续材料供应商和环境认证机构的合作确保了产品的可信度。许多公司正在利用全通路分销策略——将零售业务与强大的电商业务相结合——来覆盖更广泛的受众。透过社群媒体、影响力合作和社群参与讲述品牌故事有助于凸显品牌价值。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 宠物人性化趋势日益明显

- 消费者在宠物照护方面的支出增加

- 消费者对道德实践的需求

- 循环经济中的经济机会

- 产业陷阱与挑战

- 宠物产品需求的季节性

- 发展中和欠发达地区缺乏意识且支出低

- 宠物照护费用高

- 机会

- 成长动力

- 成长潜力分析

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 贸易统计(HS编码:33051090)

- 主要进口国

- 主要出口国

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 宠物食品

- 宠物配件

- 宠物护理产品

- 宠物服饰和寝具

第六章:市场估计与预测:依宠物类型,2021-2034

- 主要趋势

- 狗

- 猫

- 鸟类

- 小动物(如兔子、仓鼠)

- 鱼类和爬虫类

- 其他(例如外来宠物)

第七章:市场估计与预测:依价格,2021-2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 网路零售

- 电子商务平台(亚马逊、Chewy 等)

- 品牌自有网站

- 线下零售

- 宠物专卖店

- 超市和大卖场

- 兽医诊所

- 生态/有机商店

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Beco Pets

- Colgate-Palmolive

- Freshpet

- Green Pet Shop

- Hurtta

- Jiminy's

- Kurgo

- Pawz

- Petco

- Petcurean

- Purina

- RC Pet Products

- Ruffwear

- Spectrum Brands

- West Paw

The Global Sustainable Pet Products Market was valued at USD 35.1 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 72.6 billion by 2034. This expansion is driven by increasingly eco-conscious pet owners who treat their pets as family members and are investing more in premium, ethically produced goods. Demand for biodegradable waste bags, non-plastic grooming items, responsibly sourced pet food, and recyclable packaging reflects a broader shift toward environmentally friendly pet care. Rising disposable incomes are fueling spending on health-focused pet products, and both emerging and established brands are innovating in materials, formulations, and packaging to meet these evolving expectations.

This surge in sustainable pet care is reshaping the industry, with health trends, environmental concerns, and lifestyle changes at its core. Consumers are now aligning their values with the products they choose for their pets, prioritizing wellness, ethical sourcing, and minimal environmental impact. As pet owners become more eco-aware, they are actively replacing conventional products with alternatives made from biodegradable, cruelty-free, or recycled materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.1 Billion |

| Forecast Value | $72.6 Billion |

| CAGR | 7.6% |

Additionally, the rising popularity of plant-based diets, clean-label formulations, and toxin-free grooming solutions reflects a broader cultural shift toward holistic, conscious living. This transformation is not just a passing trend-it signals a long-term movement where sustainability becomes a standard expectation in pet care purchasing decisions, influencing product development, packaging design, and marketing strategies across the sector.

In 2024, the sustainable pet food segment held a 39.6% share and is expected to grow at an 8% CAGR. Pet owners are increasingly choosing organic, responsibly sourced, and nutritionally dense food options to support their pets' overall health and well-being. Concerns over the environmental footprint of traditional meat-based diets are boosting interest in alternative proteins like insect-based, plant-based, or lab-grown options. Consumers value brands that practice transparent sourcing, clean labeling, and eco-friendly packaging.

The dog segment dominated pet categories in 2024, capturing 37.4% share, and is forecasted to grow at 8.2% CAGR through 2034. The strong emotional bond between owners and dogs is driving increased spending on sustainable products, including biodegradable waste bags, plant-based foods, and accessories made from recycled materials or eco-friendly textiles. This demand is directly tied to the rising trend of pet humanization.

U.S. Sustainable Pet Products Market held a 60.2% share and is projected to reach USD 14.9 billion by 2034. High pet ownership rates and consumer interest in eco-conscious products-supported by robust retail and e-commerce channels-are propelling this growth. U.S. companies offer plant-based pet foods, biodegradable waste bags, and sustainably packaged goods to meet pet parents' evolving needs.

Leading players in this space include West Paw, Pawz, Beco Pets, Kurgo, Ruffwear, Spectrum Brands, Colgate Palmolive, Jiminy's, Petcurean, Freshpet, Petco, Green Pet Shop, RC Pet Products, Purina, and Hurtta. Top brands in the sustainable pet products arena are investing heavily in eco-friendly innovation and supply chain transparency to capture consumer loyalty. They are expanding their portfolios to include plant-based ingredients, biodegradable materials, and recyclable packaging. Partnerships with sustainable material suppliers and environmental certification bodies ensure product credibility. Many companies are leveraging omnichannel distribution strategies-combining retail presence with strong e-commerce-to reach a wider audience. Storytelling through social media, influencer collaborations, and community engagement helps highlight brand values.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Pet type

- 2.2.3 Price

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing trend of pet humanization

- 3.2.1.2 Higher consumer spending on pet care

- 3.2.1.3 Consumer demand for ethical practices

- 3.2.1.4 Economic opportunities in the circular economy

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Seasonality in pet products demand

- 3.2.2.2 Lack of awareness & low spending in developing and under-developed regions

- 3.2.2.3 High pet care cost

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code: 33051090)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Pet food

- 5.3 Pet accessories

- 5.4 Pet care products

- 5.5 Pet apparel and bedding

Chapter 6 Market Estimates & Forecast, By Pet Type, 2021-2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Small animals (e.g., rabbits, hamsters)

- 6.6 Fish & reptiles

- 6.7 Others (e.g., exotic pets)

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Online retail

- 8.2.1 E-commerce platforms (Amazon, Chewy, etc.)

- 8.2.2 Brand-owned websites

- 8.3 Offline retail

- 8.3.1 Pet specialty stores

- 8.3.2 Supermarkets and hypermarkets

- 8.3.3 Veterinary clinics

- 8.3.4 Eco/organic stores

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Beco Pets

- 10.2 Colgate-Palmolive

- 10.3 Freshpet

- 10.4 Green Pet Shop

- 10.5 Hurtta

- 10.6 Jiminy's

- 10.7 Kurgo

- 10.8 Pawz

- 10.9 Petco

- 10.10 Petcurean

- 10.11 Purina

- 10.12 RC Pet Products

- 10.13 Ruffwear

- 10.14 Spectrum Brands

- 10.15 West Paw