|

市场调查报告书

商品编码

1773469

乳化起酥油市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Emulsified Shortenings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

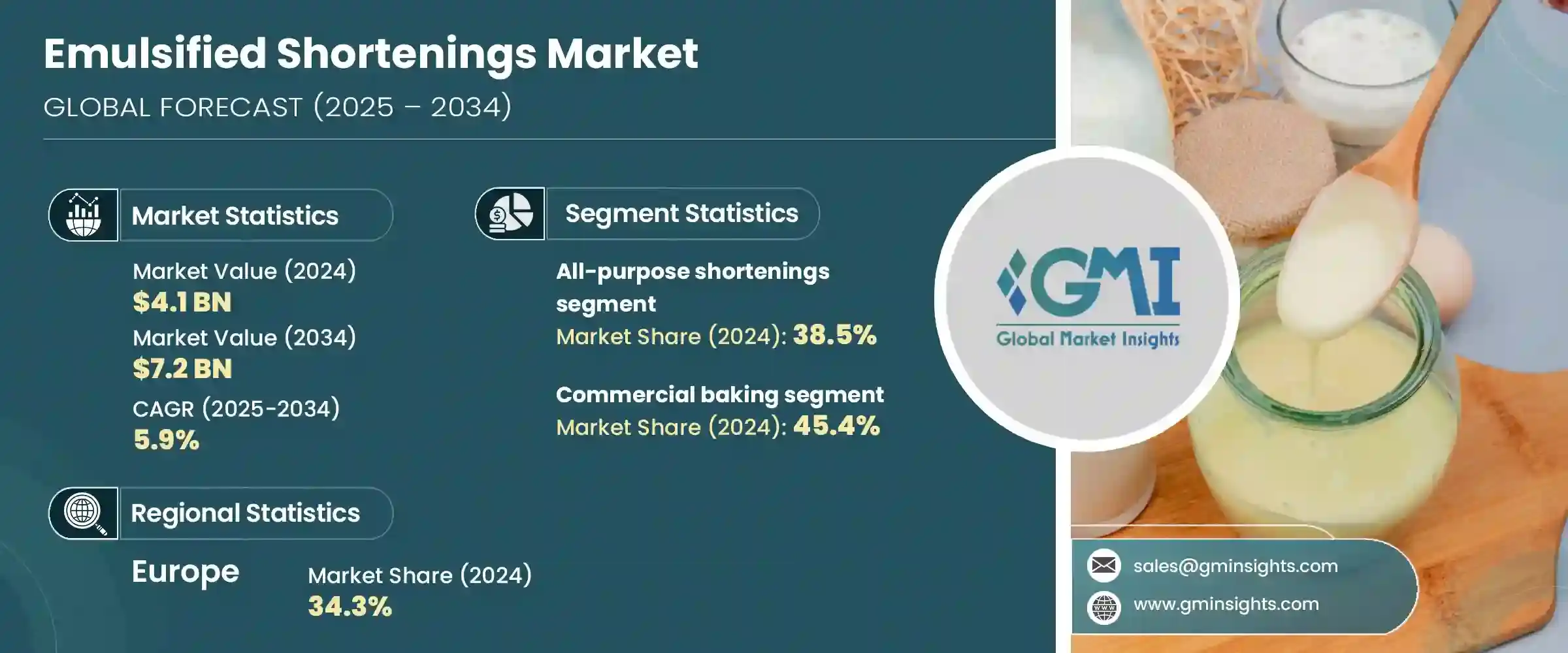

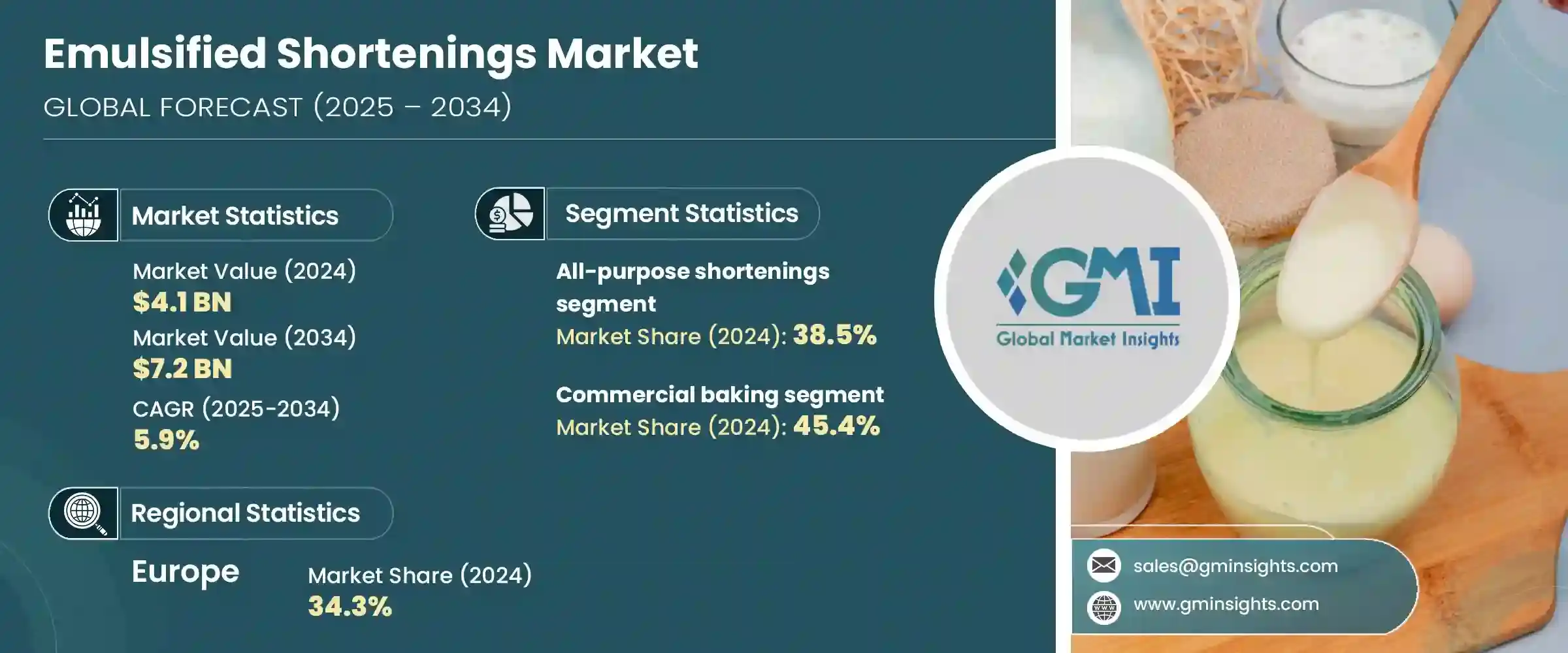

2024年,全球乳化起酥油市场规模达41亿美元,预估年复合成长率为5.9%,到2034年将达72亿美元。这些起酥油是特殊配方的脂肪混合物,添加了乳化剂,可增强油包水混合物的稳定性。由于其能够改善通气性、稠度、质地和整体保质期,它们在加工食品和烘焙行业中至关重要。随着对方便即食食品、清洁标籤替代品和植物性脂肪替代品的需求不断增长,市场正在稳步发展。

人们越来越倾向于健康配方,例如非氢化和无反式脂肪的起酥油,这持续推动产品创新。技术进步和更严格的食品法规正推动製造商不断创新,开发既可持续又能适应消费者不断变化的偏好的原料。家庭烘焙的日益普及,以及发展中地区餐饮连锁店的快速扩张,正在进一步推动市场需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 41亿美元 |

| 预测值 | 72亿美元 |

| 复合年增长率 | 5.9% |

企业正在积极优化其产品组合,以满足多样化的区域风味偏好、不断变化的饮食需求以及对透明、清洁标籤成分日益增长的需求。透过调整产品组合,使其符合文化品味和注重健康的消费趋势,製造商能够充分利用成熟市场和高成长发展中市场的扩张机会。这种在地化策略不仅能够提升顾客忠诚度,还能帮助品牌在全球食品监管日益严格和消费模式不断转变的背景下保持竞争力。

通用起酥油市场在2024年占据最大份额,贡献了16亿美元的市场规模,占38.5%。由于其性能可靠、价格实惠且功能多样,通用起酥油在各种加工食品和烘焙食品中广泛应用。这些特性使其在寻求用途广泛且一致性高的配料的大型食品製造商中备受青睐。

直销市场在2024年占据48.8%的市场份额,预期复合年增长率为5%,仍是最受欢迎的市场管道。这种销售方式吸引了寻求客製化产品规格、批量供应能力和快速交付的大型工业买家。它还为製造商提供了战略优势,使其能够保持价格控制、技术支援和精简的供应物流,使其成为该行业增长最快的分销方式。

2024年,欧洲乳化起酥油市场占34.3%的市场。这一领先地位源于该地区先进的食品生产生态系统、加工食品和特色烘焙食品消费的不断增长,以及消费者对更健康脂肪替代品日益增长的偏好。欧洲法规青睐清洁标籤产品和符合道德标准的原料,符合市场需求。可靠的采购实践,例如使用可持续采收的油,进一步加速了该地区乳化起酥油领域的成长。

AAK AB、丰益国际、阿彻丹尼尔斯米德兰公司、邦吉和嘉吉公司等主要参与者在全球乳化起酥油市场中扮演关键角色。这些公司凭藉着强大的全球网络和多元化的产品组合,稳居创新和分销的前沿。乳化起酥油市场的领导者正专注于多种策略方针,以巩固和扩大其市场地位。

定製配方开发仍然是重中之重,这使得供应商能够满足商业和工业应用领域客户的特定需求。许多公司正在投资清洁标籤技术和更健康的脂肪替代品,以符合法规和消费者的健康期望。永续性是企业高度重视的,企业采用经过认证的棕榈油和植物性原料,以吸引具有环保意识的买家。此外,企业正在加强直接面向客户的分销管道,以确保产品的一致性和成本效益。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 通用起酥油

- 蛋糕和糖霜起酥油

- 煎炸起酥油

- 特种起酥油

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 商业烘焙

- 餐饮服务

- 食品製造

- 零售和消费者

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 分销商和批发商

- 零售通路

- 食品服务分销商

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Cargill Incorporated

- Bunge

- Archer Daniels Midland Company

- AAK AB

- Wilmar International

- Fuji Oil Holdings

- IOI Group

- Musim Mas

- Olenex

- Intercontinental Specialty Fats

- Ventura Foods

- Apical Group

- Sime Darby Plantation

- Mewah International

- Carotino

- Liberty Oil Mills

- Felda IFFCO

- Oleo- Fats

- PT SMART

- Golden Agri- Resources

The Global Emulsified Shortenings Market was valued at USD 4.1 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 7.2 billion by 2034. These shortenings are specially formulated fat blends that incorporate emulsifiers, enhancing the stability of water-in-oil mixtures. Their use is critical in processed food and bakery sectors due to their ability to improve aeration, consistency, texture, and overall shelf life. The market is advancing steadily on the back of rising demand for convenient, ready-to-eat food products, clean-label alternatives, and plant-based fat replacements.

The shift towards health-conscious formulations, such as non-hydrogenated and trans-fat-free shortenings, continues to fuel product innovation. Technological progress and tighter food regulations are pushing manufacturers to innovate with ingredients that are both sustainable and adaptable to evolving consumer preferences. The growing popularity of home baking, along with the rapid expansion of food service chains in developing regions, is driving further demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 5.9% |

Companies are actively refining their product portfolios to cater to diverse regional flavor preferences, evolving dietary requirements, and the rising demand for transparent, clean-label ingredients. By aligning their offerings with cultural tastes and health-conscious consumer trends, manufacturers are positioning themselves to capitalize on expansion opportunities in both mature and high-growth developing markets. This localized approach not only enhances customer loyalty but also allows brands to stay competitive amid tightening food regulations and shifting consumption patterns worldwide.

The all-purpose shortenings segment represented the largest segment in 2024, contributing USD 1.6 billion and a 38.5% share. Their wide usage across various processed foods and bakery applications stems from their dependable performance, affordability, and multi-functionality. These attributes make them highly desirable among large-scale food manufacturers seeking versatile and consistent ingredients.

The direct sales segment accounted for a 48.8% share in 2024 and is anticipated to grow at a CAGR of 5%, remaining the most preferred route to the market. This sales approach appeals to large industrial buyers who seek tailored product specifications, bulk supply capabilities, and prompt delivery. It also offers a strategic advantage by enabling manufacturers to maintain pricing control, technical support, and streamlined supply logistics, making it the fastest-growing distribution method in the sector.

Europe Emulsified Shortenings Market held a 34.3% share in 2024. This leadership stems from the region's advanced food production ecosystem, increased consumption of processed and specialty baked goods, and rising consumer inclination toward healthier fat alternatives. European regulations favor clean-label products and ethically sourced ingredients, which align with market demands. Reliable sourcing practices, such as the use of sustainably harvested oils, have further accelerated regional growth in the emulsified shortenings space.

Key players such as AAK AB, Wilmar International, Archer Daniels Midland Company, Bunge, and Cargill Incorporated play a pivotal role in the global emulsified shortenings landscape. These companies have anchored themselves at the forefront of innovation and distribution through robust global networks and diversified portfolios. Leading companies in the emulsified shortenings market are focusing on several strategic approaches to secure and expand their market positions.

Custom formulation development remains a top priority, allowing suppliers to cater to specific client needs across commercial and industrial applications. Many are investing in clean-label technologies and healthier fat alternatives to align with regulatory and consumer health expectations. A strong emphasis is placed on sustainability, with firms adopting certified palm oils and plant-based inputs to appeal to environmentally conscious buyers. Additionally, firms are strengthening direct-to-customer distribution channels to ensure product consistency and cost efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 All-purpose shortenings

- 5.3 Cake and icing shortenings

- 5.4 Frying shortenings

- 5.5 Specialty shortenings

Chapter 6 Market Estimates and Forecast, By Applications, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Commercial baking

- 6.3 Food service

- 6.4 Food manufacturing

- 6.5 Retail and consumer

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Distributors and wholesalers

- 7.4 Retail channels

- 7.5 Food service distributors

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Cargill Incorporated

- 9.2 Bunge

- 9.3 Archer Daniels Midland Company

- 9.4 AAK AB

- 9.5 Wilmar International

- 9.6 Fuji Oil Holdings

- 9.7 IOI Group

- 9.8 Musim Mas

- 9.9 Olenex

- 9.10 Intercontinental Specialty Fats

- 9.11 Ventura Foods

- 9.12 Apical Group

- 9.13 Sime Darby Plantation

- 9.14 Mewah International

- 9.15 Carotino

- 9.16 Liberty Oil Mills

- 9.17 Felda IFFCO

- 9.18 Oleo- Fats

- 9.19 PT SMART

- 9.20 Golden Agri- Resources