|

市场调查报告书

商品编码

1773472

无乳糖益生菌市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Lactose-Free Probiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

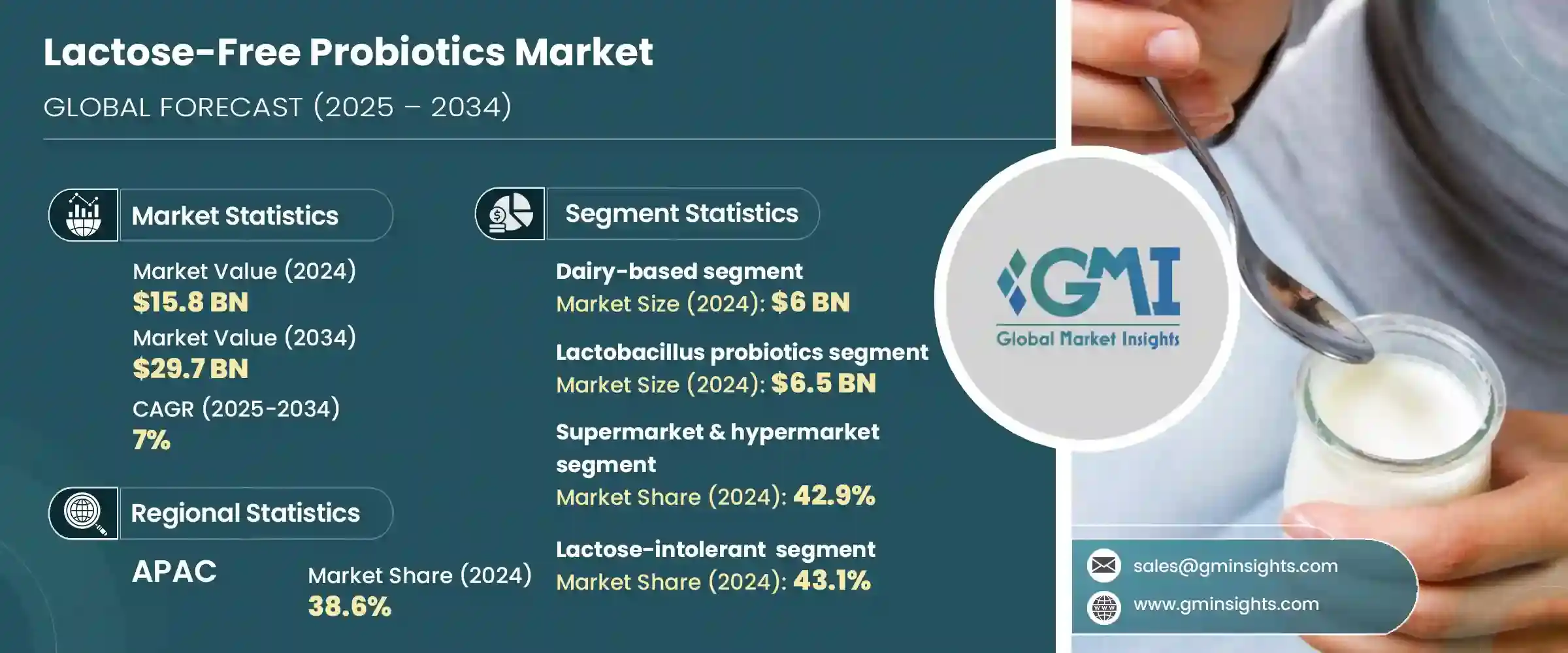

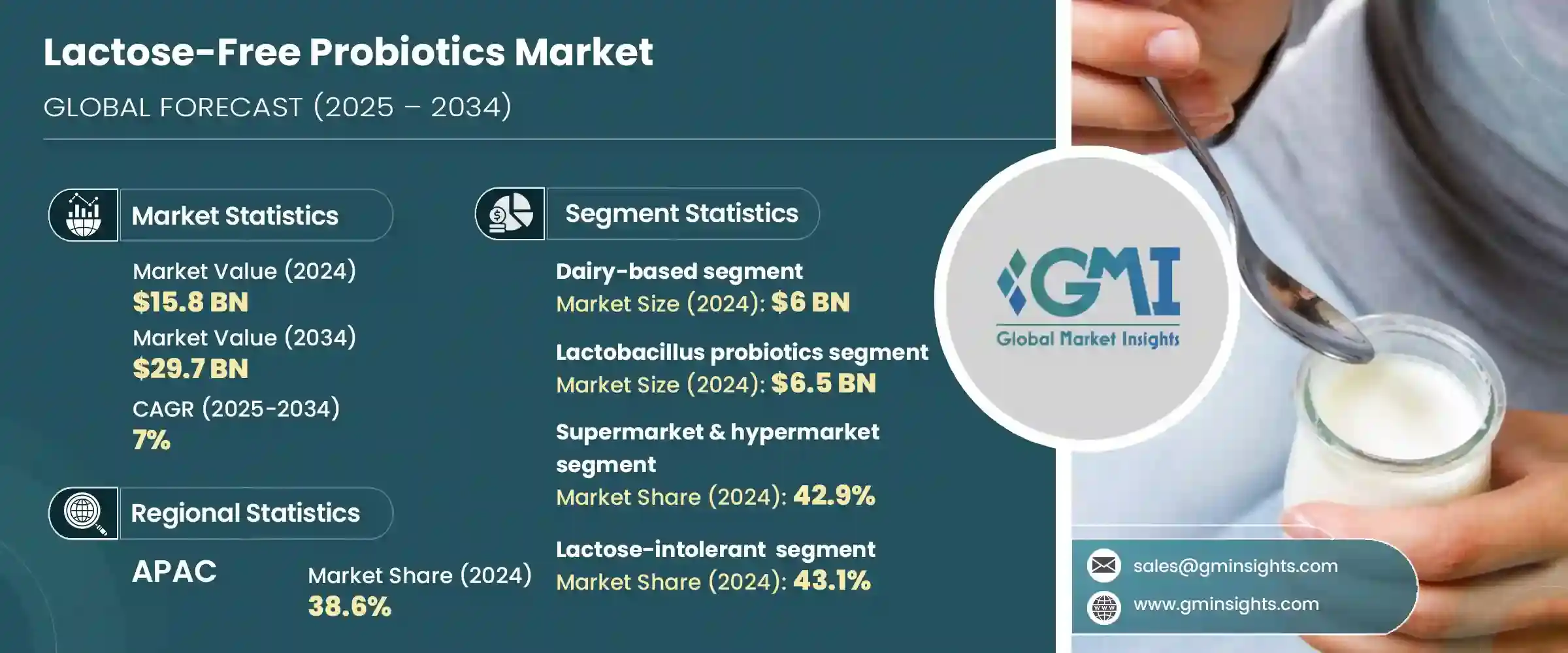

2024 年全球无乳糖益生菌市场规模达 158 亿美元,预计年复合成长率为 7%,到 2034 年将达到 297 亿美元。这些益生菌不含乳糖,有助于维持消化系统和免疫系统健康,是乳糖不耐症患者、乳製品过敏者或植物性饮食者的理想选择。由于消费者对肠道健康的关注以及乳糖吸收不良的普遍存在,不断扩张的功能性食品和营养保健品行业已开始关注这一类别。优格、饮料、补充剂和零食等产品富含益生菌益处,不会引起消化不适。随着北美和亚太地区消费者对健康无乳替代品的需求日益增长,各大品牌纷纷创新地使用杏仁、大豆、燕麦和椰子等植物性成分。含有嗜酸乳桿菌和乳双歧桿菌等菌株的耐储存胶囊和粉末的需求也在增加。清洁标籤、无过敏原产品和个人化营养的兴起正在刺激需求。

随着健康意识的增强,无乳糖益生菌对于注重健康的消费者日益重要。这些产品不仅迎合了乳糖不耐症族群的需求,也吸引了那些积极寻求消化支持、免疫系统益处和整体肠道健康,同时又不想承受乳製品带来的不适的消费者。消费者越来越重视清洁标示产品和天然成分,这使得无乳糖益生菌成为日常营养的首选。预防性医疗保健和功能性食品的趋势进一步推动了这种需求,因为越来越多的人将益生菌视为均衡生活方式的基础。随着人们对植物性和无过敏原替代品的兴趣日益浓厚,无乳糖益生菌已成为现代饮食习惯中的关键元素,这反映出各个年龄层的消费者正在转向更具包容性和更注重健康的食品选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 158亿美元 |

| 预测值 | 297亿美元 |

| 复合年增长率 | 7% |

2024年,乳製品无乳糖益生菌市场占据38.2%的市场份额,价值60亿美元。该市场包括优格和克菲尔等传统乳製品的无乳糖版本,提供熟悉的口感和风味,并添加了嗜酸乳桿菌和乳双歧桿菌等有益菌株。消费者通常选择这些产品,因为它们在不牺牲口感的情况下提供消化益处。

2024年,乳酸菌菌株市场规模达65亿美元,占41.1%。这一市场主导地位源于其已被证实的消化健康益处,以及在无乳优格、饮料和营养补充剂中的广泛应用。其中,嗜酸乳桿菌尤其受欢迎,因为它能够支持肠道健康,并帮助乳糖敏感族群消化。

2024年,亚太地区无乳糖益生菌市场占比38.6%,这得益于乳糖不耐症的普遍存在、肠道健康意识的不断增强、城镇化进程的加快以及可支配收入的增加。该地区各国正在大力投资营养研究和产品开发,尤其是在富含益生菌的食品和婴儿营养领域。科技创新、监管激励措施和消费者需求的共同作用,使该地区在无乳糖益生菌市场成长方面处于领先地位。

该行业的主要参与者包括达能公司、Probi AB、雀巢公司、科汉森控股公司和养乐多本社株式会社,它们均以其在产品创新和分销方面的领导地位而闻名。无乳糖益生菌市场的领先公司正在追求创新、产品组合扩张和策略合作伙伴关係,以扩大其影响力。各公司正在投资研发新菌株和交付形式,例如植物优格、即饮配方和环保包装,以满足清洁标籤和个人化营养的需求。与研究机构的合作和临床试验有助于验证健康声明,增强消费者信任。製造商也正在与零售商和直接面向消费者的管道建立联盟,以扩大市场准入。在地化的产品线和文化客製化行销支援向新兴市场的地理扩张。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 乳製品无乳糖益生菌

- 优格

- 克菲尔

- 起司

- 冰淇淋

- 其他的

- 植物益生菌

- 大豆基

- 杏仁基

- 椰子基

- 燕麦基

- 其他的

- 水果益生菌

- 果汁

- 冰沙

- 其他的

- 益生菌补充剂

- 胶囊

- 平板电脑

- 粉末

- 液体

- 其他的

第六章:市场估计与预测:按益生菌菌株,2021 - 2034 年

- 主要趋势

- 乳酸桿菌

- 嗜酸乳桿菌

- 鼠李糖乳桿菌

- 植物乳酸桿菌

- 其他的

- 双歧桿菌

- 双歧桿菌

- 长双歧桿菌

- 乳酸双歧桿菌

- 其他的

- 链球菌

- 嗜热链球菌

- 其他的

- 芽孢桿菌

- 凝结芽孢桿菌

- 枯草桿菌

- 其他的

- 酵母菌

- 布拉氏酵母菌

- 其他的

- 其他的

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 超市和大卖场

- 专卖店

- 药局和药局

- 网路零售

- 其他的

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 乳糖不耐症患者

- 注重健康的消费者

- 老年人口

- 儿童和婴儿

- 其他的

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 消化健康

- 免疫支持

- 体重管理

- 女性健康

- 儿童健康

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Nestle SA

- Danone SA

- Yakult Honsha Co., Ltd.

- Chr. Hansen Holding A/S

- Probi AB

- BioGaia AB

- Lifeway Foods, Inc.

- General Mills, Inc. (Yoplait)

- Fonterra Co-operative Group

- Kerry Group

- Lallemand Inc.

- DSM

- DuPont (IFF)

- Morinaga Milk Industry Co., Ltd.

- Bifodan A/S

- Probiotical SpA

- Winclove Probiotics

- Biosearch Life

- Culturelle (i-Health, Inc.)

- GoodBelly (NextFoods, Inc.)

- Ganeden, Inc. (Kerry)

- Attune Foods

- Valio Ltd.

- Arla Foods

- Organic Valley

- Stonyfield Farm, Inc.

- Meiji Holdings Co., Ltd.

- Chobani, LLC

- Yili Group

- Mengniu Dairy

The Global Lactose-Free Probiotics Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 29.7 billion by 2034. These probiotics support digestive and immune health without containing lactose, making them ideal for lactose-intolerant individuals, those allergic to dairy, or people following plant-based diets. The expanding functional food and nutraceutical sector has embraced this category due to consumer interest in gut health and the prevalence of lactose malabsorption. Products such as yogurts, beverages, supplements, and snacks offer probiotic benefits without digestive discomfort. With consumers in North America and Asia-Pacific increasingly demanding healthy, dairy-free alternatives, brands are innovating using plant-based bases like almond, soy, oat, and coconut. There's also growth in shelf-stable capsules and powders featuring strains such as Lactobacillus acidophilus and Bifidobacterium3lactis. The rise of clean-label, allergen-free options, and personalized nutrition is fueling demand.

As awareness around health grows, lactose-free probiotics are becoming essential for wellness-focused consumers. These products not only cater to individuals with lactose intolerance but also appeal to those actively seeking digestive support, immune system benefits, and overall gut health without the discomfort associated with dairy. Consumers are increasingly prioritizing clean-label products and natural ingredients, making lactose-free probiotics a preferred option in daily nutrition. The trend toward preventive healthcare and functional foods has further fueled this demand, as more people view probiotics as a foundational part of a balanced lifestyle. With rising interest in plant-based and allergen-free alternatives, lactose-free probiotics are positioned as a key element in modern dietary habits, reflecting a shift toward more inclusive and health-conscious food choices across age groups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $29.7 Billion |

| CAGR | 7% |

Dairy-based lactose-free probiotics segment held a 38.2% share in 2024, representing USD 6 billion. This segment includes lactose-free versions of traditional dairy products like yogurt and kefir, offering familiar textures and flavors enhanced with beneficial strains like Lactobacillus acidophilus and Bifidobacterium lactis. Consumers often choose these options because they provide digestive benefits without sacrificing taste.

The Lactobacillus strain segment generated USD 6.5 billion or 41.1% in 2024. This dominance stems from its proven digestive health benefits and its extensive use in dairy-free yogurts, beverages, and supplement products. Among its varieties, Lactobacillus acidophilus is especially popular for supporting gut wellness and aiding digestion in lactose-sensitive individuals.

Asia-Pacific Lactose-Free Probiotics Market held 38.6% in 2024, propelled by widespread lactose intolerance and growing awareness of gut health, rising urbanization, and increased disposable income. Countries in this region are investing in nutritional research and product development, especially in probiotic-rich foods and baby nutrition. The combination of scientific innovation, regulatory incentives, and consumer demand has positioned the region at the forefront of lactose-free probiotic growth.

Key players in the industry include Danone S.A., Probi AB, Nestle S.A., Chr. Hansen Holding A/S, and Yakult Honsha Co., Ltd., are all known for their leadership in product innovation and distribution. Leading companies in the lactose-free probiotics market are pursuing innovation, portfolio expansion, and strategic partnerships to enhance their footprint. Firms are investing in R&D to develop new strains and delivery formats-such as plant-based yogurts, ready-to-drink formulations, and eco-friendly packaging-to meet clean-label and personalized nutrition demands. Collaboration with research institutions and clinical trials helps validate health claims, strengthening consumer trust. Manufacturers are also forging alliances with retailers and direct-to-consumer channels to expand market access. Geographic expansion into emerging markets is supported by localized product lines and culturally tailored marketing.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dairy-based lactose-free probiotics

- 5.2.1 Yogurt

- 5.2.2 Kefir

- 5.2.3 Cheese

- 5.2.4 Ice cream

- 5.2.5 Others

- 5.3 Plant-based probiotics

- 5.3.1 Soy-based

- 5.3.2 Almond-based

- 5.3.3 Coconut-based

- 5.3.4 Oat-based

- 5.3.5 Others

- 5.4 Fruit-based probiotics

- 5.4.1 Juices

- 5.4.2 Smoothies

- 5.4.3 Others

- 5.5 Probiotic supplements

- 5.5.1 Capsules

- 5.5.2 Tablets

- 5.5.3 Powders

- 5.5.4 Liquids

- 5.5.5 Others

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lactobacillus

- 6.2.1 L. acidophilus

- 6.2.2 L. rhamnosus

- 6.2.3 L. plantarum

- 6.2.4 Others

- 6.3 Bifidobacterium

- 6.3.1 B. bifidum

- 6.3.2 B. longum

- 6.3.3 B. lactis

- 6.3.4 Others

- 6.4 Streptococcus

- 6.4.1 S. thermophilus

- 6.4.2 Others

- 6.5 Bacillus

- 6.5.1 B. coagulans

- 6.5.2 B. subtilis

- 6.5.3 Others

- 6.6 Saccharomyces

- 6.6.1 S. boulardii

- 6.6.2 Others

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets & hypermarkets

- 7.3 Specialty stores

- 7.4 Pharmacies & drugstores

- 7.5 Online retail

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Lactose-intolerant individuals

- 8.3 Health-conscious consumers

- 8.4 Elderly population

- 8.5 Children & infants

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Digestive health

- 9.3 Immune support

- 9.4 Weight management

- 9.5 Women's health

- 9.6 Pediatric health

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Nestle S.A.

- 11.2 Danone S.A.

- 11.3 Yakult Honsha Co., Ltd.

- 11.4 Chr. Hansen Holding A/S

- 11.5 Probi AB

- 11.6 BioGaia AB

- 11.7 Lifeway Foods, Inc.

- 11.8 General Mills, Inc. (Yoplait)

- 11.9 Fonterra Co-operative Group

- 11.10 Kerry Group

- 11.11 Lallemand Inc.

- 11.12 DSM

- 11.13 DuPont (IFF)

- 11.14 Morinaga Milk Industry Co., Ltd.

- 11.15 Bifodan A/S

- 11.16 Probiotical S.p.A.

- 11.17 Winclove Probiotics

- 11.18 Biosearch Life

- 11.19 Culturelle (i-Health, Inc.)

- 11.20 GoodBelly (NextFoods, Inc.)

- 11.21 Ganeden, Inc. (Kerry)

- 11.22 Attune Foods

- 11.23 Valio Ltd.

- 11.24 Arla Foods

- 11.25 Organic Valley

- 11.26 Stonyfield Farm, Inc.

- 11.27 Meiji Holdings Co., Ltd.

- 11.28 Chobani, LLC

- 11.29 Yili Group

- 11.30 Mengniu Dairy